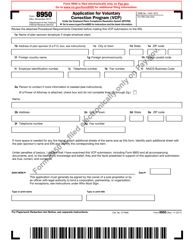

This version of the form is not currently in use and is provided for reference only. Download this version of

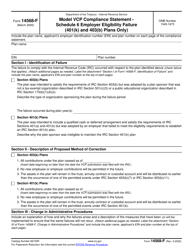

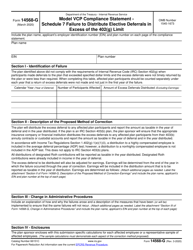

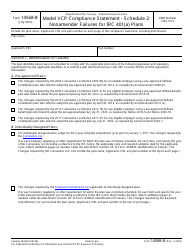

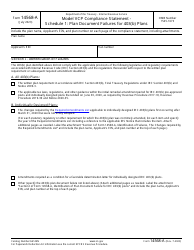

IRS Form 14568

for the current year.

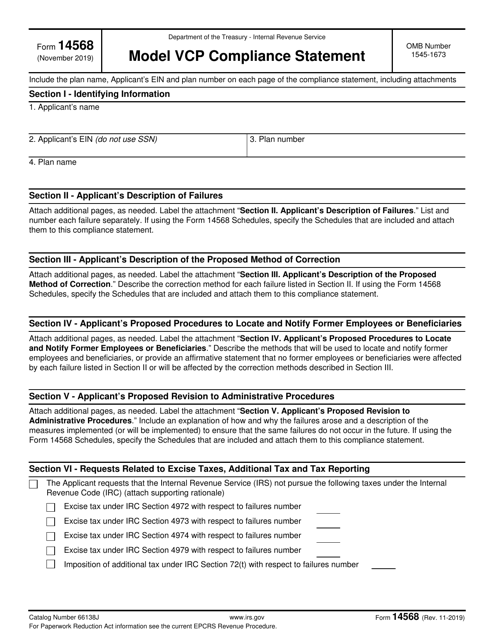

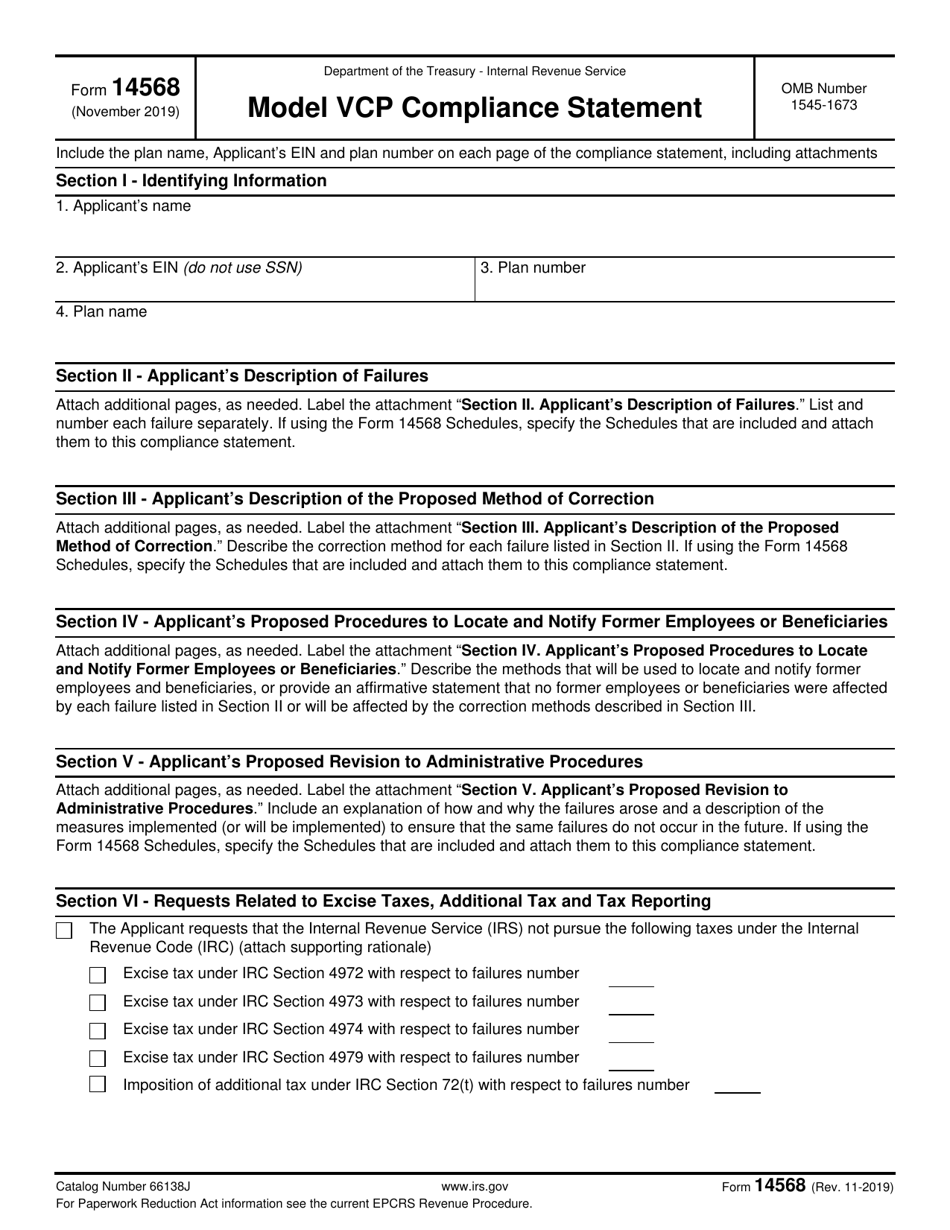

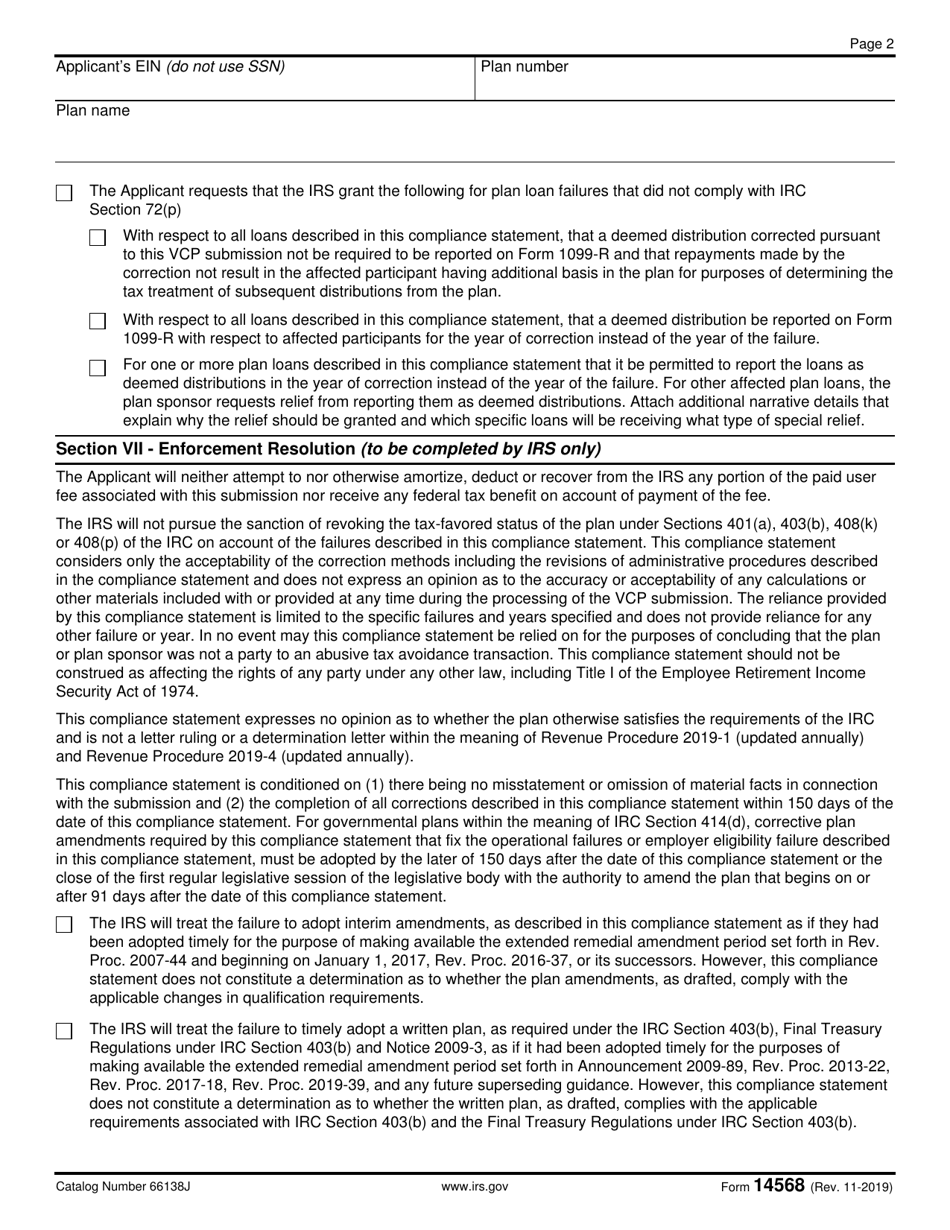

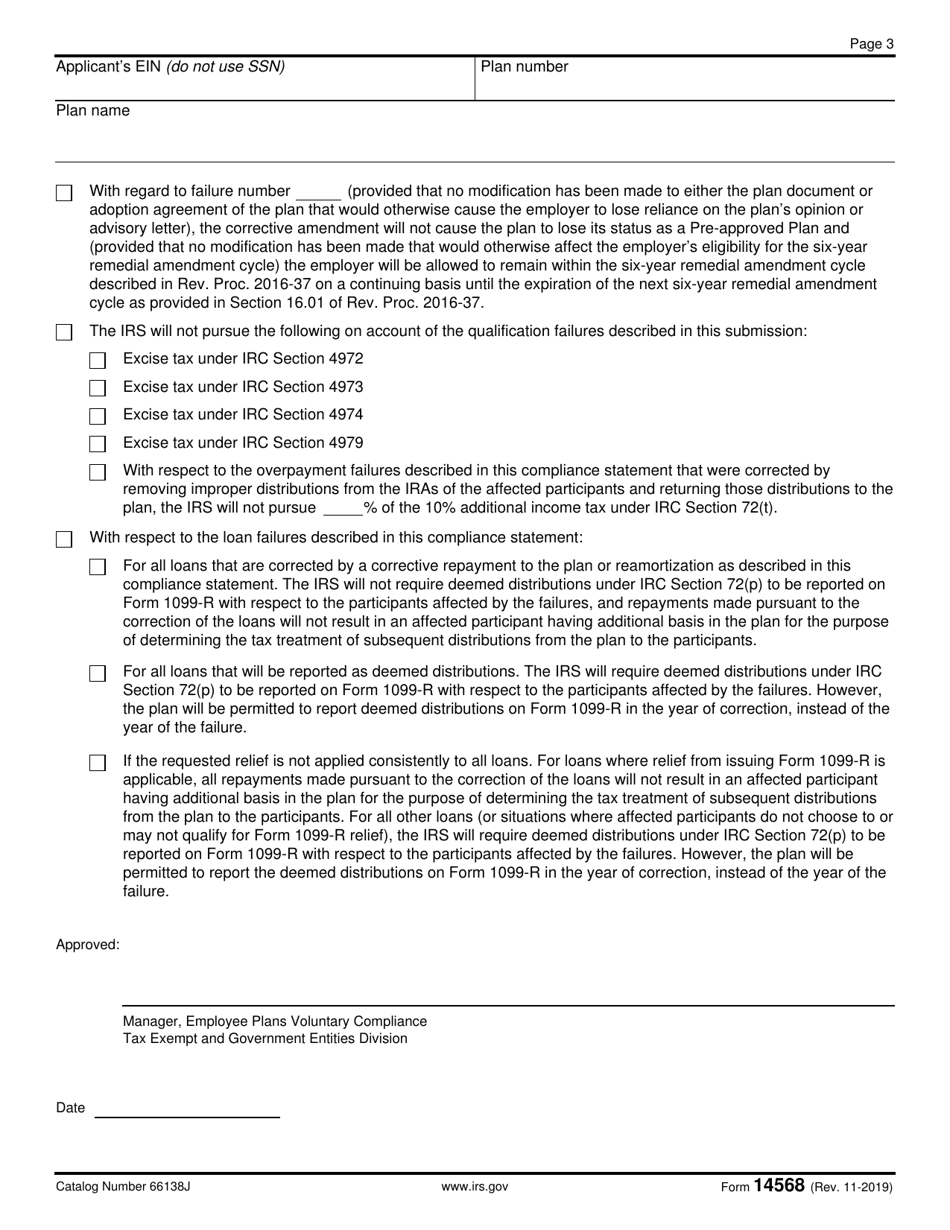

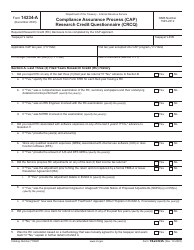

IRS Form 14568 Model Vcp Compliance Statement

