This version of the form is not currently in use and is provided for reference only. Download this version of

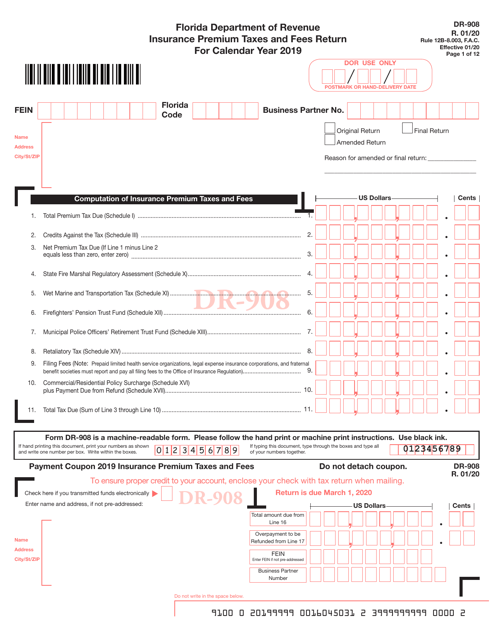

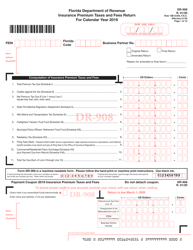

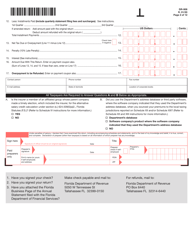

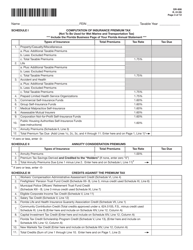

