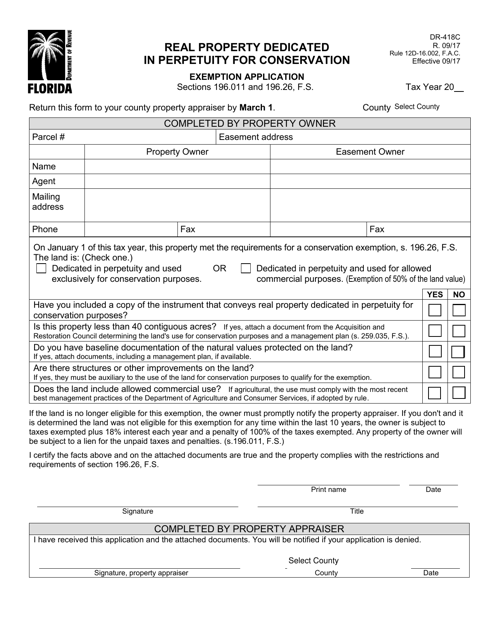

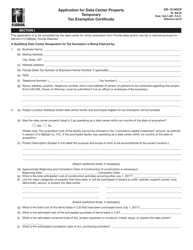

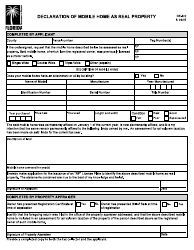

Form DR-418C Real Property Dedicated in Perpetuity for Conservation, Exemption Application - Florida

What Is Form DR-418C?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-418C?

A: Form DR-418C is an Exemption Application for Real Property Dedicated in Perpetuity for Conservation in Florida.

Q: What is the purpose of Form DR-418C?

A: The purpose of Form DR-418C is to apply for an exemption for real property dedicated in perpetuity for conservation in Florida.

Q: Who should use Form DR-418C?

A: Form DR-418C should be used by property owners who have dedicated their property for conservation purposes and want to apply for an exemption.

Q: Are there any eligibility requirements for the exemption?

A: Yes, to be eligible for the exemption, the property must be dedicated in perpetuity for conservation purposes and meet certain criteria set by Florida law.

Q: What documentation do I need to submit with Form DR-418C?

A: You will need to provide documentation such as a deed or conservation easement to support your application for the exemption.

Q: Is there a deadline for submitting Form DR-418C?

A: Yes, the application must be submitted by March 1st of the year for which you are seeking the exemption.

Q: What happens after I submit Form DR-418C?

A: Once you submit the form, the property appraiser will review your application and determine if you qualify for the exemption.

Q: What if I have questions or need assistance with Form DR-418C?

A: If you have questions or need assistance, you can contact your local property appraiser's office or the Florida Department of Revenue.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-418C by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.