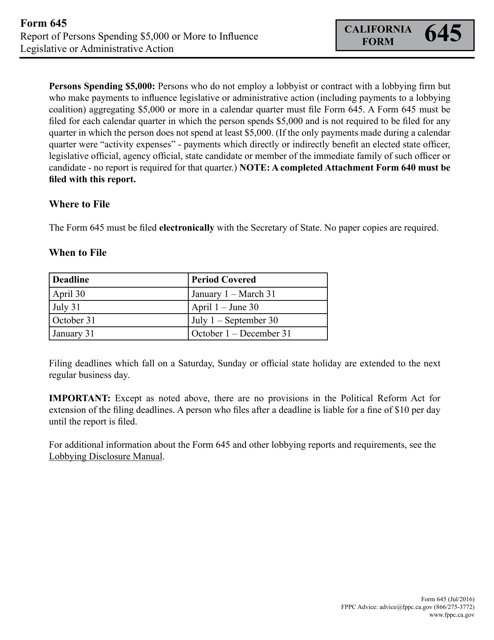

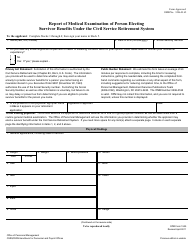

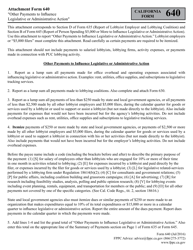

Form 645 Report of Persons Spending $5,000 or More to Influence Legislative or Administrative Action - California

