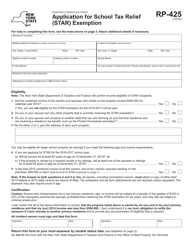

This version of the form is not currently in use and is provided for reference only. Download this version of

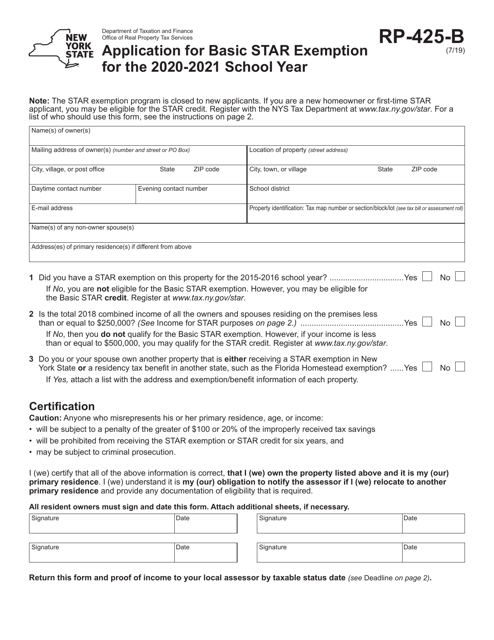

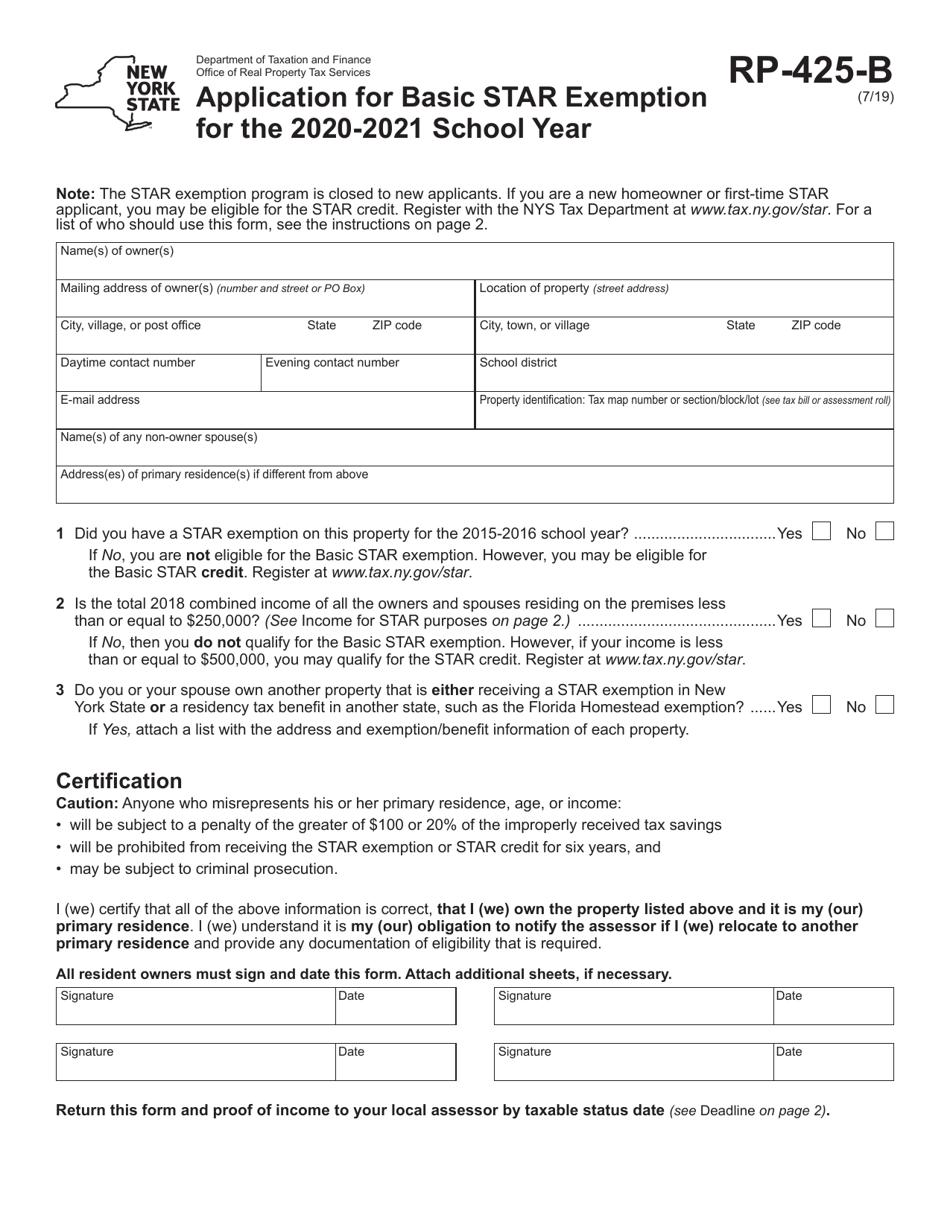

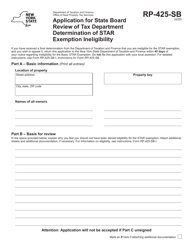

Form RP-425-B

for the current year.

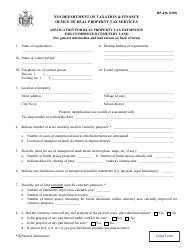

Form RP-425-B Application for Basic Star Exemption - New York

What Is Form RP-425-B?

