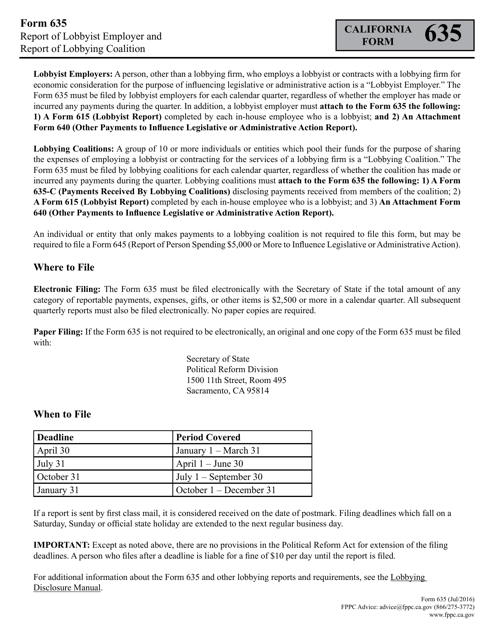

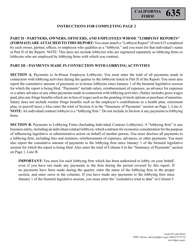

Form 635 Report of Lobbyist Employer and Report of Lobbying Coalition - California

