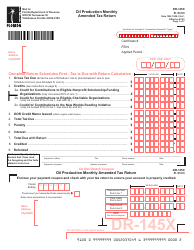

This version of the form is not currently in use and is provided for reference only. Download this version of

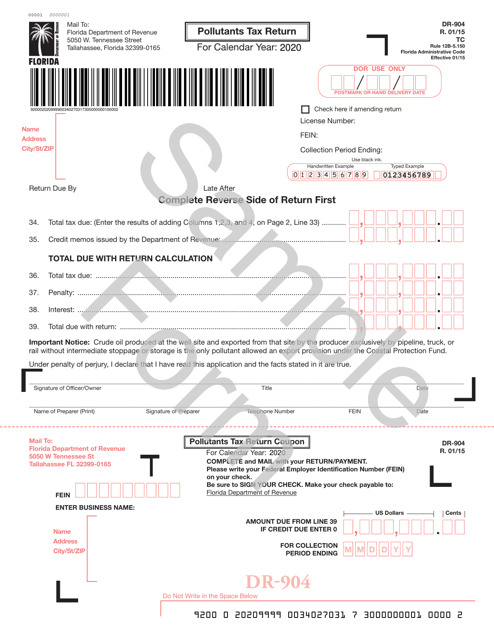

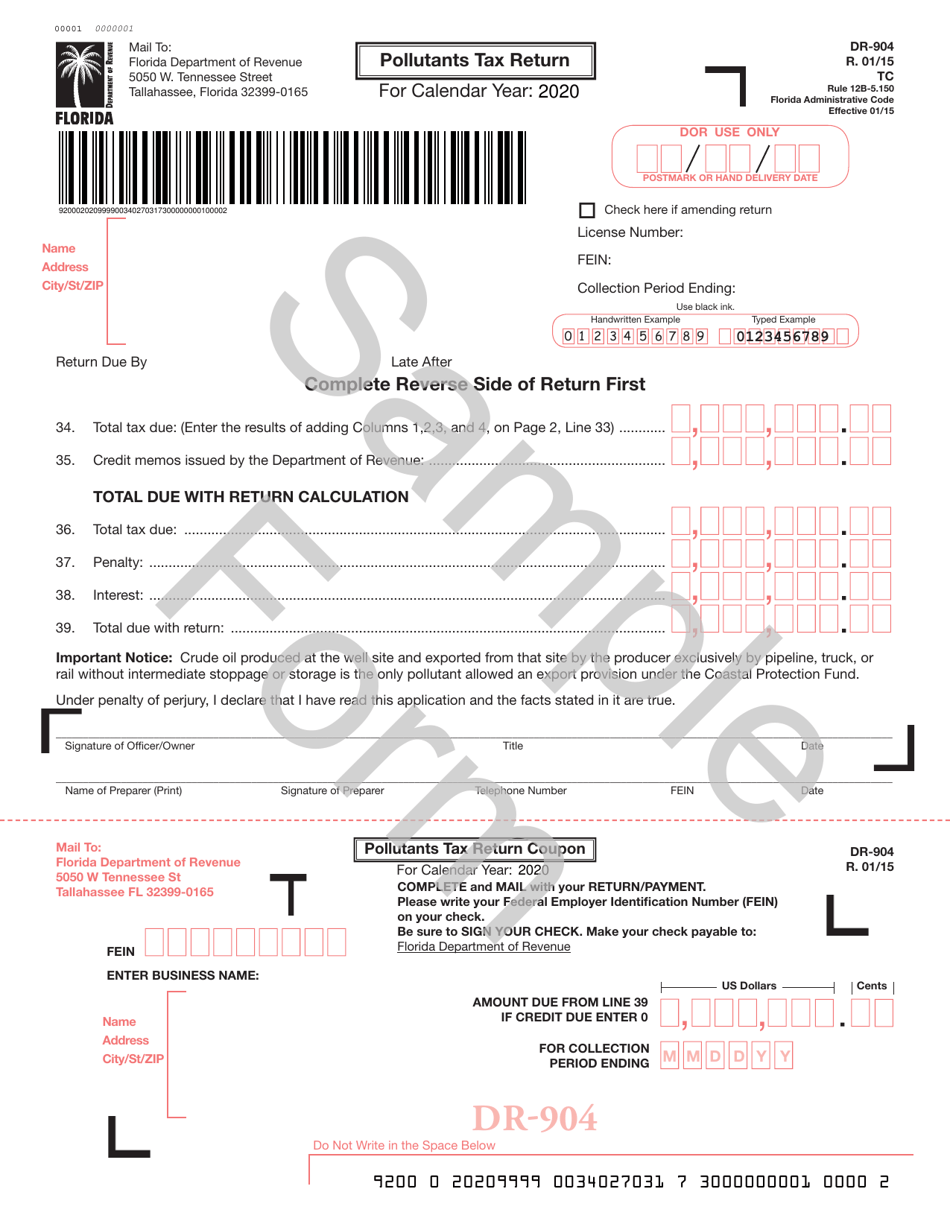

