This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8880

for the current year.

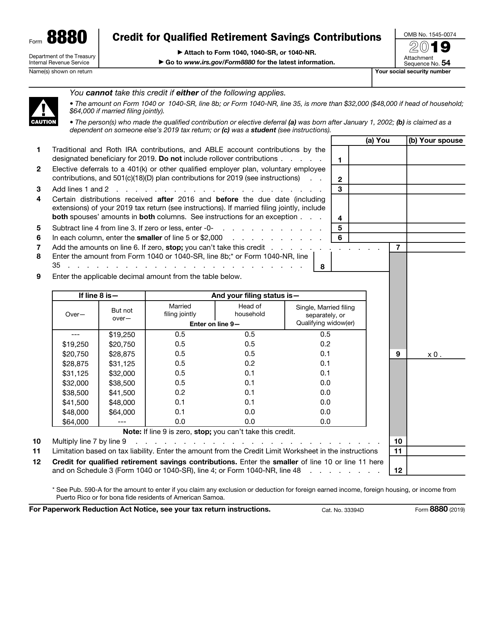

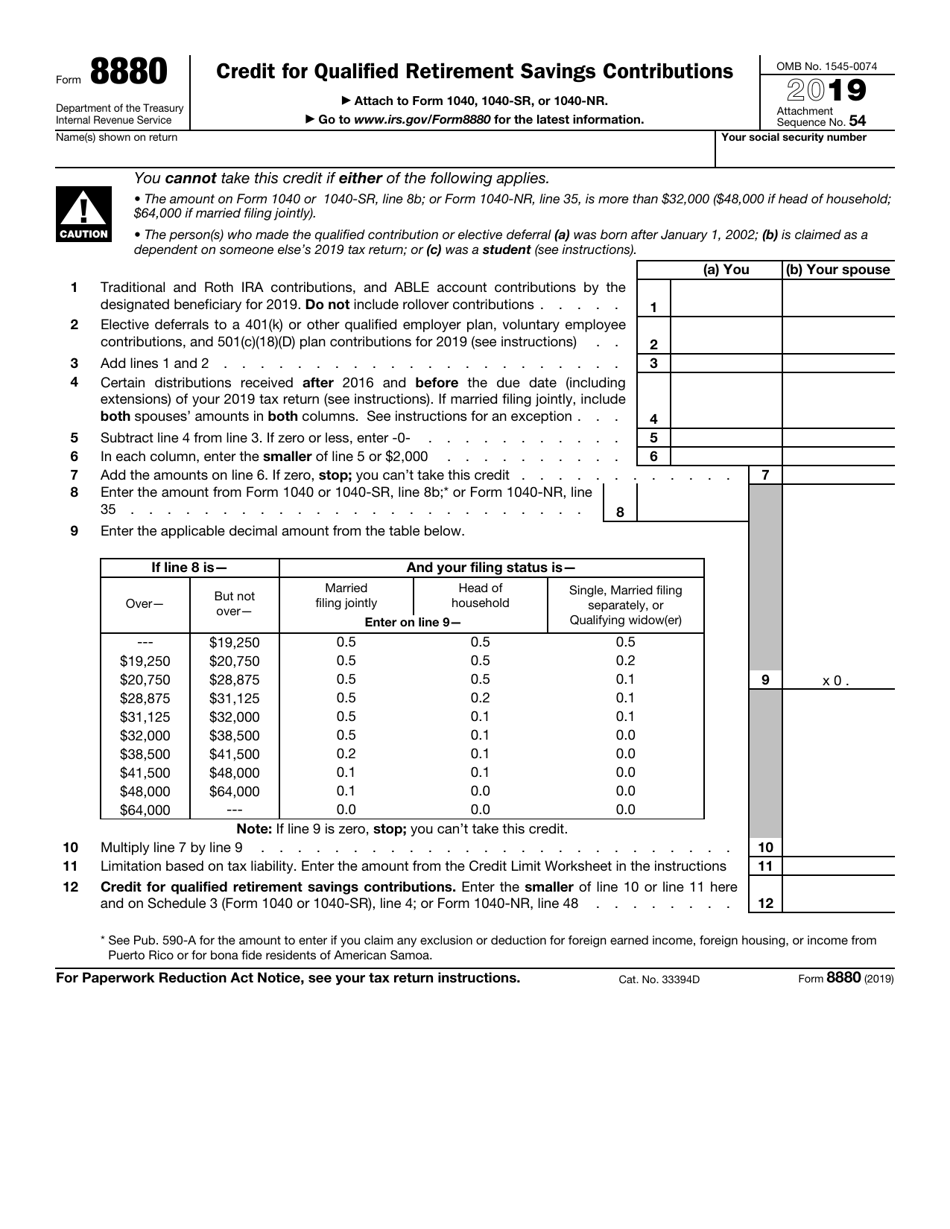

IRS Form 8880 Credit for Qualified Retirement Savings Contributions

What Is Form 8880?

IRS Form 8880, Credit for Qualified Retirement Savings Contributions , is a document issued by the Internal Revenue Service (IRS) . Individuals use this application to figure the amount of their retirement savings contributions credit (also known as Saver's Credit).

IRS Form 8880 was last revised in 2019 . The document is revised annually because every year the IRS updates income and contribution limits. A fillable Form 8880 is available for download below.

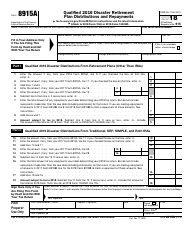

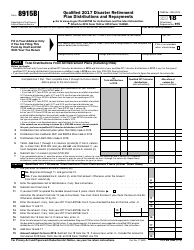

Unlike many other IRS forms, this form does not require a lot of identification information. It is connected with the fact that it is supposed to be attached to IRS Form 1040, IRS Form 1040-SR, or IRS Form 1040-NR, where the identification information is already entered. The application itself is presented on one page and it is accompanied by one page of instructions.

What Is Form 8880 Used For?

The application helps taxpayers calculate their saver's credit however, not all taxpayers are eligible for the credit. Form 8880 eligibility is a very important factor which is described precisely in the application instructions. An individual cannot take the credit, if:

- The amount on Form 1040, Individual Income Tax Return, or 1040-SR, U.S. Tax Return for Seniors, (line 8b); or Form 1040-NR, U.S. Nonresident Alien Income Tax Return, (line 35), is more than $32,000 ($48,000 if head of household; $64,000 if married filing jointly);

- The person who made the qualified contribution or elective deferral:

- Was born after January 1, 2002;

- Is claimed as a dependent on someone else's 2019 tax return;

- Was a student.

