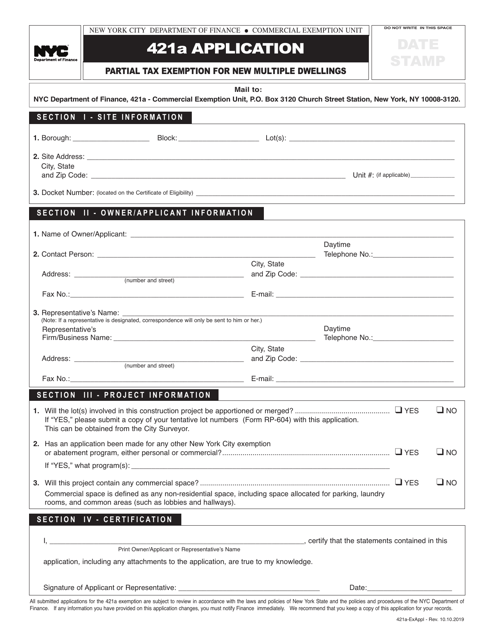

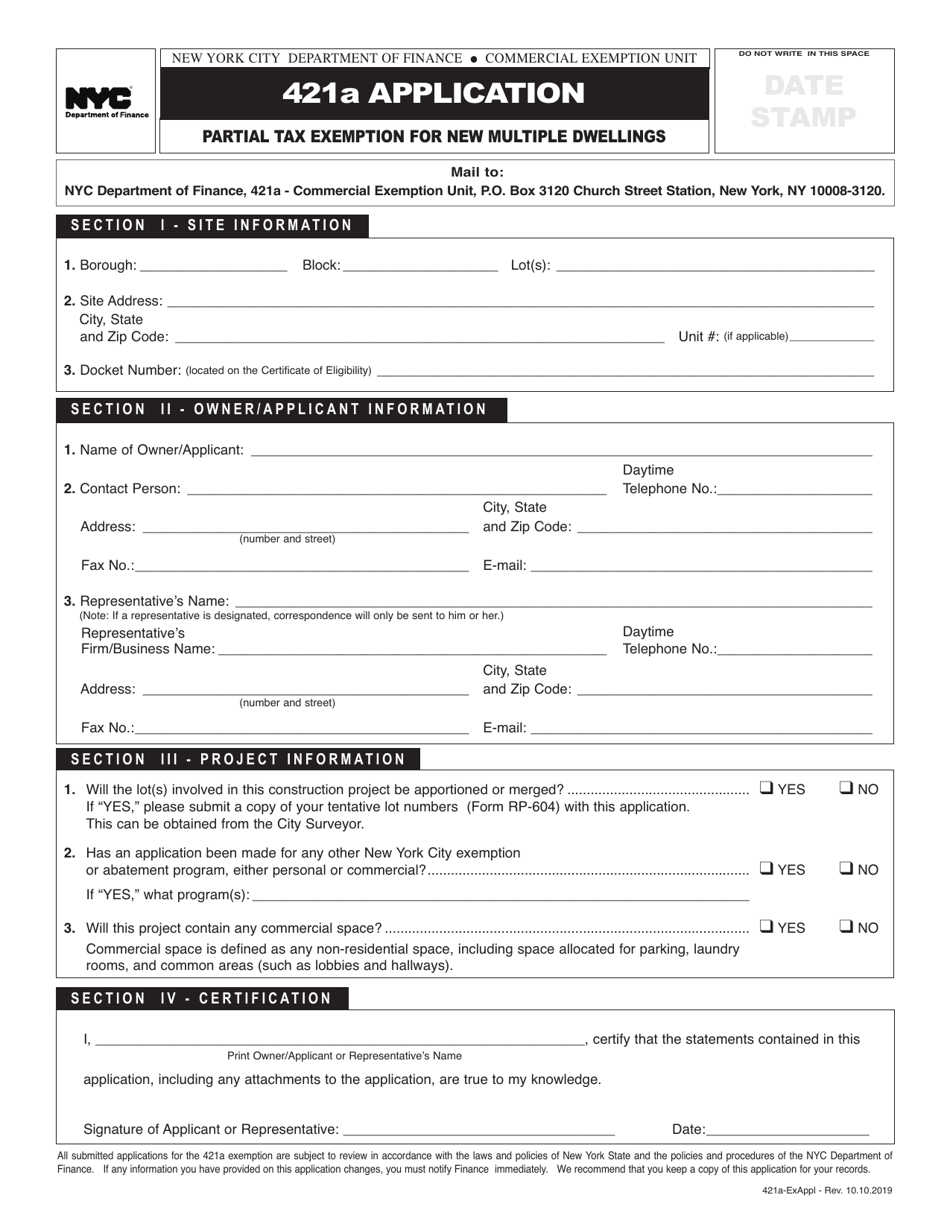

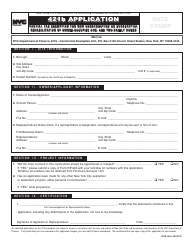

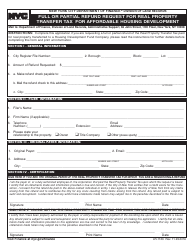

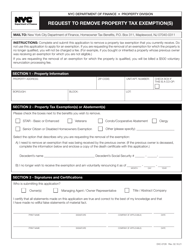

421a Partial Tax Exemption for New Multiple Dwellings Application - New York City