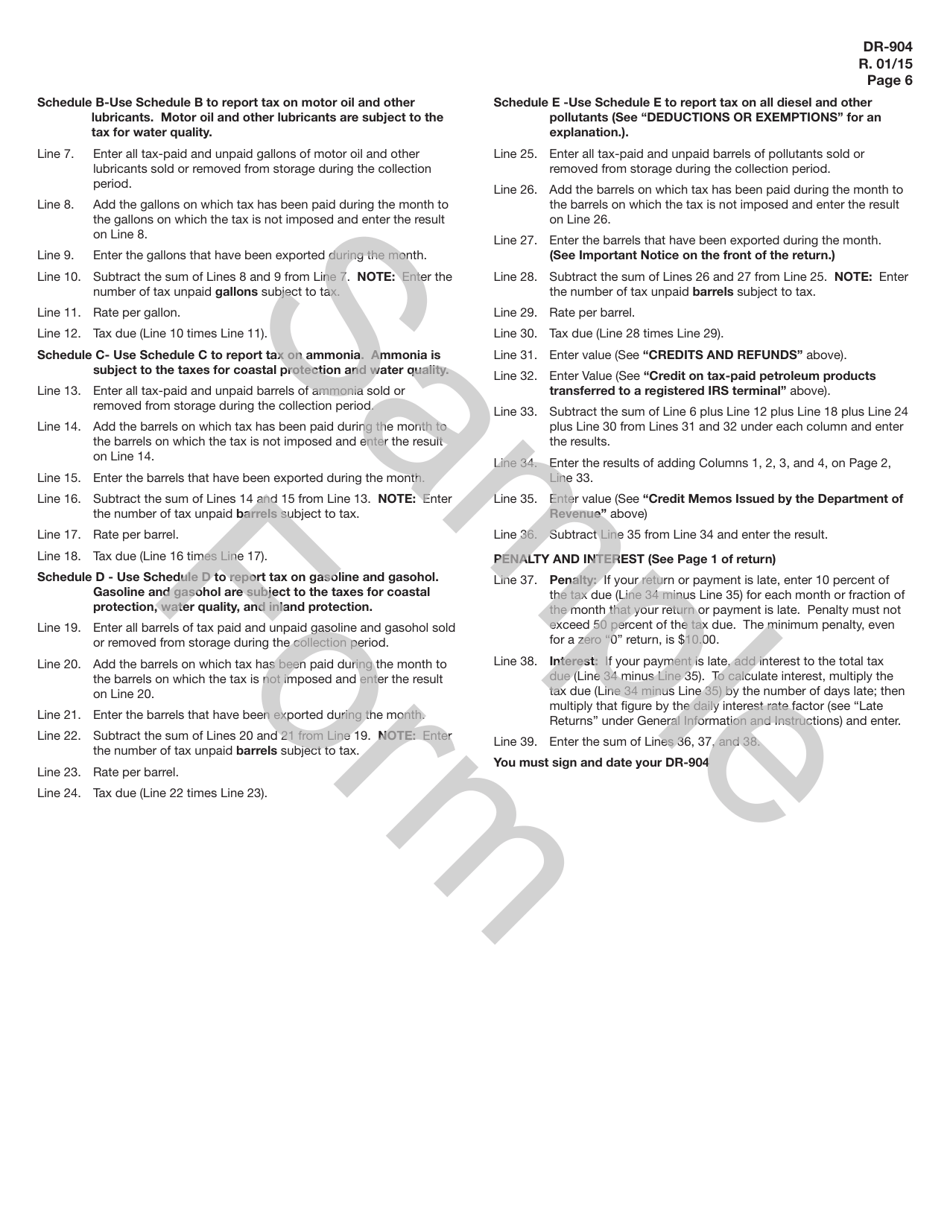

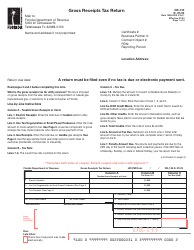

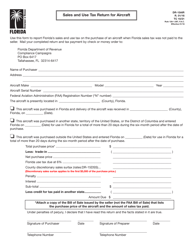

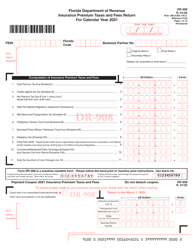

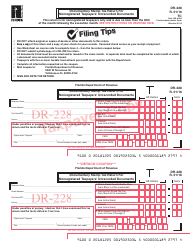

Form DR-904

for the current year.

