This version of the form is not currently in use and is provided for reference only. Download this version of

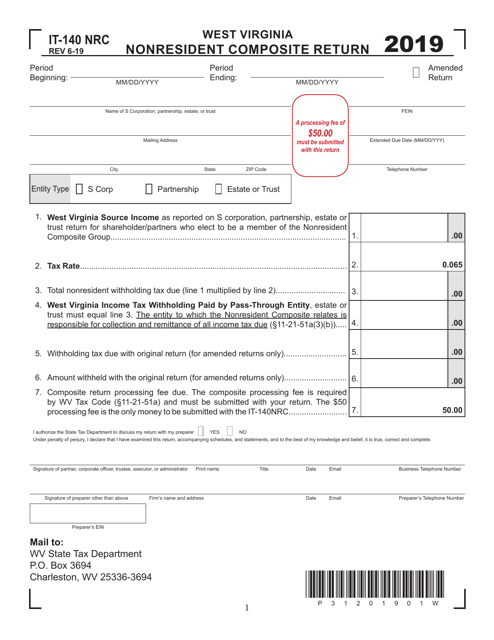

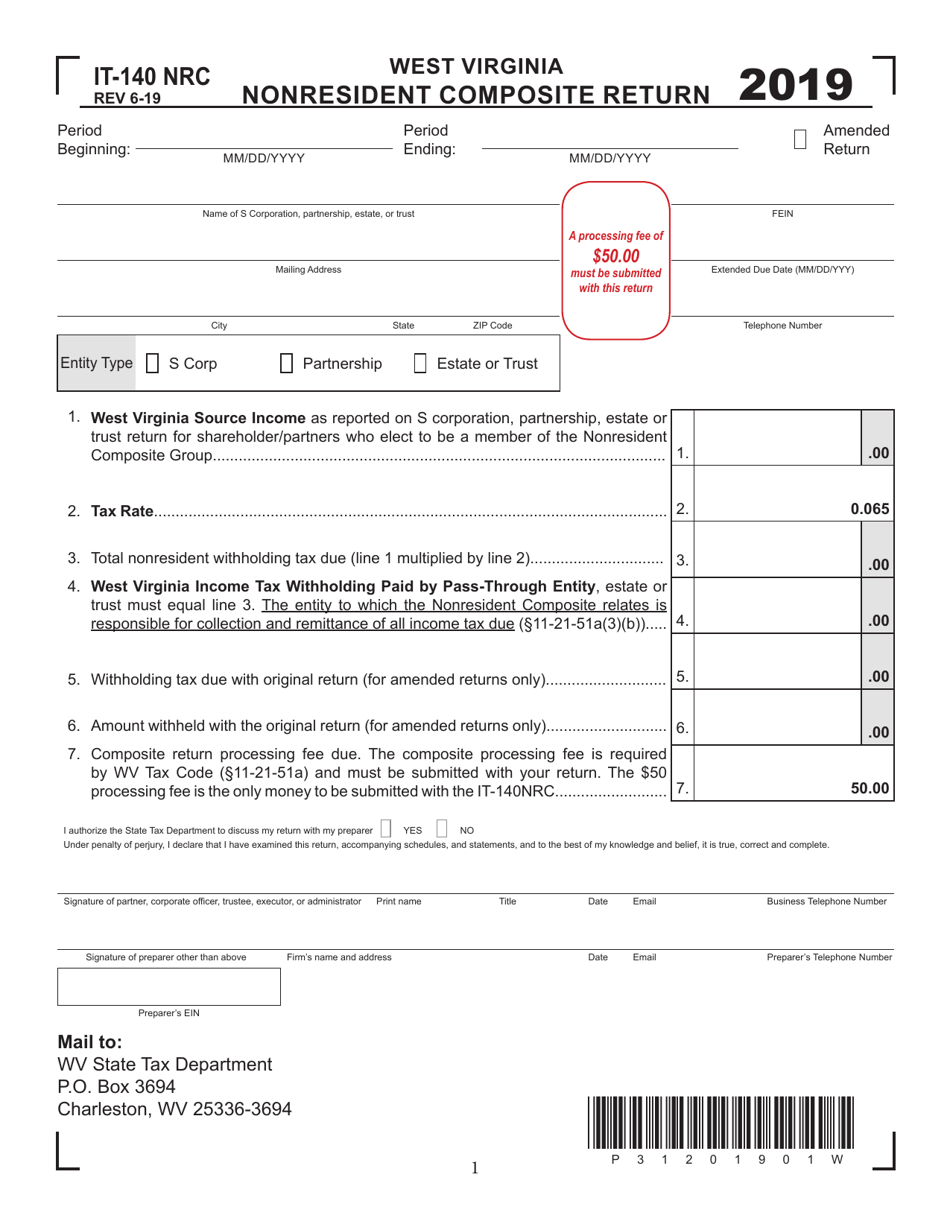

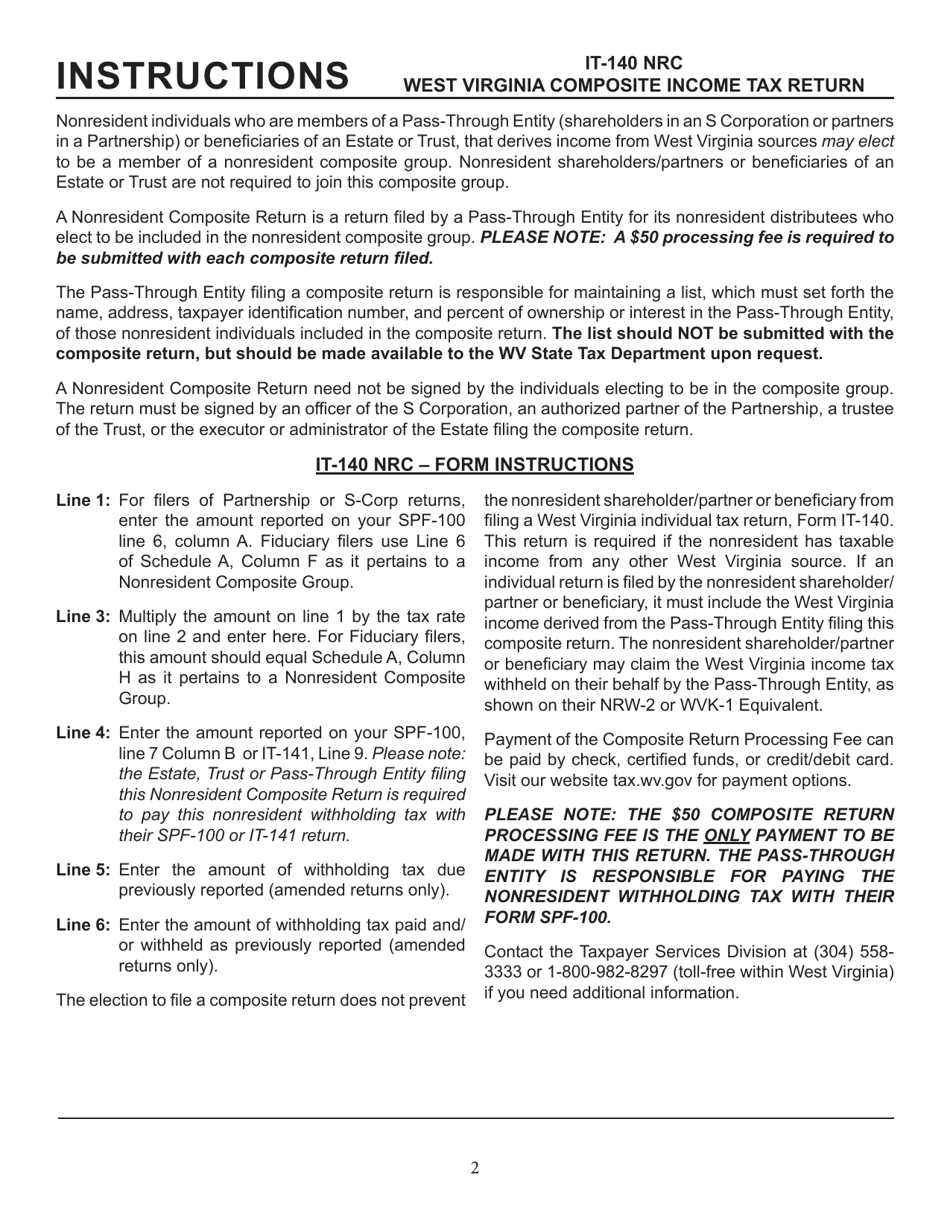

Form IT-140 NRC

for the current year.

Form IT-140 NRC Nonresident Composite Return - West Virginia

What Is Form IT-140 NRC?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140 NRC?

A: Form IT-140 NRC is the Nonresident Composite Return for West Virginia.

Q: Who should file Form IT-140 NRC?

A: Nonresident individuals who have income from West Virginia sources and are part of a composite filing for their nonresident shareholders.

Q: What is a composite return?

A: A composite return is a single tax return filed on behalf of multiple nonresident shareholders.

Q: What is the purpose of Form IT-140 NRC?

A: The purpose of Form IT-140 NRC is to report and pay taxes on behalf of nonresident shareholders.

Q: Are there any special requirements for filing Form IT-140 NRC?

A: Yes, you must obtain a waiver of any additional state or local taxes due from each nonresident shareholder.

Q: When is the deadline for filing Form IT-140 NRC?

A: The deadline for filing Form IT-140 NRC is the same as the regular income tax filing deadline, which is usually April 15th.

Q: Can I file Form IT-140 NRC electronically?

A: Yes, you can file Form IT-140 NRC electronically through the West Virginia Electronic Filing System.

Q: What should I do if I have questions about Form IT-140 NRC?

A: If you have questions about Form IT-140 NRC, you can contact the West Virginia Department of Revenue for assistance.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-140 NRC by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.