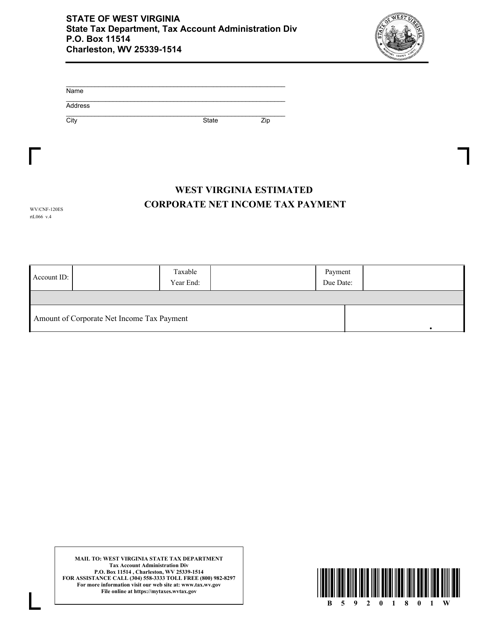

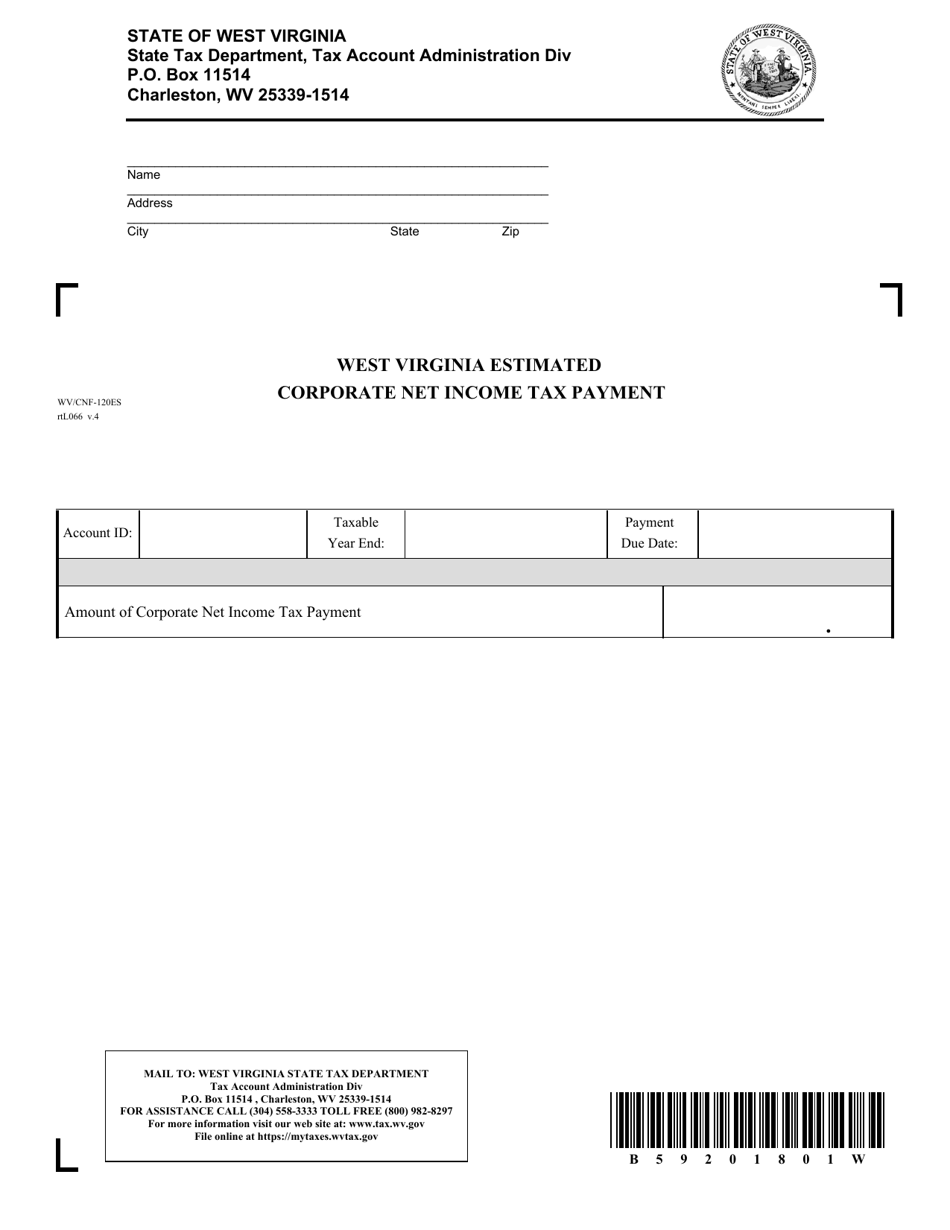

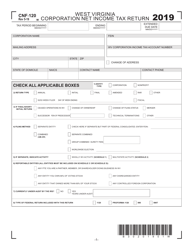

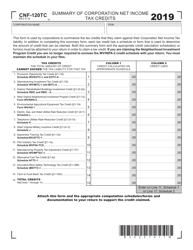

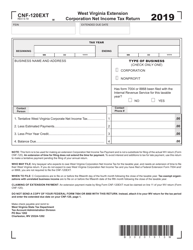

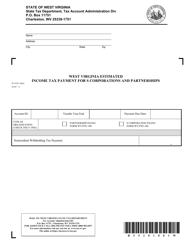

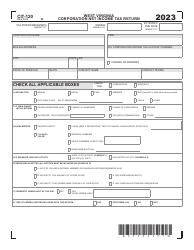

Form WV / CNF-120ES West Virginia Estimated Corporate Net Income Tax Payment - West Virginia

What Is Form WV/CNF-120ES?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/CNF-120ES?

A: Form WV/CNF-120ES is a form used in West Virginia to make estimated corporate net income tax payments.

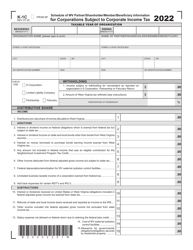

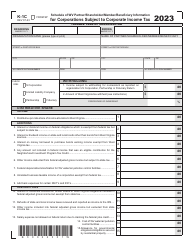

Q: What is West Virginia Estimated Corporate Net Income Tax?

