This version of the form is not currently in use and is provided for reference only. Download this version of

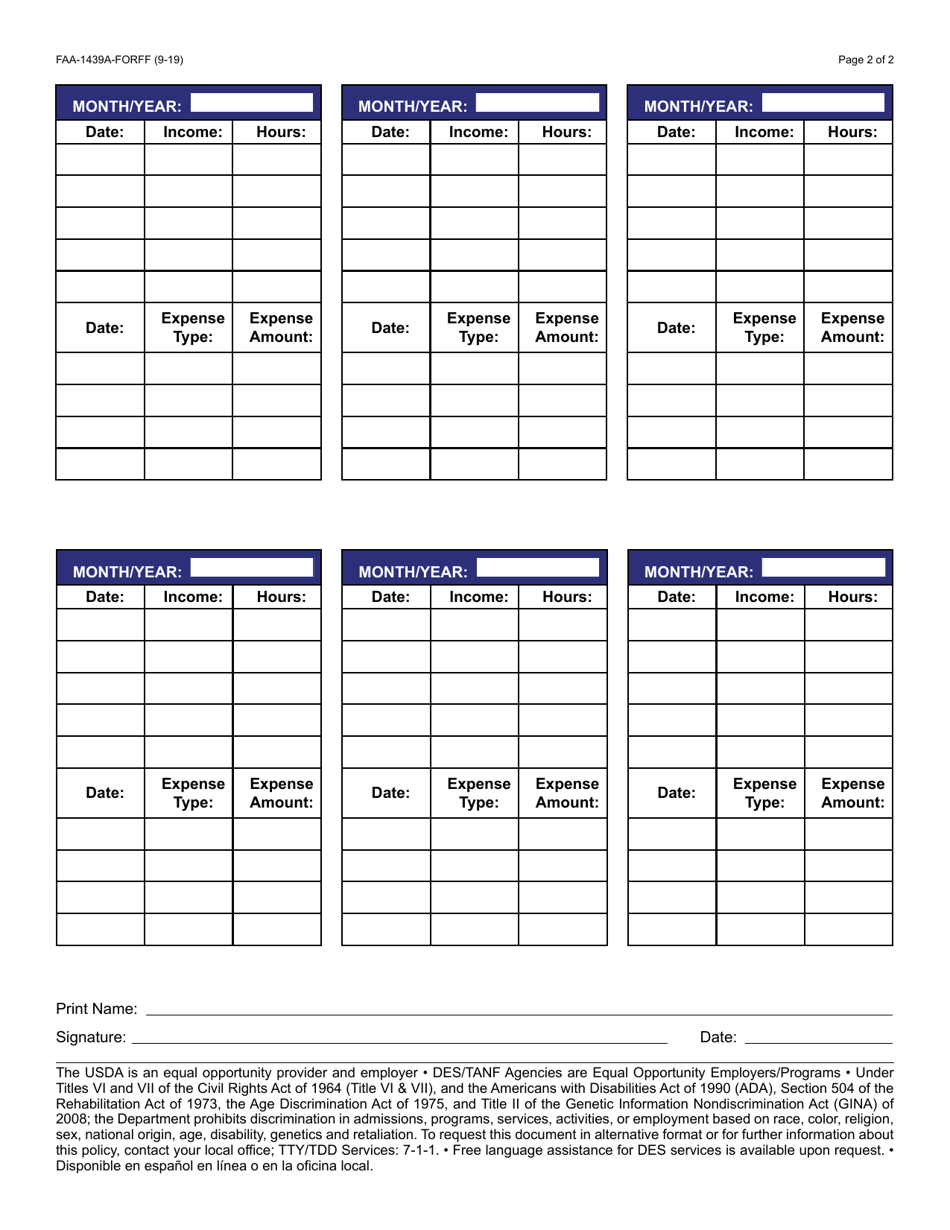

Form FAA-1439A

for the current year.

