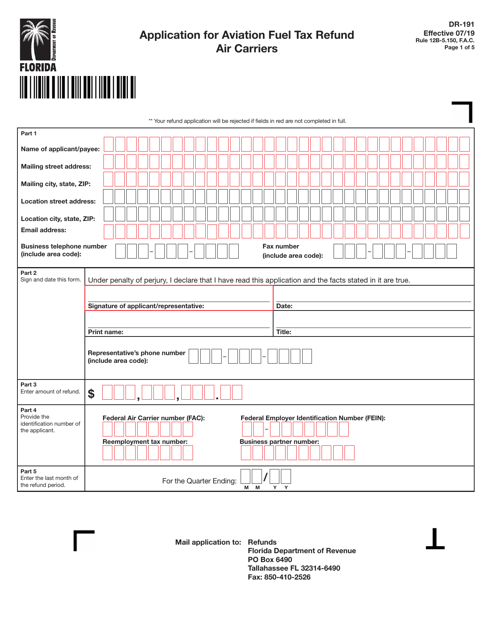

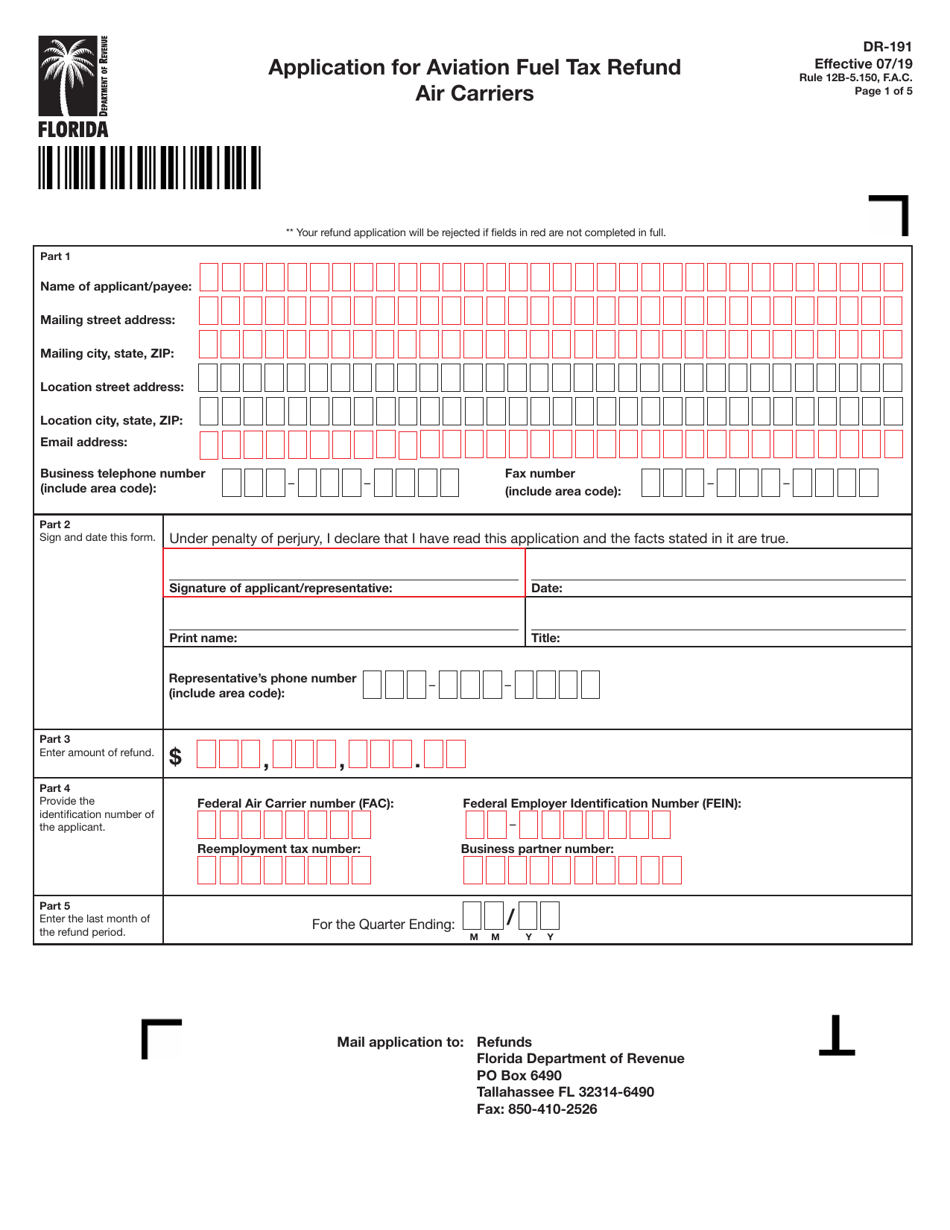

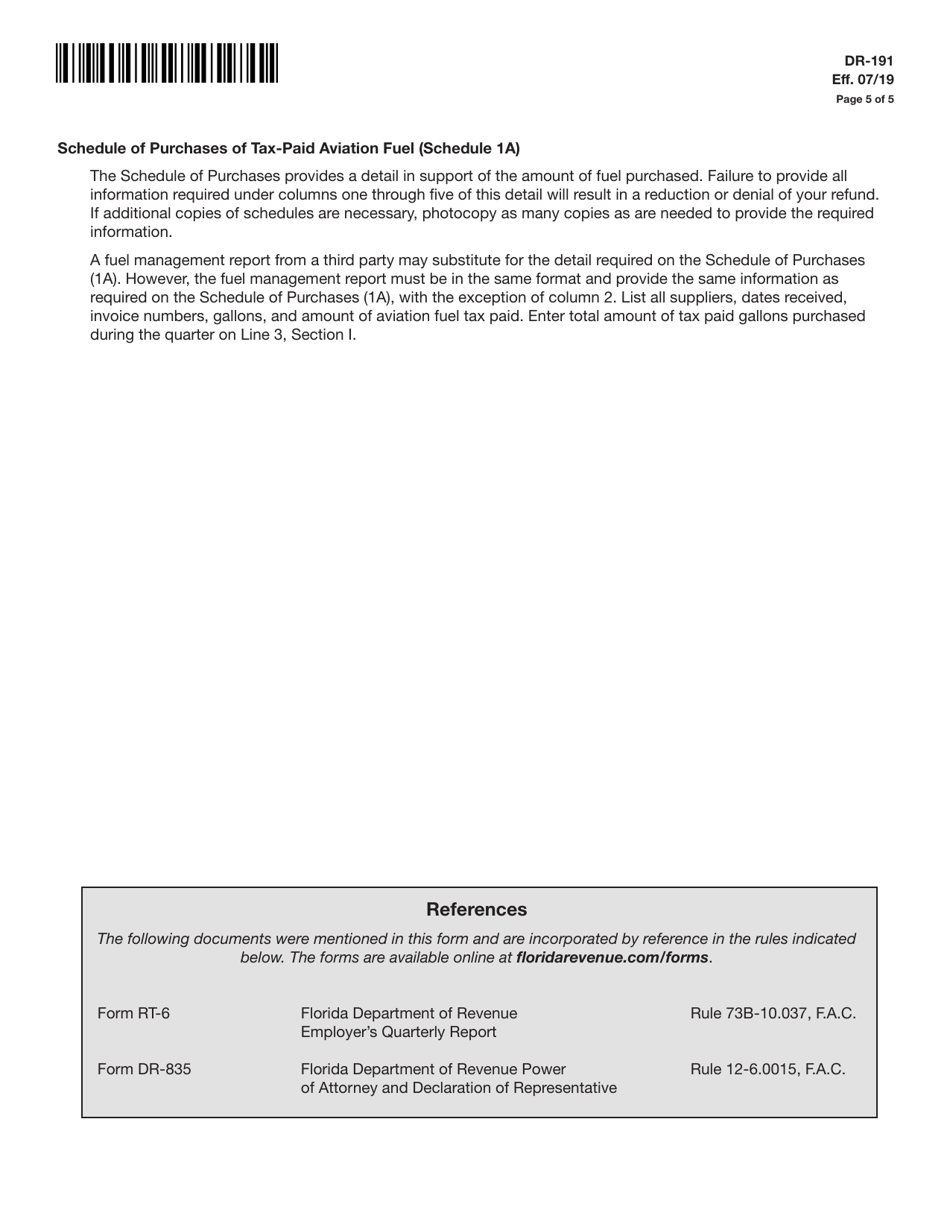

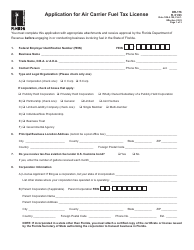

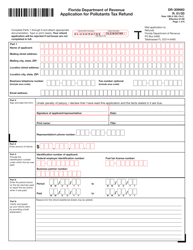

Form DR-191 Application for Aviation Fuel Tax Refund - Air Carriers - Florida

What Is Form DR-191?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-191?