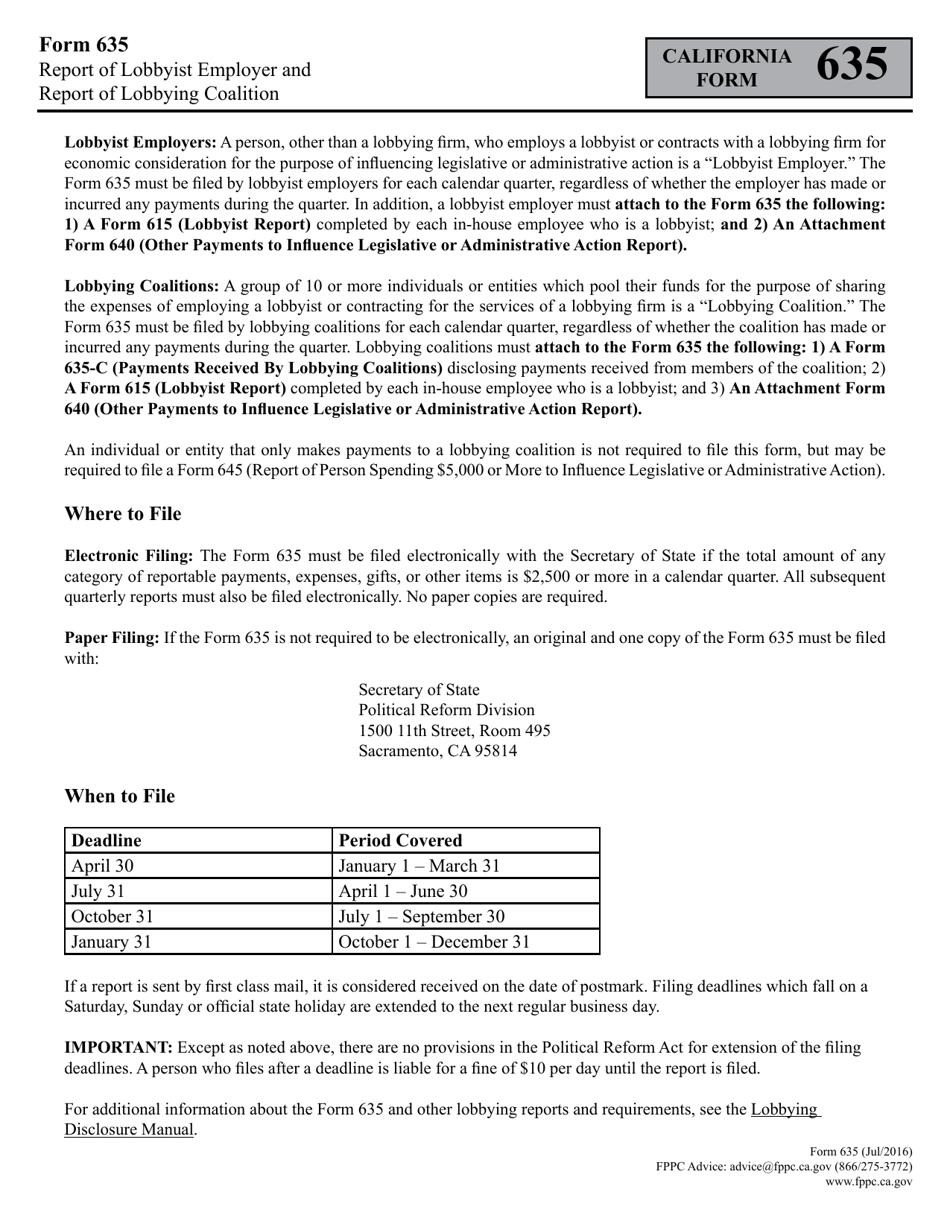

What Is Form 635?

This is a legal form that was released by the California Fair Political Practices Commission - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 635?

A: Form 635 is a report required by the state of California for lobbyist employers and lobbying coalitions.

Q: Who needs to file Form 635?

A: Lobbyist employers and lobbying coalitions in California are required to file Form 635.

