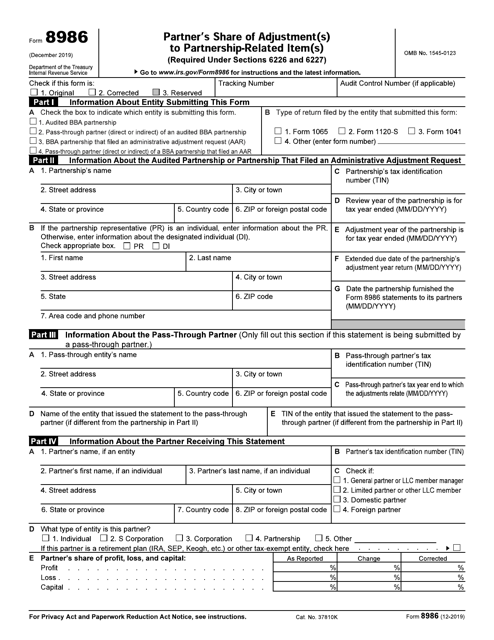

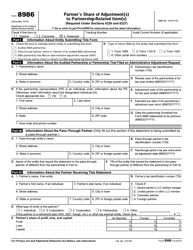

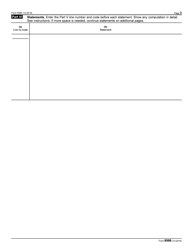

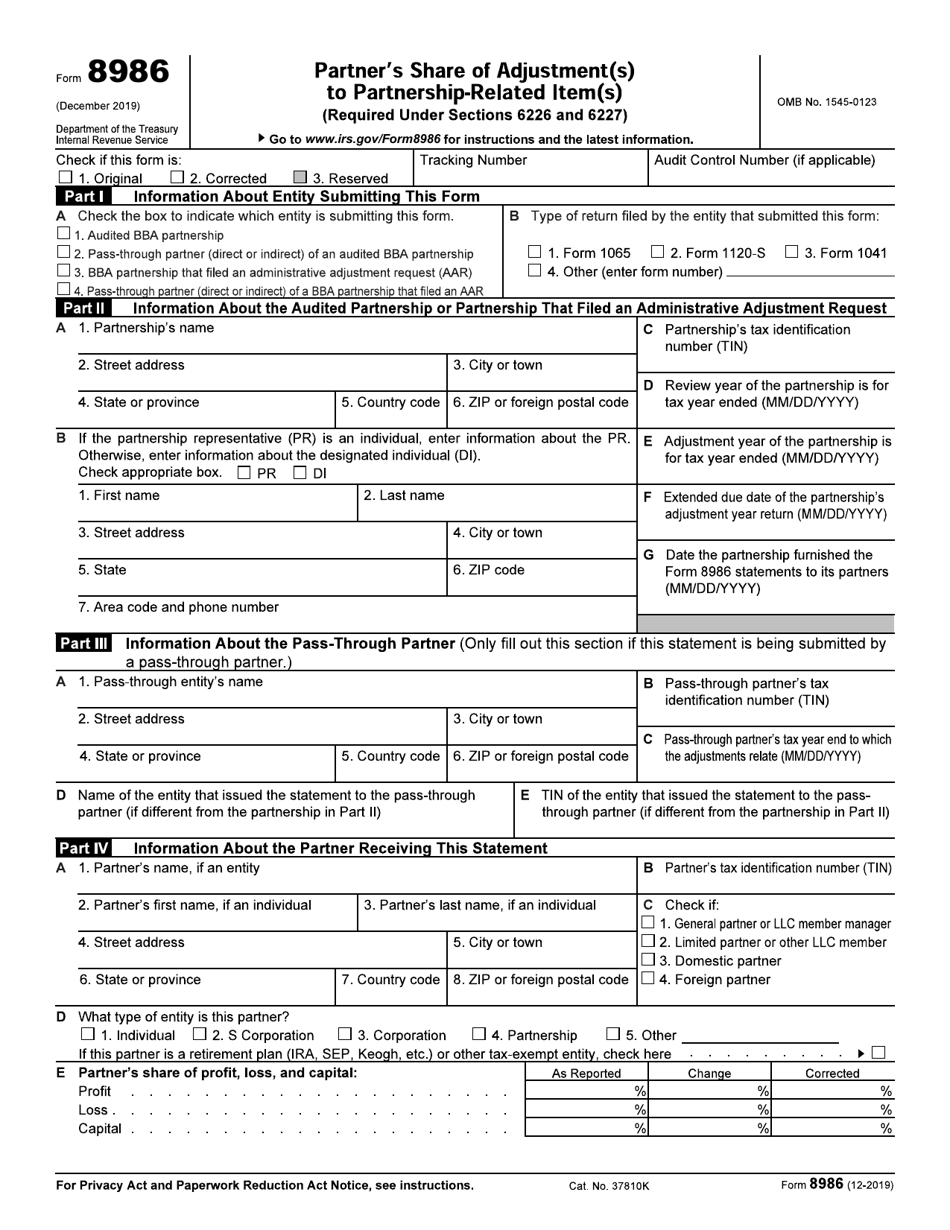

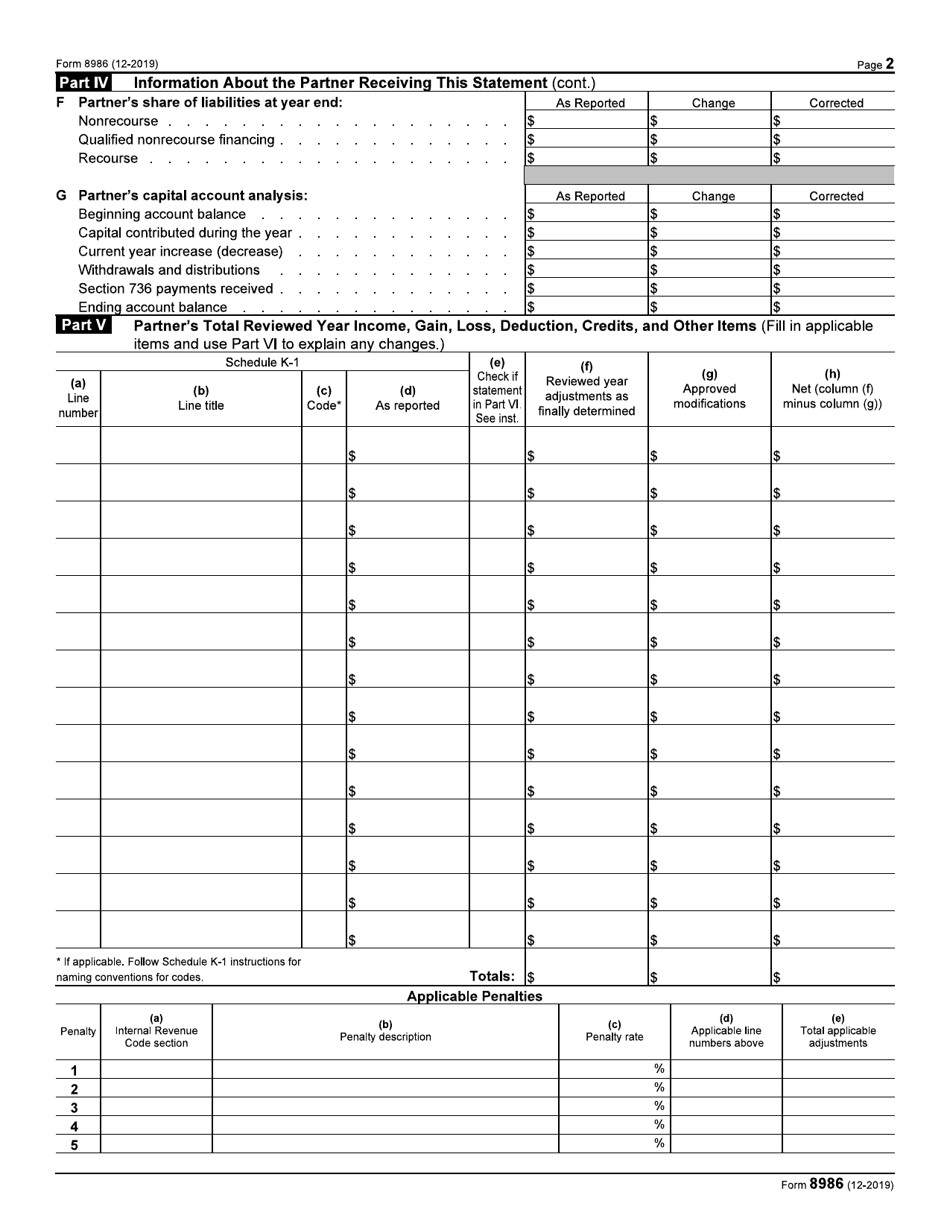

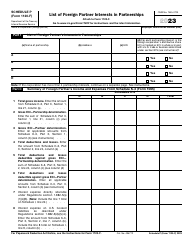

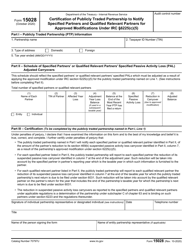

IRS Form 8986 Partner's Share of Adjustment(S) to Partnership-Related Item(S) (Required Under Sections 6226 and 6227)

What Is IRS Form 8986?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8986?

A: IRS Form 8986 is used to report a partner's share of adjustments to partnership-related items.

Q: When is IRS Form 8986 required?

A: IRS Form 8986 is required under Sections 6226 and 6227 of the Internal Revenue Code.

Q: What does IRS Form 8986 report?

A: IRS Form 8986 reports a partner's share of adjustments to partnership-related items.

Q: Who needs to file IRS Form 8986?

A: Partnerships are required to file IRS Form 8986.

Q: What is the purpose of IRS Form 8986?

A: The purpose of IRS Form 8986 is to accurately report a partner's share of adjustments to partnership-related items.

Form Details:

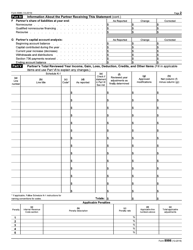

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8986 through the link below or browse more documents in our library of IRS Forms.