A: Form DR-191 is an Application for Aviation Fuel Tax Refund - Air Carriers in Florida.

Q: Who can use Form DR-191?

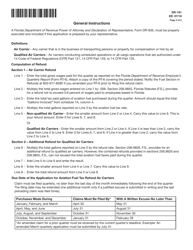

A: Form DR-191 can be used by air carriers in Florida who are seeking a refund of aviation fuel taxes paid.

Q: What is the purpose of Form DR-191?

A: The purpose of Form DR-191 is to apply for a refund of aviation fuel taxes paid by air carriers in Florida.

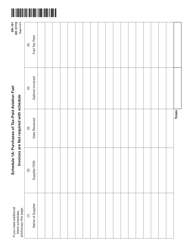

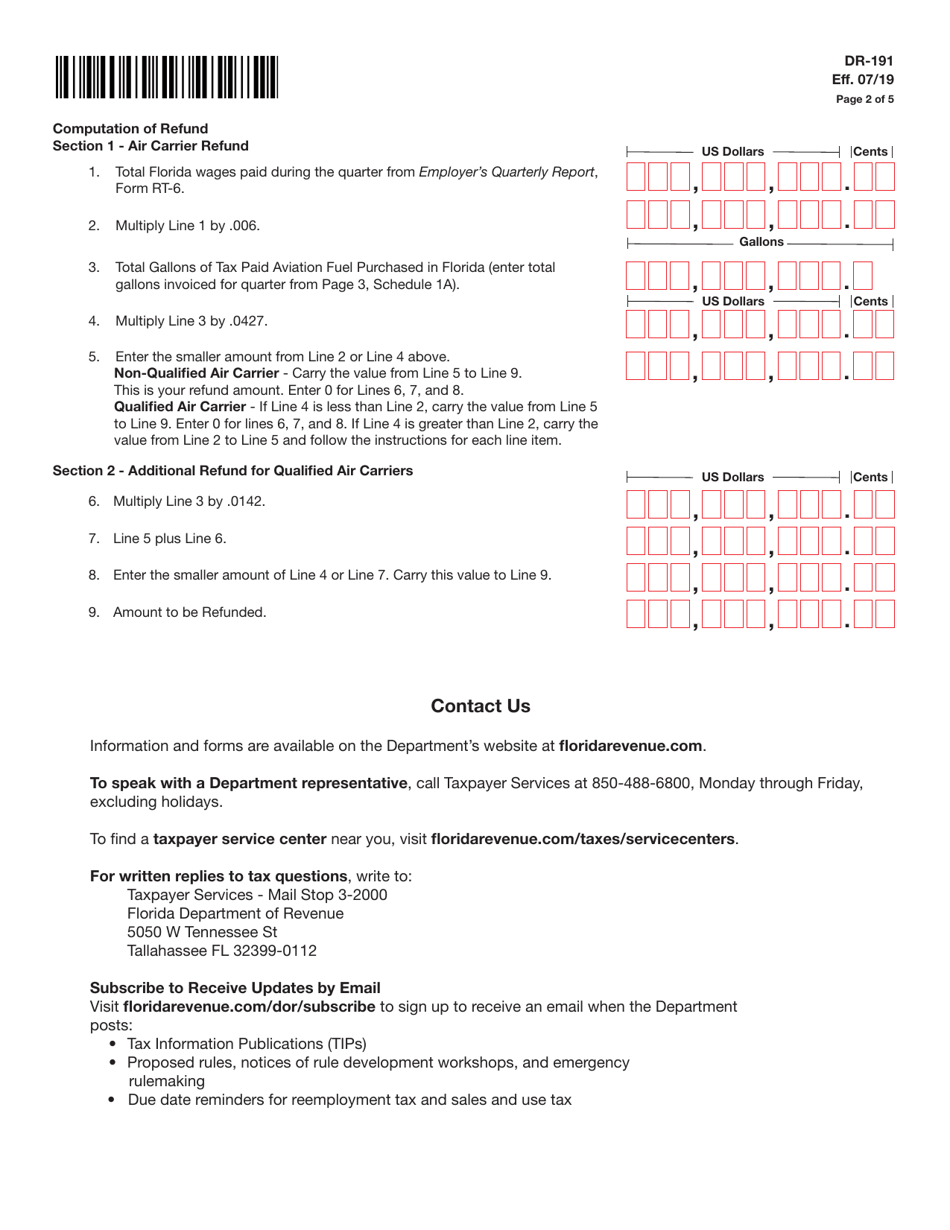

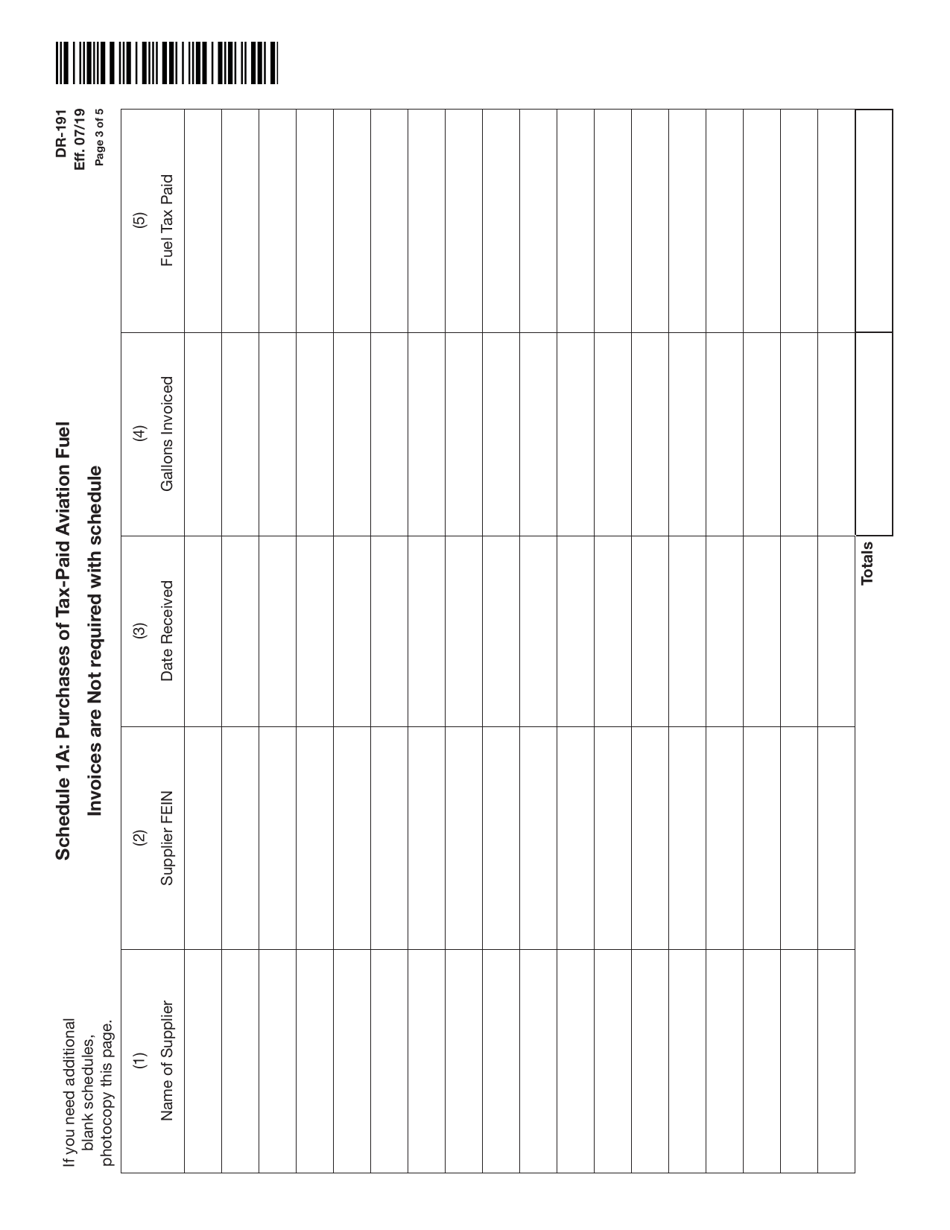

Q: What information is required on Form DR-191?

A: Form DR-191 requires information such as the air carrier's name, address, fuel purchase details, and tax payment information.

