This version of the form is not currently in use and is provided for reference only. Download this version of

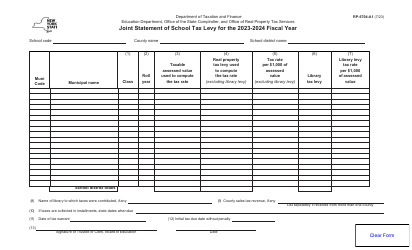

Form RP-6704-C1

for the current year.

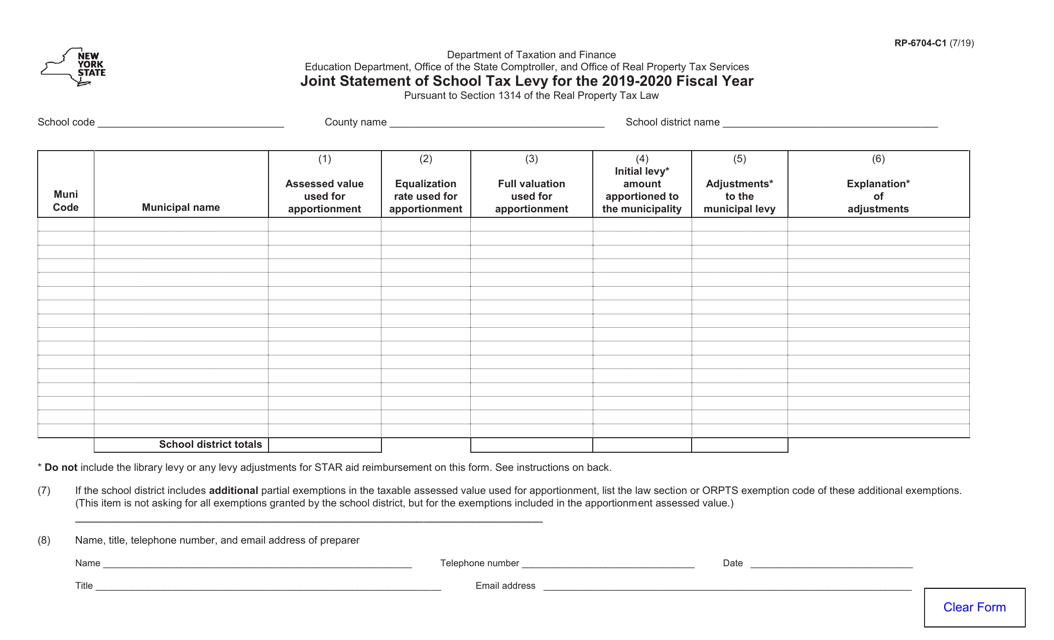

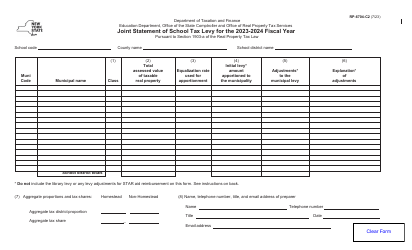

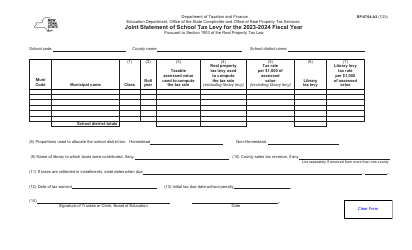

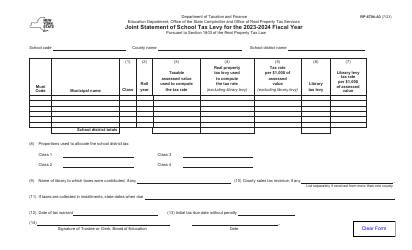

Form RP-6704-C1 Joint Statement of School Tax Levy - New York

What Is Form RP-6704-C1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-6704-C1?

A: Form RP-6704-C1 is the Joint Statement of School Tax Levy in New York.

Q: Who needs to file Form RP-6704-C1?

A: School districts in New York need to file Form RP-6704-C1.

Q: What is the purpose of Form RP-6704-C1?

A: Form RP-6704-C1 is used to report the school tax levy for the district.

Q: When is Form RP-6704-C1 due?

A: Form RP-6704-C1 is due by October 1st each year.

