This version of the form is not currently in use and is provided for reference only. Download this version of

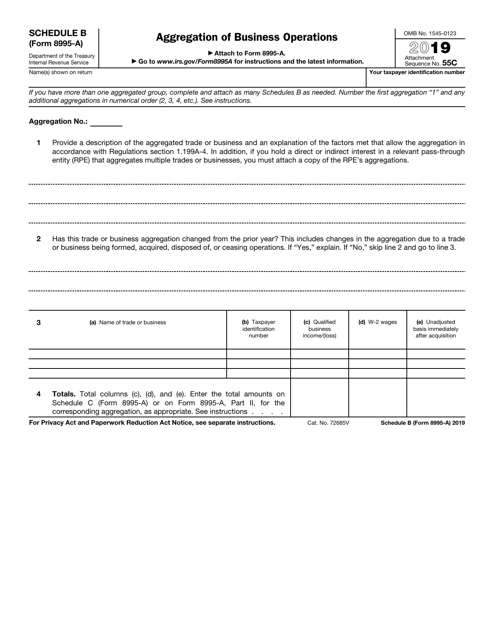

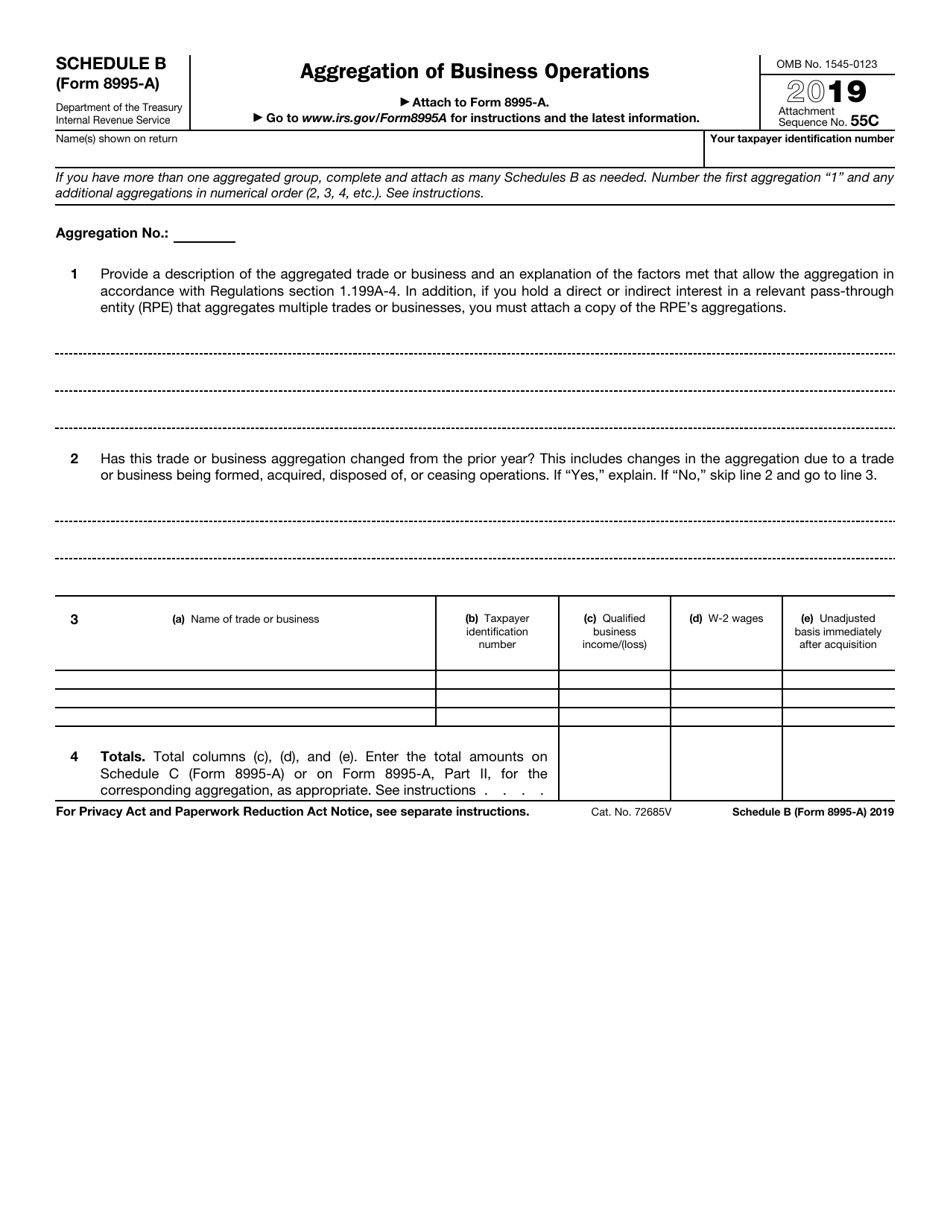

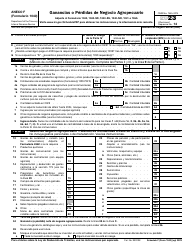

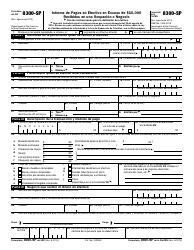

IRS Form 8995-A Schedule B

for the current year.

IRS Form 8995-A Schedule B Aggregation of Business Operations

What Is IRS Form 8995-A Schedule B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8995-A, Qualified Business Income Deduction. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a schedule that is used for the aggregation of business operations.

Q: What is the purpose of Schedule B on Form 8995-A?

A: The purpose of Schedule B on Form 8995-A is to aggregate business operations.

Q: When is IRS Form 8995-A Schedule B used?

A: IRS Form 8995-A Schedule B is used when you need to combine or aggregate multiple business operations.

Q: Do I need to file IRS Form 8995-A Schedule B?

A: You only need to file IRS Form 8995-A Schedule B if you have multiple business operations that need to be aggregated.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A Schedule B through the link below or browse more documents in our library of IRS Forms.