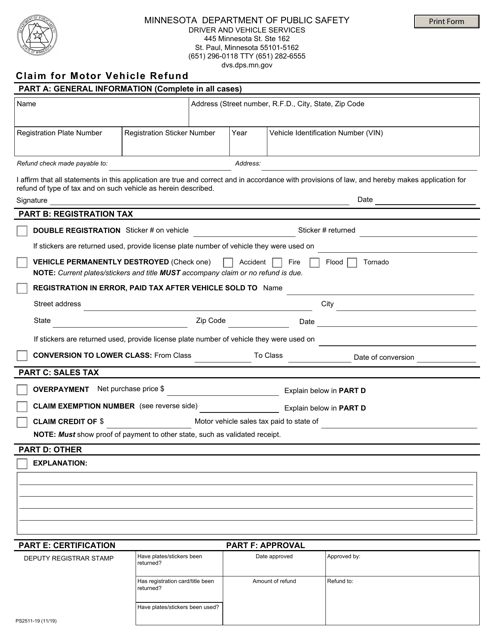

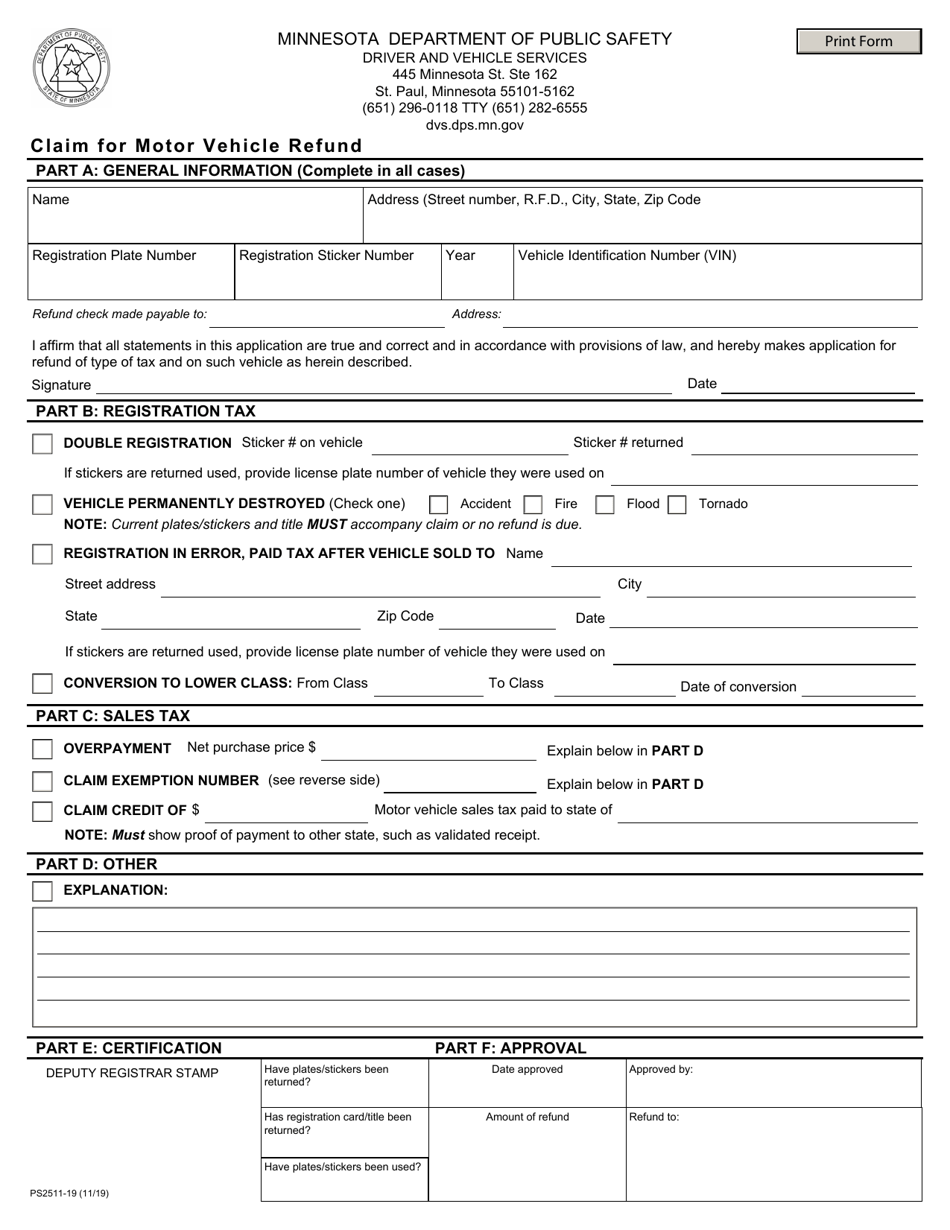

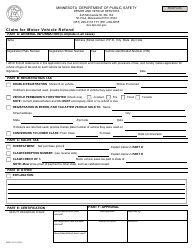

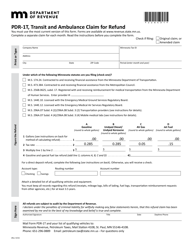

Form PS2511 Claim for Motor Vehicle Refund - Minnesota

What Is Form PS2511?

This is a legal form that was released by the Minnesota Department of Public Safety - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PS2511?