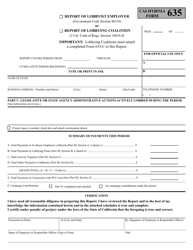

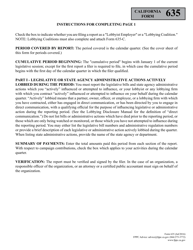

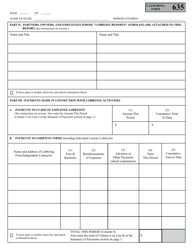

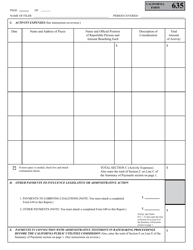

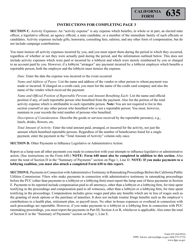

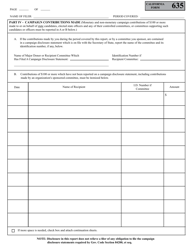

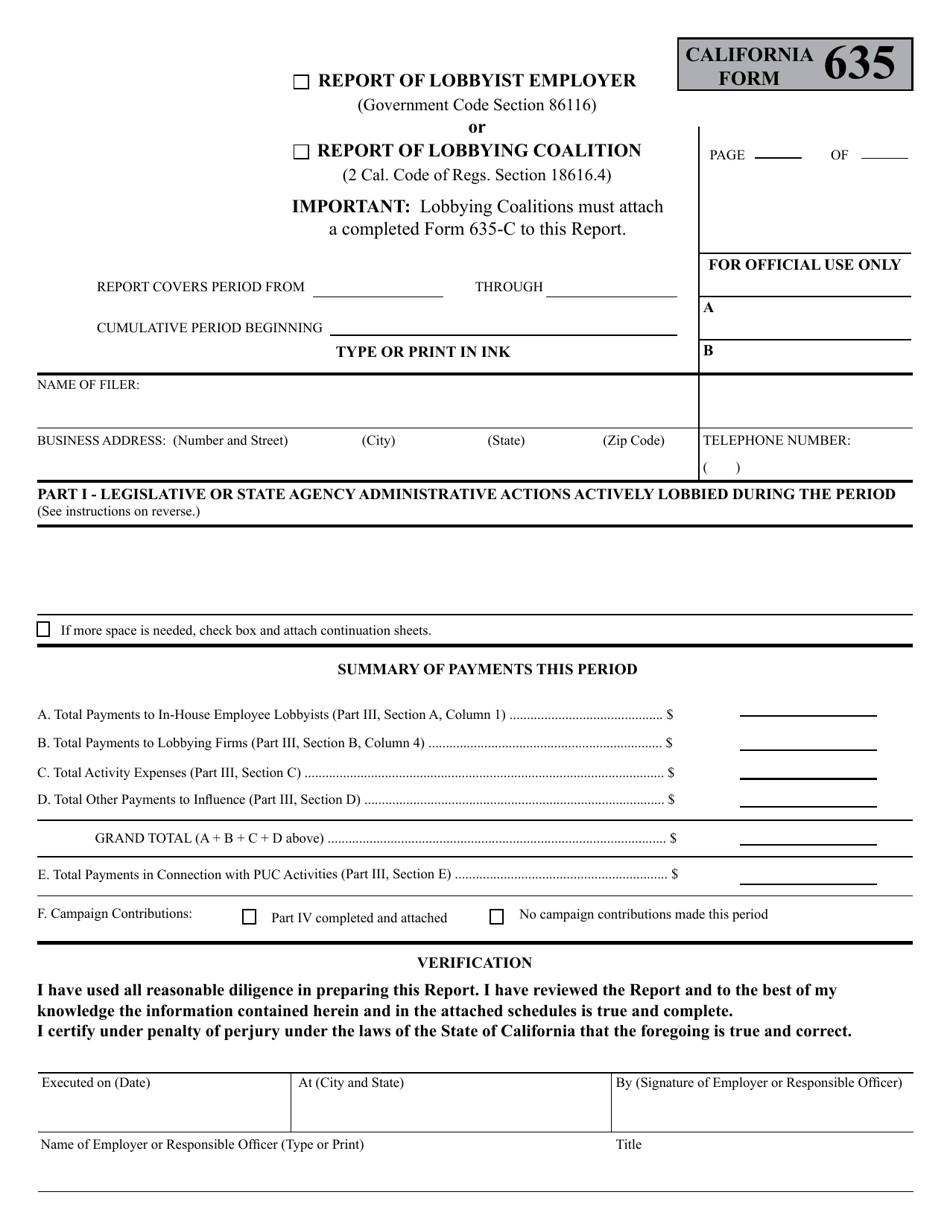

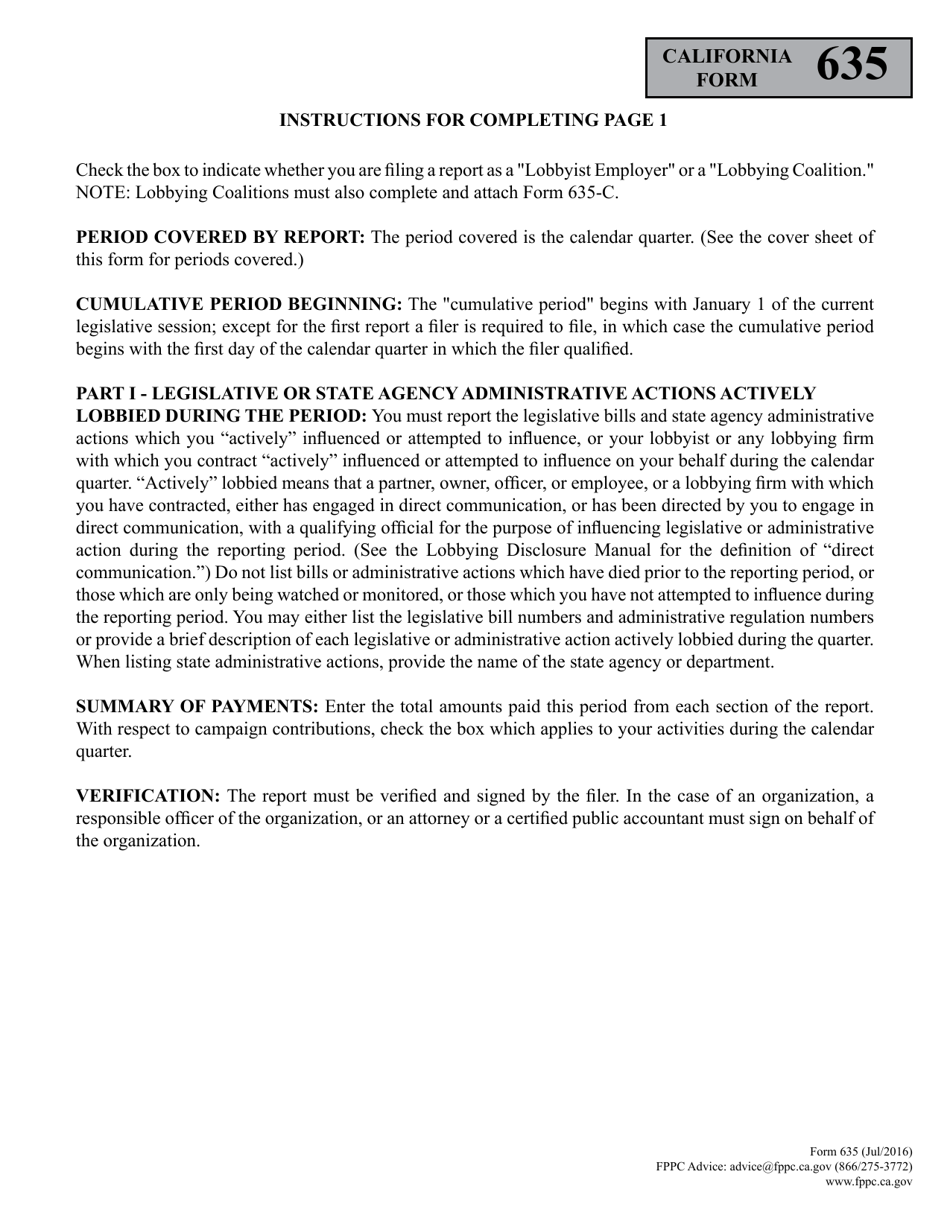

