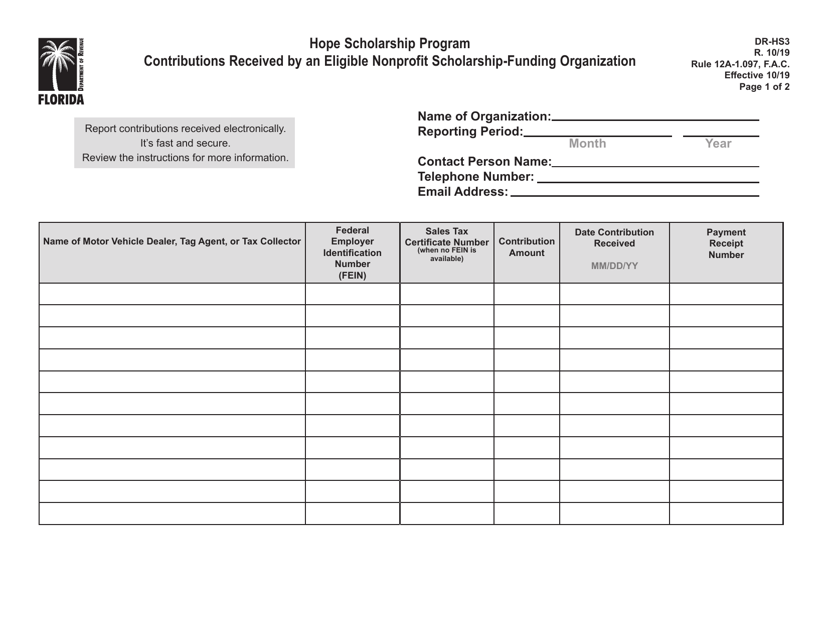

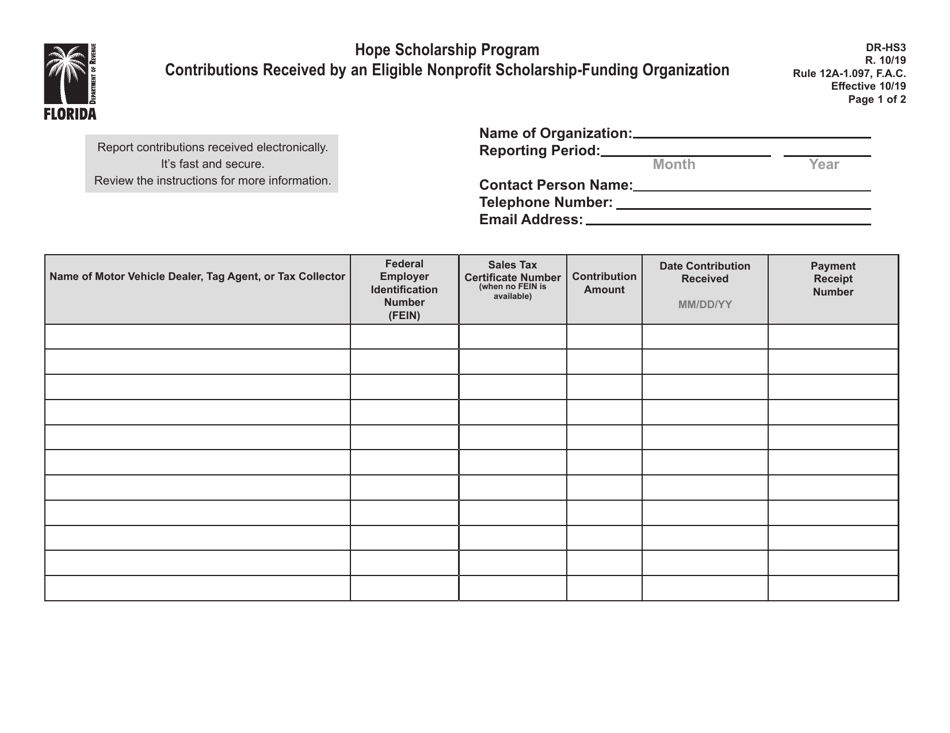

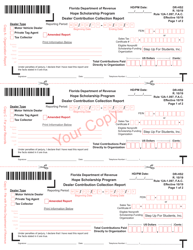

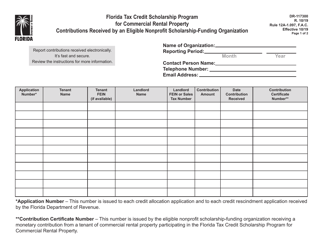

Form DR-HS3 Hope Scholarship Program Contributions Received by an Eligible Nonprofit Scholarship-Funding Organization - Florida

What Is Form DR-HS3?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-HS3?

A: Form DR-HS3 is a tax form used to report contributions received by an eligible nonprofit scholarship-funding organization in Florida for the Hope Scholarship Program.