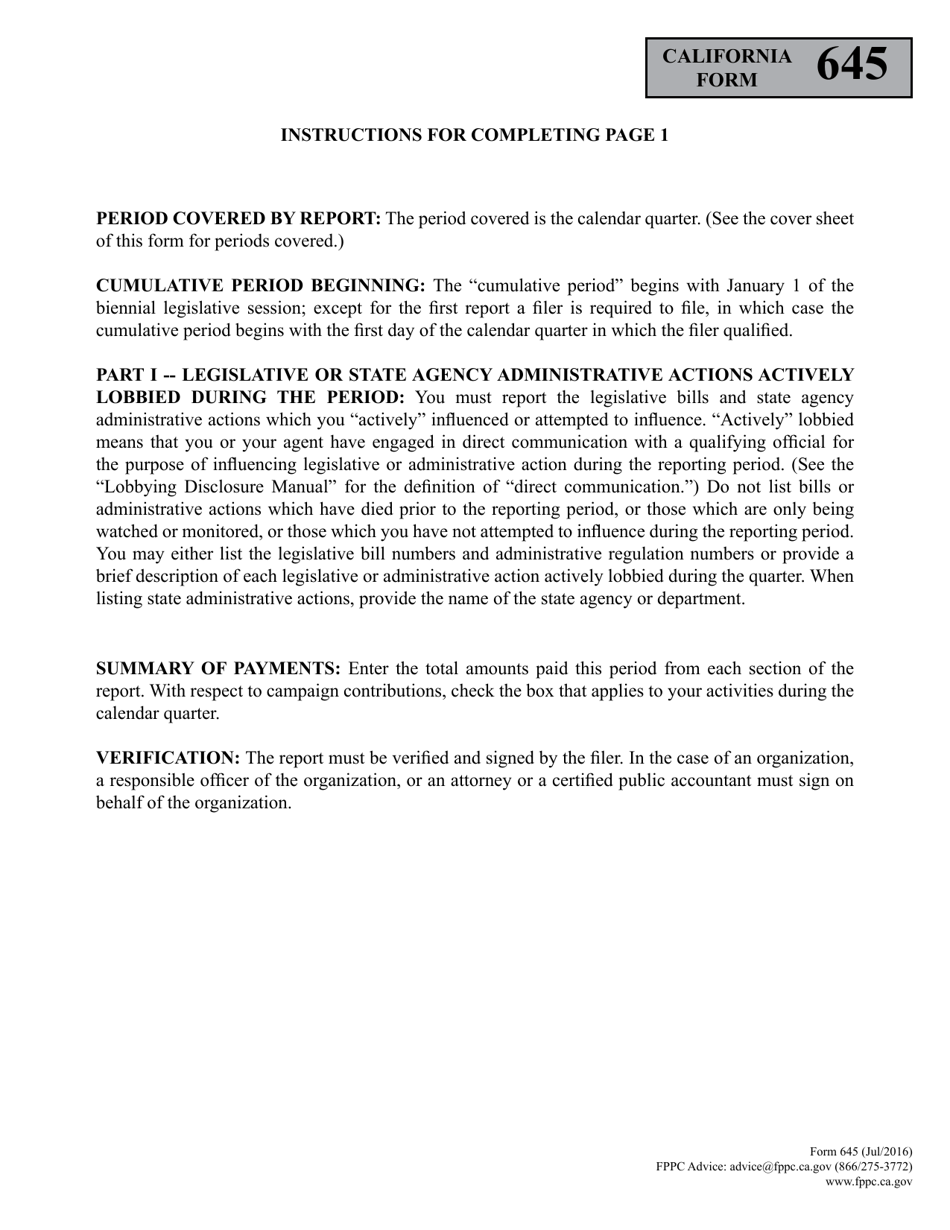

What Is Form 645?

This is a legal form that was released by the California Fair Political Practices Commission - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 645?