A: Form PS2511 is the Claim for Motor Vehicle Refund specifically for residents of Minnesota.

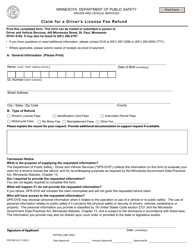

Q: Why would I need to file Form PS2511?

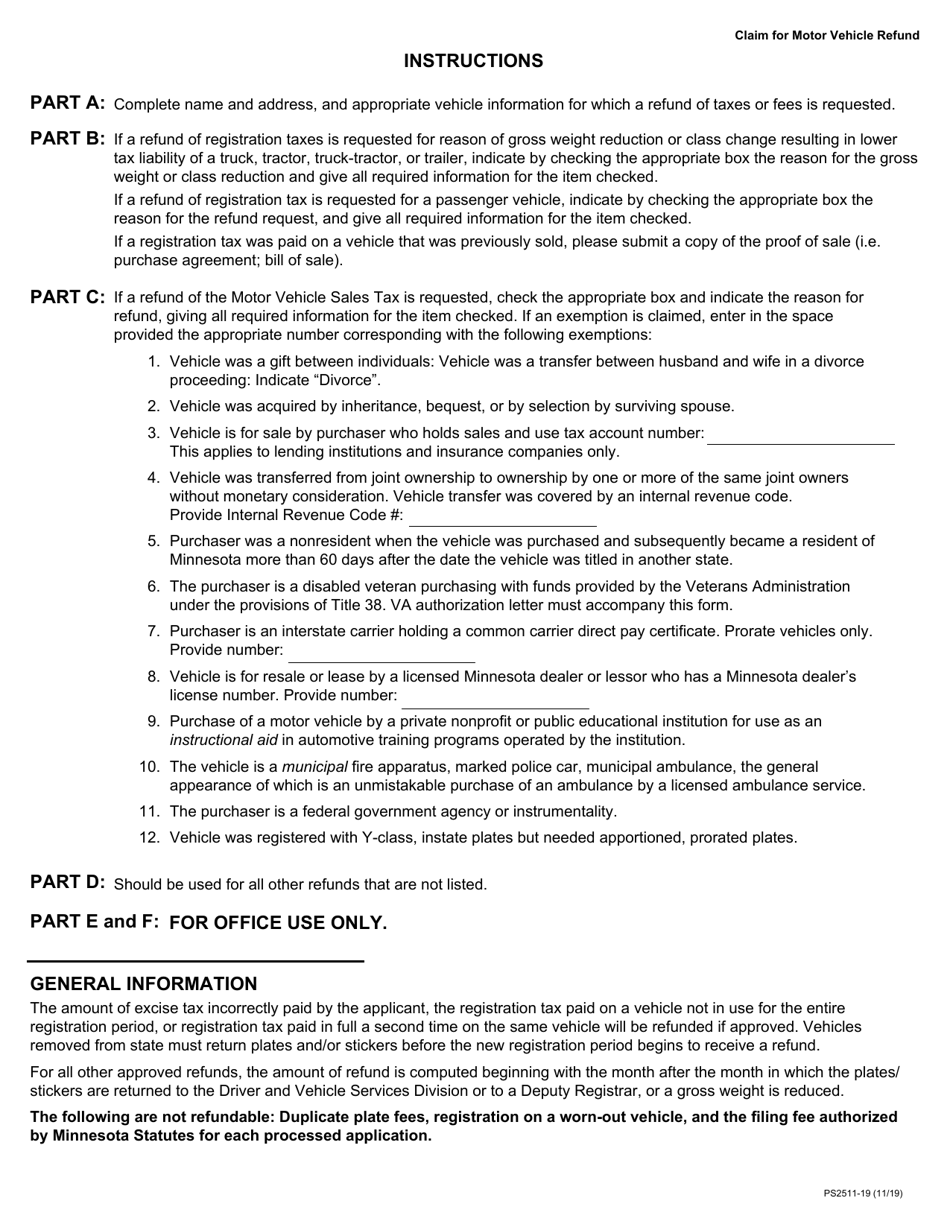

A: You would need to file Form PS2511 if you are a resident of Minnesota and you believe you are eligible for a motor vehicle refund.

Q: What is the purpose of the motor vehicle refund?

A: The motor vehicle refund is designed to provide partial reimbursement for taxes and fees paid on a motor vehicle that was titled or registered in Minnesota.

Q: What information do I need to provide on Form PS2511?

A: You will need to provide your personal information, details about the vehicle, information about the taxes and fees paid, and any supporting documents as required.

Q: Is there a deadline for filing Form PS2511?

A: Yes, the deadline for filing Form PS2511 is typically within 4 years from the date of purchase or lease of the motor vehicle.

Q: How long does it take to process the motor vehicle refund?

A: The processing time for the motor vehicle refund can vary, but typically it takes around 60 days from the date the department receives a complete and accurate claim.

Q: What happens if my motor vehicle refund claim is approved?

A: If your claim is approved, you will receive a refund for the eligible amount, either by direct deposit or by check.

Q: What should I do if my motor vehicle refund claim is denied?

A: If your claim is denied, you will receive a denial letter explaining the reason. You may then have the option to appeal the decision.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Minnesota Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PS2511 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Public Safety.