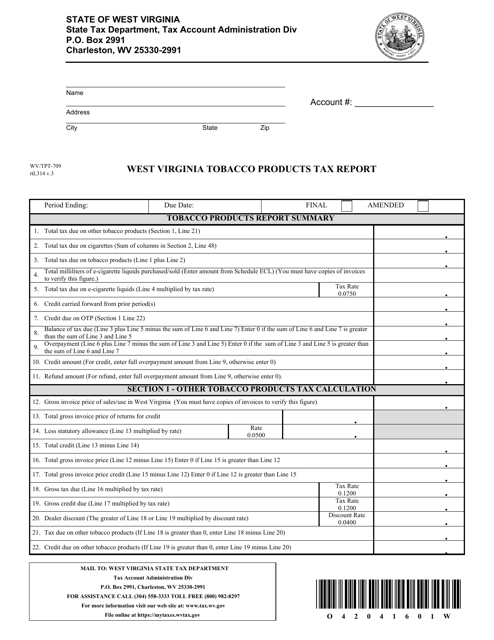

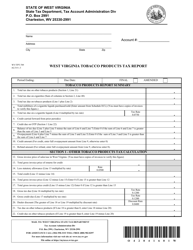

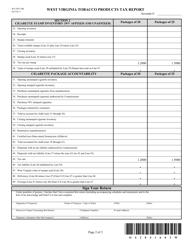

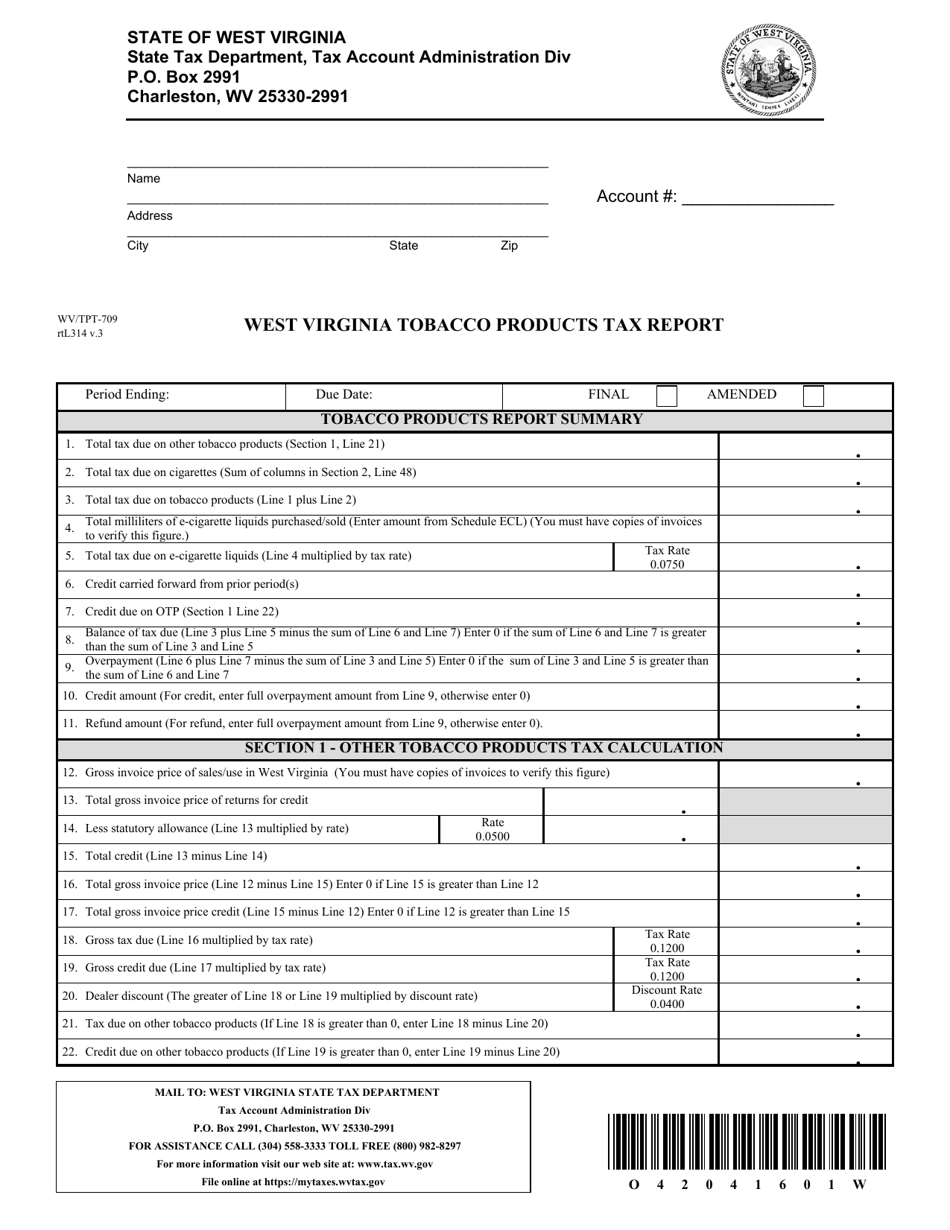

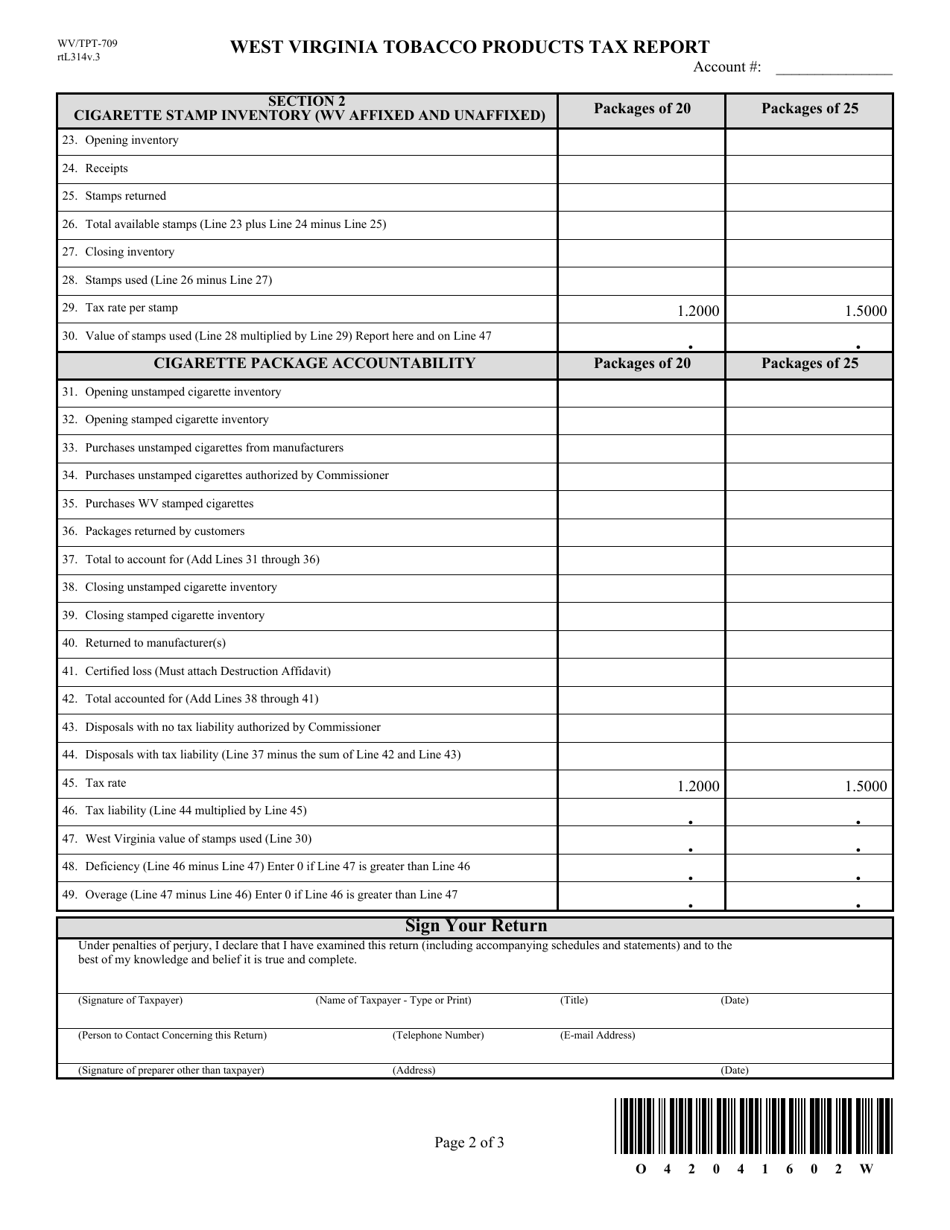

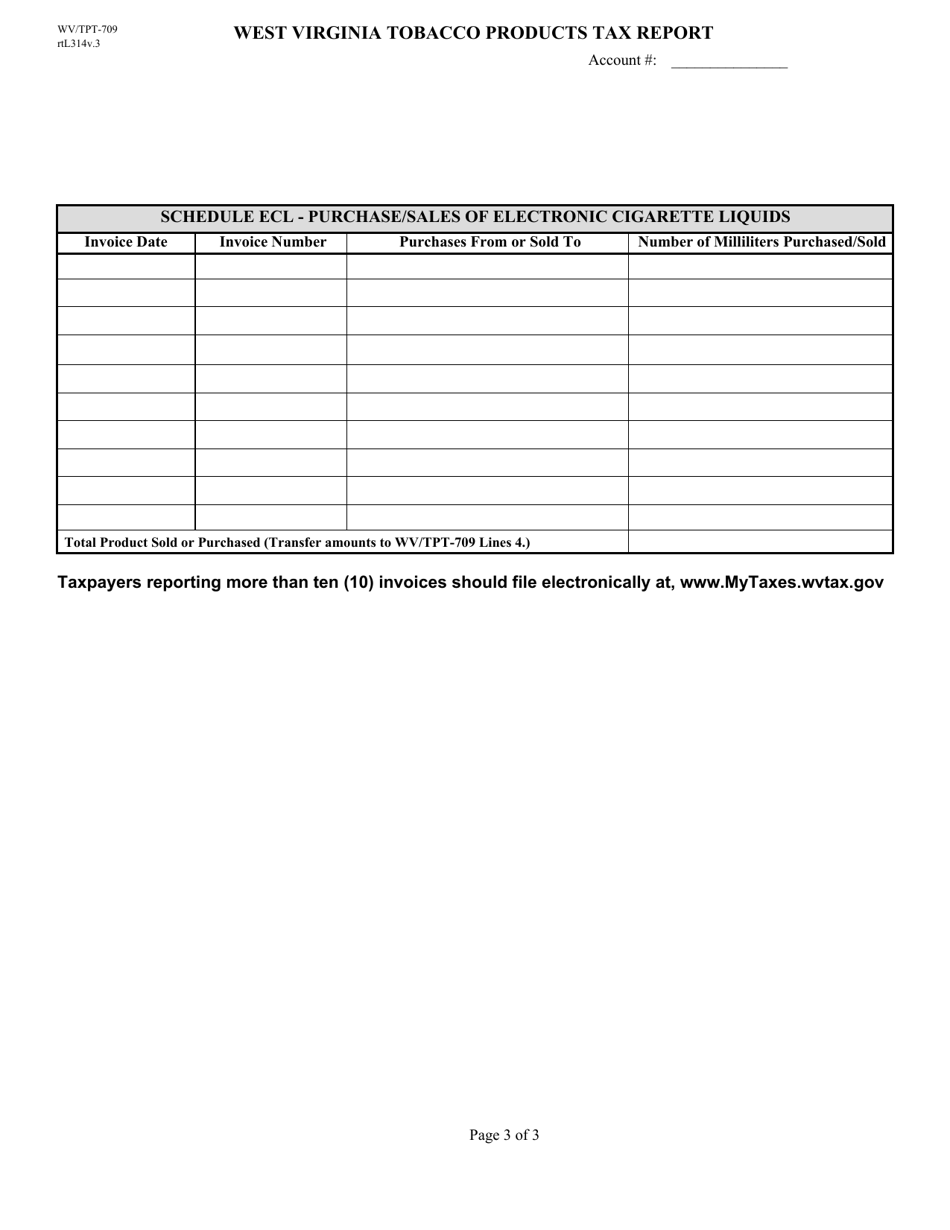

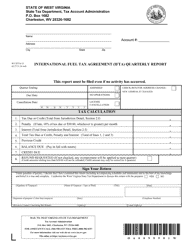

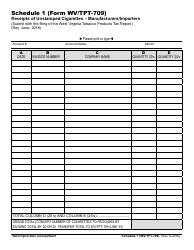

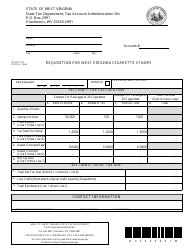

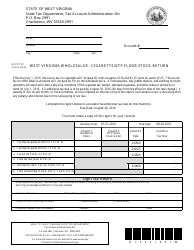

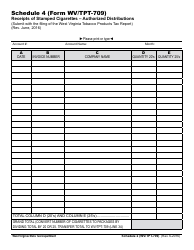

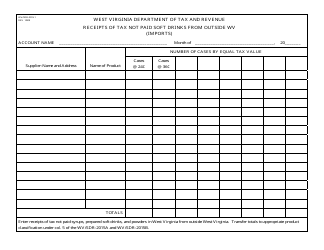