Q: Is there a penalty for late filing of Form RP-6704-C1?

A: Yes, there may be penalties for late filing of Form RP-6704-C1.

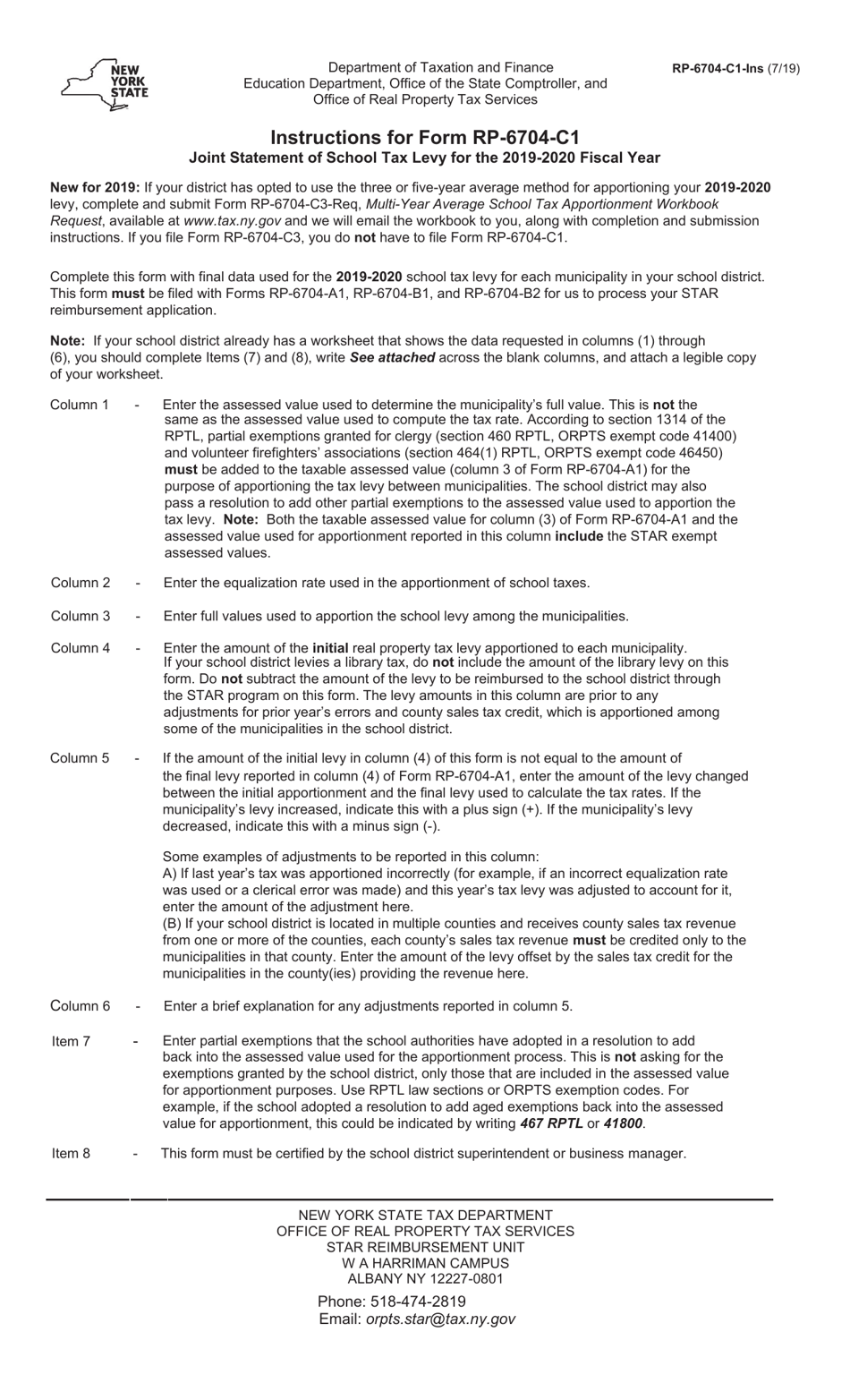

Q: Are there any instructions for completing Form RP-6704-C1?

A: Yes, the form comes with instructions that should be followed carefully.

Q: Is Form RP-6704-C1 used for all types of taxes?

A: No, Form RP-6704-C1 is specifically for reporting school tax levy.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6704-C1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.