A: West Virginia Estimated Corporate Net Income Tax is a tax paid by corporations based on their estimated net income for the year.

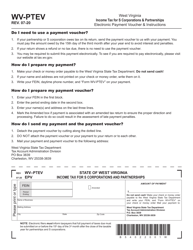

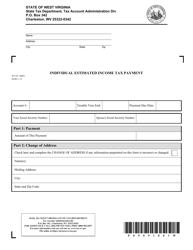

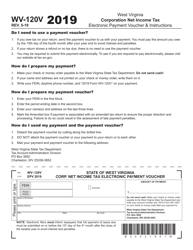

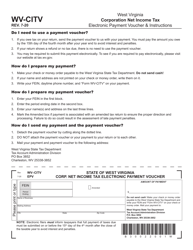

Q: How do I use Form WV/CNF-120ES?

A: You can use Form WV/CNF-120ES to make estimated tax payments by filling out the form with your income information and sending it to the West Virginia Department of Revenue.

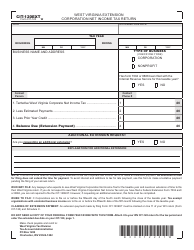

Q: Why do I need to make estimated tax payments?

A: Corporations are required to make estimated tax payments to avoid underpayment penalties and ensure they have paid enough tax throughout the year.

