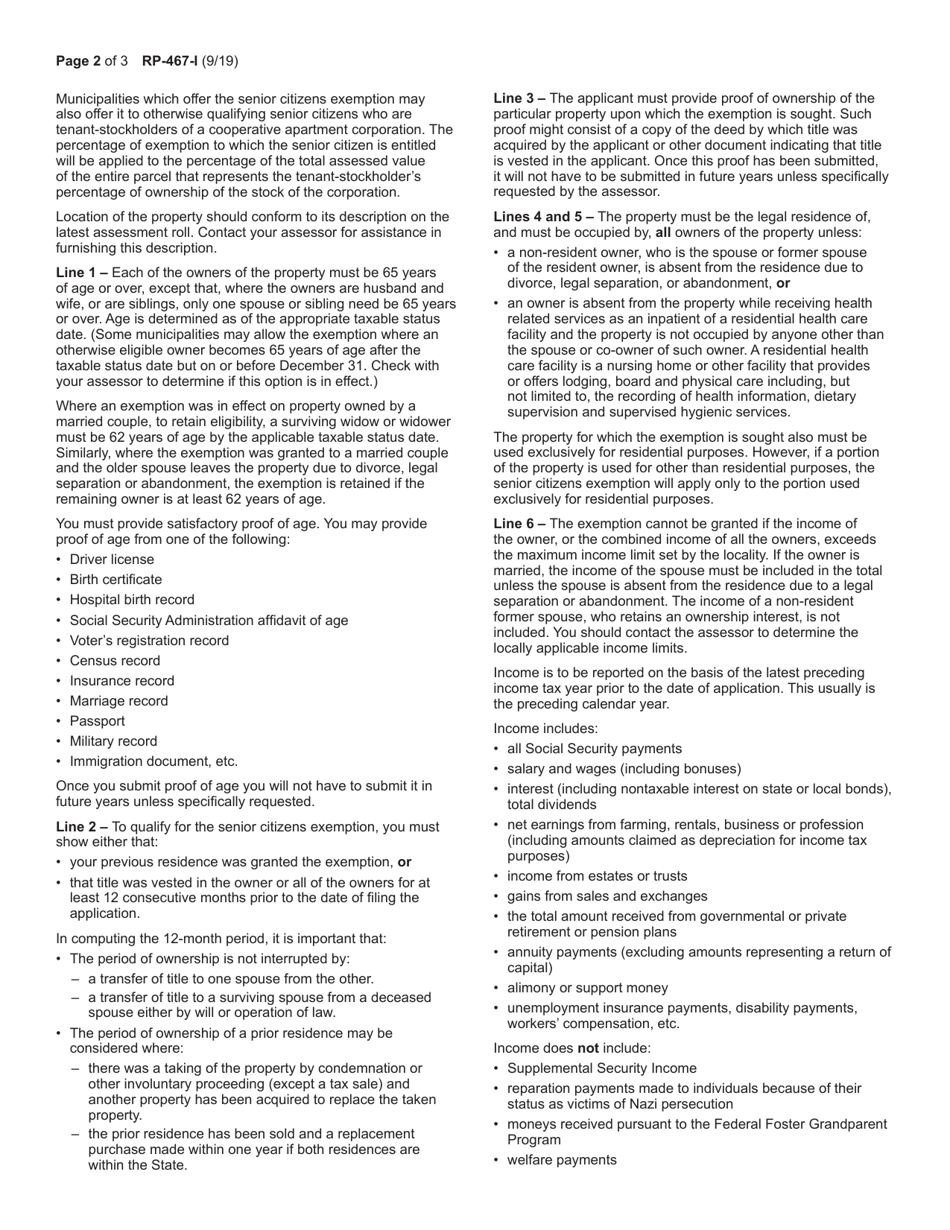

This version of the form is not currently in use and is provided for reference only. Download this version of

