This version of the form is not currently in use and is provided for reference only. Download this version of

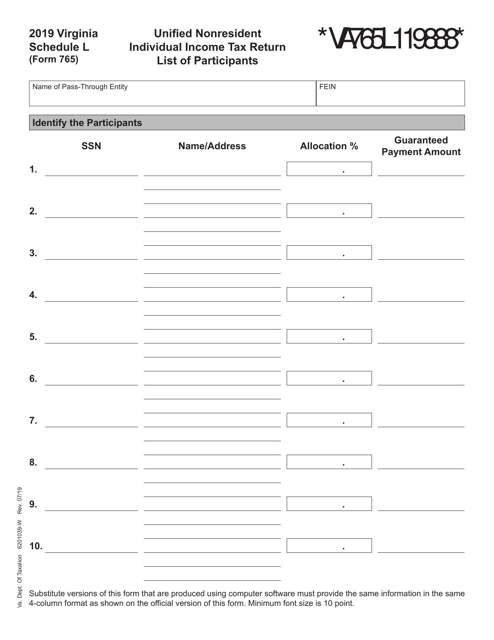

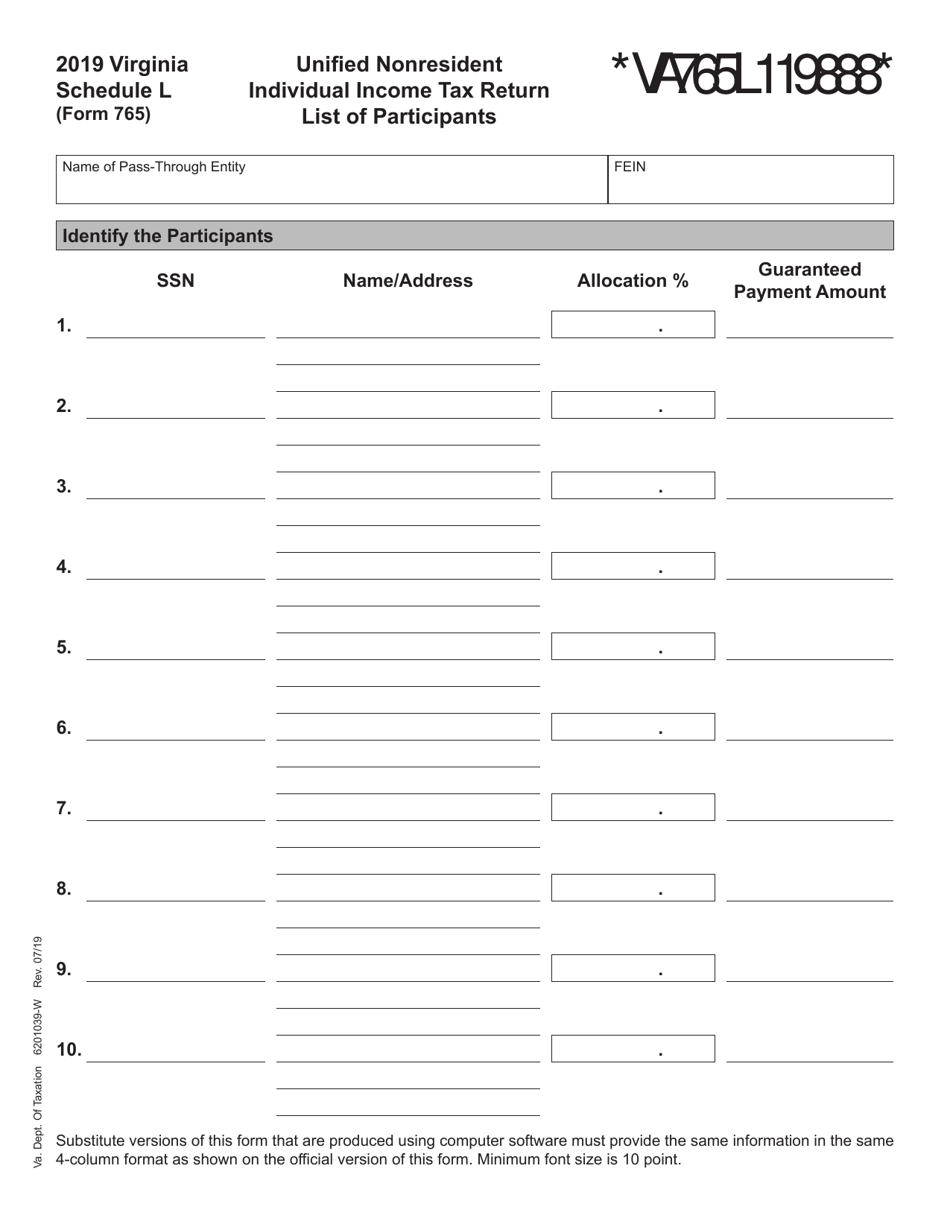

Form 765 Schedule L

for the current year.

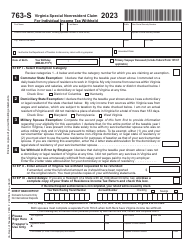

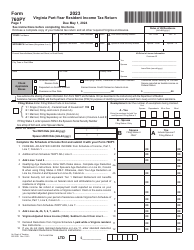

Form 765 Schedule L Unified Nonresident Individual Income Tax Return List of Participants - Virginia

What Is Form 765 Schedule L?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form 765, Unified Nonresident Individual Income Tax Return (Composite Return). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 765 Schedule L?

A: Form 765 Schedule L is a tax return form for nonresident individuals to report their income in Virginia.

Q: Who needs to file Form 765 Schedule L?

A: Nonresident individuals who have earned income in Virginia need to file Form 765 Schedule L.

Q: What is the purpose of Form 765 Schedule L?

A: The purpose of Form 765 Schedule L is to calculate and report the income tax liability of nonresident individuals in Virginia.

Q: What information is required on Form 765 Schedule L?

A: Form 765 Schedule L requires information about the nonresident individual's income, deductions, and tax credits in Virginia.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 765 Schedule L by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.