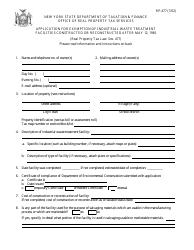

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-425-B?

A: Form RP-425-B is the application form for the Basic STAR exemption in New York.

Q: What is the Basic STAR exemption?

A: The Basic STAR exemption is a property tax relief program for homeowners in New York.

Q: Who is eligible for the Basic STAR exemption?

A: Homeowners who own and live in their primary residence in New York are generally eligible for the Basic STAR exemption.

Q: What is the purpose of Form RP-425-B?

A: Form RP-425-B is used to apply for the Basic STAR exemption and provide necessary information to the assessor.

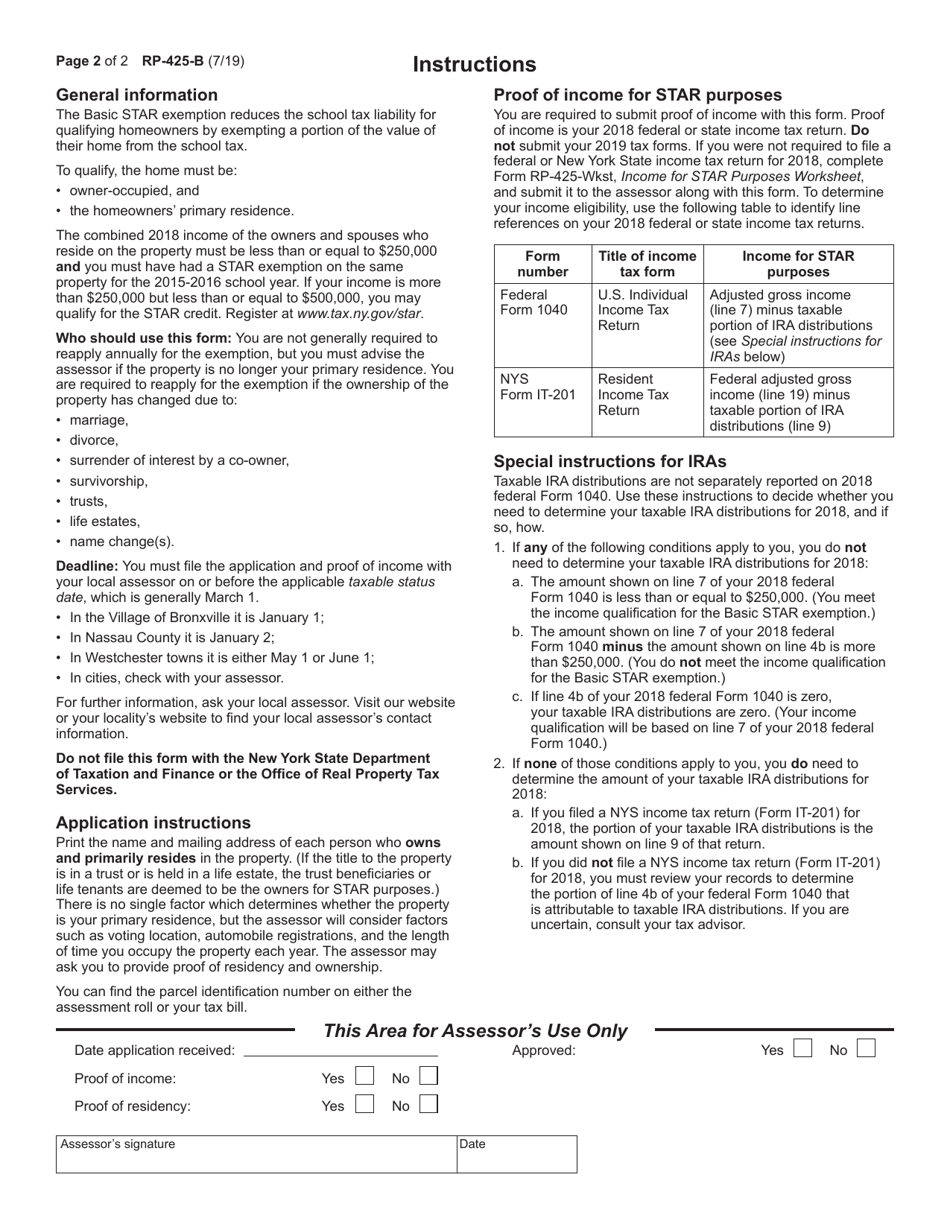

Q: What information is required on Form RP-425-B?

A: Form RP-425-B requires information about the property, including address and ownership details, as well as the names and Social Security numbers of all owners.

Q: When should I submit Form RP-425-B?

A: Form RP-425-B must be filed with the assessor by the appropriate deadline specified by your local municipality.

Q: Is there a fee for filing Form RP-425-B?

A: No, there is no fee for filing Form RP-425-B.

Q: What happens after I submit Form RP-425-B?

A: After you submit Form RP-425-B, the assessor will review your application and determine your eligibility for the Basic STAR exemption.

Q: Can I apply for the Basic STAR exemption if I already receive Enhanced STAR?

A: No, homeowners who receive the Enhanced STAR exemption are not eligible for the Basic STAR exemption. They must continue to apply for the Enhanced STAR exemption.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.