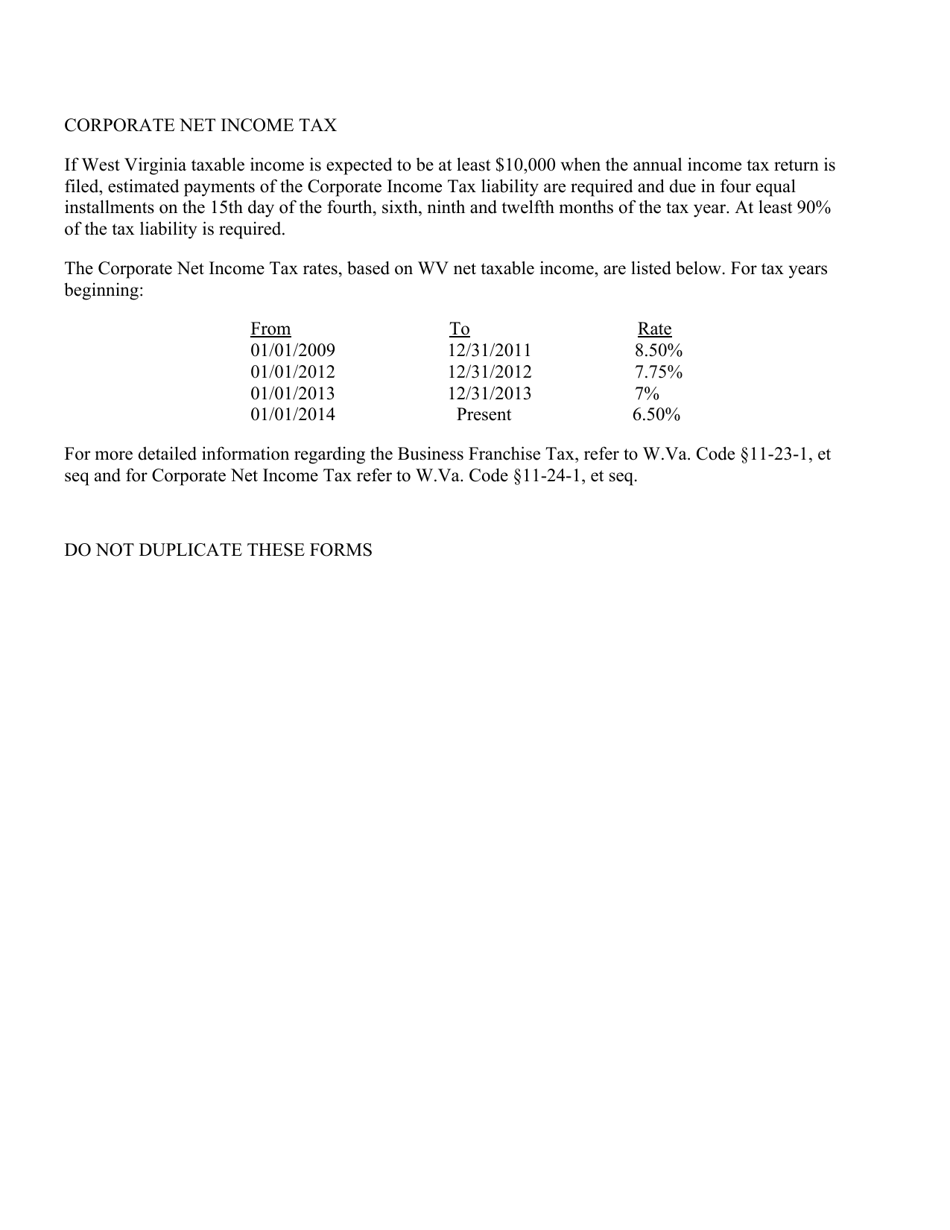

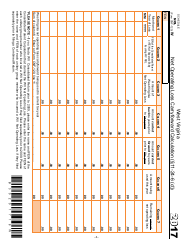

Q: When are West Virginia Estimated Corporate Net Income Tax payments due?

A: The payment due dates for West Virginia Estimated Corporate Net Income Tax are April 15, June 15, September 15, and December 15.

Q: What happens if I don't make estimated tax payments?

A: If you don't make estimated tax payments, you may be subject to underpayment penalties and interest on the unpaid tax amount.

Q: How do I know how much to pay for West Virginia Estimated Corporate Net Income Tax?

A: You can calculate your estimated tax payment using the instructions and worksheets provided with Form WV/CNF-120ES.

Q: Are there any exceptions to the requirement of making estimated tax payments?

A: There may be exceptions for certain small corporations, as well as corporations with no West Virginia tax liability in the previous year. Consult the instructions for Form WV/CNF-120ES for more information.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CNF-120ES by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.