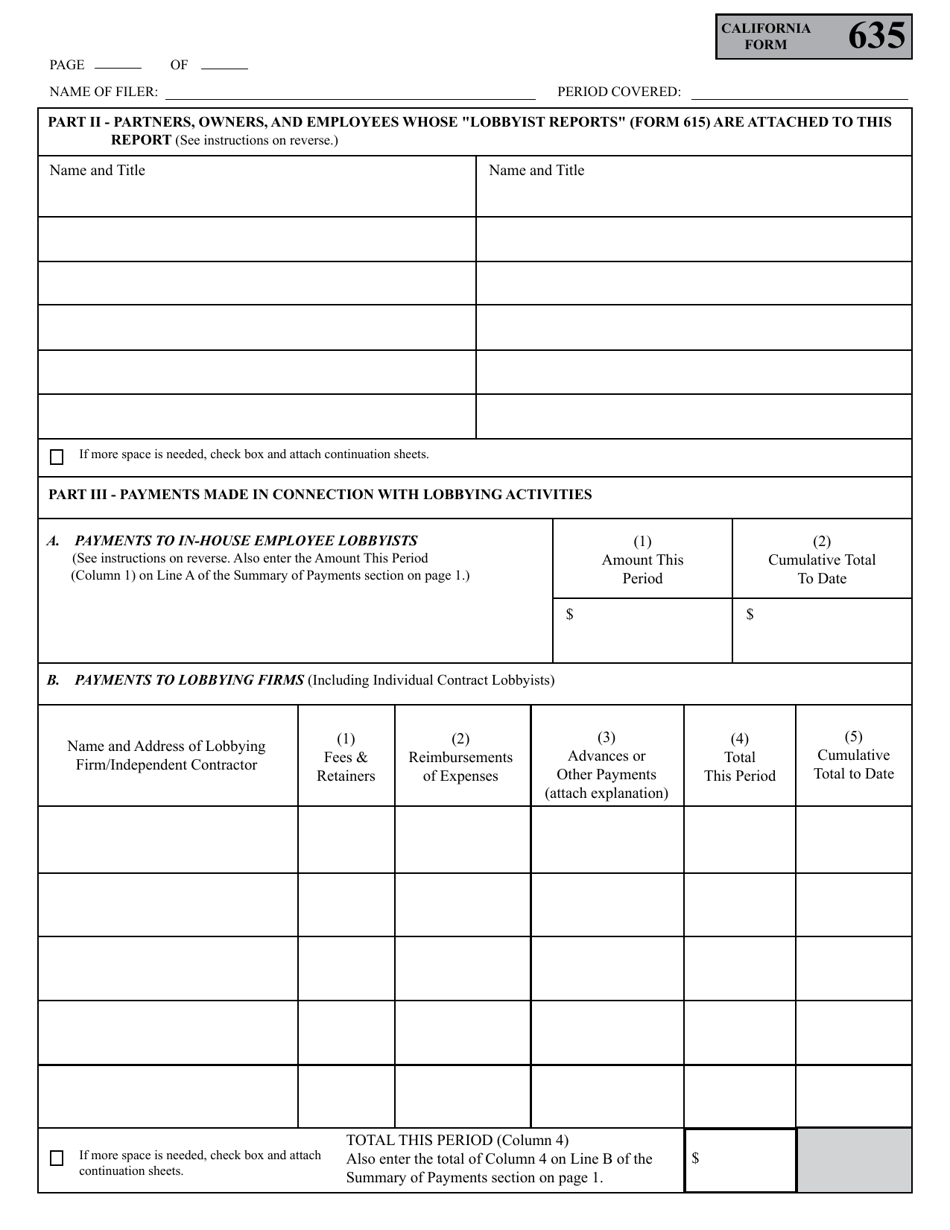

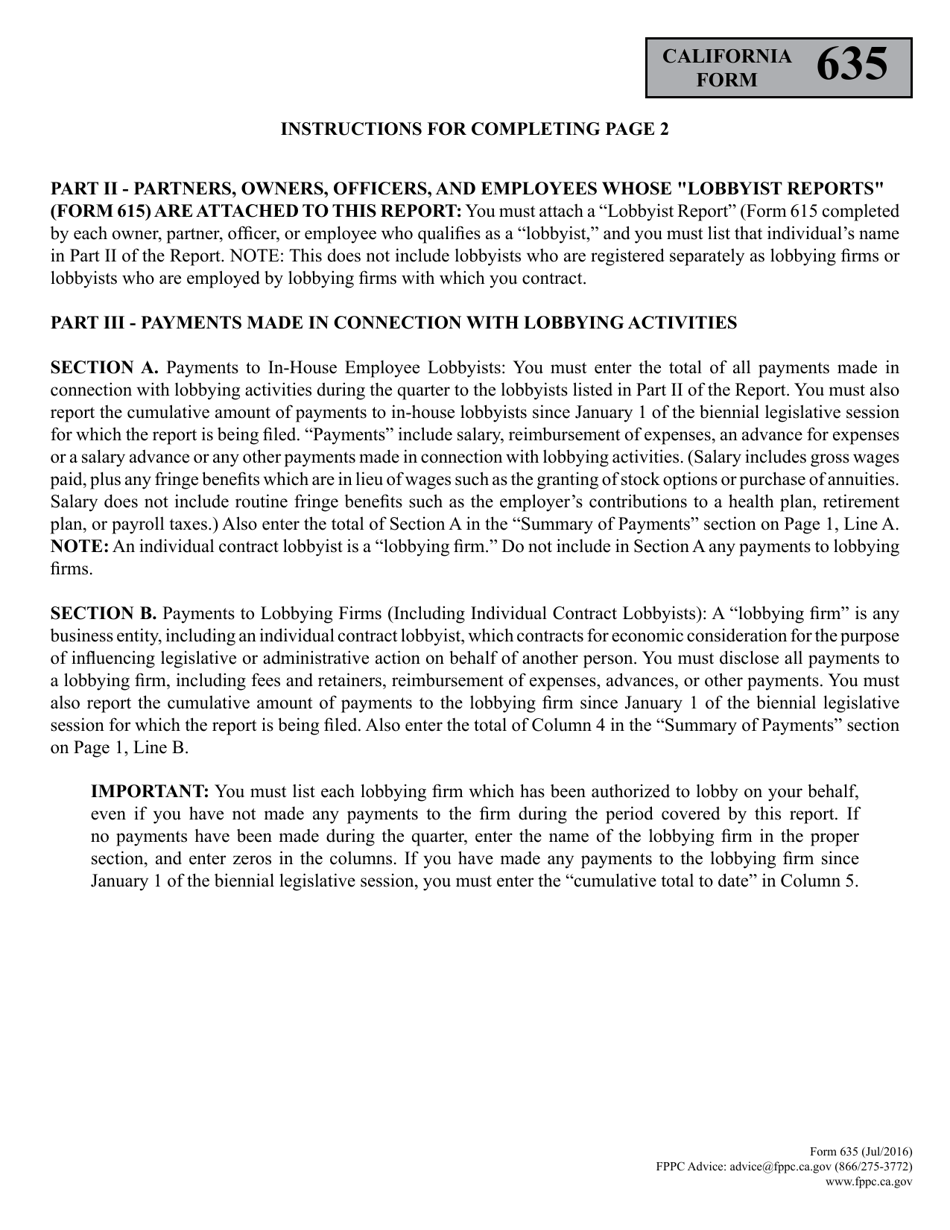

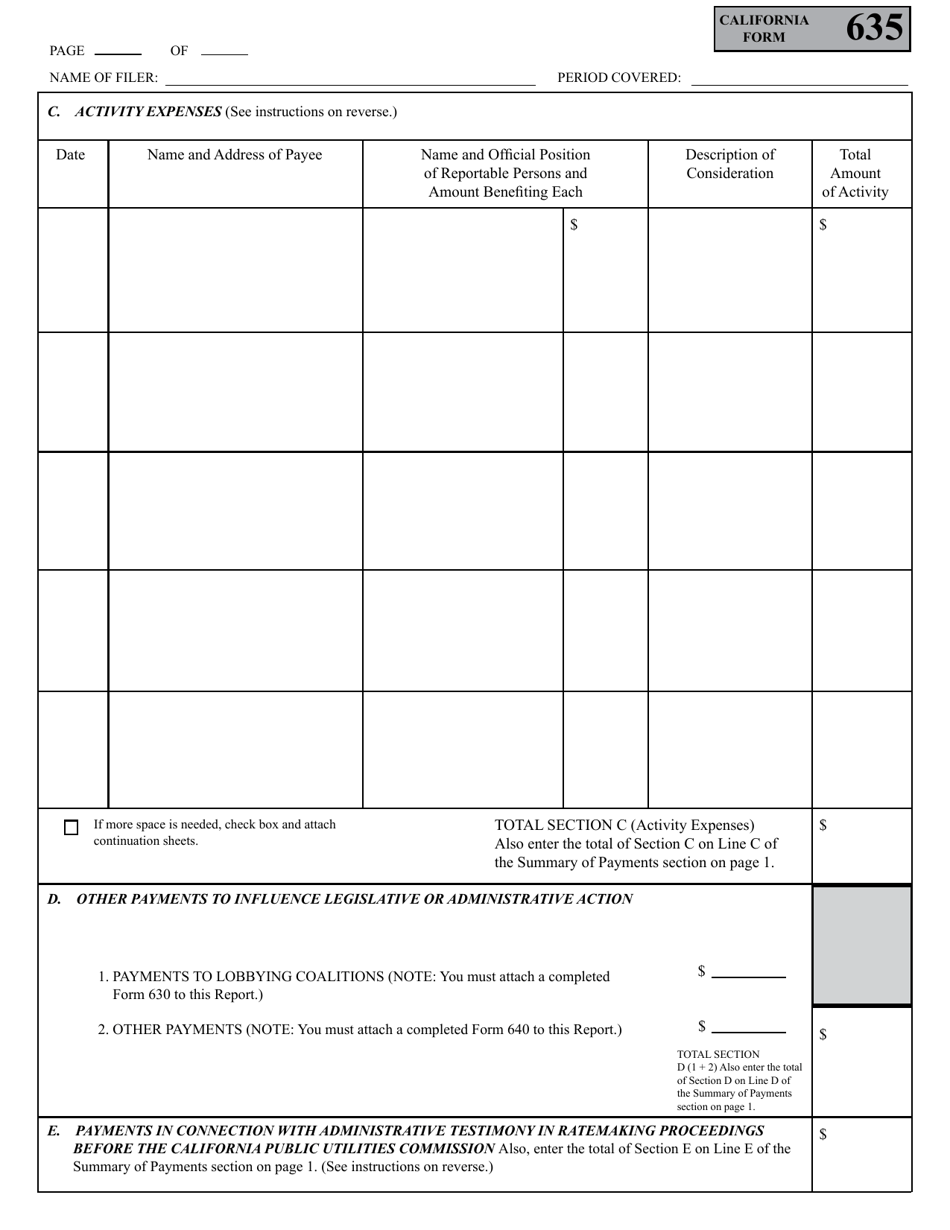

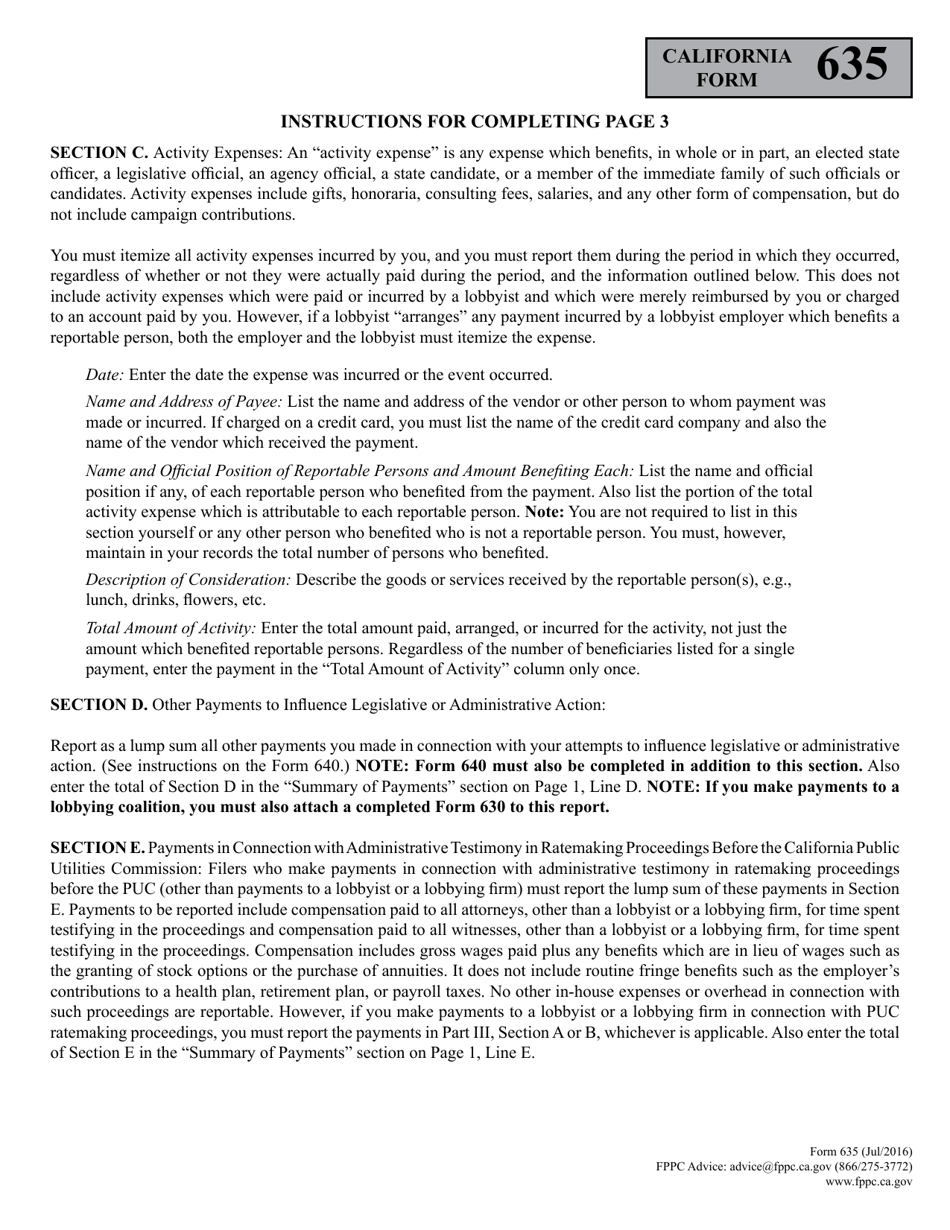

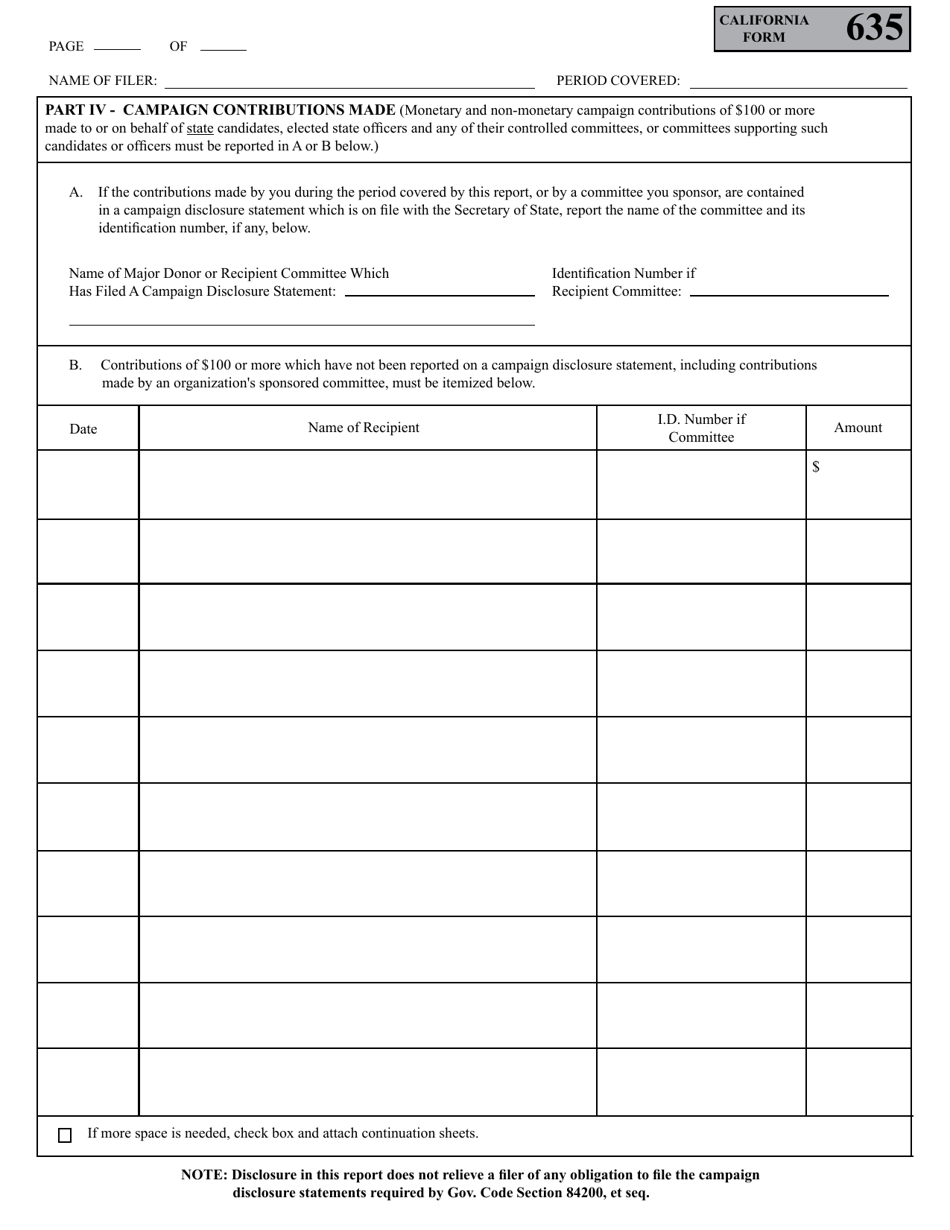

Q: What information is required on Form 635?

A: Form 635 requires information such as the name and address of the lobbyist employer or lobbying coalition, details about lobbying activities, and expenditures.

Q: When is Form 635 due?

A: Form 635 must be filed quarterly, with the due dates being April 30, July 31, October 31, and January 31.

Q: Is there a fee for filing Form 635?

A: No, there is no fee for filing Form 635.

Q: What are the consequences of not filing Form 635?

A: Failure to file Form 635 or filing it late can result in penalties, fines, and potential legal consequences.

Q: Are there any exemptions to filing Form 635?

A: There are specific exemptions outlined in the California Political Reform Act. It is recommended to consult legal counsel or the Fair Political Practices Commission for specific exemption criteria.

Q: Can I amend a filed Form 635?

A: Yes, you can amend a filed Form 635 by submitting an amended report with the corrected information.

Q: Who enforces the filing of Form 635?

A: The Fair Political Practices Commission is responsible for enforcing the filing requirements of Form 635 in California.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the California Fair Political Practices Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 635 by clicking the link below or browse more documents and templates provided by the California Fair Political Practices Commission.