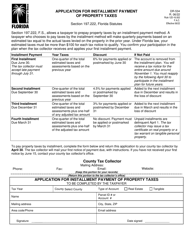

This version of the form is not currently in use and is provided for reference only. Download this version of

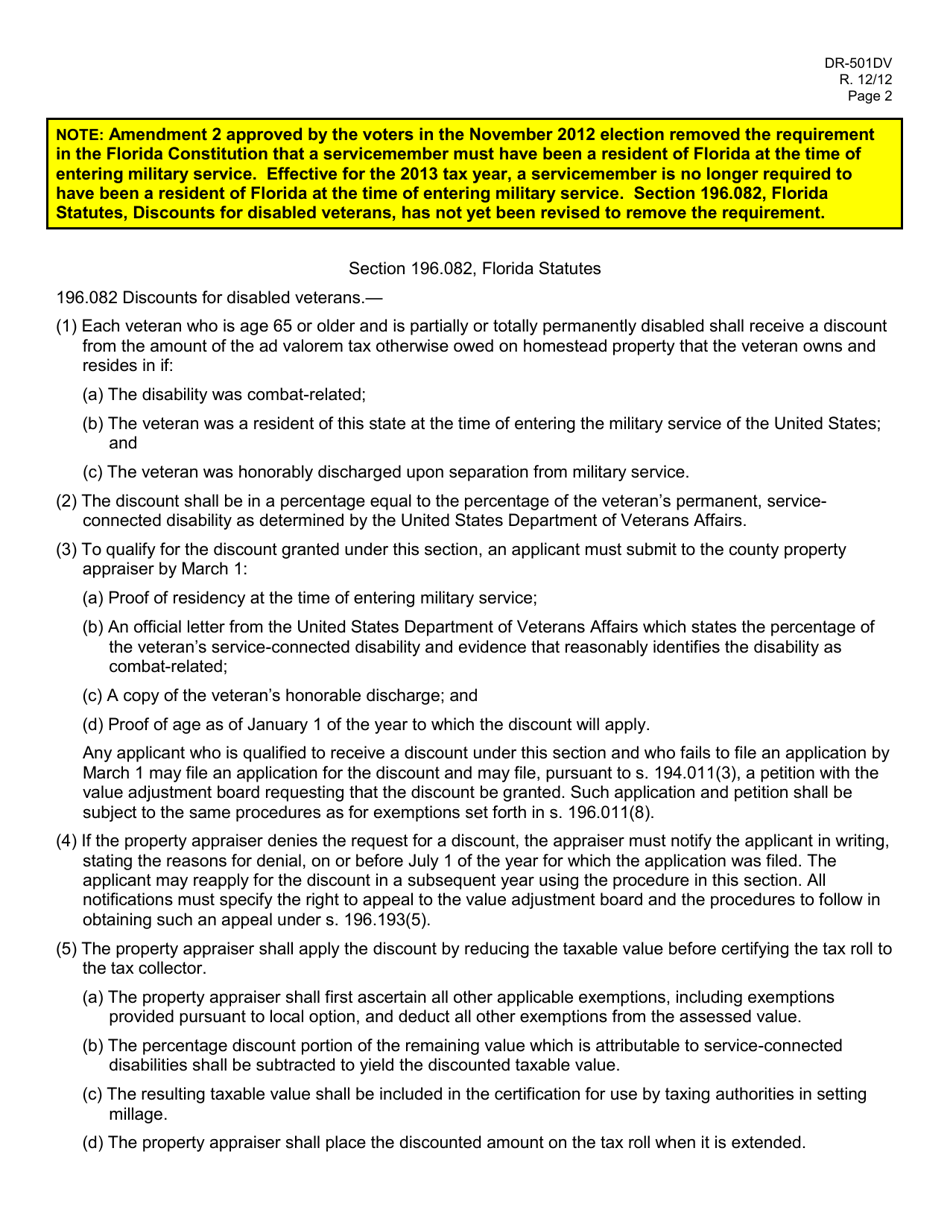

Form DR-501DV

for the current year.