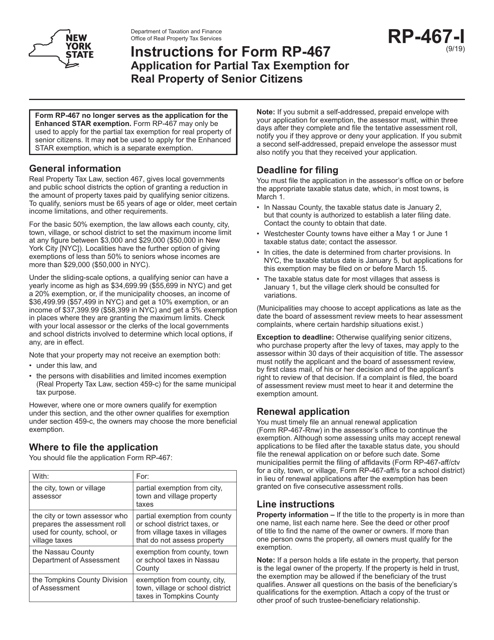

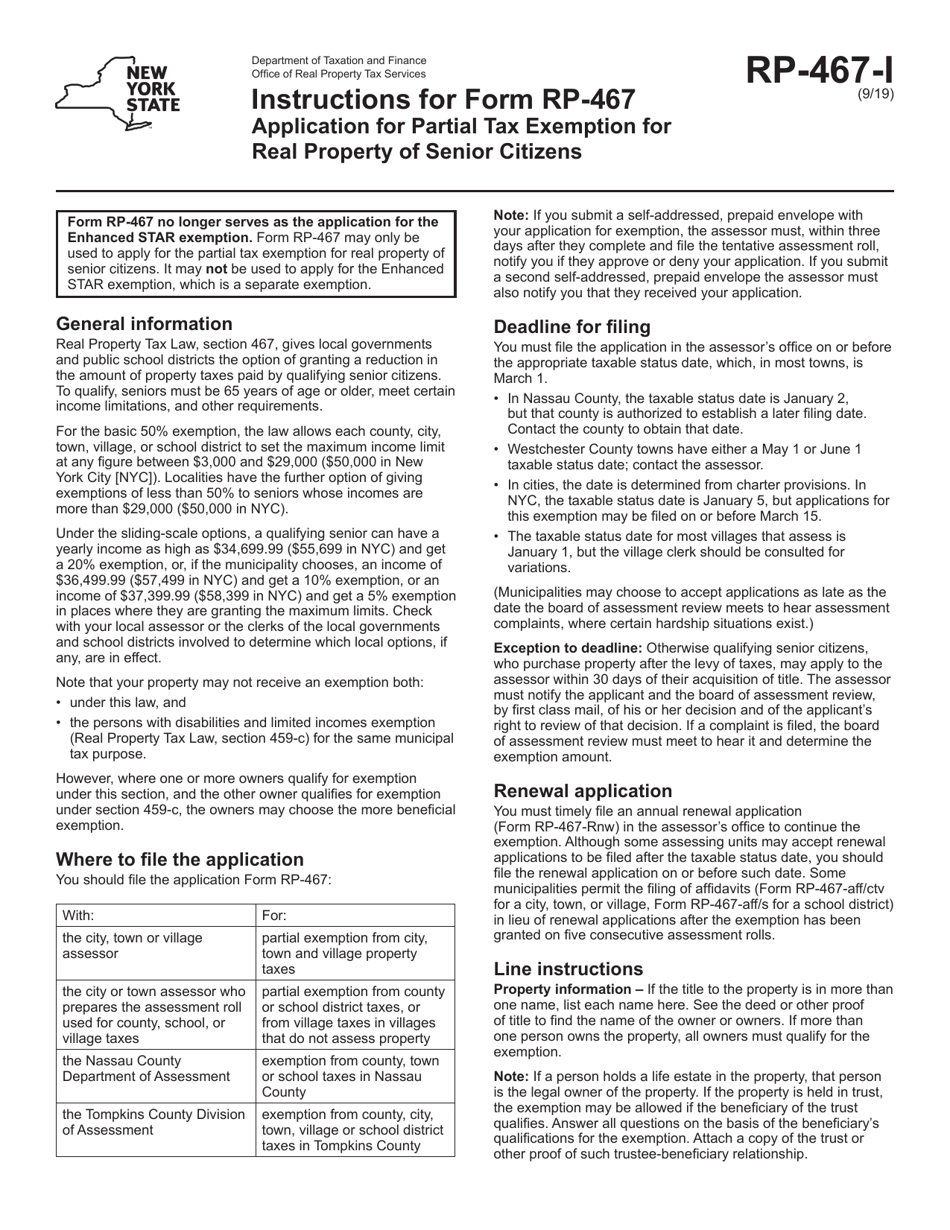

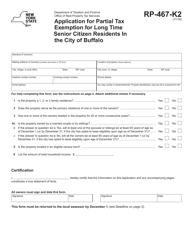

Instructions for Form RP-467

for the current year.

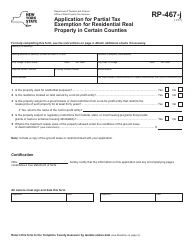

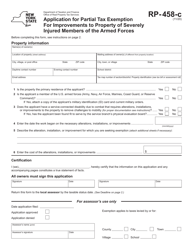

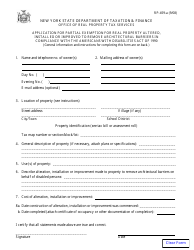

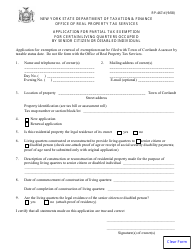

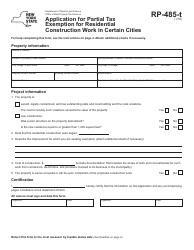

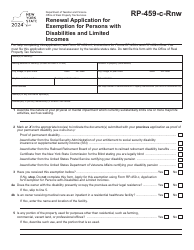

Instructions for Form RP-467 Application for Partial Tax Exemption for Real Property of Senior Citizens - New York

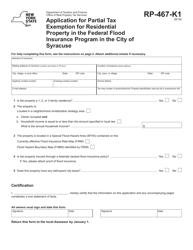

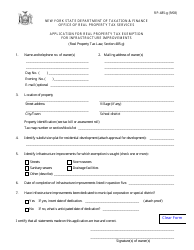

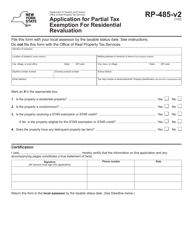

This document contains official instructions for Form RP-467 , Application for Real Property of Senior Citizens - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-467 is available for download through this link.

FAQ

Q: What is Form RP-467?

A: Form RP-467 is an application for a partial tax exemption for real property of senior citizens in New York.

Q: Who can apply for the partial tax exemption?

A: Senior citizens who own residential property in New York can apply for the partial tax exemption.

Q: What are the eligibility requirements for the exemption?

A: To be eligible, the applicant must be 65 years or older, have a combined income below a specified limit, and meet other requirements.

Q: What documents are required to be submitted with the application?

A: The applicant must provide proof of age, proof of ownership, proof of residency, and income documents.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted on or before the taxable status date of the assessing unit.

Q: What is the benefit of the partial tax exemption?

A: The exemption can reduce the property taxes owed by eligible senior citizens.

Q: Is the exemption automatic once the application is approved?

A: No, the exemption is not automatic. It must be renewed annually by filing the appropriate forms and meeting the eligibility requirements.

Q: Are there any other tax exemptions available for senior citizens in New York?

A: Yes, there are other tax exemptions and programs available, such as the Enhanced STAR program for senior citizens.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.