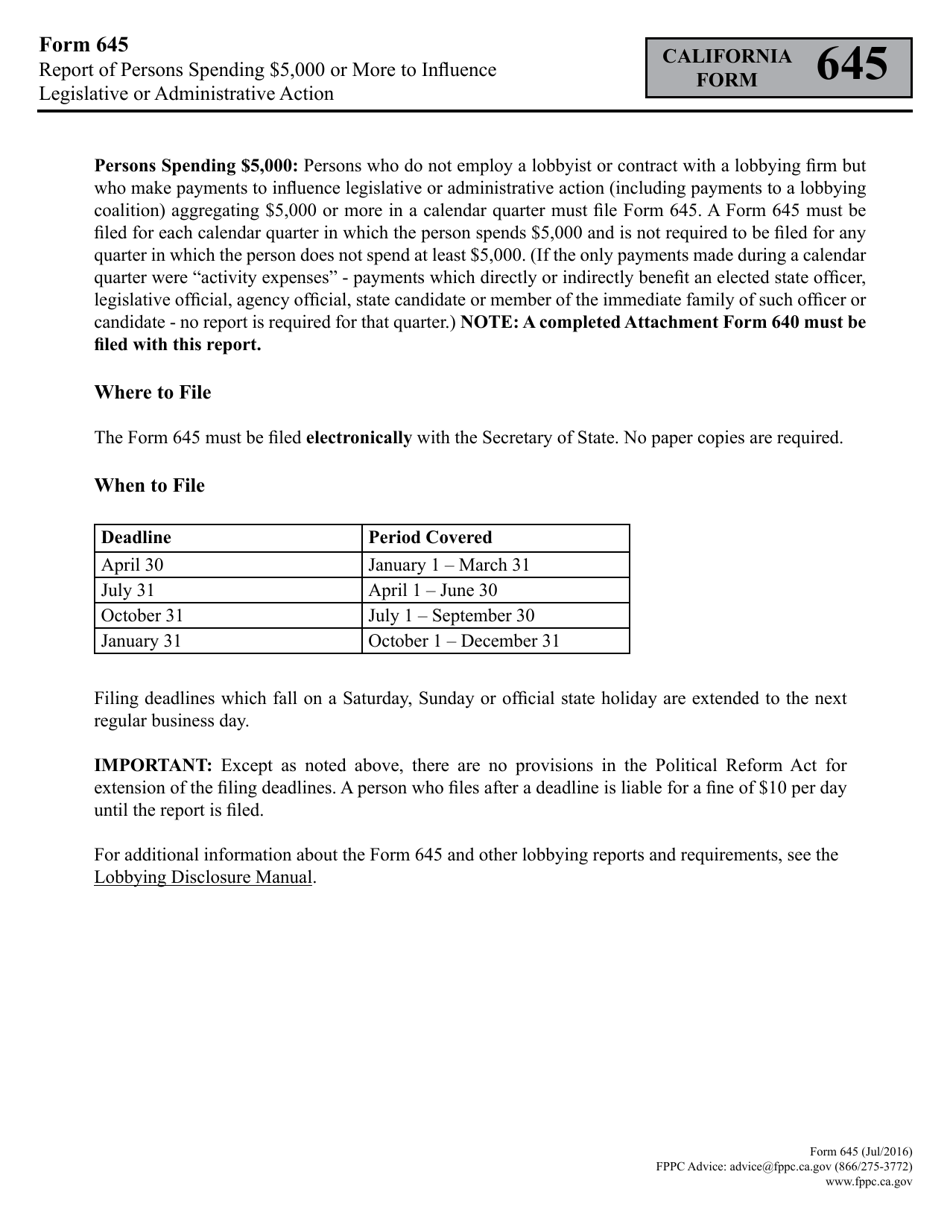

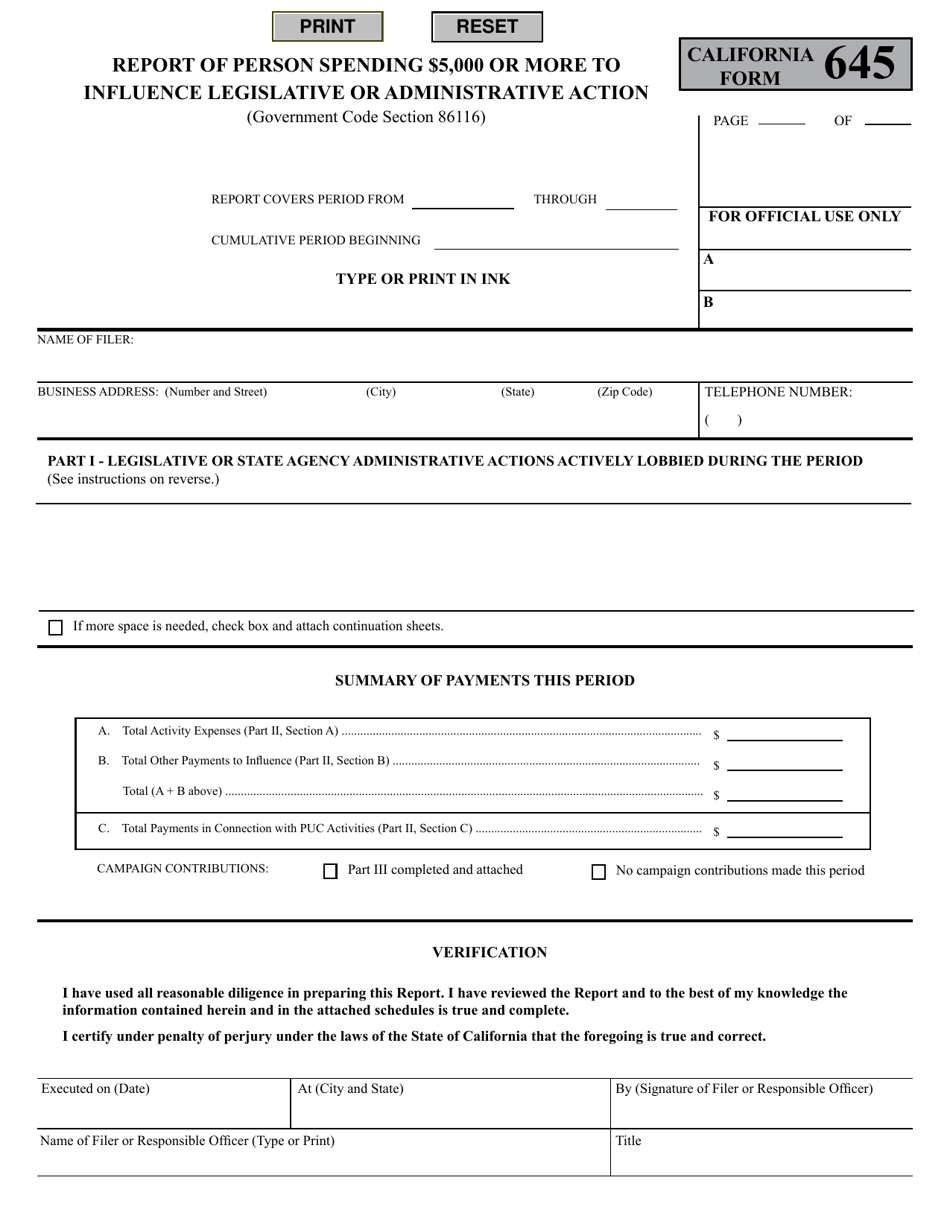

A: Form 645 is a report used in California to disclose expenditures of $5,000 or more made to influence legislative or administrative action.

