This version of the form is not currently in use and is provided for reference only. Download this version of

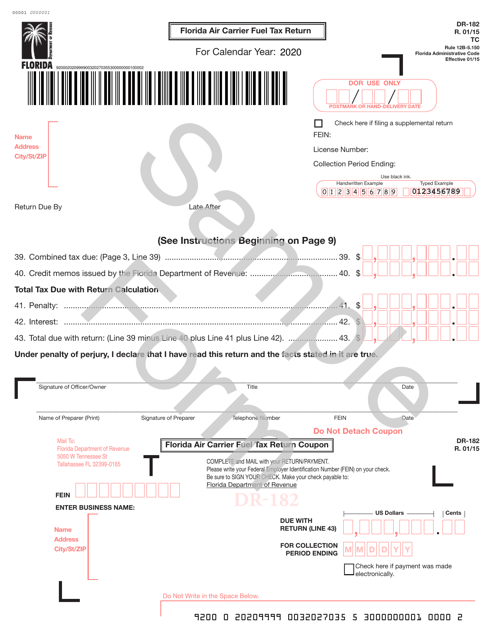

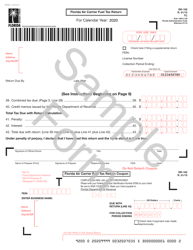

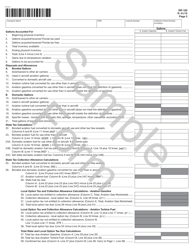

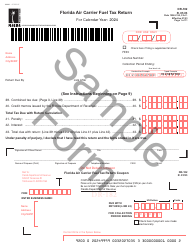

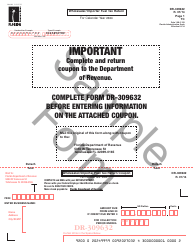

Form DR-182

for the current year.

