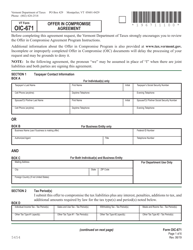

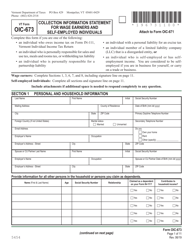

VT Form OIC-671 Offer in Compromise Agreement - Vermont

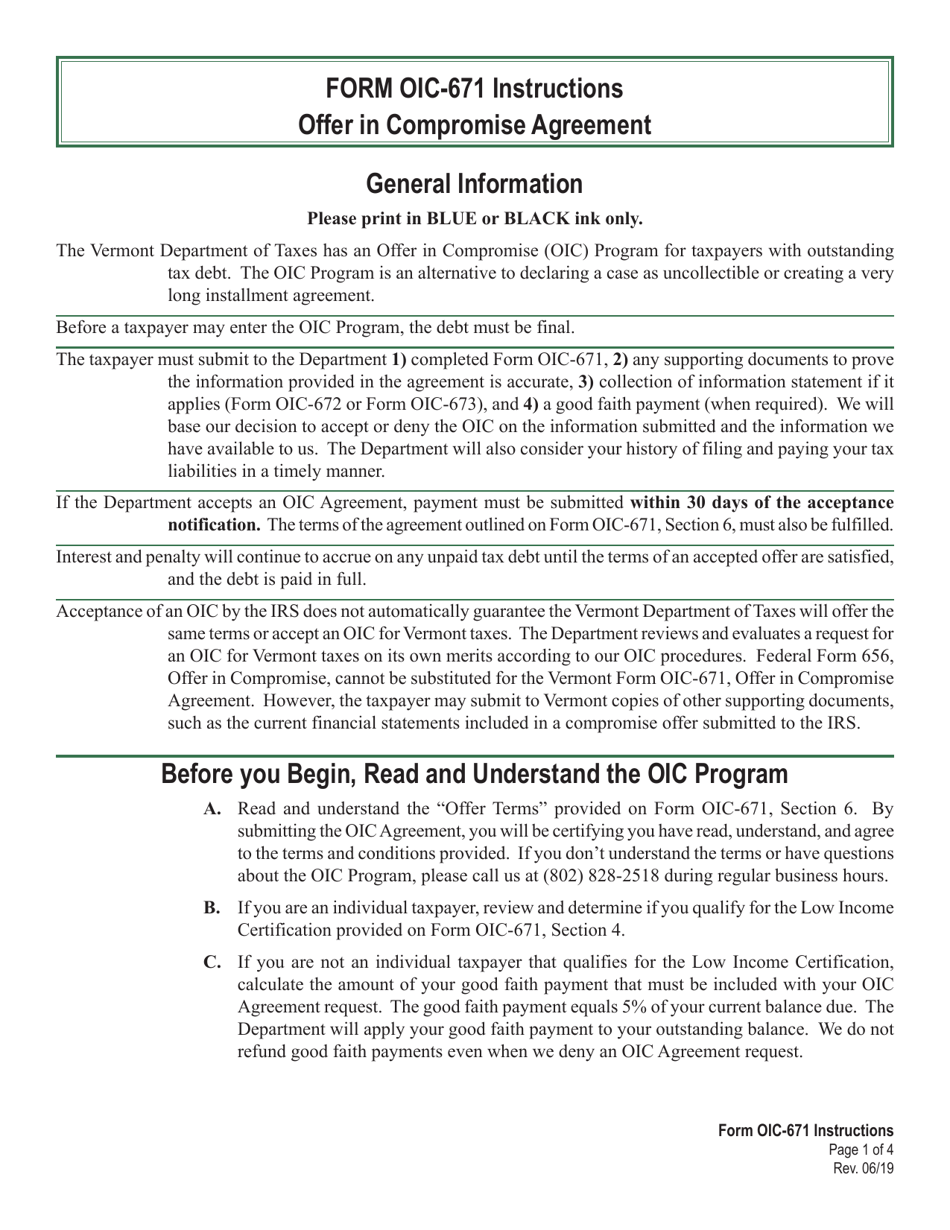

What Is VT Form OIC-671?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

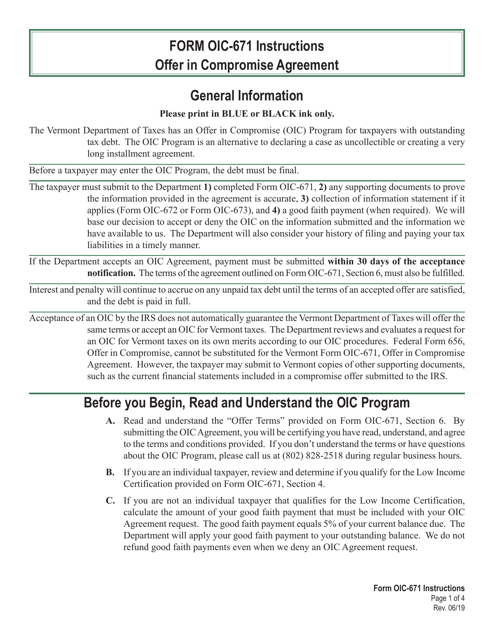

Q: What is Form OIC-671?

A: Form OIC-671 is the Offer in Compromise Agreement used in Vermont.

Q: What is an Offer in Compromise Agreement?

A: An Offer in Compromise Agreement is a settlement agreement between a taxpayer and the tax authority, where the taxpayer agrees to pay a reduced amount to resolve their tax debt.

Q: Who can use Form OIC-671?

A: Form OIC-671 can be used by taxpayers in Vermont who want to negotiate an offer in compromise with the Vermont tax authority.