Q: Who is required to file Form 645?

A: Individuals or organizations that have spent $5,000 or more in a calendar quarter to influence legislative or administrative action in California are required to file Form 645.

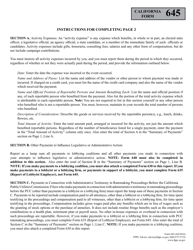

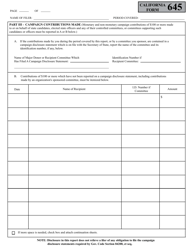

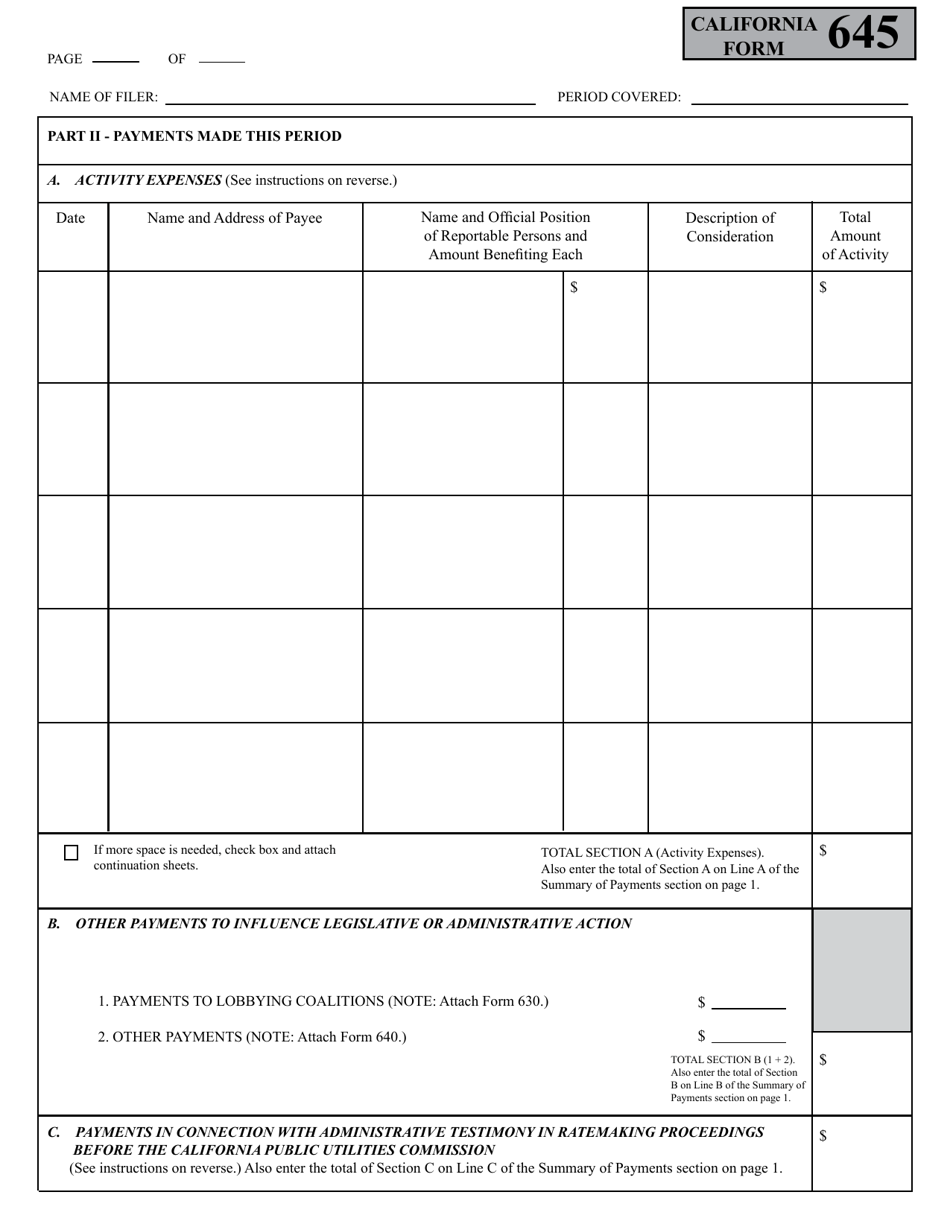

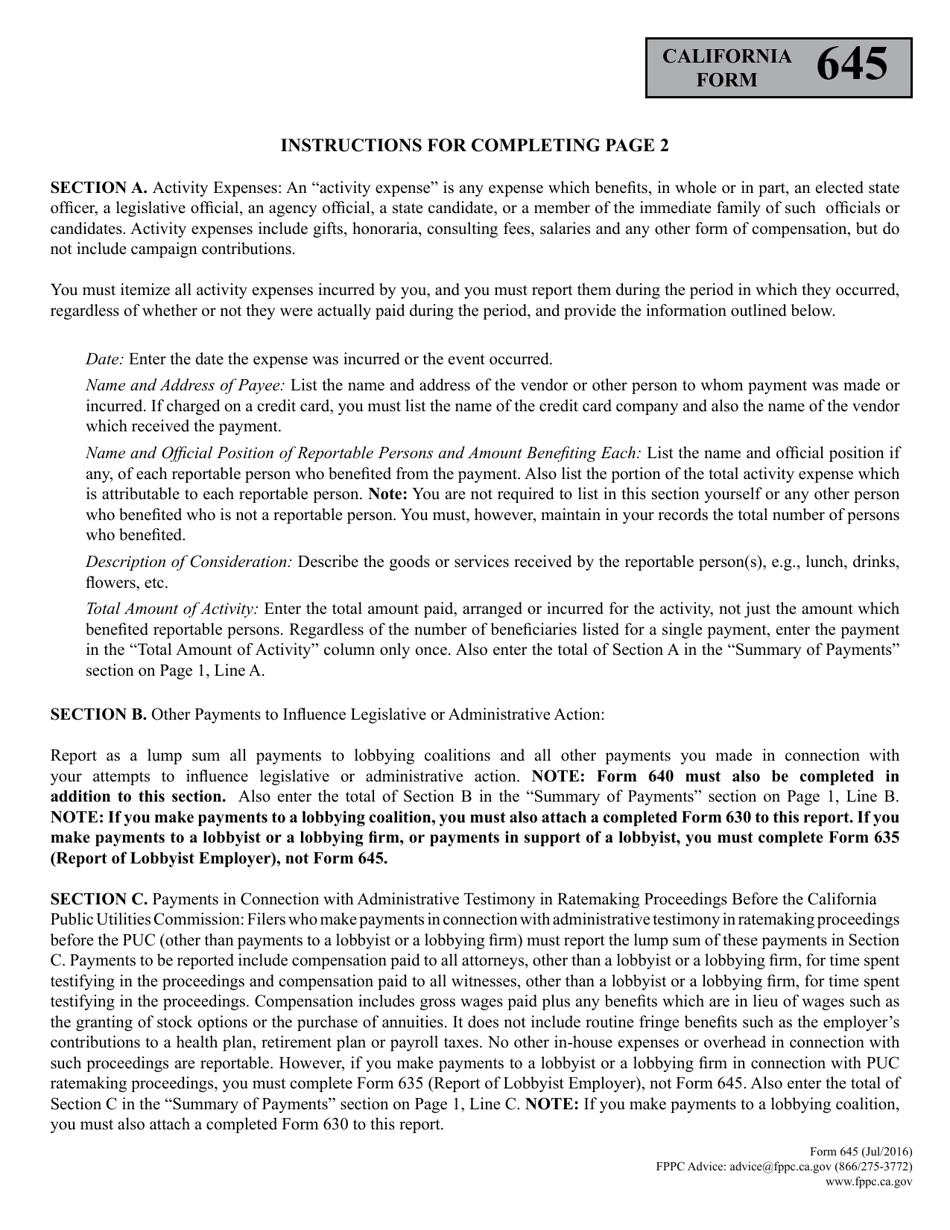

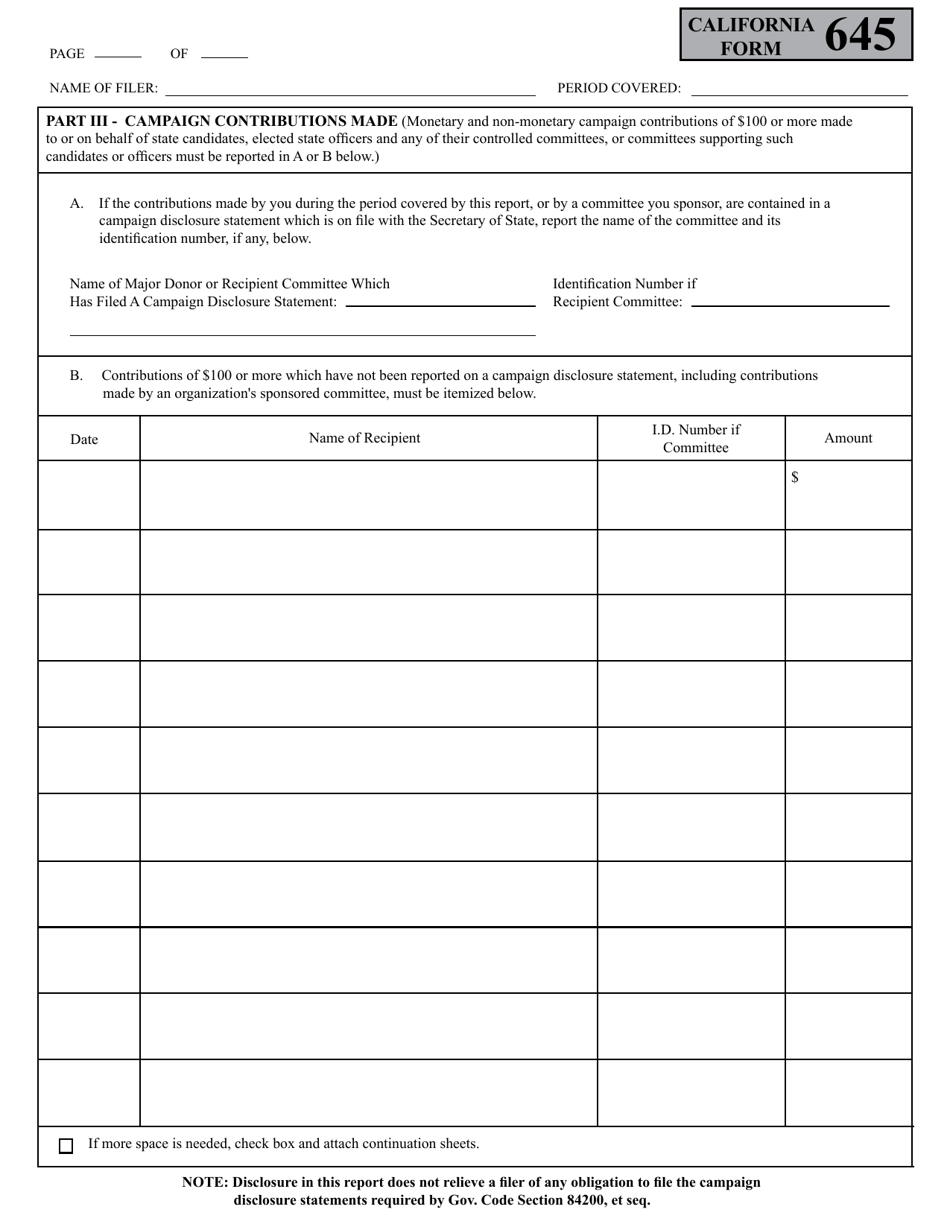

Q: What information needs to be included in Form 645?

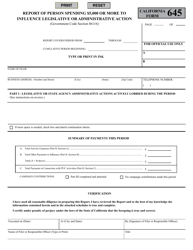

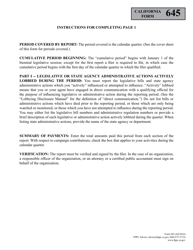

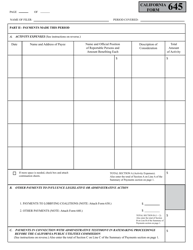

A: Form 645 requires information about the person or organization making the expenditures, the nature of the expenditures, and the recipient or target of the expenditures.

Q: When is Form 645 due?

A: Form 645 is due within 10 days after the expenditure threshold of $5,000 is met.

Q: Are there any penalties for not filing Form 645?

A: Yes, failure to file Form 645 or filing false or incomplete information can result in penalties and fines.

Q: Is Form 645 specific to California?

A: Yes, Form 645 is specific to California and is used to disclose expenditures made to influence legislative or administrative action in the state.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the California Fair Political Practices Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 645 by clicking the link below or browse more documents and templates provided by the California Fair Political Practices Commission.