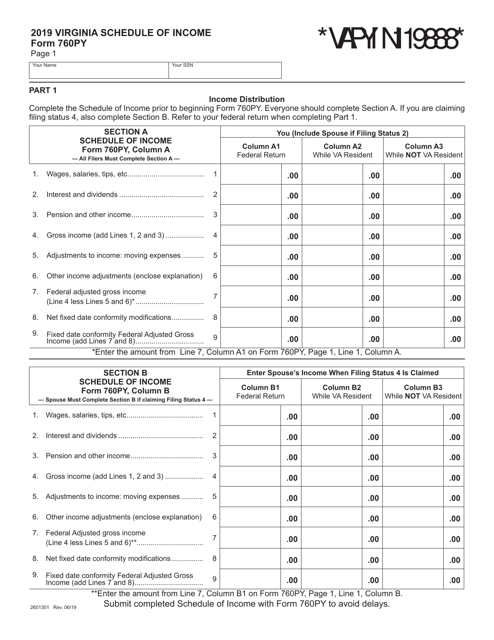

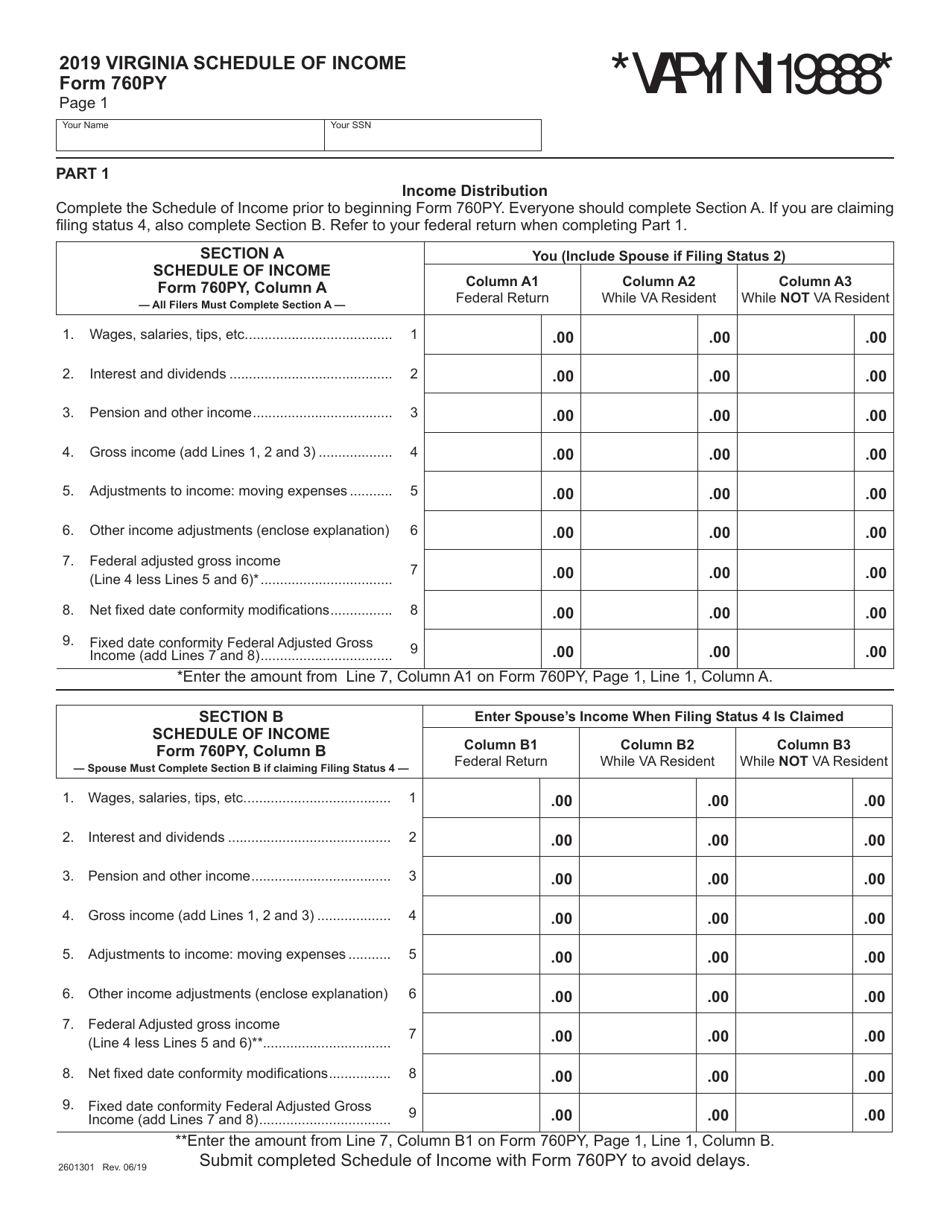

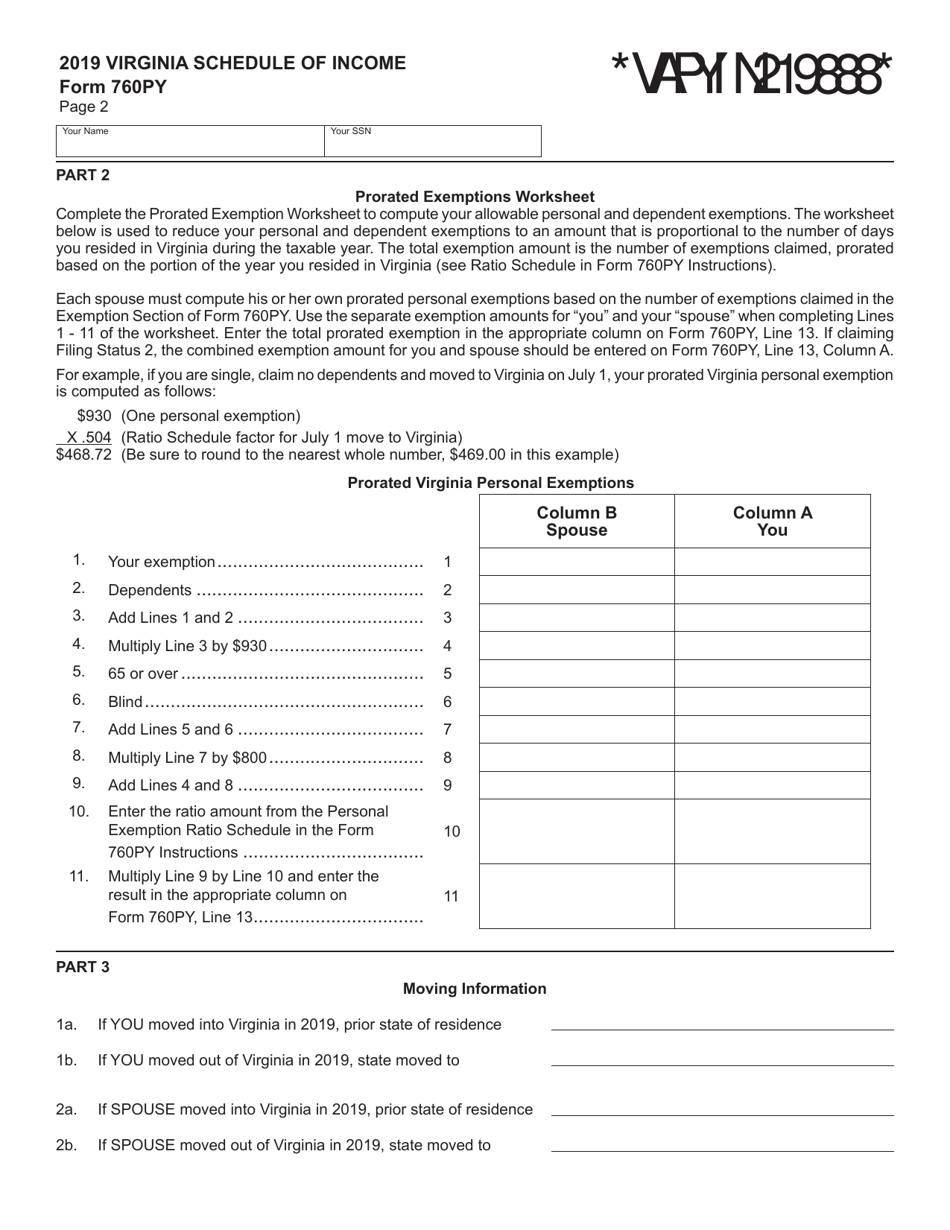

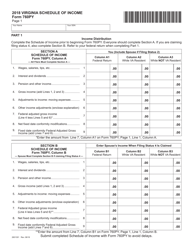

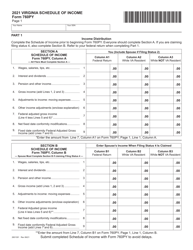

Form 760PY Schedule of Income - Virginia

What Is Form 760PY?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

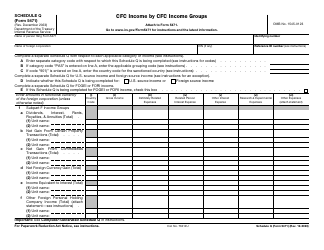

Q: What is Form 760PY Schedule of Income?

A: Form 760PY Schedule of Income is a tax form used in the state of Virginia to report income.

Q: Who needs to fill out Form 760PY Schedule of Income?

A: Form 760PY Schedule of Income needs to be filled out by residents of Virginia who have income to report.

Q: What kind of income should be reported on Form 760PY Schedule of Income?

A: All types of income, including wages, self-employment income, rental income, and investment income, should be reported on Form 760PY Schedule of Income.

Q: Is Form 760PY Schedule of Income the only tax form needed for Virginia state taxes?

A: No, Form 760PY Schedule of Income is just one part of the overall Virginia state tax return. Additionally, residents may need to fill out Form 760PY, Virginia Resident Income Tax Return.

Q: When is the deadline to file Form 760PY Schedule of Income?

A: The deadline to file Form 760PY Schedule of Income is usually April 15th, unless an extension has been granted.

Q: Do I need to include any supporting documents with Form 760PY Schedule of Income?

A: It is recommended to include any necessary supporting documents, such as W-2 forms, 1099 forms, and receipts, with Form 760PY Schedule of Income.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 760PY by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.