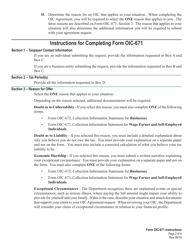

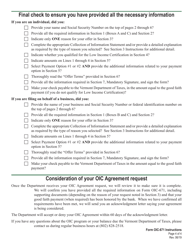

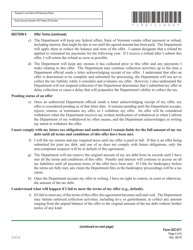

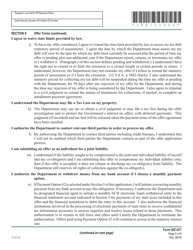

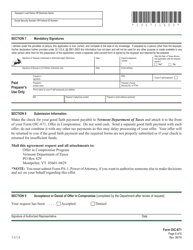

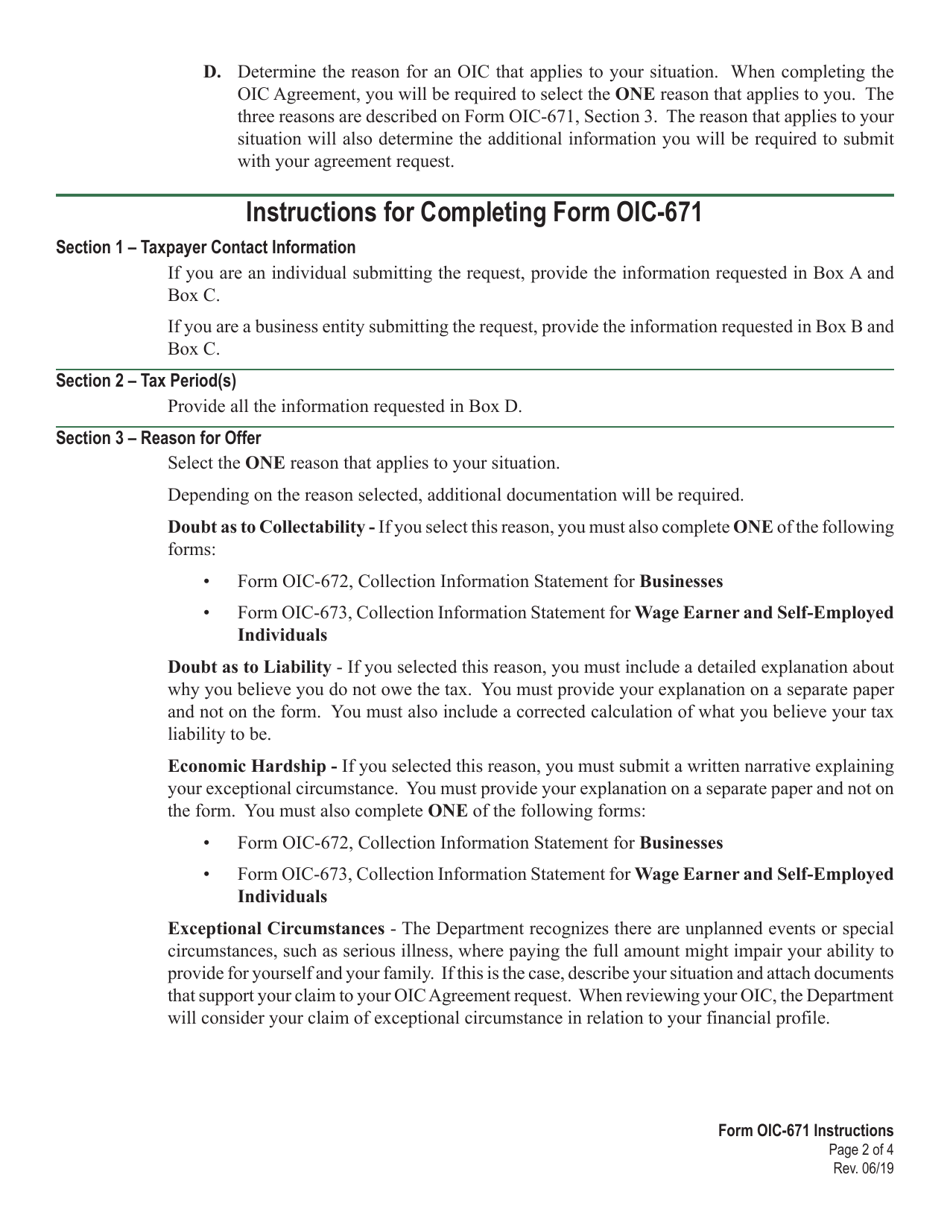

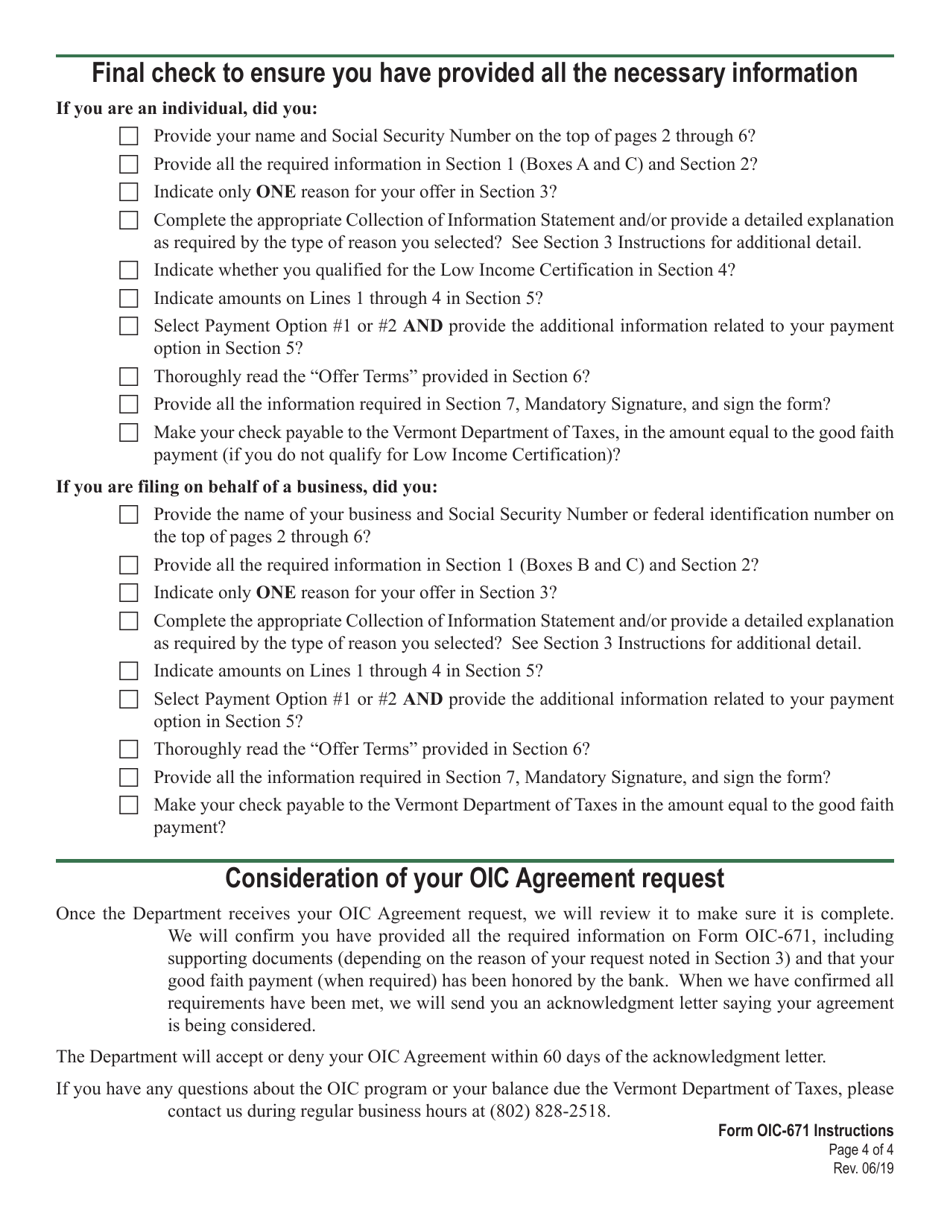

Q: How do I complete Form OIC-671?

