This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

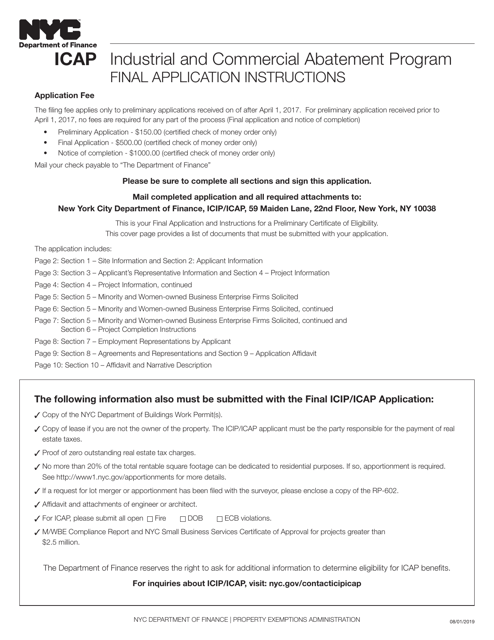

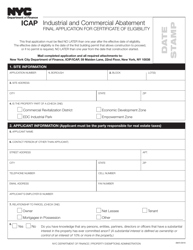

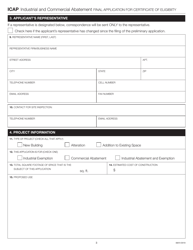

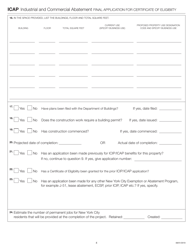

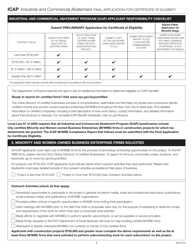

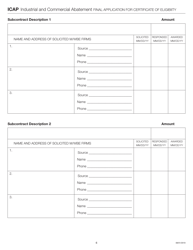

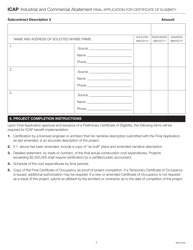

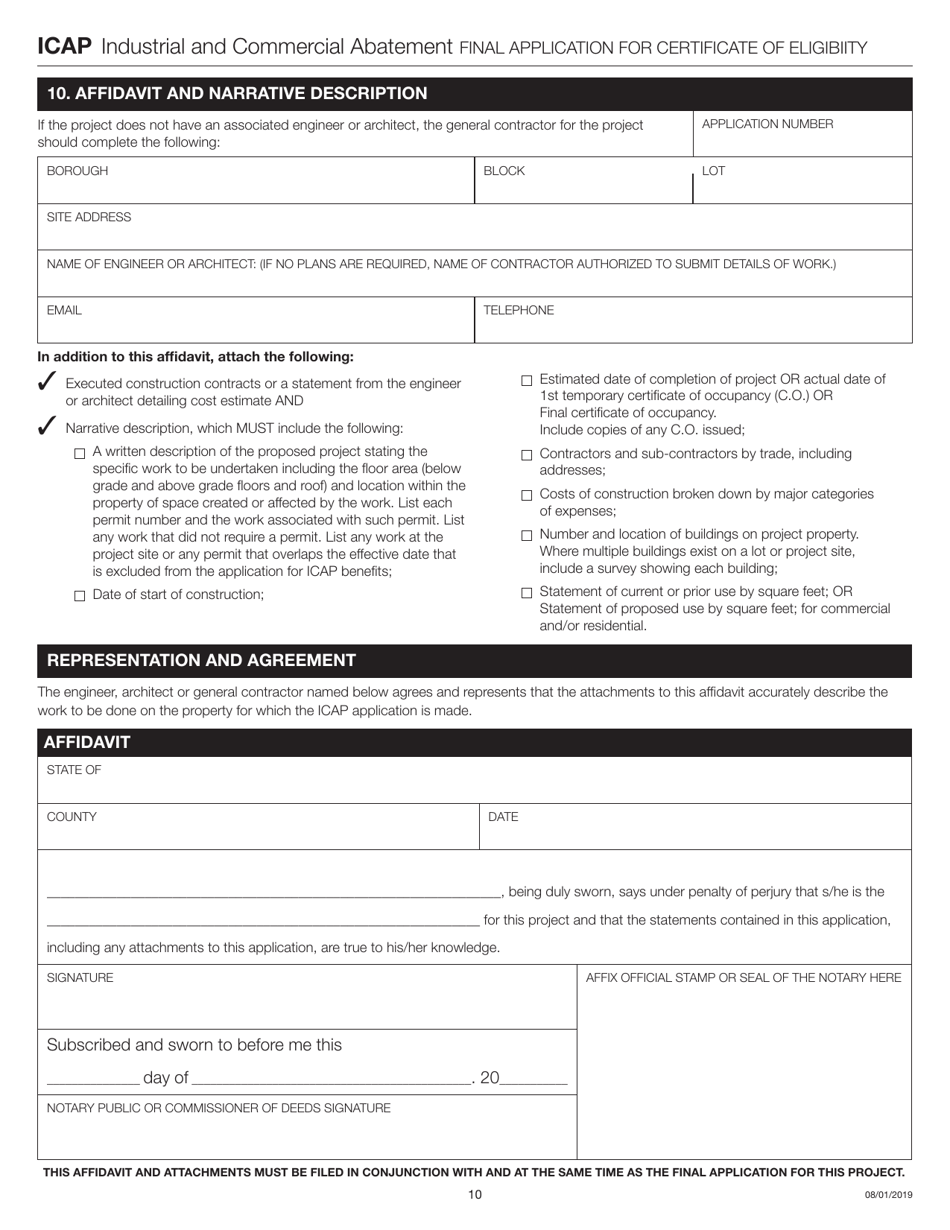

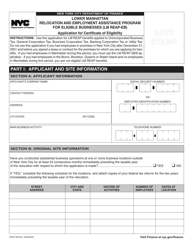

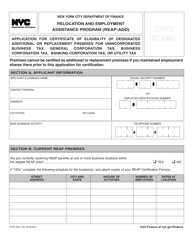

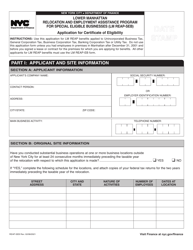

Industrial and Commercial Abatement Final Application for Certificate of Eligibility - New York City