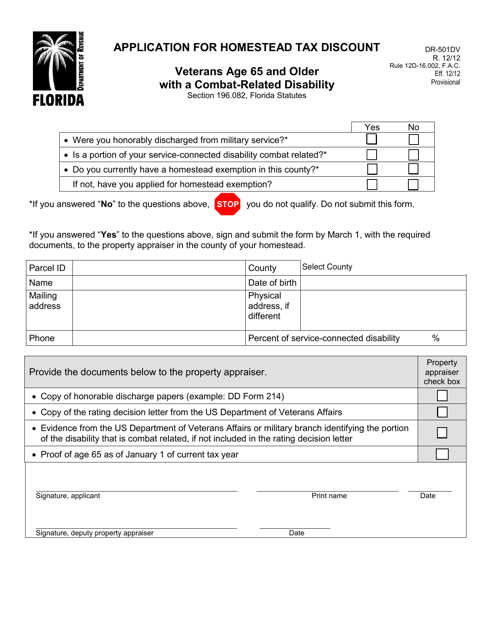

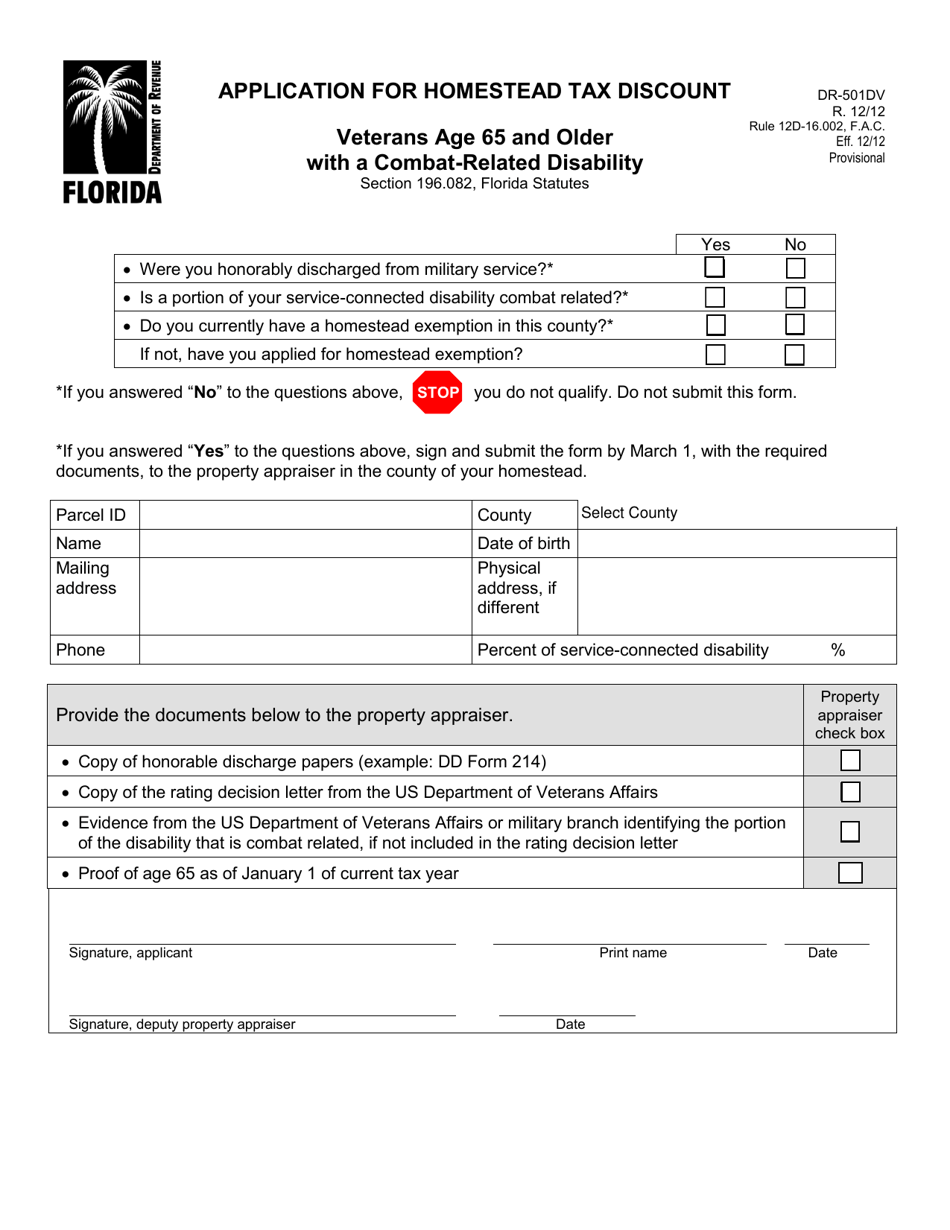

Form DR-501DV Application for Homestead Tax Discount - Veterans Age 65 and Older With a Combat-Related Disability - Florida

What Is Form DR-501DV?

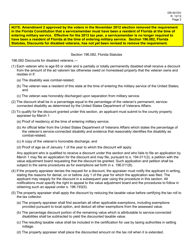

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-501DV?

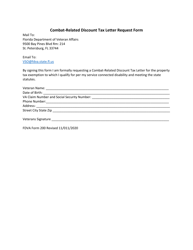

A: Form DR-501DV is an application for homestead tax discount for veterans age 65 and older with a combat-related disability in Florida.

Q: Who is eligible to use Form DR-501DV?

A: Veterans who are 65 years old or older and have a combat-related disability are eligible to use Form DR-501DV.

Q: What is the purpose of Form DR-501DV?

A: The purpose of Form DR-501DV is to claim a homestead tax discount for veterans age 65 and older with a combat-related disability in Florida.

Q: What documents do I need to submit with Form DR-501DV?

A: You will need to submit proof of age, proof of combat-related disability, and proof of residency along with Form DR-501DV.

Q: Is there a deadline to submit Form DR-501DV?

A: Yes, Form DR-501DV must be submitted to your county property appraiser's office by March 1st of each year.

Q: What is the benefit of using Form DR-501DV?

A: Using Form DR-501DV allows eligible veterans age 65 and older with a combat-related disability to receive a homestead tax discount in Florida.

Q: Can I apply for the homestead tax discount if I am not a veteran or do not have a combat-related disability?

A: No, the homestead tax discount applies specifically to veterans age 65 and older with a combat-related disability in Florida.

Q: What if I need help completing Form DR-501DV?

A: If you need help completing Form DR-501DV, you can contact your local county property appraiser's office or seek assistance from a qualified tax professional.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-501DV by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.