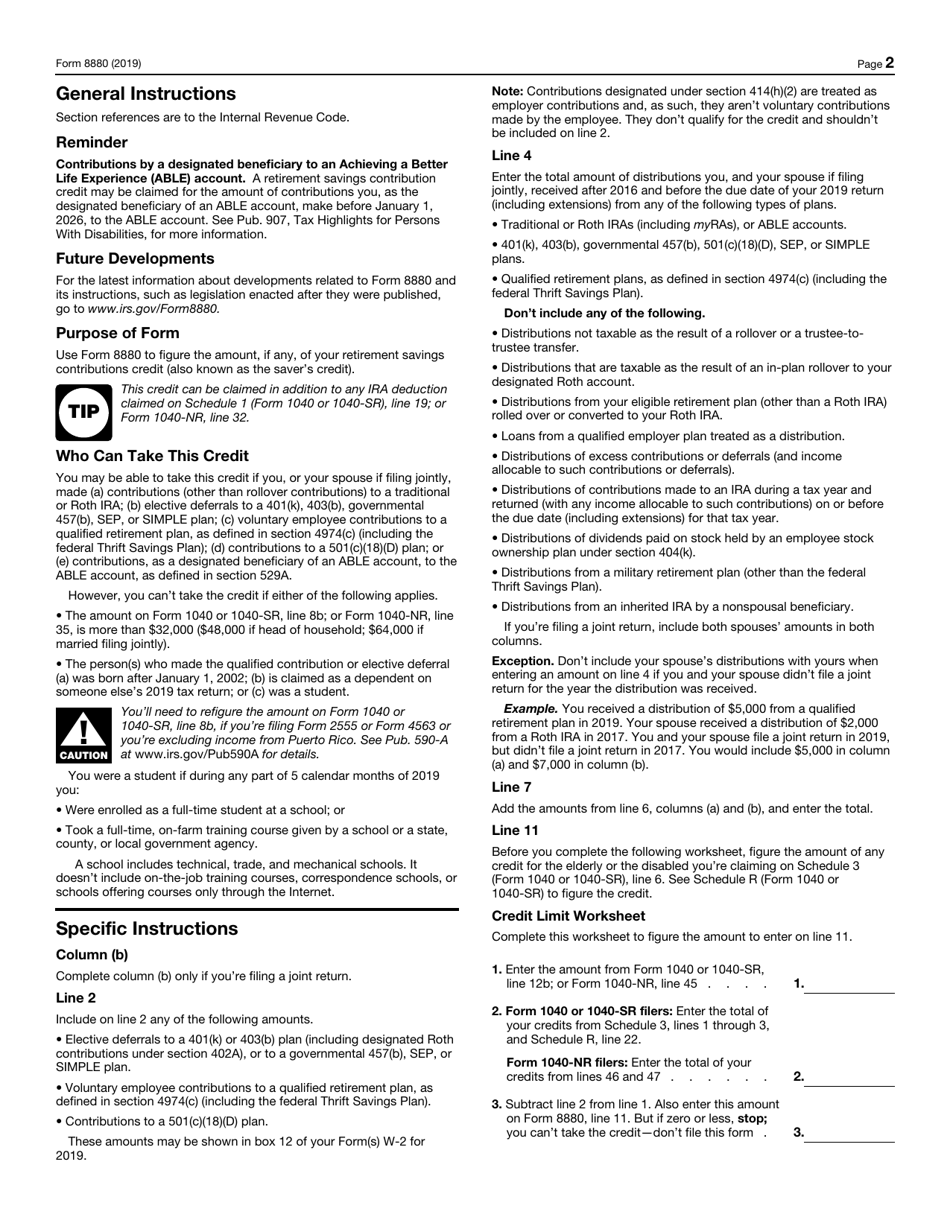

According to the Form 8880 Instructions, an individual is considered to be a student if during any part of five calendar months in 2019 they were enrolled as a full-time student at a school, or took a full-time training course given by a school or a state, county, or local government agency.

How to Fill Out Form 8880?

Form 8880 Instructions contain requirements for those who can be a claimant to take the credit. For example, if a filer made contributions (other than rollover contributions) to a traditional or Roth IRA, or contributions as a designated beneficiary of an ABLE account, to the ABLE account, they can file Form 8880. A Roth IRA is an Individual Retirement Account that allows you to pay taxes on the money you put into it upfront. Achieving a Better Life Experience (ABLE) account is a saving program for eligible people with disabilities.

In the first part of the document, an applicant is only required to state their name and social security number. After that, an applicant is supposed to fill in the gaps which cover 12 statements. After an applicant enters their contributions they are supposed to follow the formulas presented in the document to complete the rest of it. The 8880 Form also contains a table which applicants should use to find their decimal amount, based on the offered income limits and their filing status. A filer can choose a filing status from:

- Married and filing jointly;

- Head of Household;

- Married and filing separately, single, qualifying widow(er).

The instructions contain a lot of valuable information that will help applicants fill in the gaps. For example, according to the instructions, when a filer is entering the total amount of distributions they received after 2016 and before the due date of their 2019 return (line 4), they must not include:

- Distributions not taxable as the result of a rollover or a trustee-to-trustee transfer;

- Distributions of contributions made to an IRA during a tax year and returned (with any income allocable to such contributions) on or before the due date (including extensions) for that tax year;

- Distributions that are taxable as the result of an in-plan rollover to their designated Roth account;

- Loans from a qualified employer plan treated as a distribution;

- Distributions of excess contributions or deferrals (and income allocable to such contributions or deferrals);

- Distributions from a military retirement plan, other than the federal Thrift Savings Plan;

- Distributions from an inherited IRA by a non-spousal beneficiary;

- Distributions from your eligible retirement plan (other than a Roth IRA) rolled over or converted to your Roth IRA.

After the application is completed, a filer must attach it to the income tax return which is applicable to them and submit it.