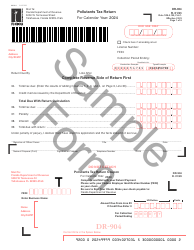

Form DR-904 Pollutants Tax Return - Florida

What Is Form DR-904?

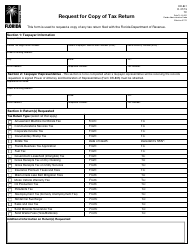

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-904?

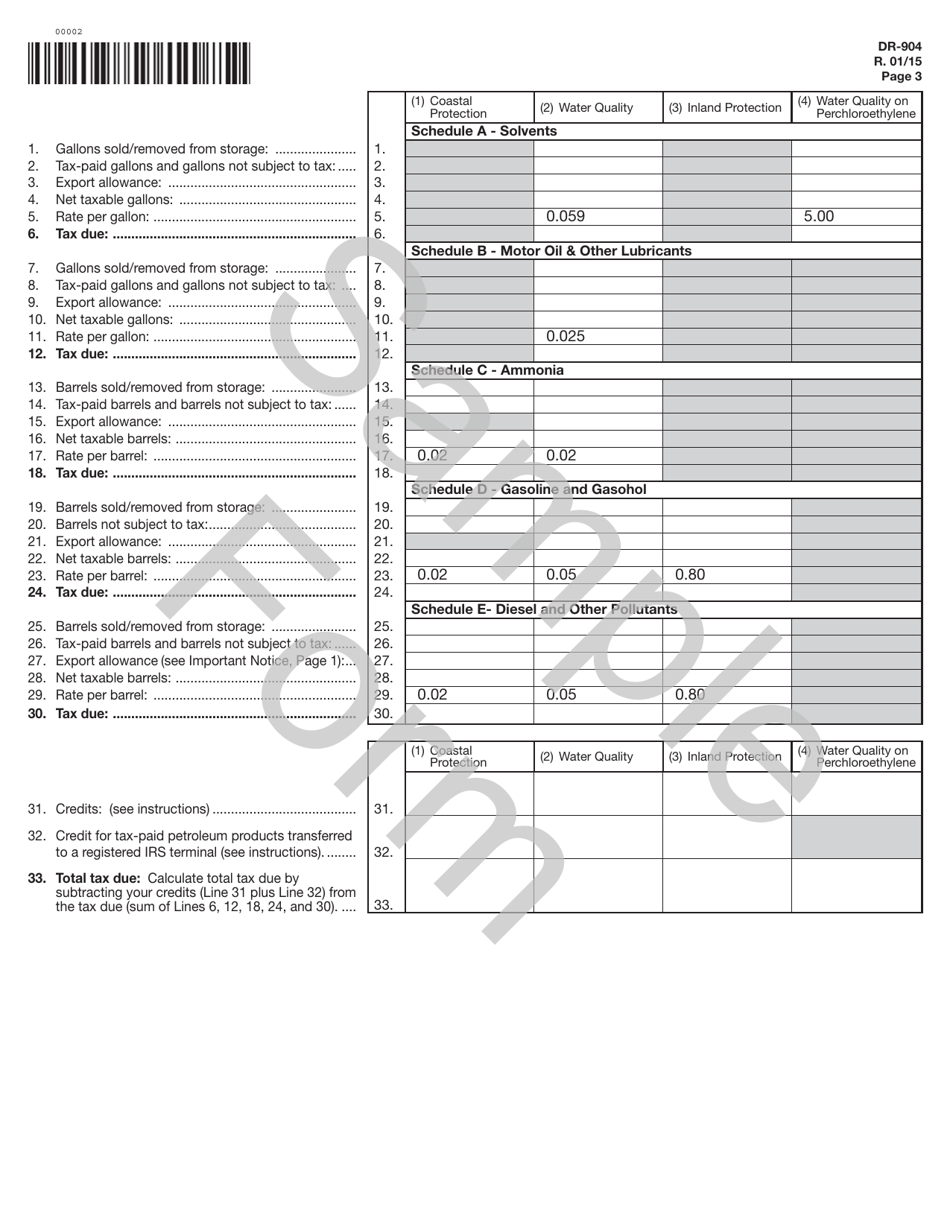

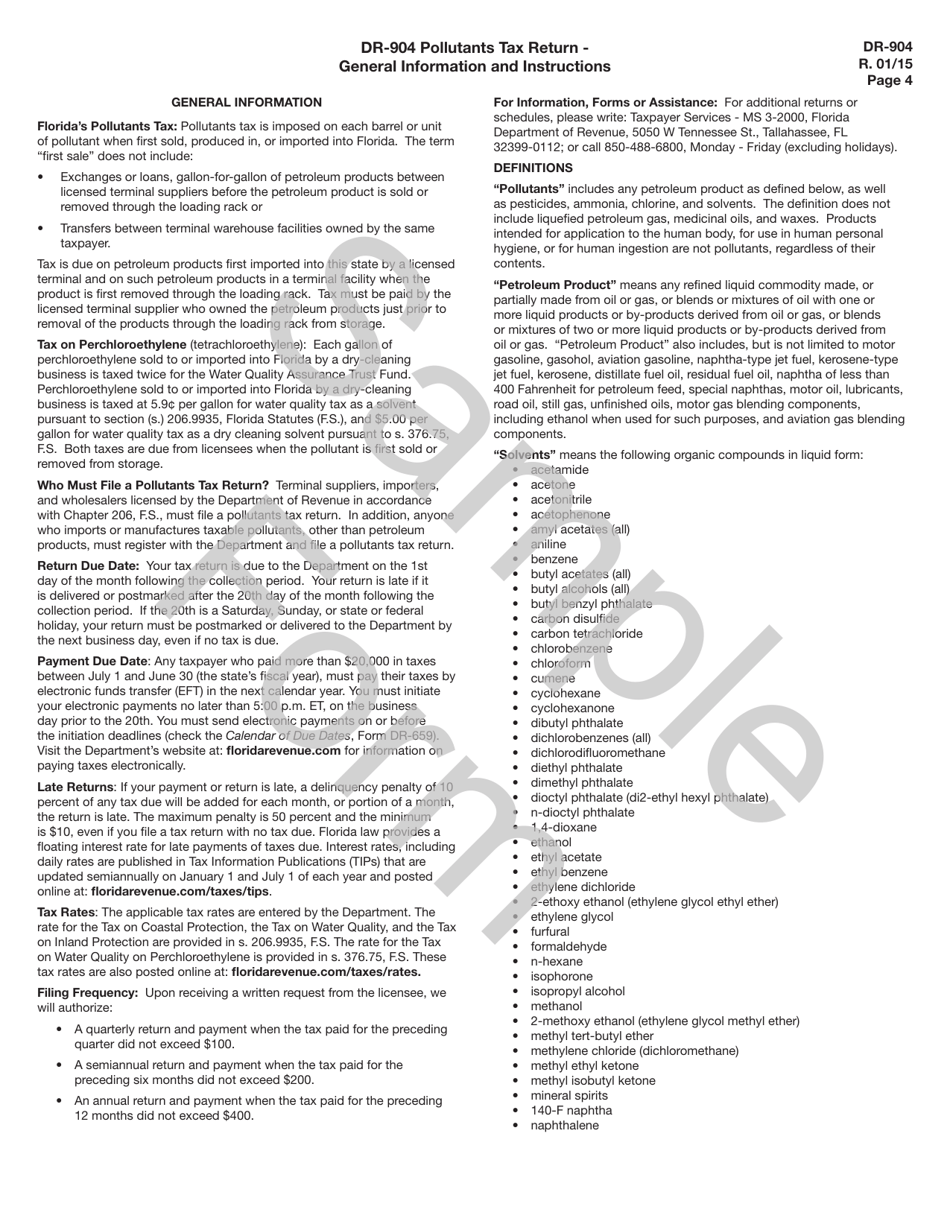

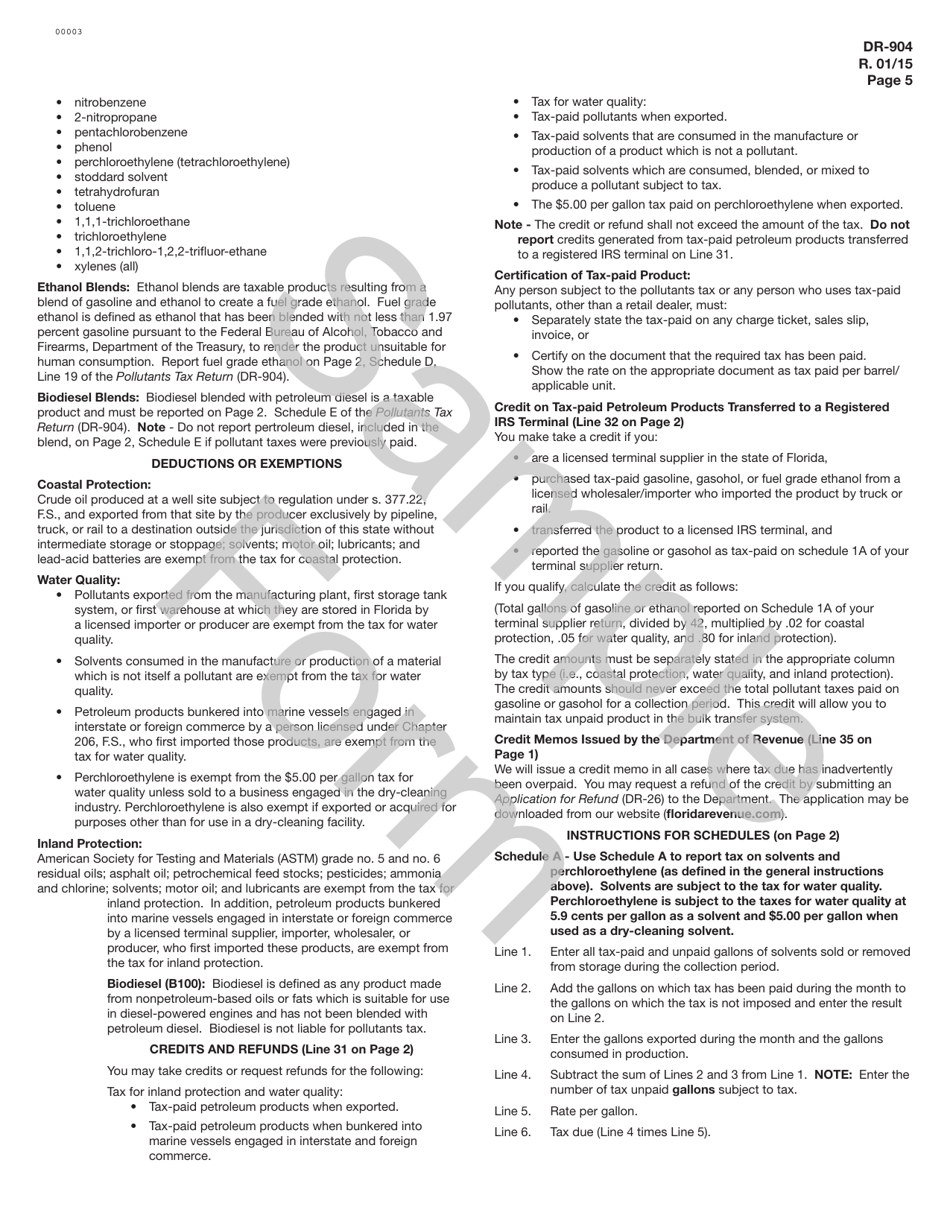

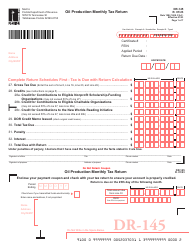

A: Form DR-904 is the Pollutants Tax Return in the state of Florida.

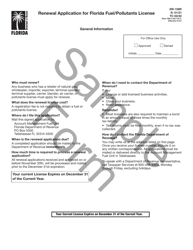

Q: Who needs to file Form DR-904?

A: Any person or business in Florida engaged in activities that result in the release or discharge of pollutants in specified amounts may need to file Form DR-904.

Q: What is the purpose of Form DR-904?

A: The purpose of Form DR-904 is to report and pay the pollutants tax in Florida.

Q: How often do you need to file Form DR-904?

A: Form DR-904 is due annually. It must be filed by April 1st of each year for the previous calendar year.

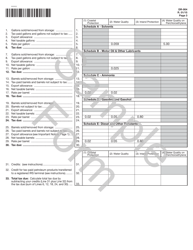

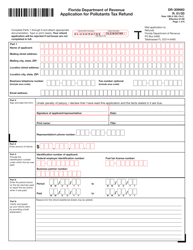

Q: What information is required on Form DR-904?

A: Form DR-904 requires information such as the nature and quantity of pollutants released, any exemptions claimed, and the amount of tax due.

Q: Are there any penalties for not filing Form DR-904?

A: Yes, there are penalties for not filing or late filing of Form DR-904. It is important to file on time to avoid penalties and interest charges.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-904 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.