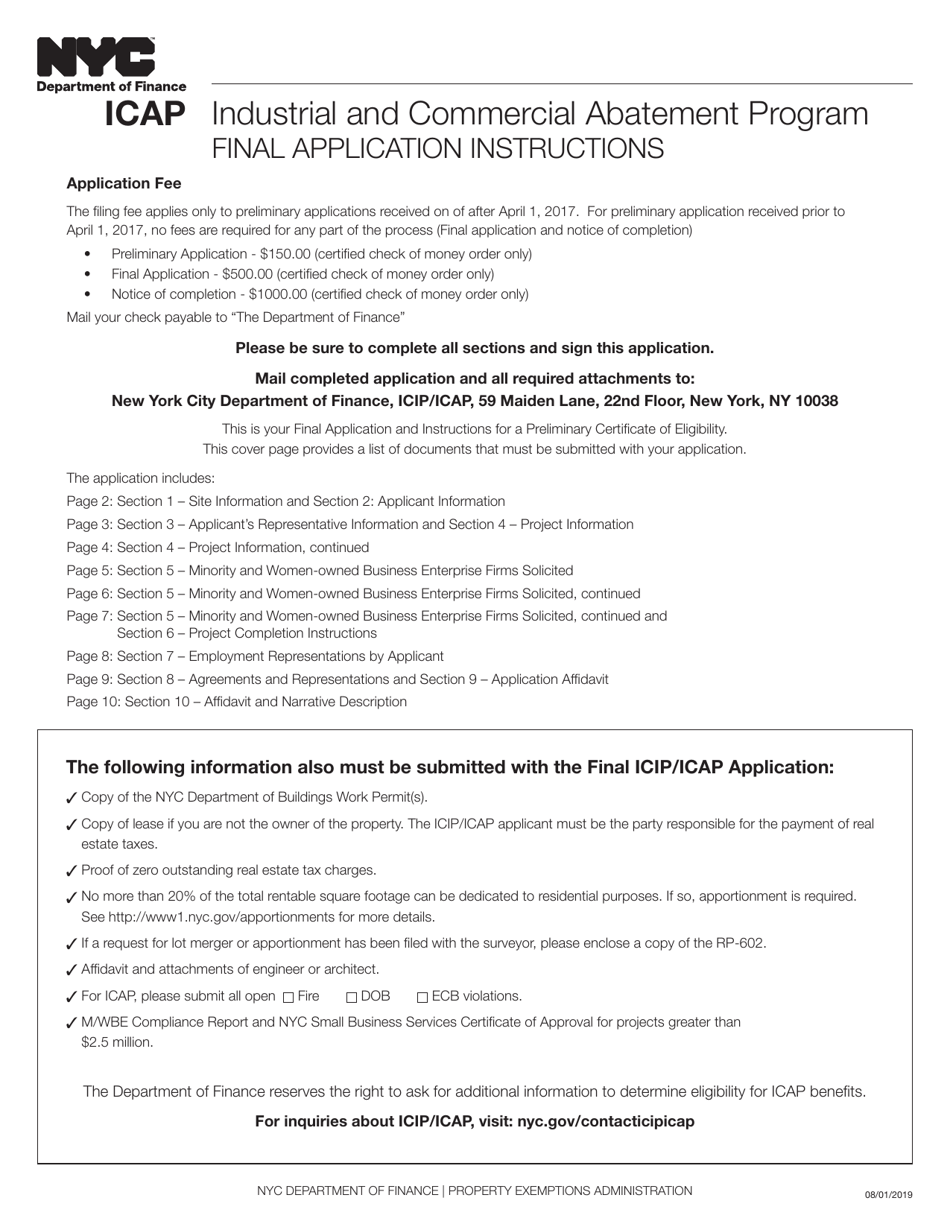

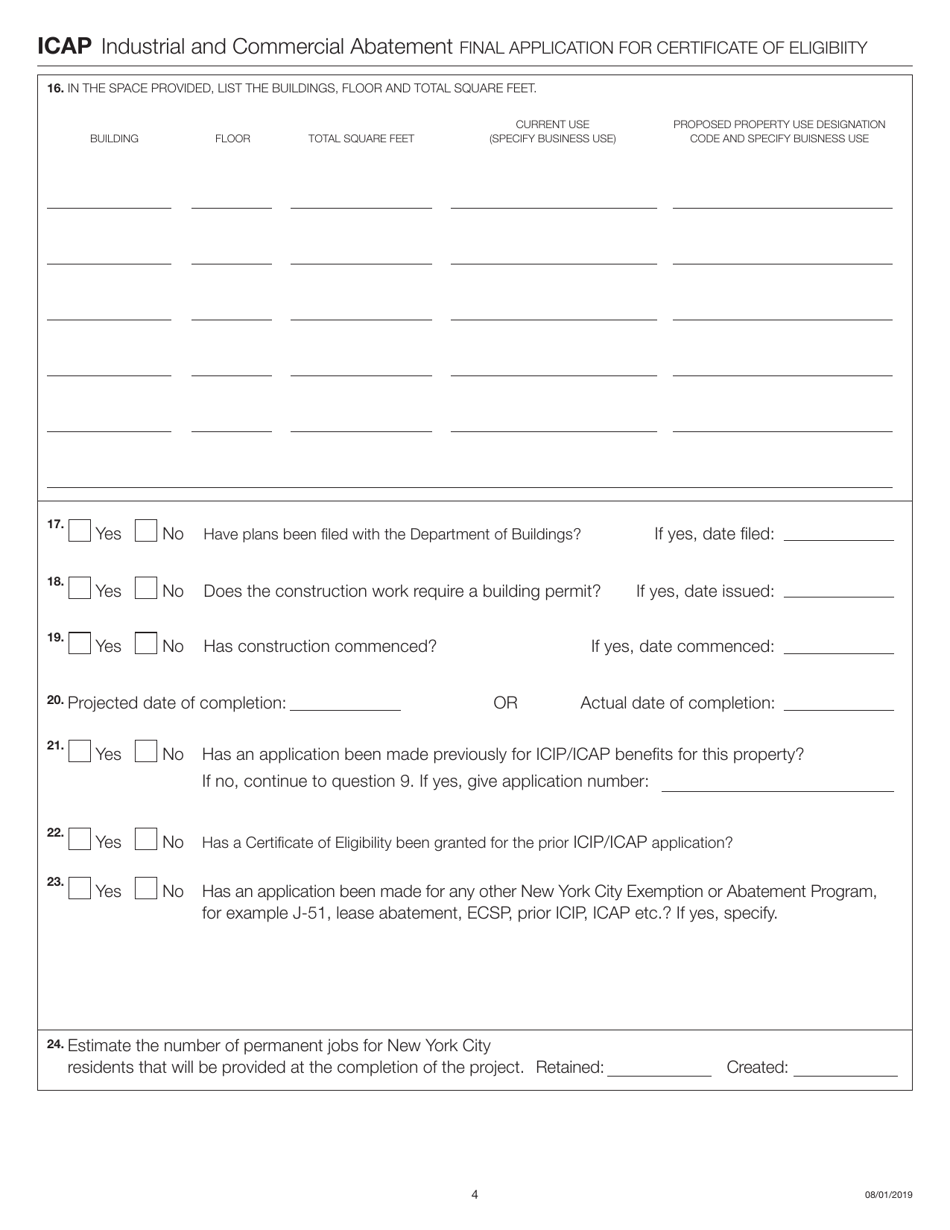

Industrial and Commercial Abatement Final Application for Certificate of Eligibility is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is an Industrial and Commercial Abatement Final Application?

A: It is an application for a Certificate of Eligibility in New York City.

Q: What is the purpose of the application?

A: The purpose is to be eligible for tax abatement for industrial and commercial properties.

Q: Who can submit the application?

A: Property owners or designated agents can submit the application.

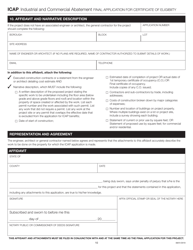

Q: What documents are required for the application?

A: Documents such as property ownership proof, lease agreements, and financial documents may be required.

Q: What is the deadline for submitting the application?

A: The deadline varies and is specified in the program guidelines.

Q: What is the benefit of obtaining a Certificate of Eligibility?

A: The benefit is the eligibility for tax abatement, which can result in reduced property taxes.

Q: How long is the tax abatement period?

A: The tax abatement period is typically between 10 to 25 years, depending on the property type.

Q: Can the tax abatement be transferred to a new owner?

A: Yes, the tax abatement can be transferred to a new owner if certain conditions are met.

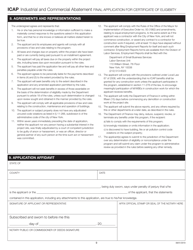

Q: Are there any fees associated with the application?

A: Yes, there may be fees that need to be paid with the application. The specific fees can be found in the program guidelines.

Form Details:

- Released on August 1, 2019;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.