This version of the form is not currently in use and is provided for reference only. Download this version of

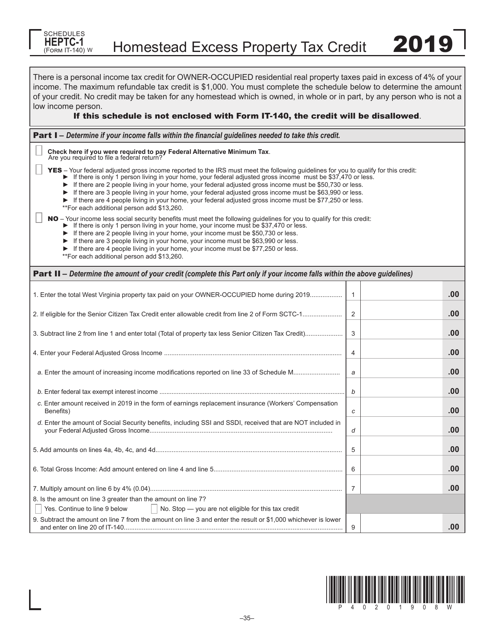

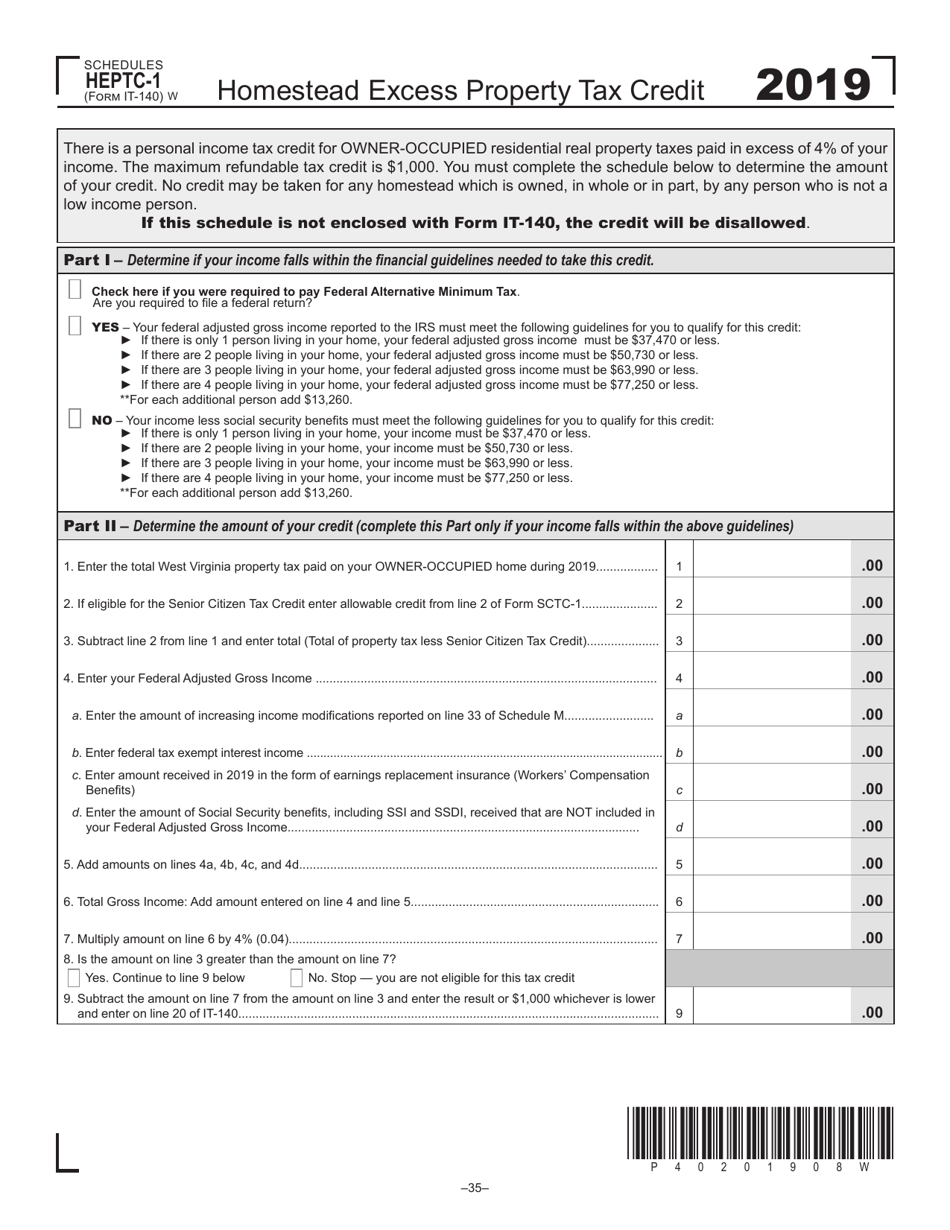

Form IT-140 Schedule HEPTC-1

for the current year.

Form IT-140 Schedule HEPTC-1 Homestead Excess Property Tax Credit - West Virginia

What Is Form IT-140 Schedule HEPTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140 Schedule HEPTC-1?

A: Form IT-140 Schedule HEPTC-1 is a tax form used in West Virginia to claim the Homestead Excess Property Tax Credit.

Q: What is the Homestead Excess Property Tax Credit?

A: The Homestead Excess Property Tax Credit is a tax credit available to qualifying West Virginia residents who have paid excess property tax on their primary residence.

Q: Who can claim the Homestead Excess Property Tax Credit?

A: West Virginia residents who meet certain eligibility requirements can claim the Homestead Excess Property Tax Credit.

Q: What are the eligibility requirements for the Homestead Excess Property Tax Credit?

A: To be eligible for the Homestead Excess Property Tax Credit, you must be a West Virginia resident, own and occupy your primary residence, and have paid excess property tax on your property.

Q: How do I claim the Homestead Excess Property Tax Credit?

A: To claim the Homestead Excess Property Tax Credit, you need to complete Form IT-140 Schedule HEPTC-1 and include it with your West Virginia tax return.

Q: Is there a deadline for claiming the Homestead Excess Property Tax Credit?

A: Yes, the deadline for claiming the Homestead Excess Property Tax Credit in West Virginia is the same as the deadline for filing your state tax return.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-140 Schedule HEPTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.