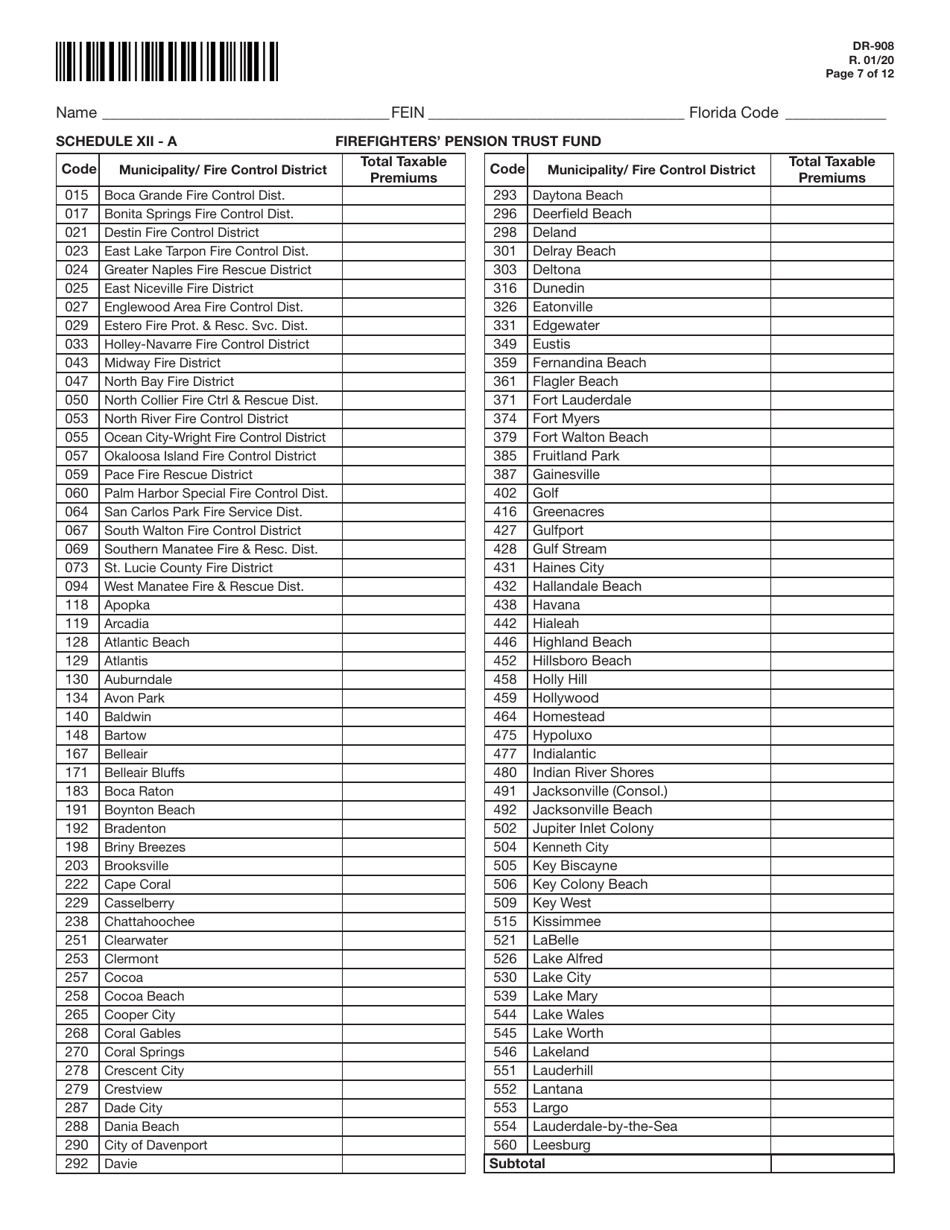

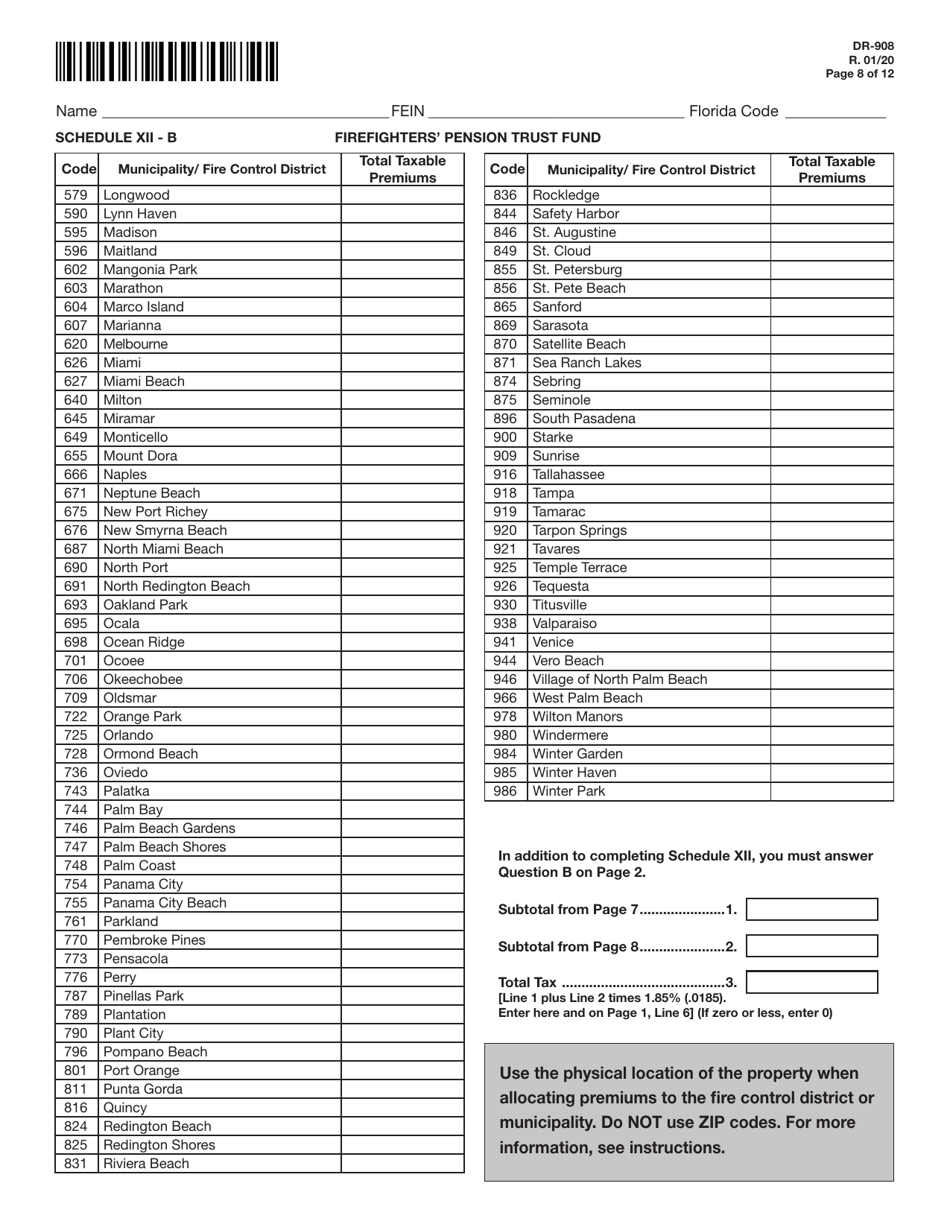

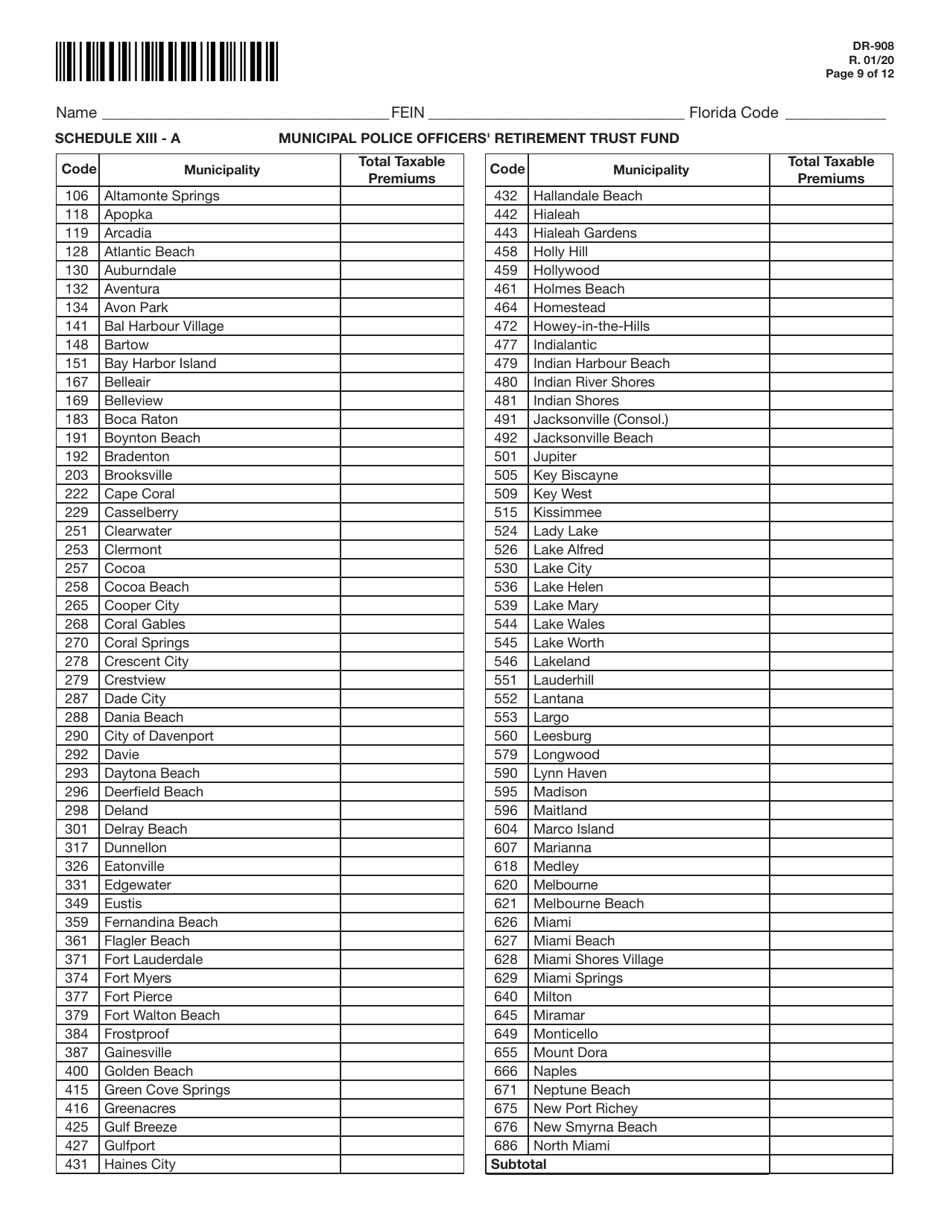

