This version of the form is not currently in use and is provided for reference only. Download this version of

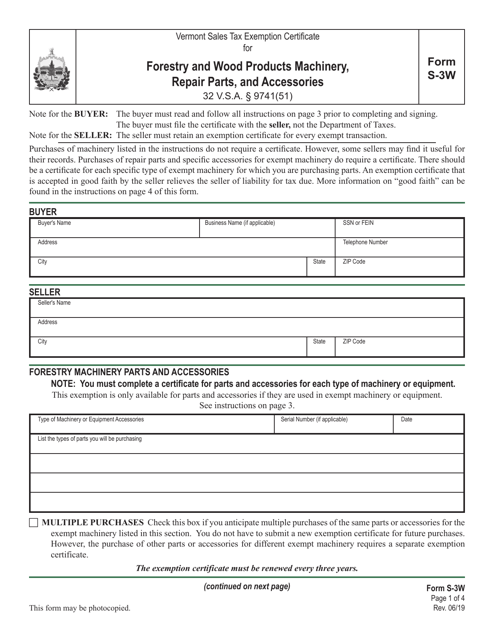

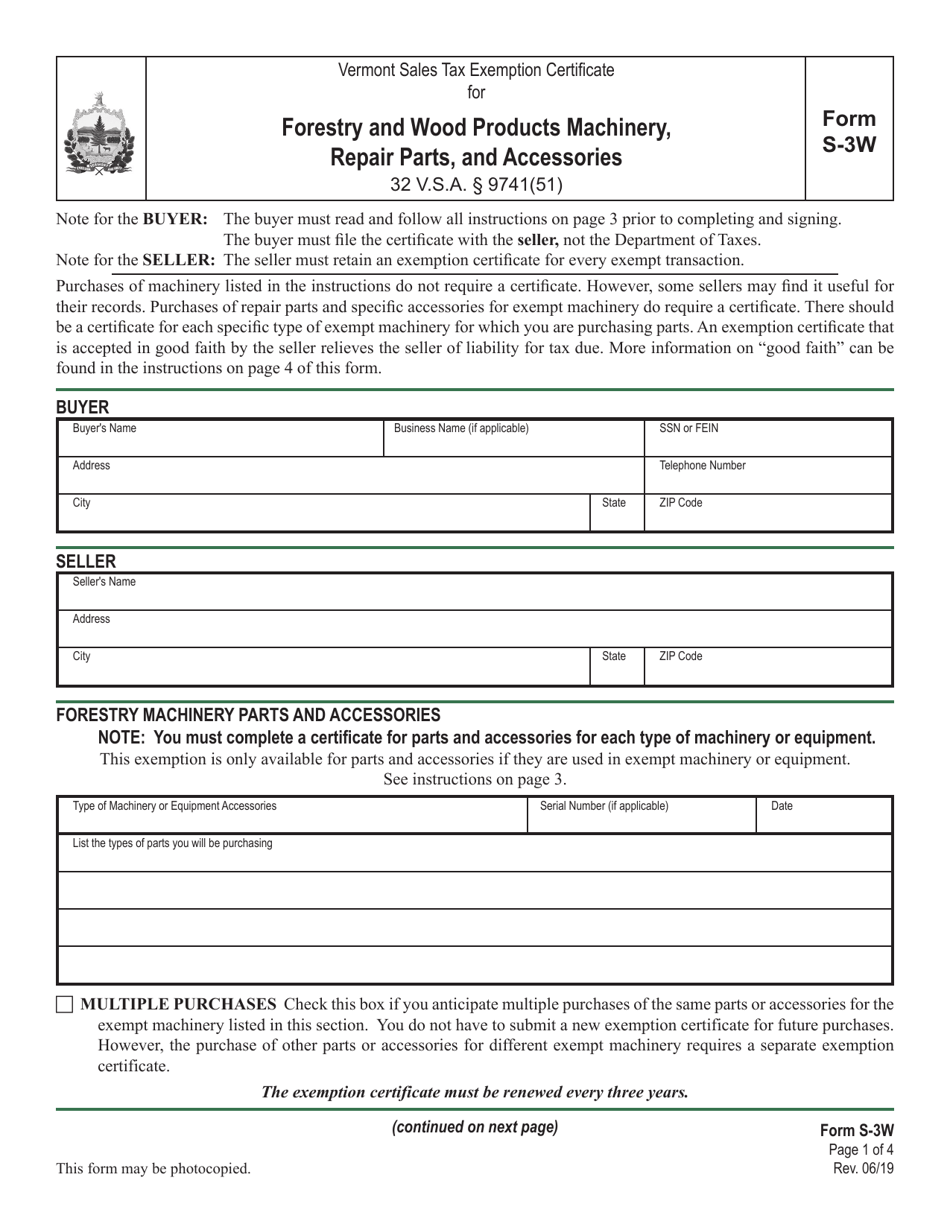

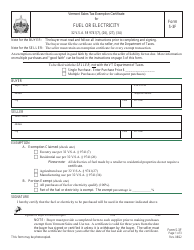

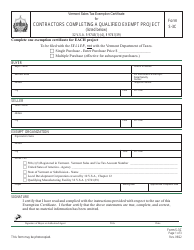

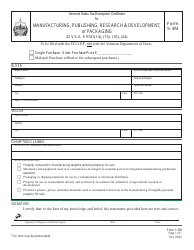

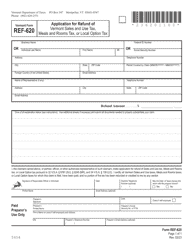

Form S-3W

for the current year.

Form S-3W Vermont Sales Tax Exemption Certificate for Forestry and Wood Products Machinery, Repair Parts, and Accessories - Vermont

What Is Form S-3W?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-3W?

A: Form S-3W is the Vermont Sales Tax Exemption Certificate for Forestry and Wood Products Machinery, Repair Parts, and Accessories.

Q: What is the purpose of Form S-3W?

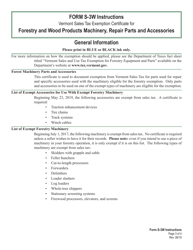

A: The purpose of Form S-3W is to claim a sales tax exemption on qualifying purchases of forestry and wood products machinery, repair parts, and accessories in Vermont.

Q: Who can use Form S-3W?

A: Individuals and businesses engaged in the forestry and wood products industry in Vermont can use Form S-3W to claim the sales tax exemption.

Q: What qualifies for the sales tax exemption on Form S-3W?

A: Forestry and wood products machinery, repair parts, and accessories that are directly used in qualifying activities are eligible for the sales tax exemption.

Q: How do I fill out Form S-3W?

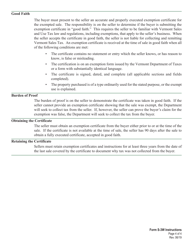

A: You need to provide your name, address, and signature, along with information about the qualifying purchases to claim the sales tax exemption.

Q: Is Form S-3W specific to Vermont?

A: Yes, Form S-3W is specific to Vermont and can only be used to claim the sales tax exemption in the state.

Q: Is there a deadline to submit Form S-3W?

A: There is no specific deadline for submitting Form S-3W. It should be provided to the seller at the time of purchase to claim the sales tax exemption.

Q: Can Form S-3W be used for other types of purchases?

A: No, Form S-3W is specifically for claiming the sales tax exemption on qualifying purchases related to the forestry and wood products industry.

Q: What should I do with a completed Form S-3W?

A: You should provide a copy of the completed Form S-3W to the seller when making qualifying purchases, and keep a copy for your records.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S-3W by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.