This version of the form is not currently in use and is provided for reference only. Download this version of

Form 502

for the current year.

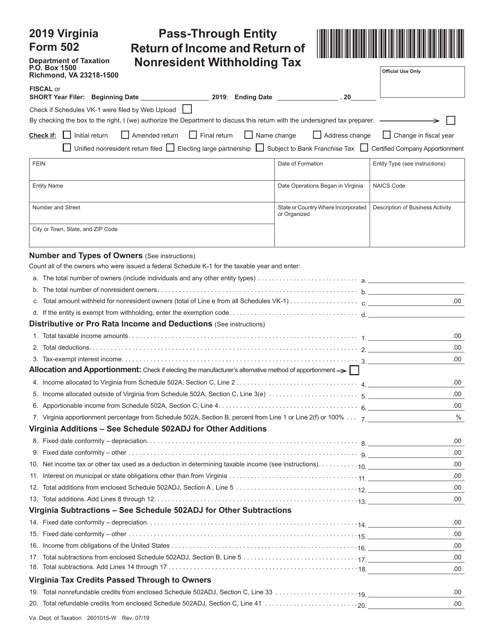

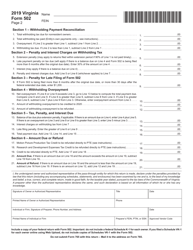

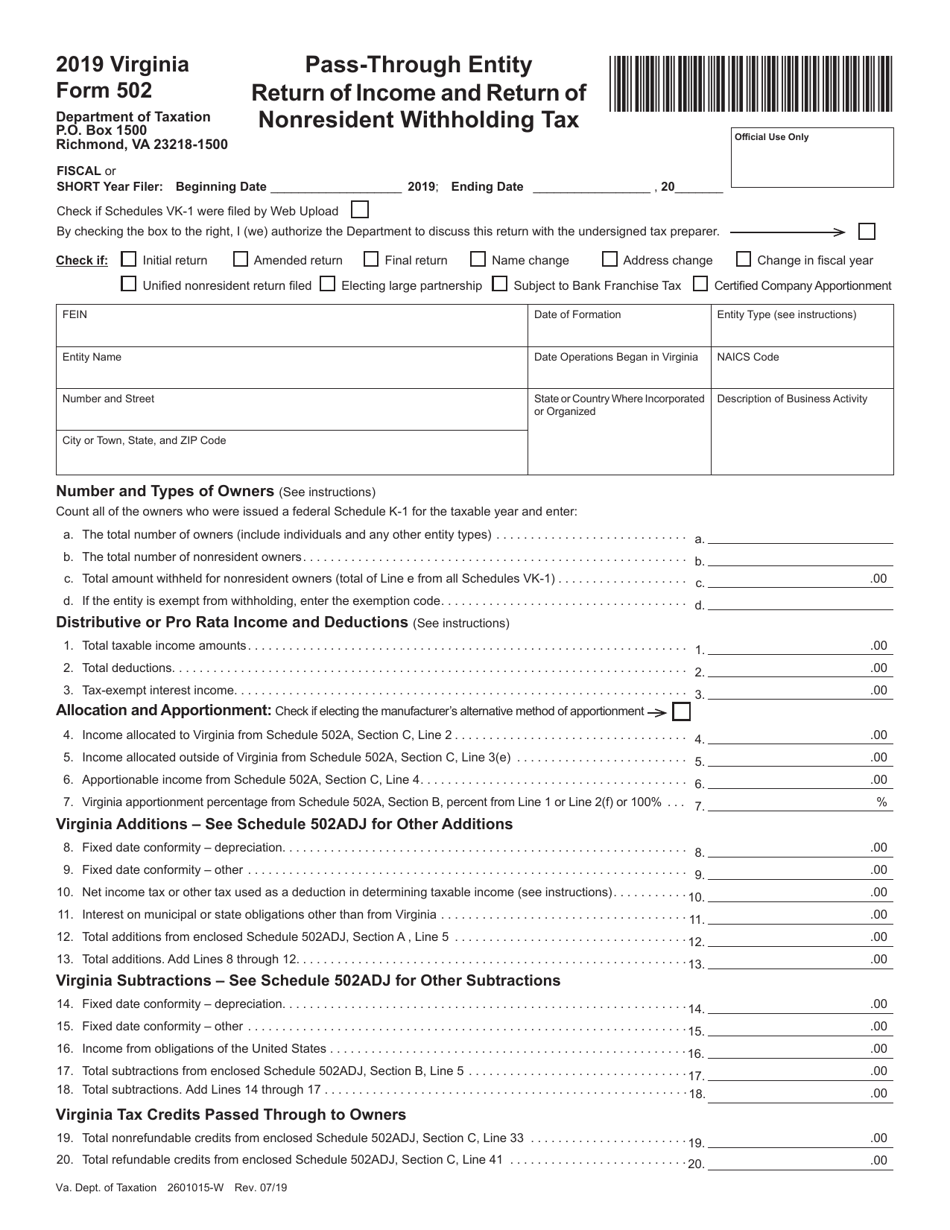

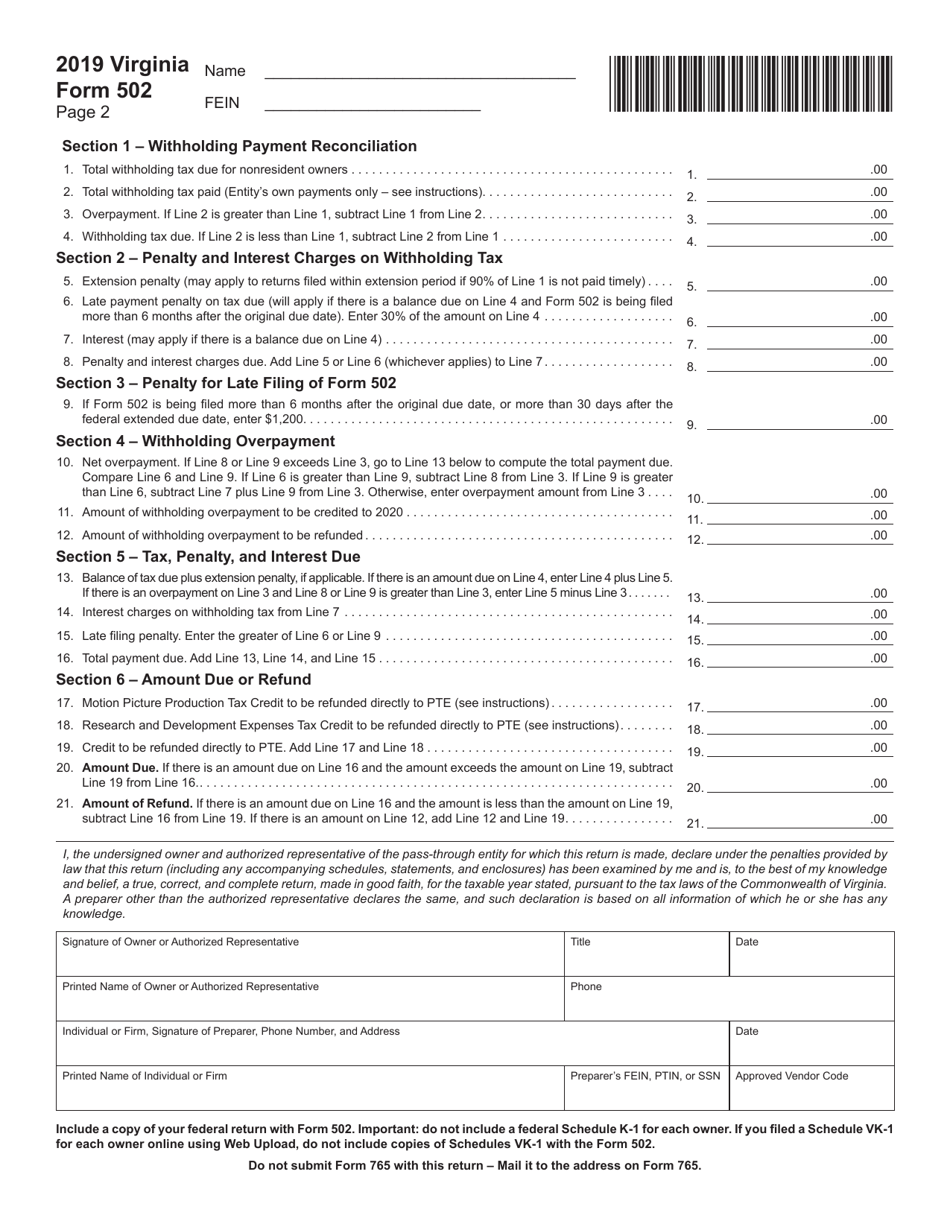

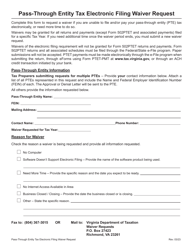

Form 502 Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax - Virginia

What Is Form 502?

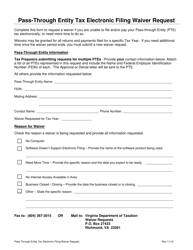

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 502?

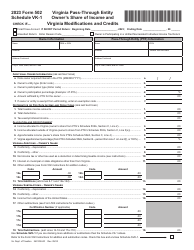

A: Form 502 is the Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax for the state of Virginia.

Q: Who needs to file Form 502?

A: Pass-through entities, such as partnerships and S corporations, that have income or conduct business in Virginia need to file Form 502.

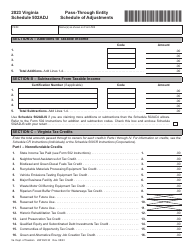

Q: What information is required on Form 502?

A: Form 502 requires information about the pass-through entity's income, deductions, and nonresident withholding tax.

Q: When is Form 502 due?

A: Form 502 is due on or before the 15th day of the 4th month following the close of the taxable year.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.