Q: How should I submit Form DR-191?

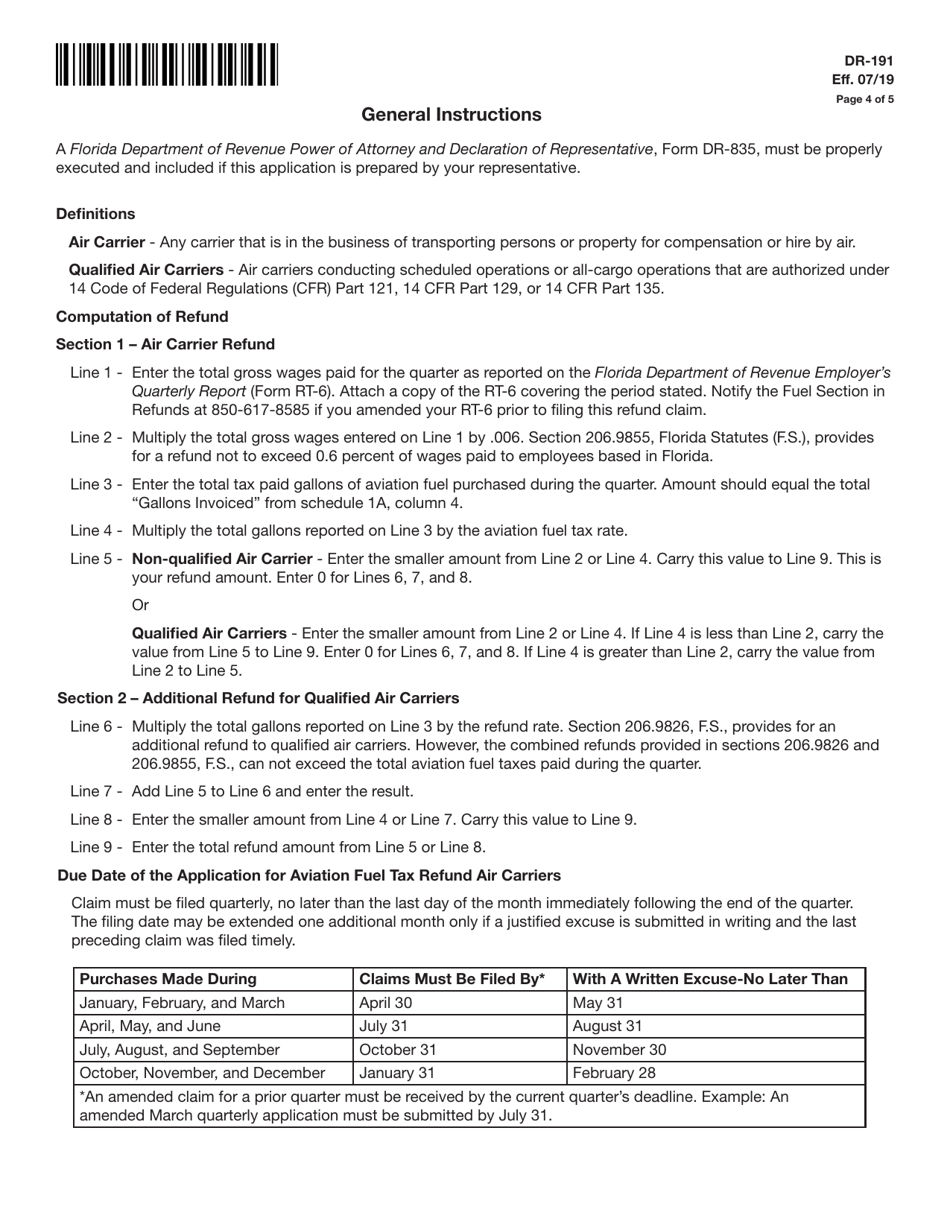

A: Form DR-191 should be submitted to the Florida Department of Revenue by mail or electronically, as specified in the instructions.

Q: Are there any deadlines for submitting Form DR-191?

A: Yes, Form DR-191 must be filed within four years from the date the fuel was paid for.

Q: Is there a fee for submitting Form DR-191?

A: No, there is no fee for submitting Form DR-191.

Q: What should I do if I have additional questions about Form DR-191?

A: If you have additional questions about Form DR-191, you should contact the Florida Department of Revenue for assistance.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-191 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.