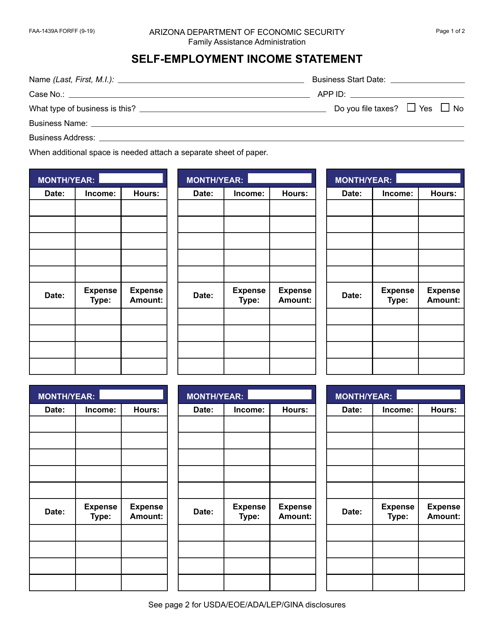

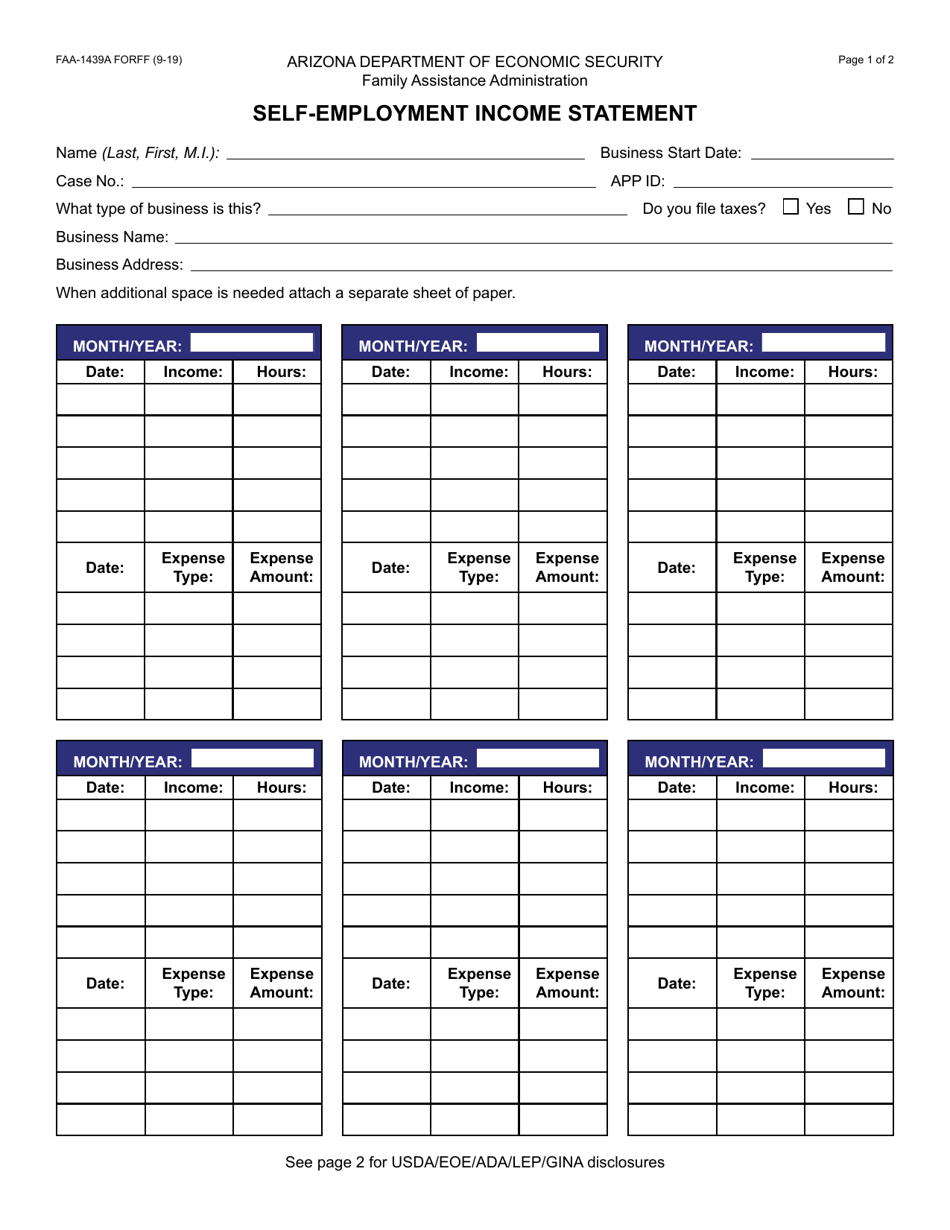

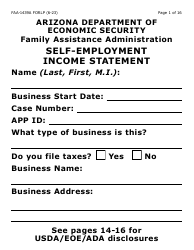

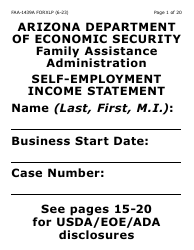

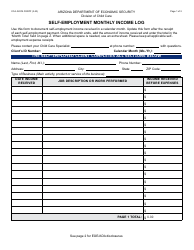

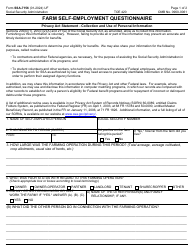

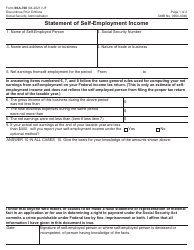

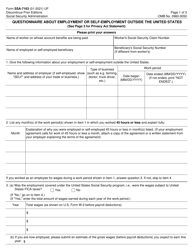

Form FAA-1439A Self-employment Income Statement - Arizona

What Is Form FAA-1439A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FAA-1439A?

A: Form FAA-1439A is a Self-employment Income Statement.

Q: Who needs to fill out Form FAA-1439A?

A: Residents of Arizona who are self-employed may need to fill out this form.

Q: What is the purpose of Form FAA-1439A?

A: The purpose of Form FAA-1439A is to report self-employment income.

Q: Do I have to submit Form FAA-1439A with my tax return?

A: It depends on the requirements of the Arizona Department of Revenue. Check their guidelines or consult a tax professional to determine if you need to submit this form.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FAA-1439A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.