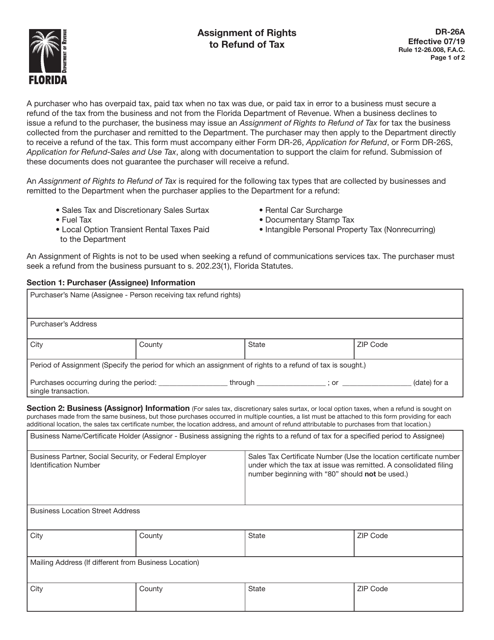

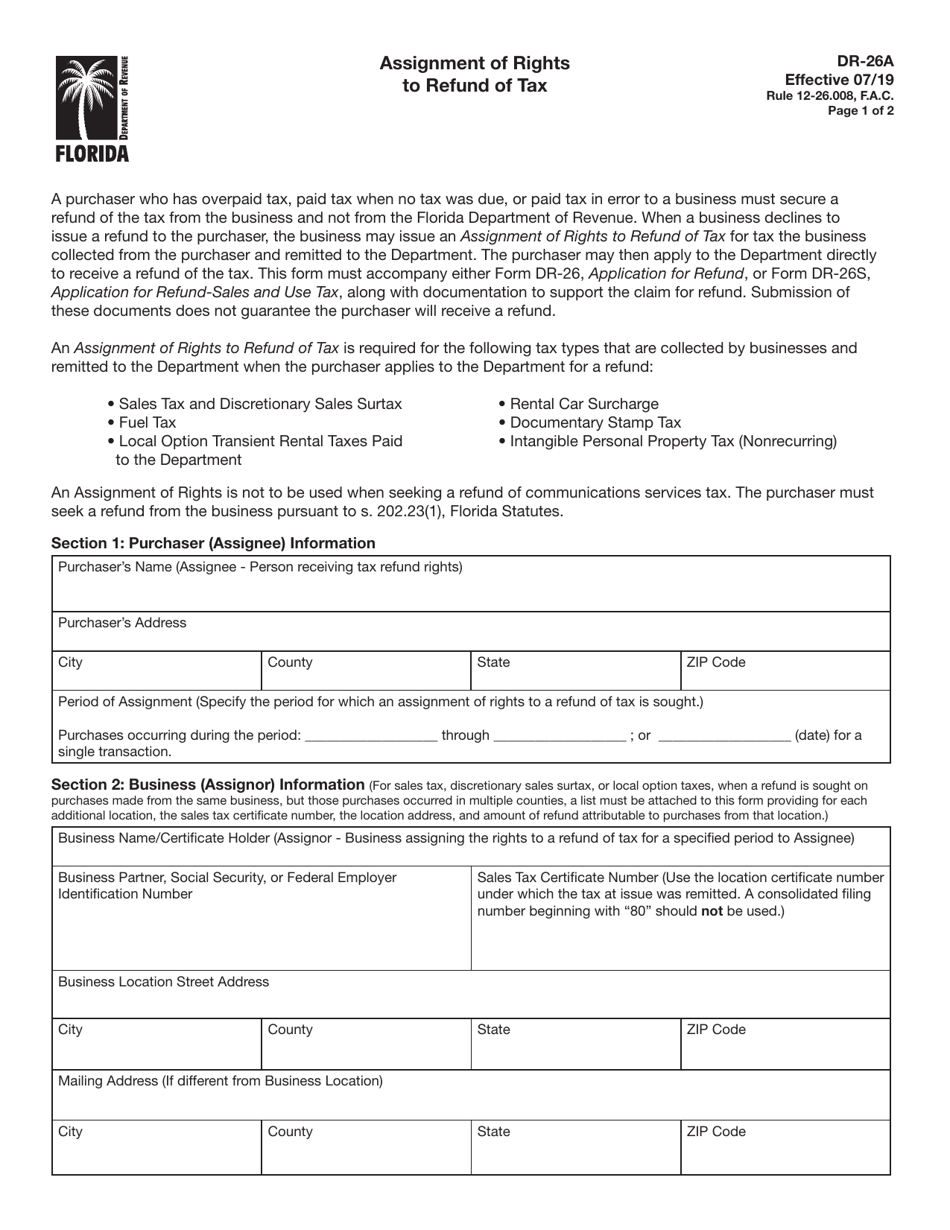

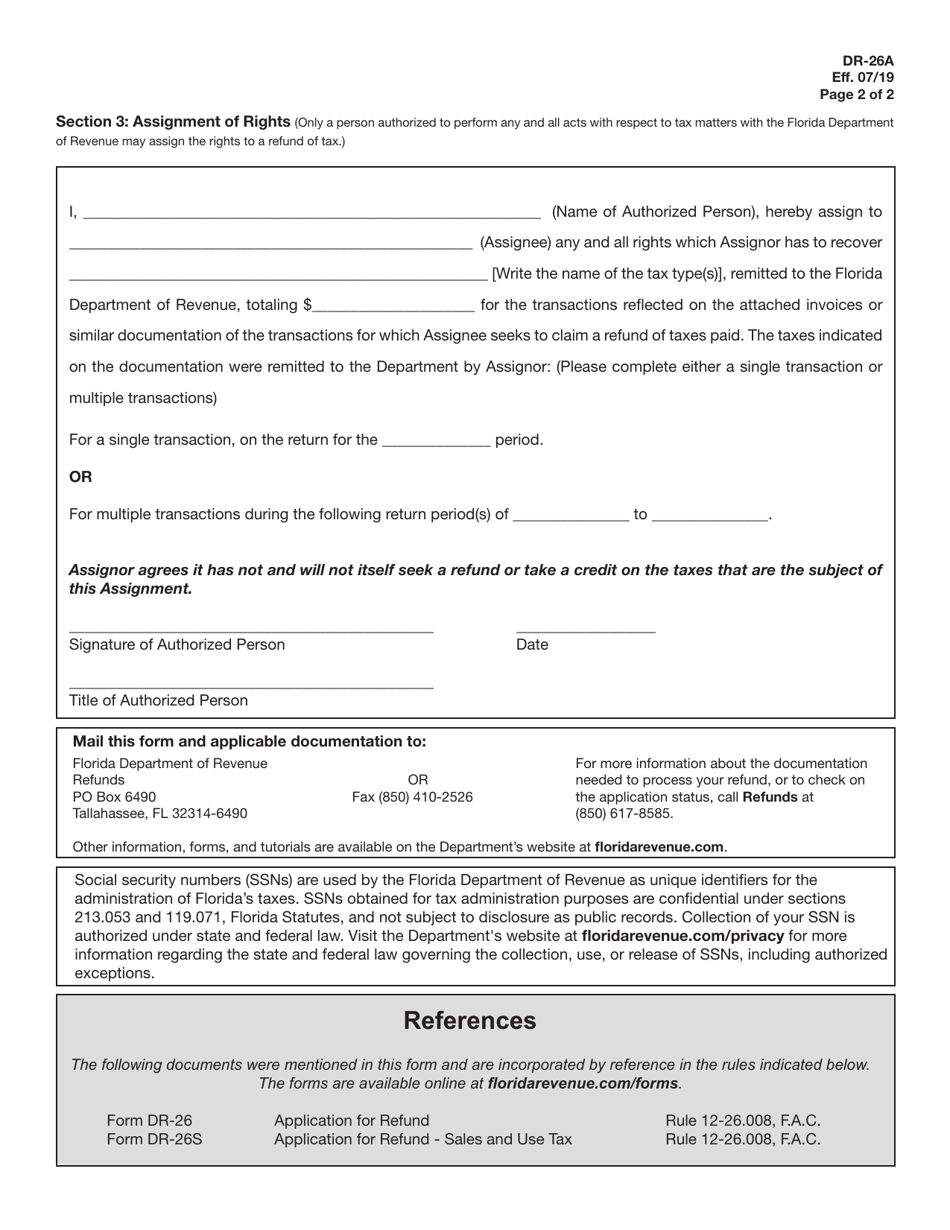

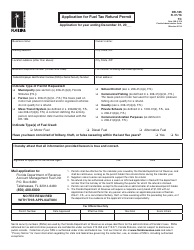

Form DR-26A Assignment of Rights to Refund of Tax - Florida

What Is Form DR-26A?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-26A?

A: Form DR-26A is a document used in Florida to assign the rights to a tax refund to someone else.

Q: Who can use Form DR-26A?

A: Form DR-26A can be used by individuals or businesses in Florida who want to assign their tax refund rights to another party.

Q: Why would someone use Form DR-26A?

A: Someone may use Form DR-26A if they want to transfer their right to a tax refund to another person or entity.

Q: Are there any fees to file Form DR-26A?

A: There are no fees to file Form DR-26A.

Q: Do I need to provide any supporting documents with Form DR-26A?

A: No, you generally do not need to provide any supporting documents with Form DR-26A, unless specifically requested by the Florida Department of Revenue.

Q: Can I electronically file Form DR-26A?

A: No, Form DR-26A cannot be filed electronically and must be submitted by mail.

Q: Can I cancel or revoke an assignment made using Form DR-26A?

A: No, once an assignment is made using Form DR-26A, it cannot be canceled or revoked.

Q: Can I assign a tax refund to multiple parties using Form DR-26A?

A: No, Form DR-26A only allows for the assignment of the tax refund to one party.

Q: What happens after I submit Form DR-26A?

A: After you submit Form DR-26A, the Florida Department of Revenue will process the assignment and update their records accordingly.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-26A by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.