What Is IRS Form 14568?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14568?

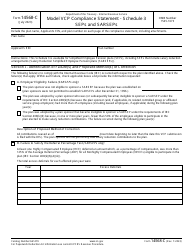

A: IRS Form 14568 is a Model VCP Compliance Statement.

Q: What does VCP stand for?

A: VCP stands for Voluntary Compliance Program.

Q: What is the purpose of IRS Form 14568?

A: The purpose of IRS Form 14568 is to apply for the Voluntary Compliance Program.

Q: Who can use IRS Form 14568?

A: IRS Form 14568 can be used by individuals, businesses, and organizations that wish to correct errors or omissions in their retirement plans.

Q: Is IRS Form 14568 mandatory?

A: No, IRS Form 14568 is not mandatory. It is a voluntary program for correcting retirement plan errors.

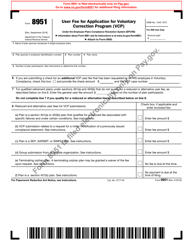

Q: Are there any fees associated with using IRS Form 14568?

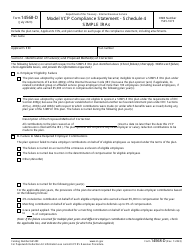

A: Yes, there are user fees associated with applying for the Voluntary Compliance Program using IRS Form 14568. The fees vary depending on the type and size of the retirement plan.

Q: What documents should be included with IRS Form 14568?

A: Along with IRS Form 14568, you will need to provide supporting documents, such as a plan document and a description of the plan's operations.

Q: Can IRS Form 14568 be filed electronically?

A: No, IRS Form 14568 cannot be filed electronically. It must be submitted by mail or hand-delivered to the address provided on the form.

Q: What happens after filing IRS Form 14568?

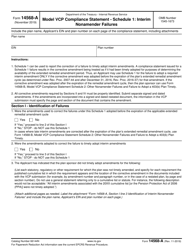

A: After filing IRS Form 14568, the IRS will review the submission and determine if the correction meets the requirements of the Voluntary Compliance Program. They will then provide a compliance statement or a proposed compliance statement.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568 through the link below or browse more documents in our library of IRS Forms.