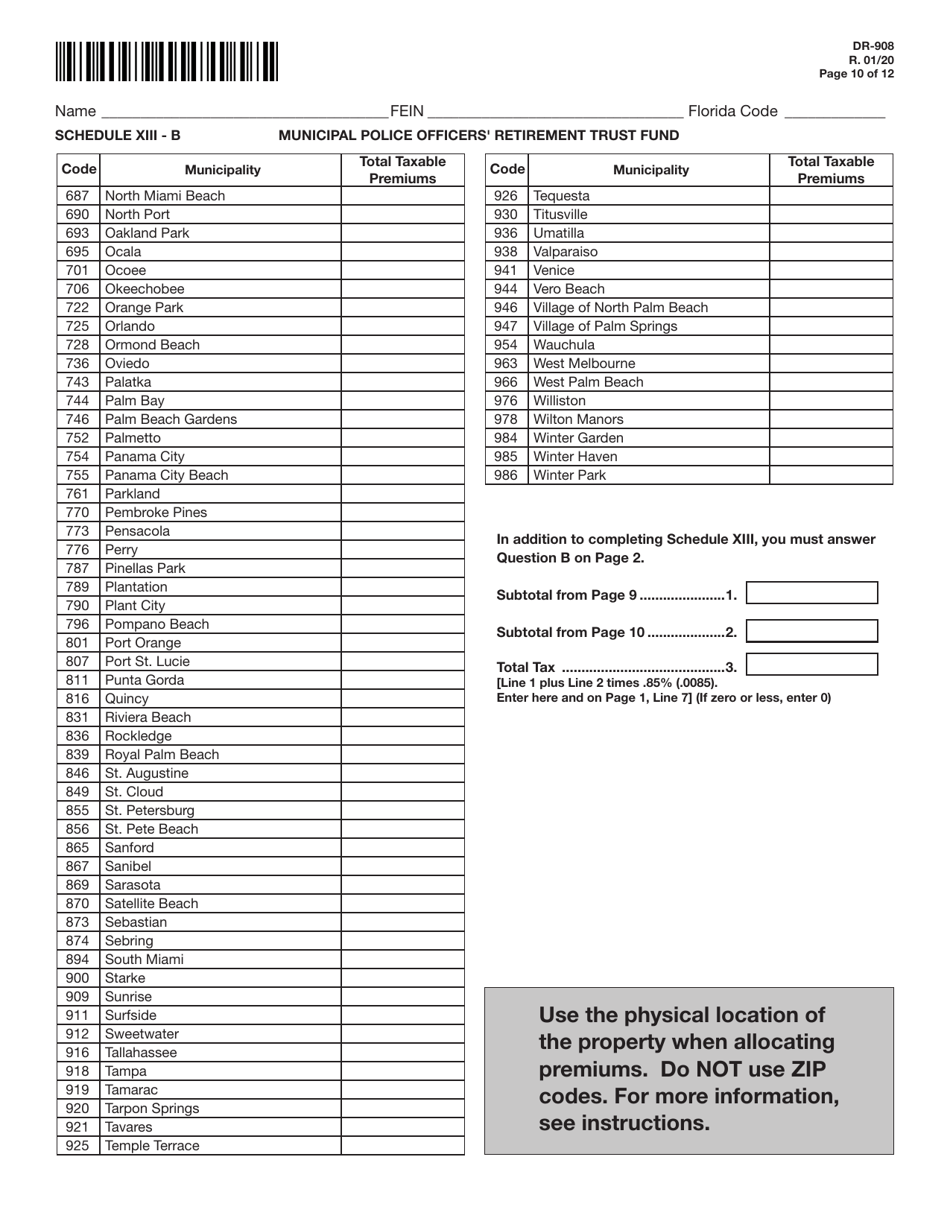

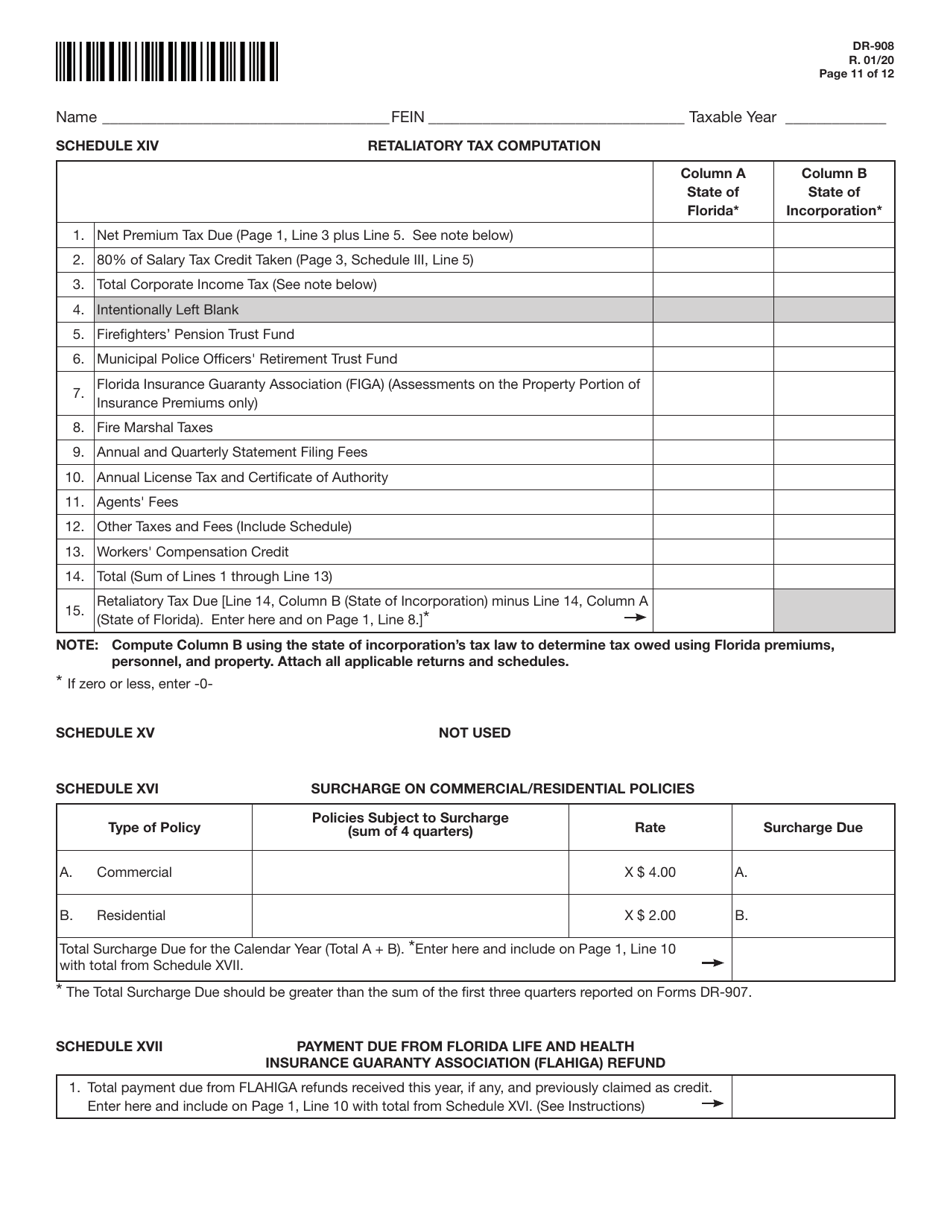

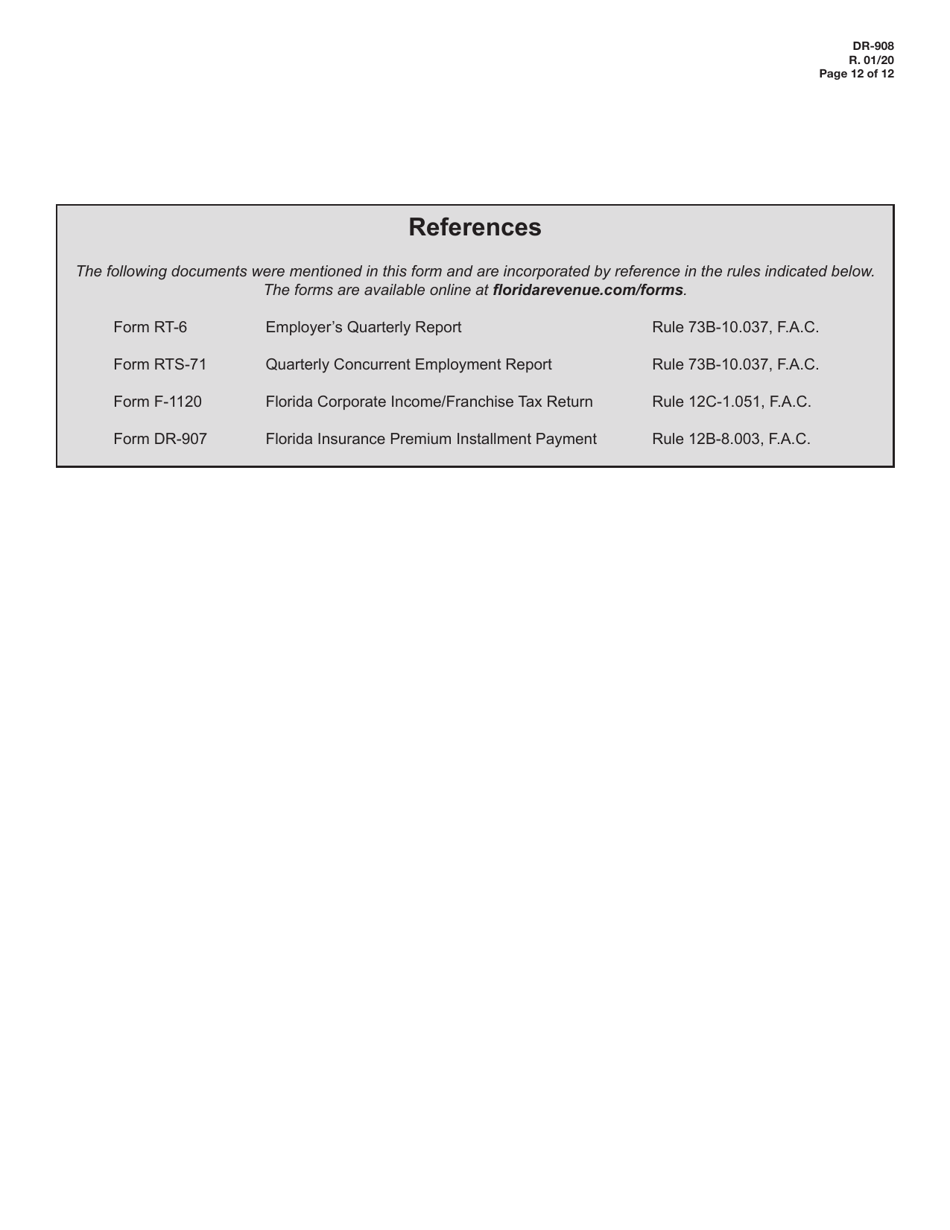

Form DR-908

for the current year.