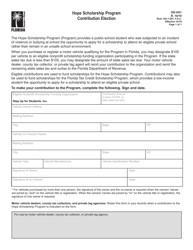

Q: What is the Hope Scholarship Program?

A: The Hope Scholarship Program is a program in Florida that provides scholarships to students who have been victims of bullying or other harmful incidents.

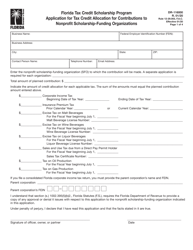

Q: Who should file Form DR-HS3?

A: Eligible nonprofit scholarship-funding organizations in Florida should file Form DR-HS3 to report contributions received for the Hope Scholarship Program.

Q: What information is required to be reported on Form DR-HS3?

A: Form DR-HS3 requires the reporting of the contributor's name, address, federal employer identification number (EIN), and the amount of the contribution.

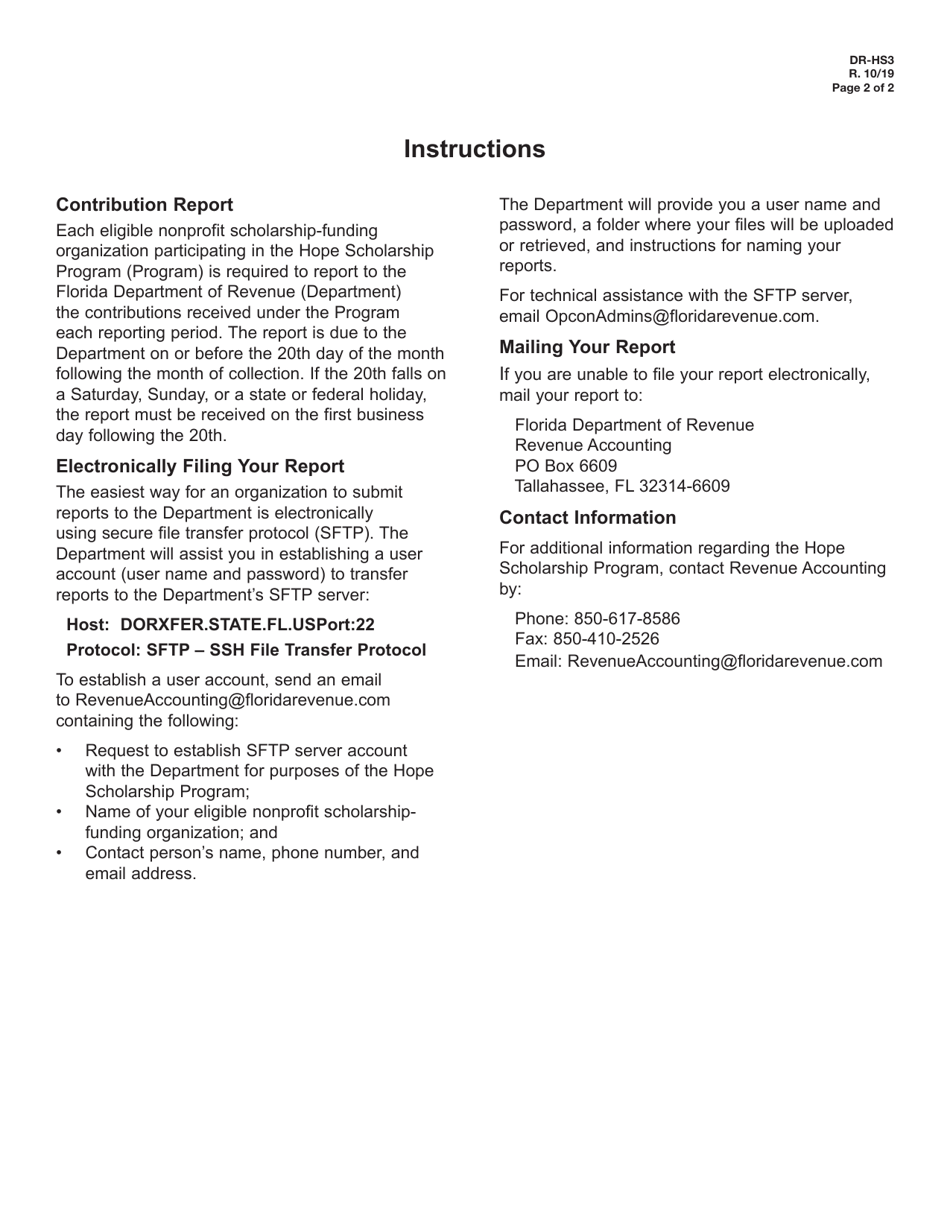

Q: When is Form DR-HS3 due?

A: Form DR-HS3 is due on or before January 31 of the year following the calendar year in which the contributions were received.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-HS3 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.