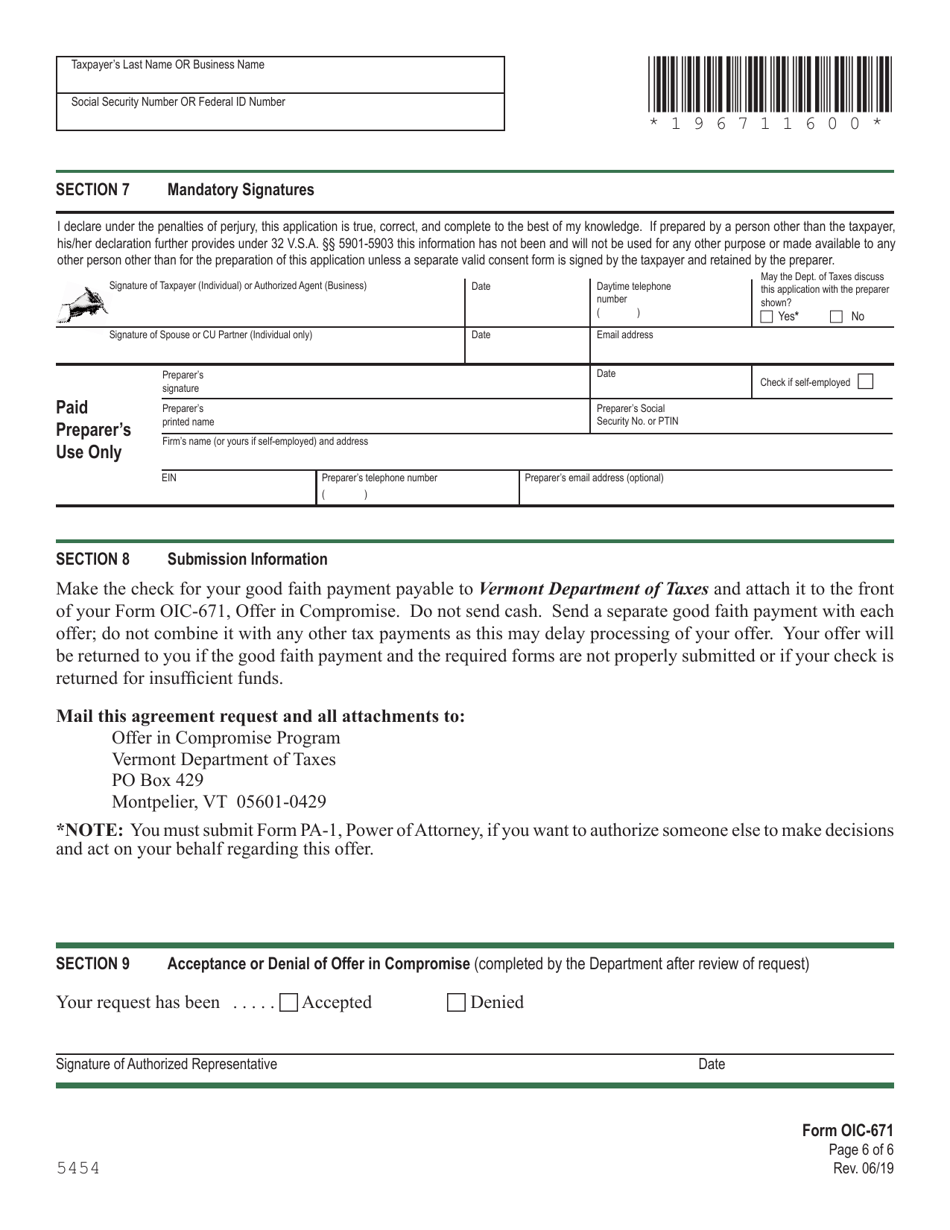

A: You need to provide your personal information, details of your tax debt, and proposed offer amount on Form OIC-671. It is recommended to seek professional assistance or refer to the instructions provided with the form.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form OIC-671 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.