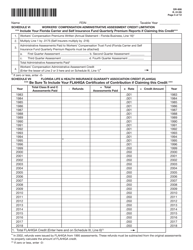

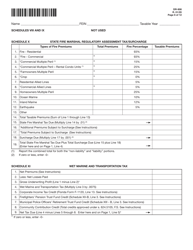

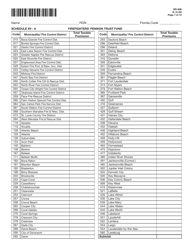

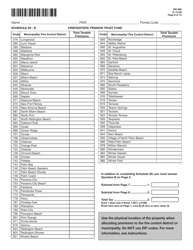

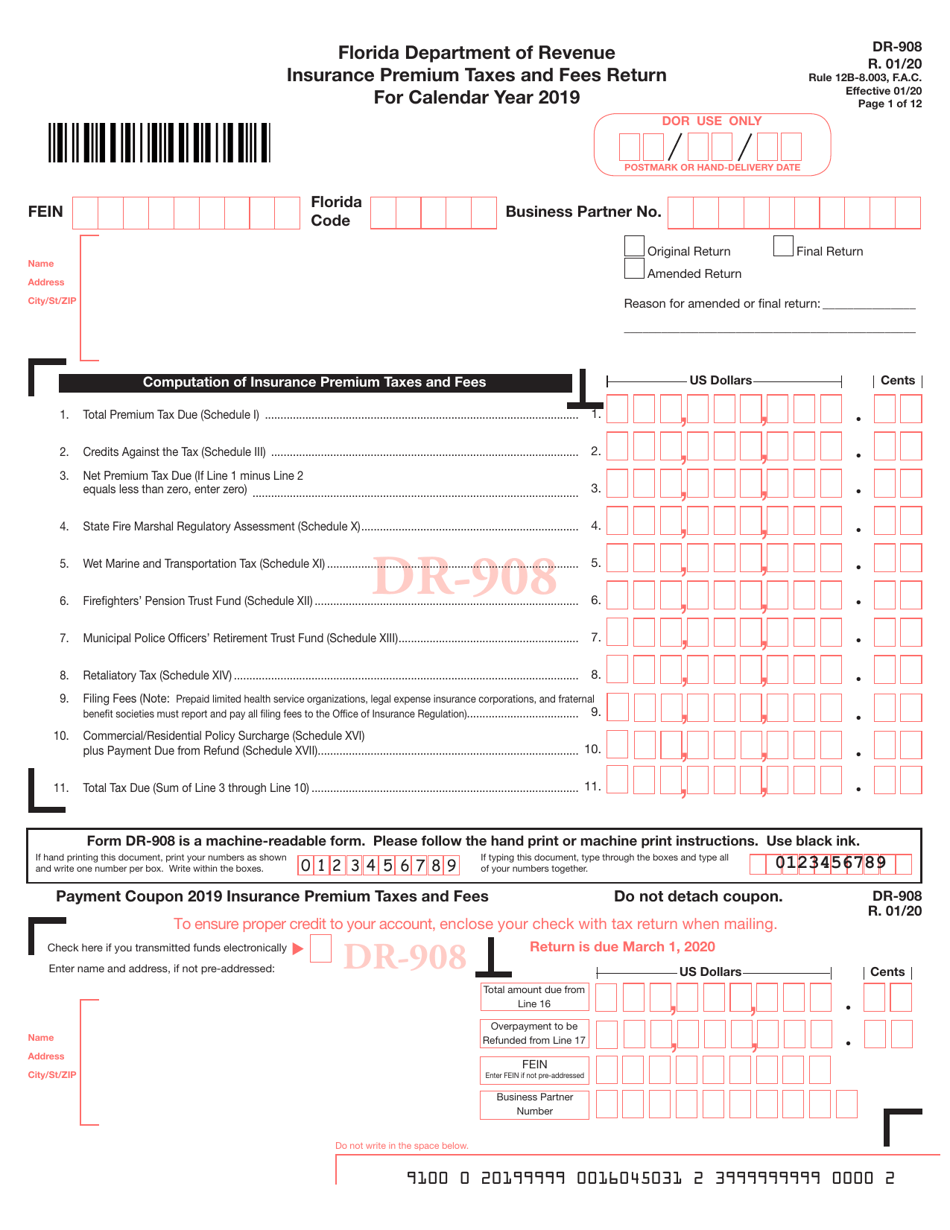

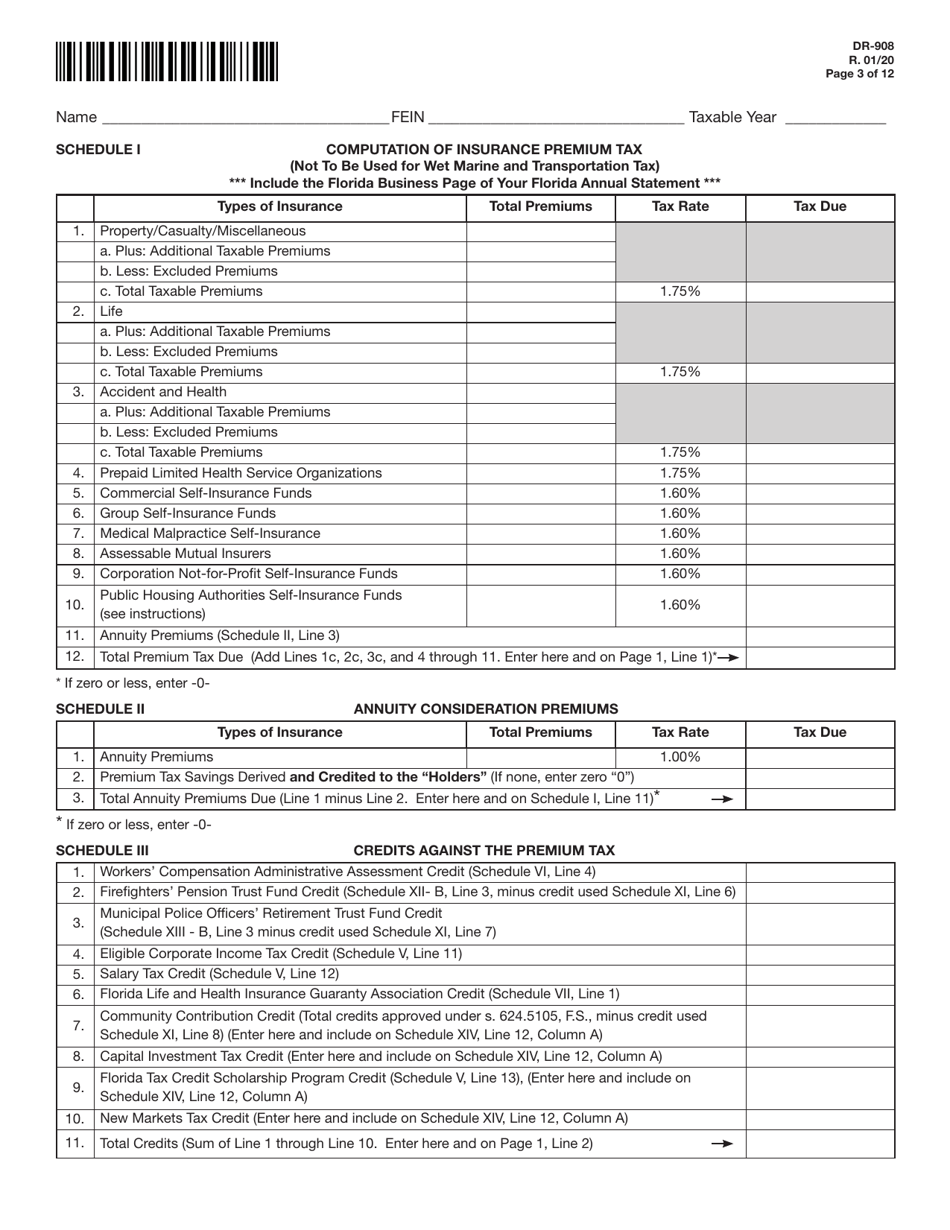

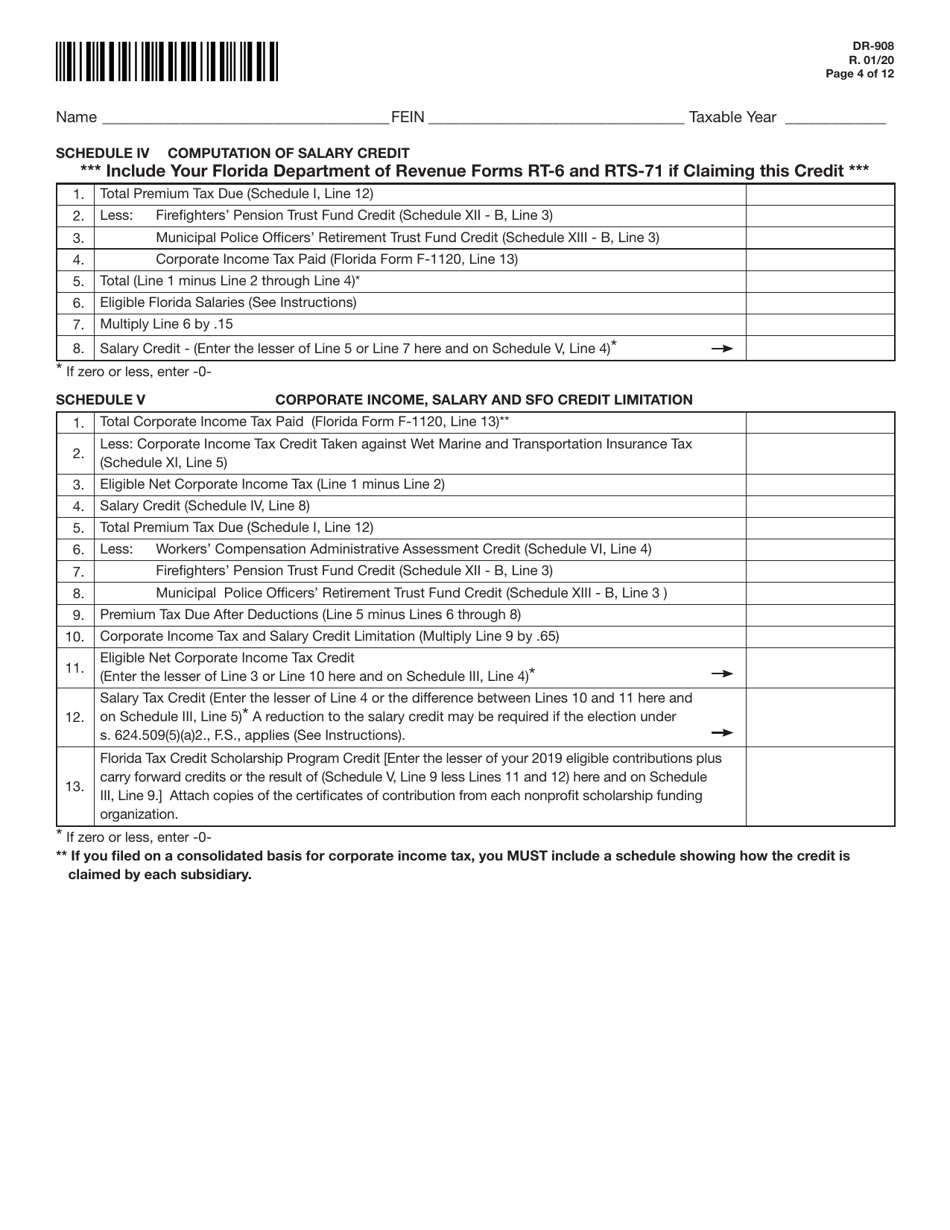

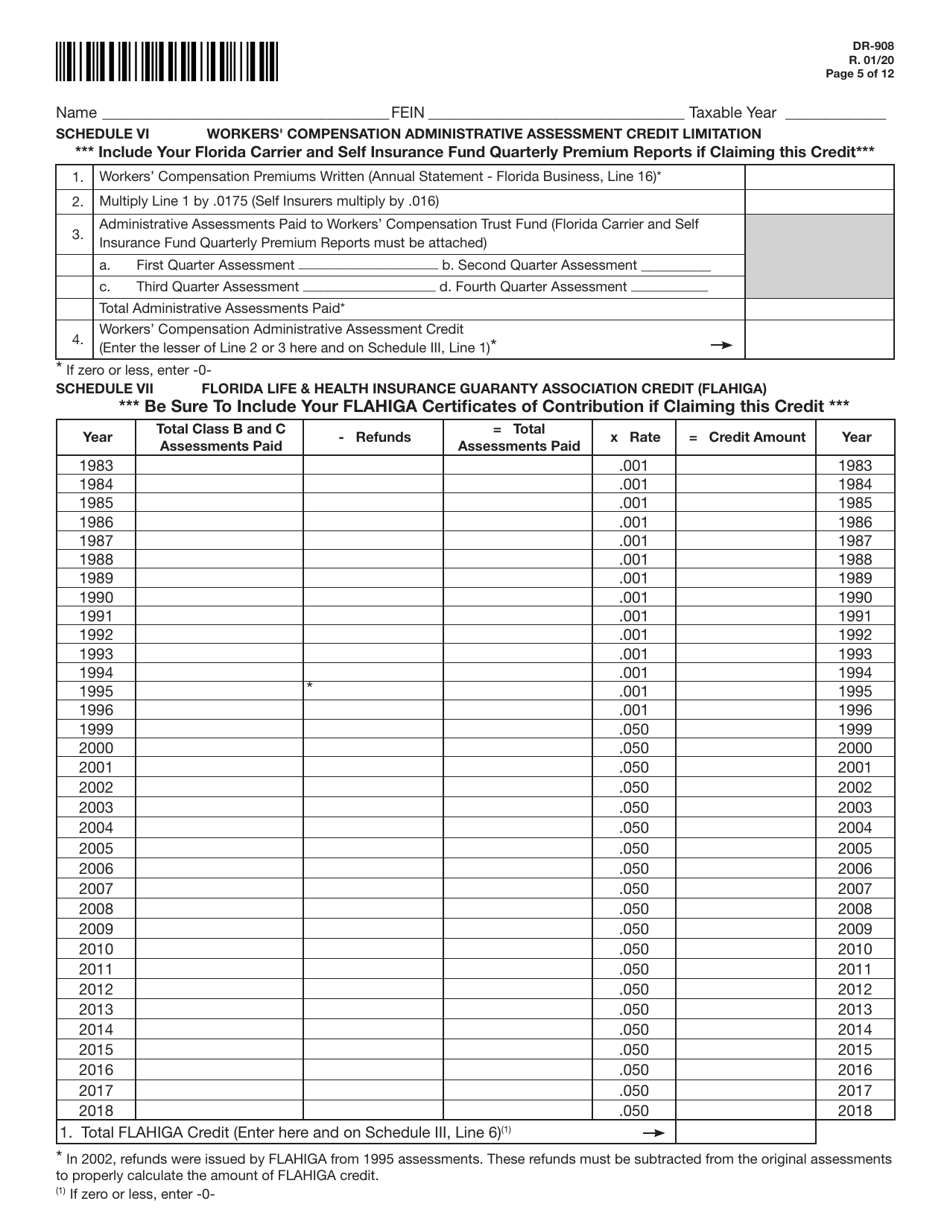