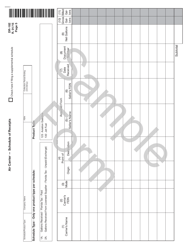

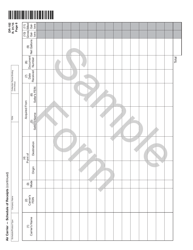

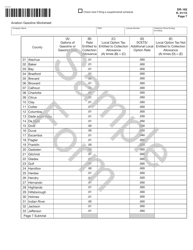

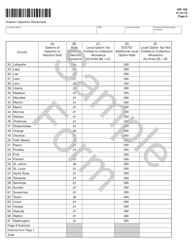

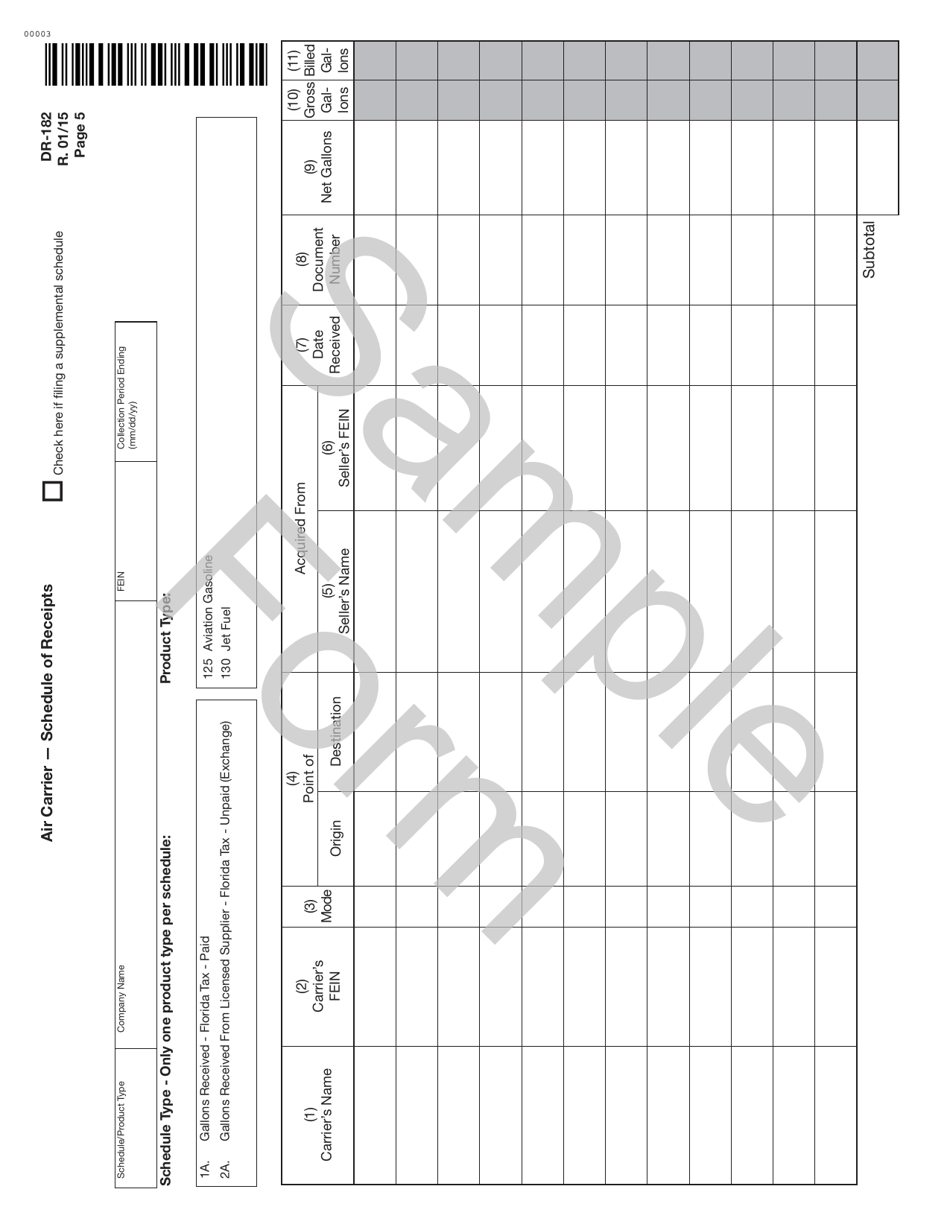

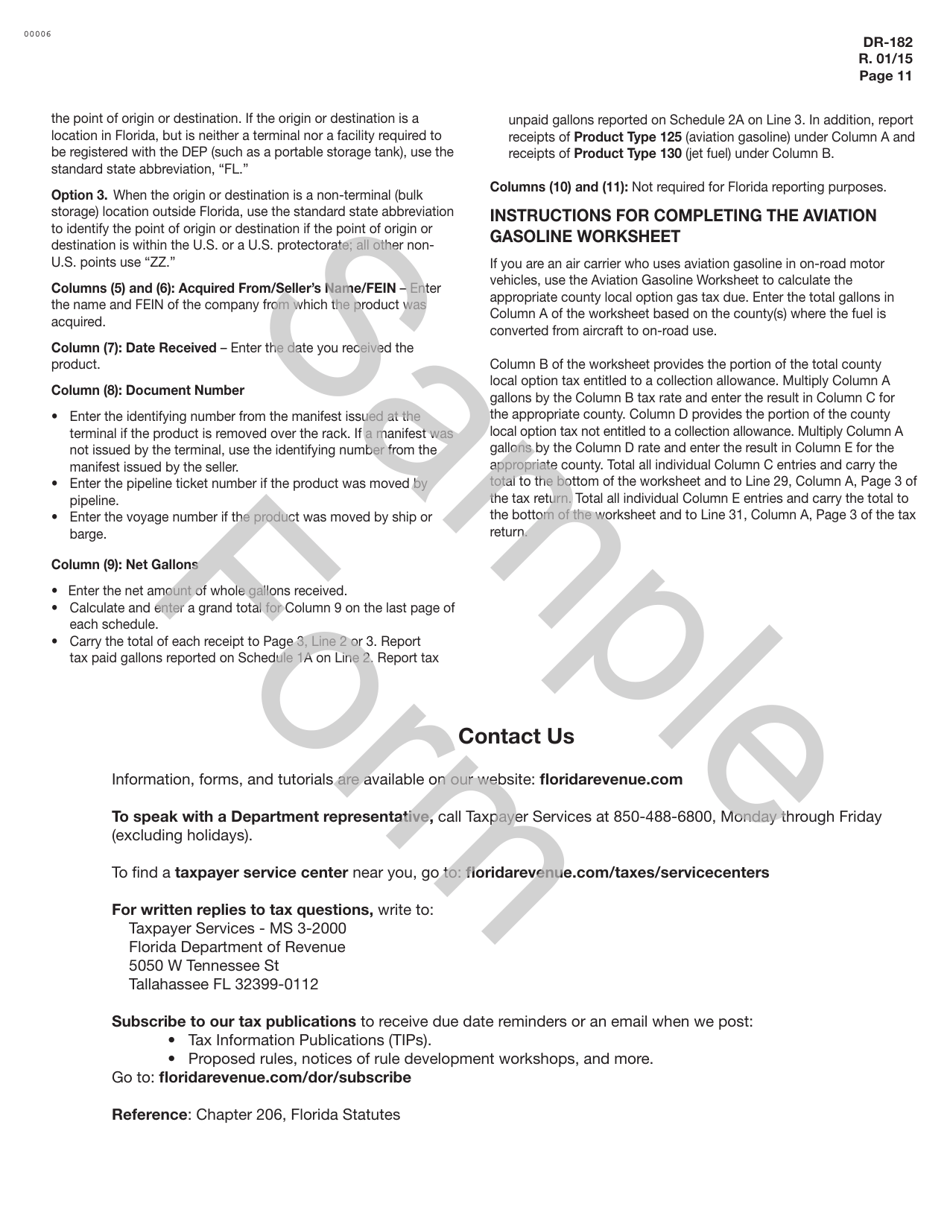

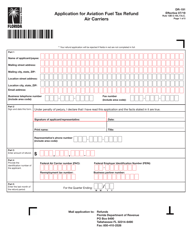

Form DR-182 Florida Air Carrier Fuel Tax Return - Florida

What Is Form DR-182?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

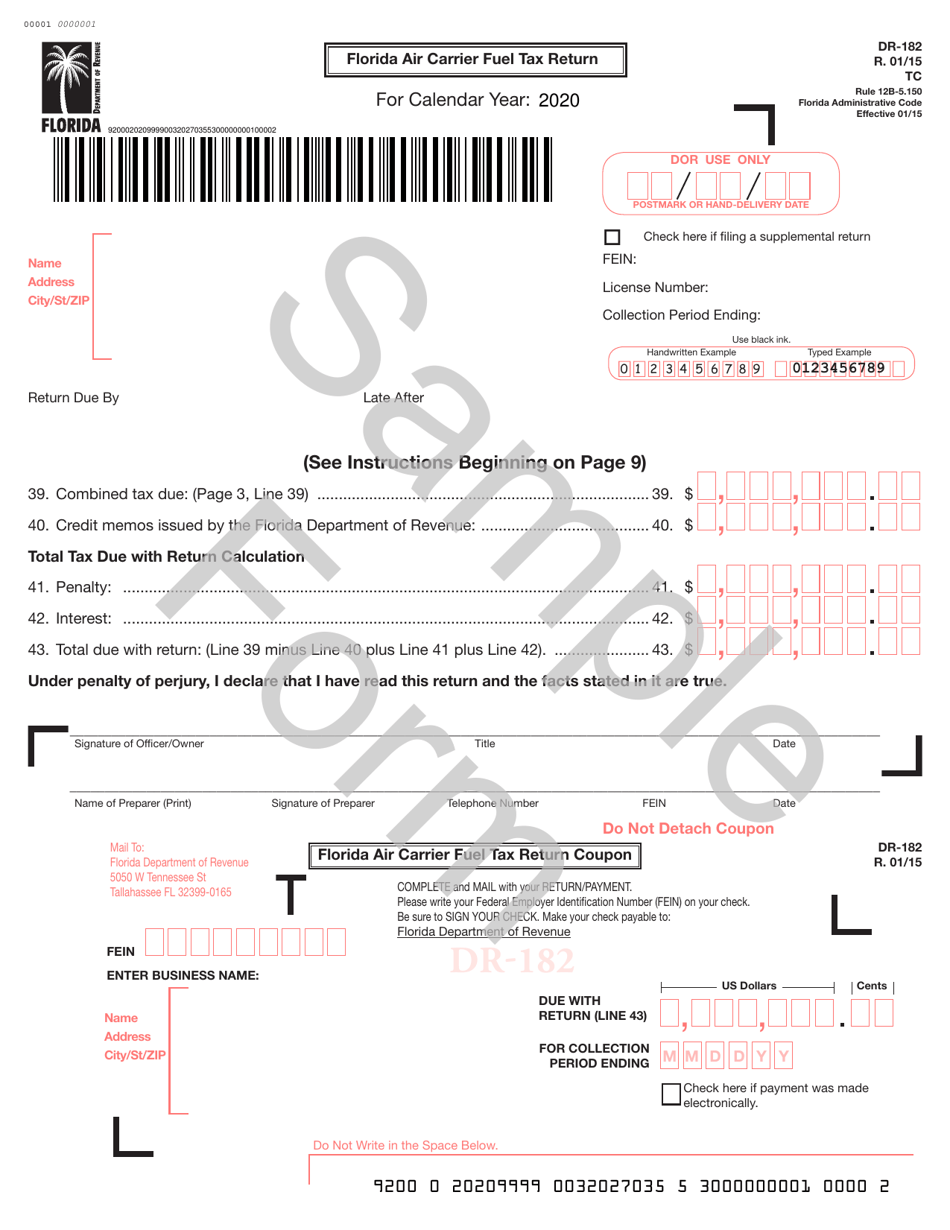

Q: What is Form DR-182?

A: Form DR-182 is the Florida Air Carrier Fuel Tax Return.

Q: Who should file Form DR-182?

A: Air carriers operating in Florida should file Form DR-182.

Q: What is the purpose of Form DR-182?

A: Form DR-182 is used to report and pay the air carrier fuel tax in Florida.

Q: When should Form DR-182 be filed?

A: Form DR-182 should be filed on a monthly basis, with the due date being the 1st day of the month following the reporting period.

Q: How can Form DR-182 be filed?

A: Form DR-182 can be filed electronically using the Florida Department of Revenue's e-Services portal.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-182 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.