Form WV / TPT-709 West Virginia Tobacco Products Tax Report - West Virginia

What Is Form WV/TPT-709?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form WV/TPT-709?

A: Form WV/TPT-709 is the West Virginia Tobacco ProductsTax Report.

Q: What is the purpose of Form WV/TPT-709?

A: The purpose of Form WV/TPT-709 is to report and pay tobacco products tax in West Virginia.

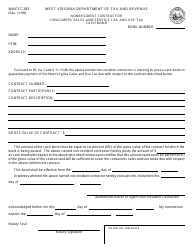

Q: Who needs to file Form WV/TPT-709?

A: Any person engaged in the sale or distribution of tobacco products in West Virginia needs to file Form WV/TPT-709.

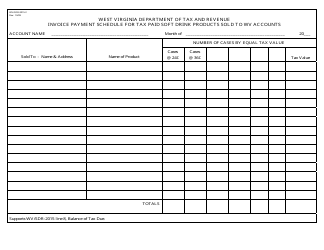

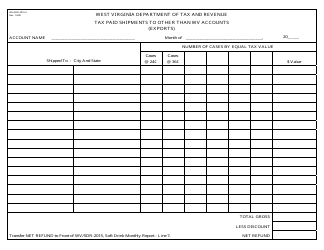

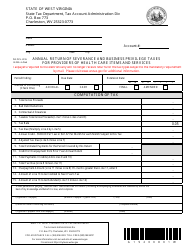

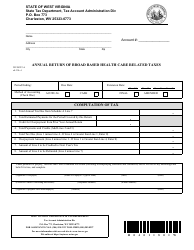

Q: What information is required on Form WV/TPT-709?

A: Form WV/TPT-709 requires information about the quantity and sales price of tobacco products sold or distributed in West Virginia.

Q: When is Form WV/TPT-709 due?

A: Form WV/TPT-709 is due on the 20th day of the month following the reporting period.

Q: Is there a penalty for not filing Form WV/TPT-709?

A: Yes, there may be penalties for not filing Form WV/TPT-709 or for filing it late.

Q: Are there any exemptions or deductions available for tobacco products tax?

A: Yes, there are certain exemptions and deductions available for tobacco products tax. You should consult the instructions for Form WV/TPT-709 for more information.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/TPT-709 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.