421a Multiple Dwellings Application is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

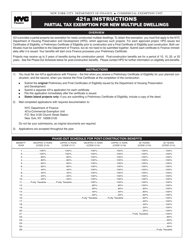

Q: What is the 421a Partial Tax Exemption for New Multiple Dwellings?

A: The 421a Partial Tax Exemption is a program in New York City that provides tax benefits for developers of new multiple dwellings.

Q: Who is eligible to apply for the 421a tax exemption?

A: Developers of new multiple dwellings in New York City are eligible to apply for the 421a tax exemption.

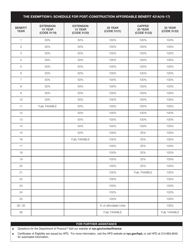

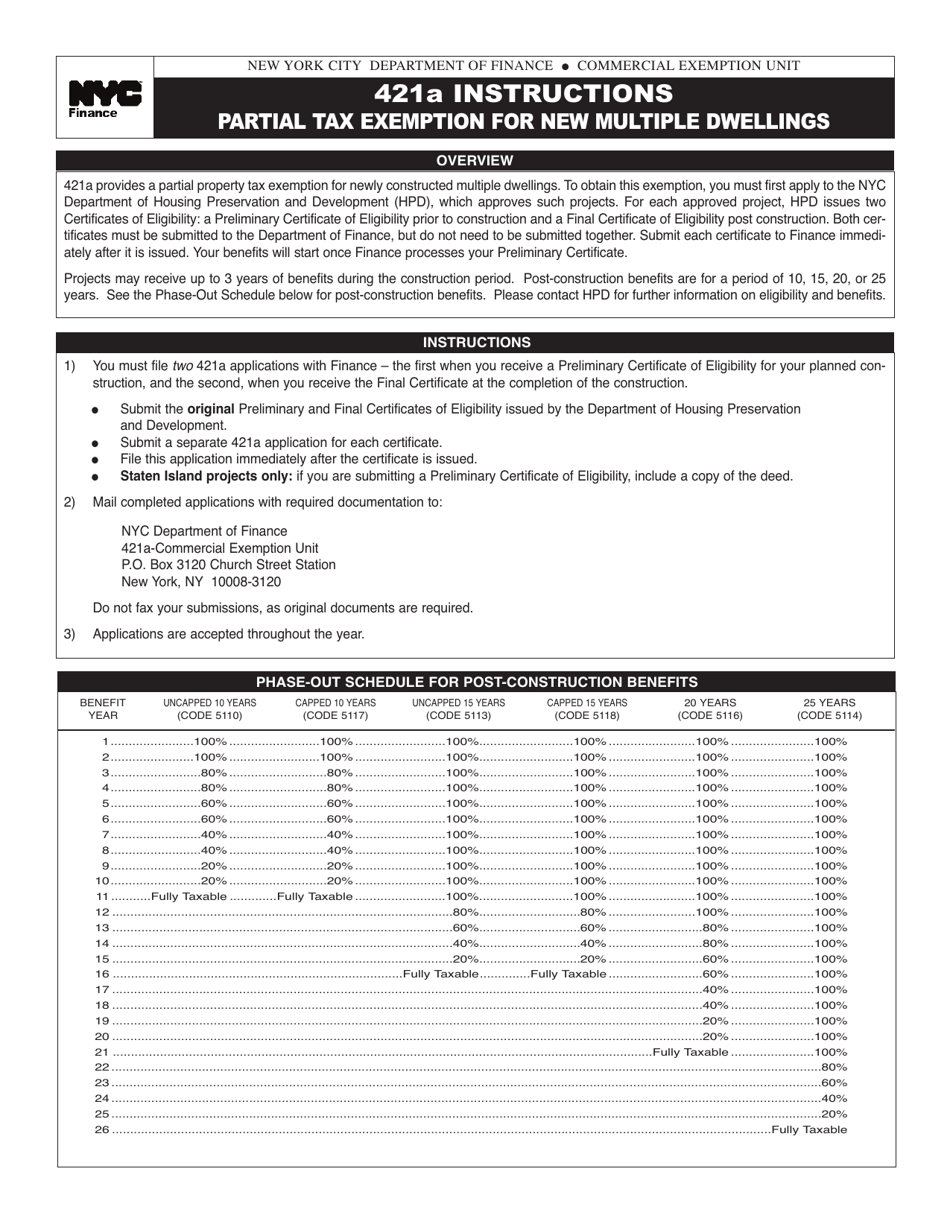

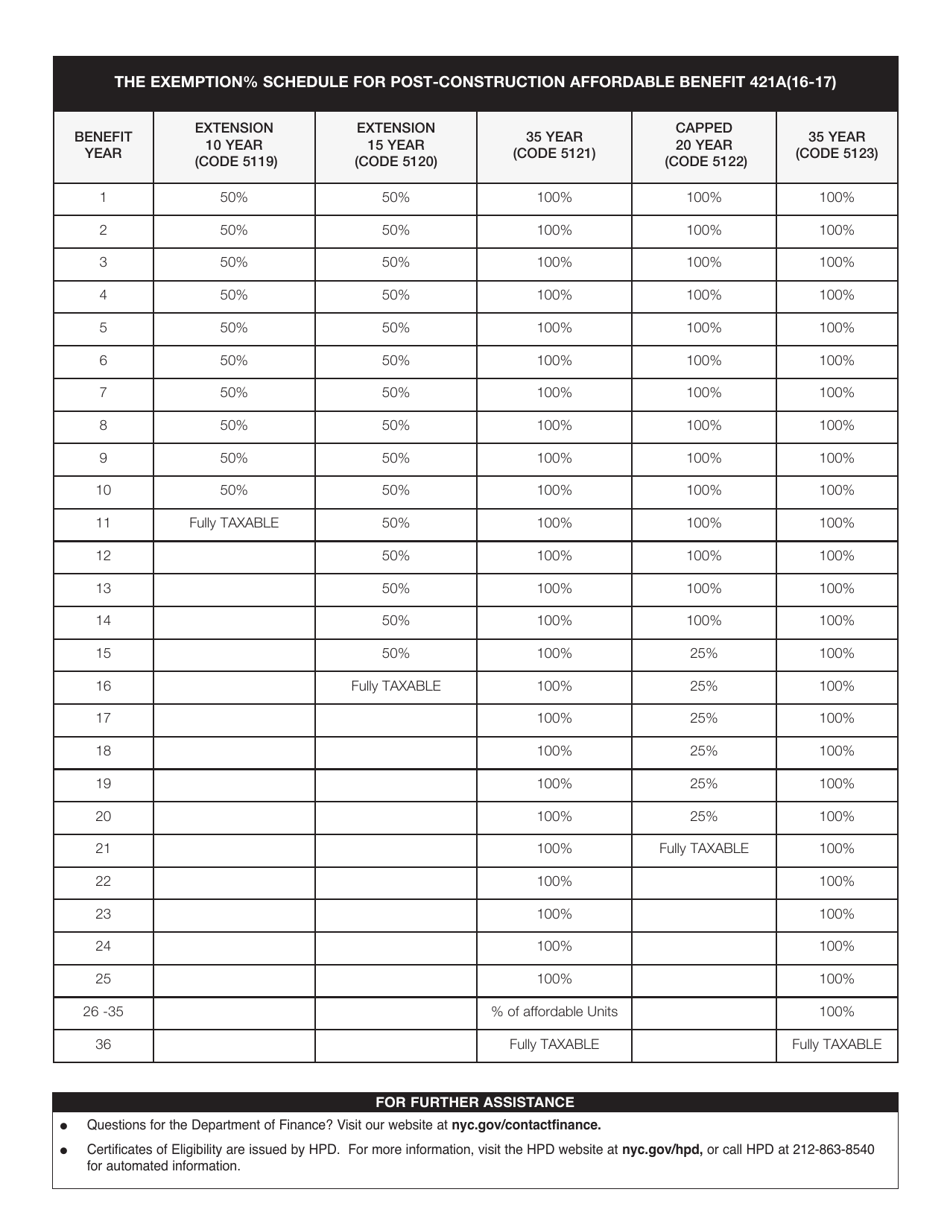

Q: What are the benefits of the 421a tax exemption?

A: The 421a tax exemption can provide developers with reduced property taxes for a specific period of time, which can help make the development more financially viable.

Q: How long does the 421a tax exemption last?

A: The length of the tax exemption period can vary depending on the specific project and location, but it is typically for a period of 10 to 15 years.

Q: What are the requirements to qualify for the 421a tax exemption?

A: To qualify for the 421a tax exemption, developers must meet certain requirements, such as providing a certain percentage of affordable housing units in their development.

Form Details:

- Released on October 10, 2019;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.