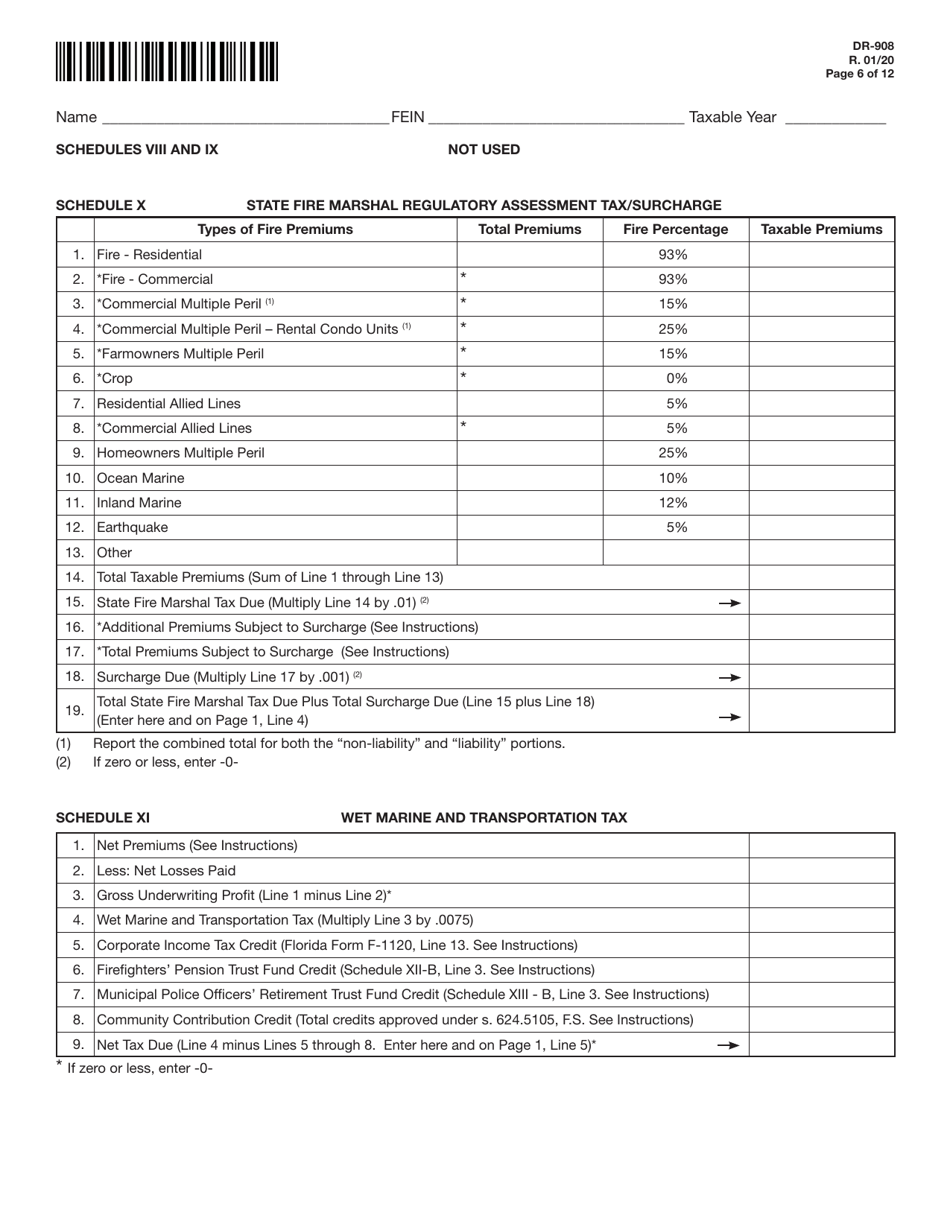

Form DR-908 Insurance Premium Taxes and Fees Return - Florida

What Is Form DR-908?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DR-908?

