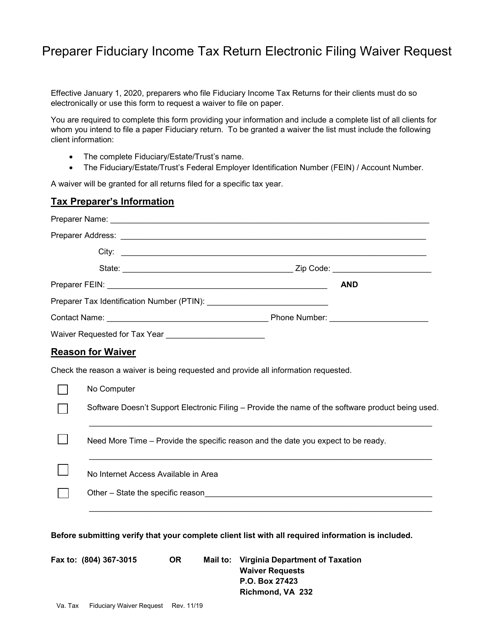

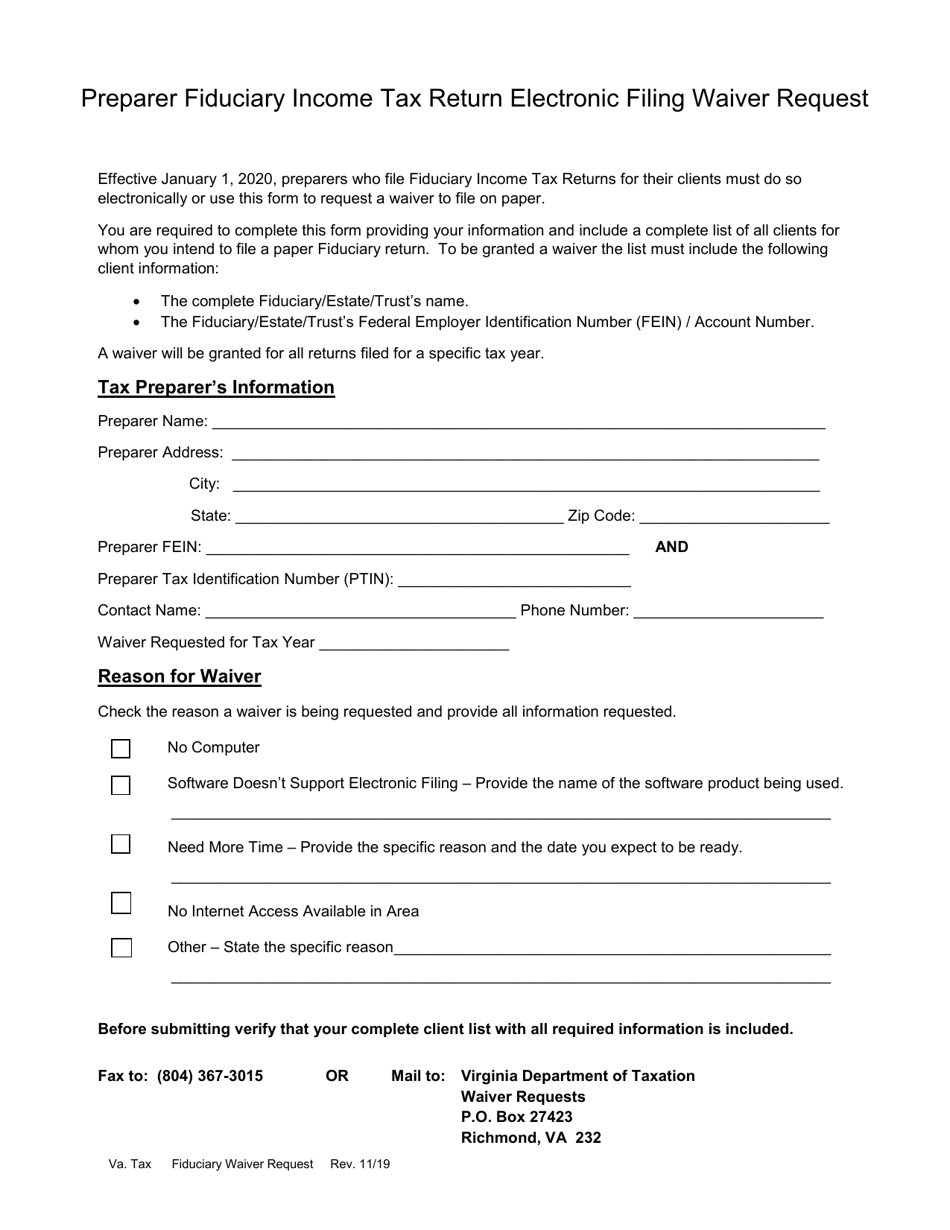

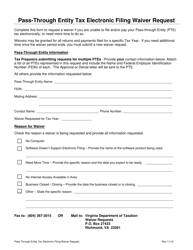

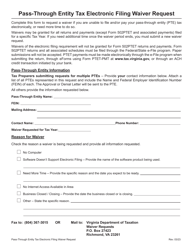

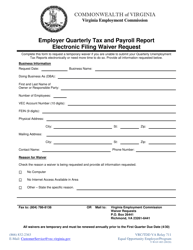

Preparer Fiduciary Income Tax Return Electronic Filing Waiver Request - Virginia

Preparer Electronic Filing Waiver Request is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

Q: What is the Preparer Fiduciary Income Tax Return Electronic Filing Waiver Request for?

A: The waiver request is for the electronic filing of the Preparer Fiduciary Income Tax Return.

Q: Who is eligible to file the waiver request?

A: Any preparer of fiduciary income tax returns in Virginia is eligible to file the waiver request.

Q: What is the purpose of the waiver request?

A: The purpose of the waiver request is to request permission to file the Preparer Fiduciary Income Tax Return in paper format instead of electronically.

Q: How can I file the waiver request?

A: You can file the waiver request by completing and submitting the Preparer Fiduciary Income Tax Return Electronic Filing Waiver Request form to the appropriate authority in Virginia.

Q: What information is required to be included in the waiver request form?

A: The waiver request form requires information such as the preparer's name, contact information, reason for requesting the waiver, and signature.

Q: Is there a deadline for filing the waiver request?

A: Yes, the waiver request must be filed before the due date of the Preparer Fiduciary Income Tax Return.

Q: Will I be notified of the decision on my waiver request?

A: Yes, the appropriate authority in Virginia will notify you of their decision on your waiver request.

Q: What happens if my waiver request is denied?

A: If your waiver request is denied, you will be required to file the Preparer Fiduciary Income Tax Return electronically.

Q: Can I appeal the decision on my waiver request?

A: Yes, you have the right to appeal the decision on your waiver request if it is denied.

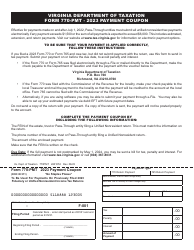

Form Details:

- Released on November 1, 2019;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.