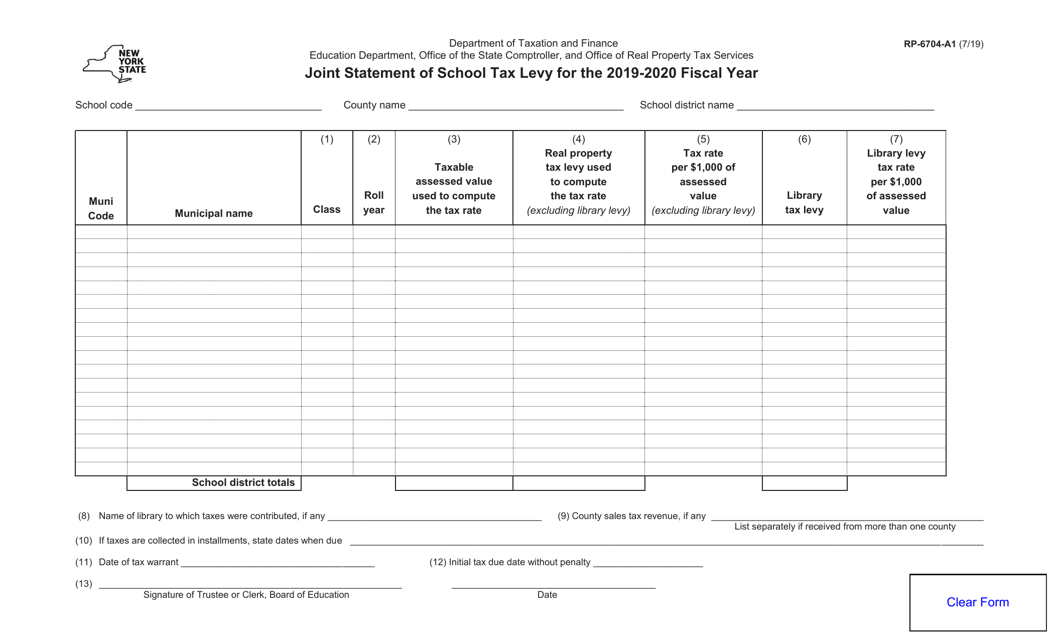

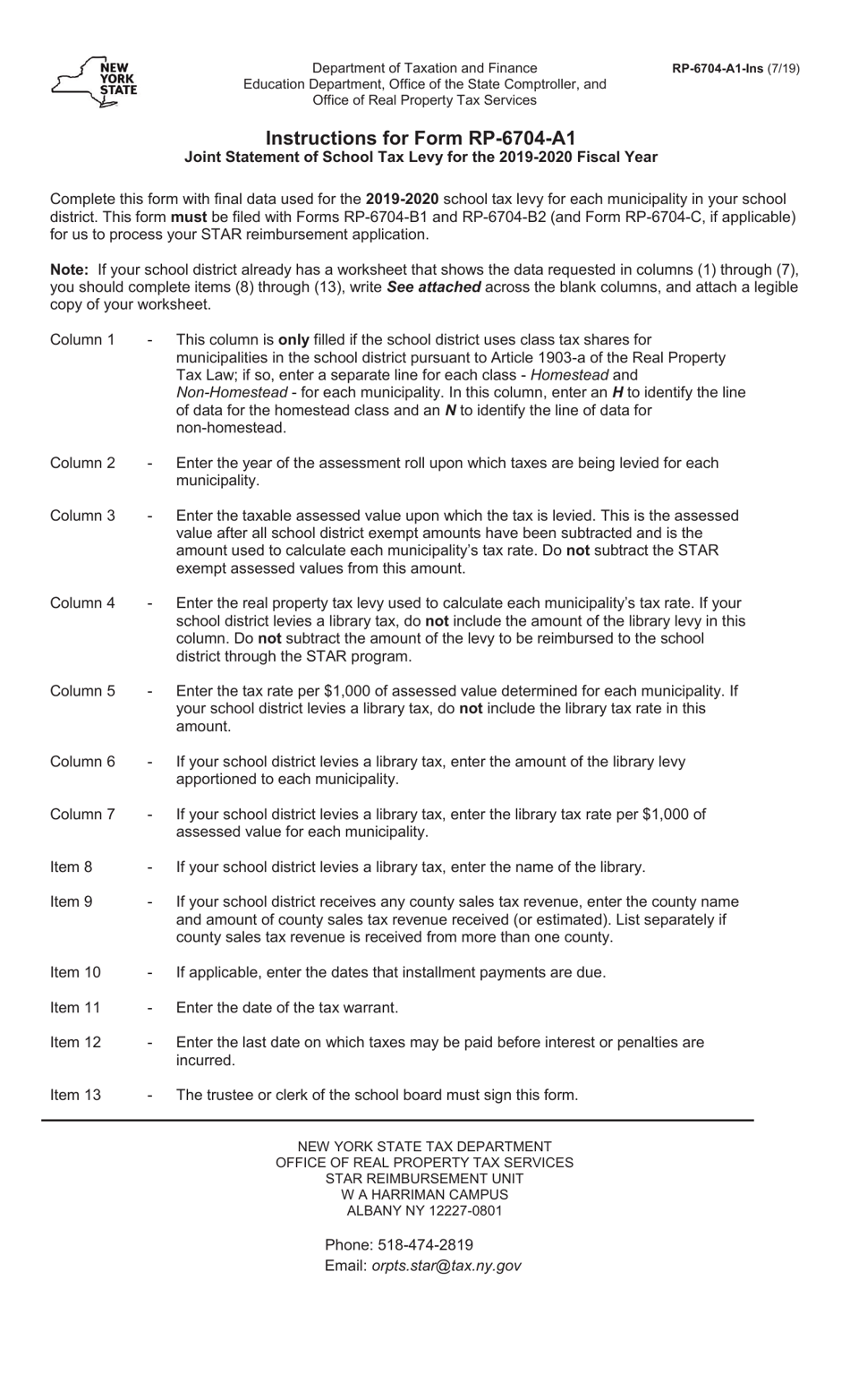

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-6704-A1

for the current year.

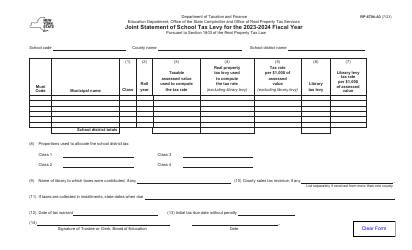

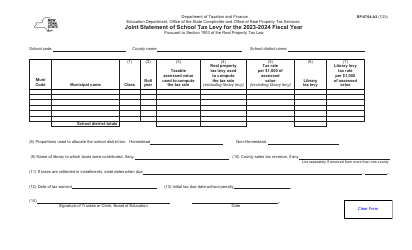

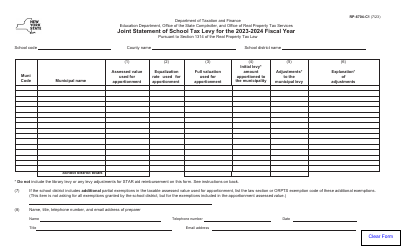

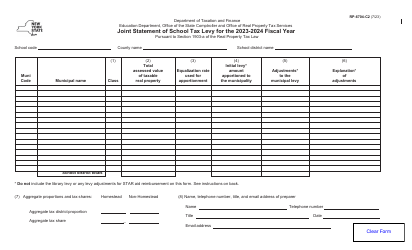

Form RP-6704-A1 Joint Statement of School Tax Levy - New York

What Is Form RP-6704-A1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-6704-A1?

A: Form RP-6704-A1 is a joint statement of school tax levy in New York.

Q: Who needs to fill out this form?

A: This form needs to be filled out by school districts in New York.

Q: What is the purpose of Form RP-6704-A1?

A: The purpose of this form is to report the school tax levy for budgetary purposes.

Q: When is Form RP-6704-A1 due?

A: The due date for this form varies, but it is typically submitted to the New York State Department of Taxation and Finance by October 15th.

Q: Is there a fee to file this form?

A: No, there is no fee to file Form RP-6704-A1.

Q: What happens if I don't file this form?

A: If you fail to file this form, your school district may face penalties or lose out on state funding.

Q: Are there any other documents required to be submitted with Form RP-6704-A1?

A: There are no additional documents required to be submitted with this form.

Q: Who can I contact for help with Form RP-6704-A1?

A: You can contact the New York State Department of Taxation and Finance or your local school district for assistance with this form.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6704-A1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.