A: Form DR-908 is the Insurance Premium Taxes and Fees Return for the state of Florida.

Q: Who needs to file Form DR-908?

A: Insurance companies and other entities subject to insurance premium taxes and fees in Florida are required to file Form DR-908.

Q: What is the purpose of filing Form DR-908?

A: The purpose of filing Form DR-908 is to report and remit insurance premium taxes and fees owed to the state of Florida.

Q: When is Form DR-908 due?

A: Form DR-908 is due annually on March 1st.

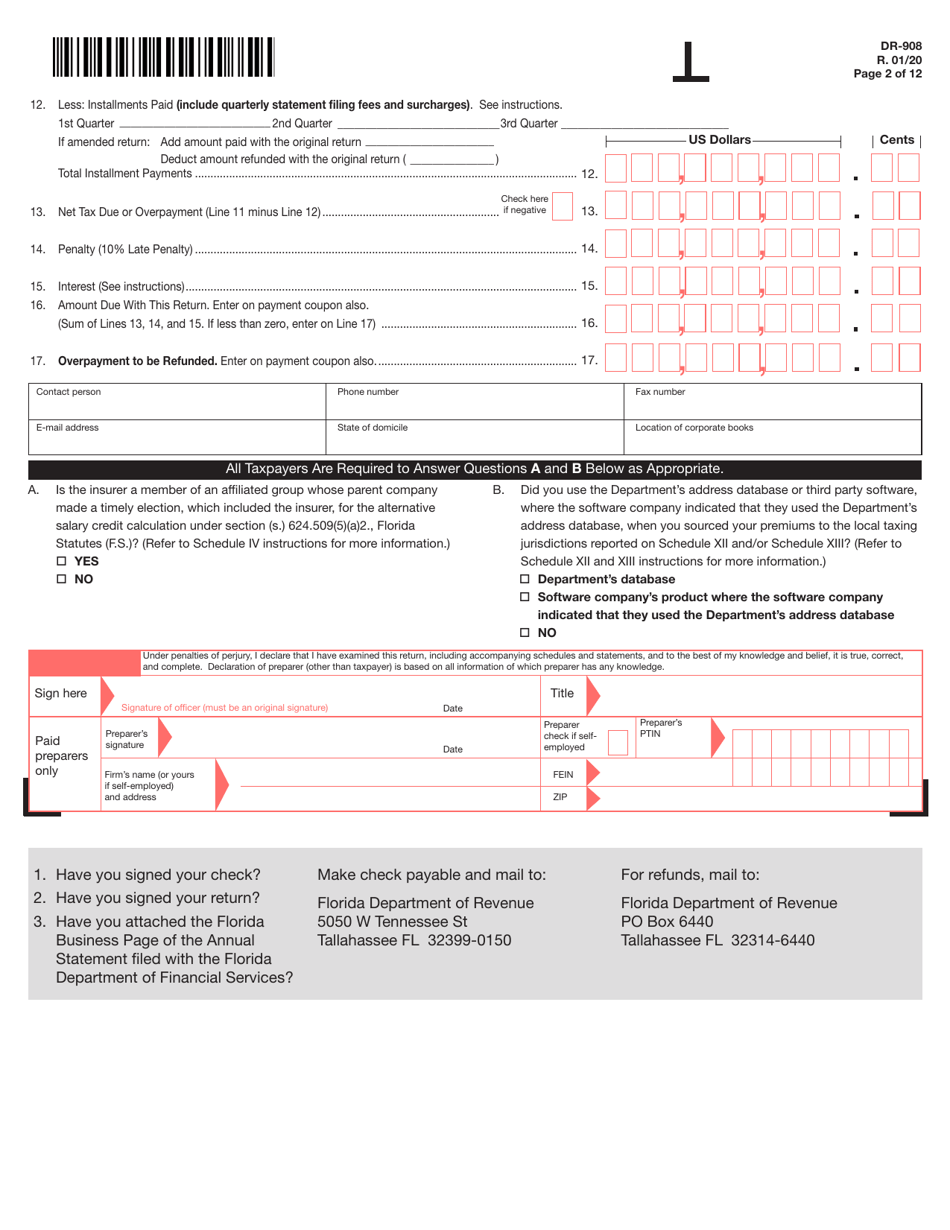

Q: Are there any penalties for late filing of Form DR-908?

A: Yes, there may be penalties for late filing or failure to file Form DR-908.

Q: Is there any extension available for filing Form DR-908?

A: Yes, extensions to file Form DR-908 may be granted upon request.

Q: What supporting documents do I need to include with Form DR-908?

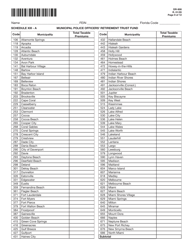

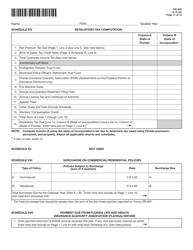

A: Supporting documents may vary depending on the specific circumstances, but generally, insurance companies should include detailed schedules and any necessary attachments with their Form DR-908.

Q: Who can I contact for more information or assistance regarding Form DR-908?

A: For more information or assistance regarding Form DR-908, you can contact the Florida Department of Revenue or consult the instructions provided with the form.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-908 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.