This version of the form is not currently in use and is provided for reference only. Download this version of

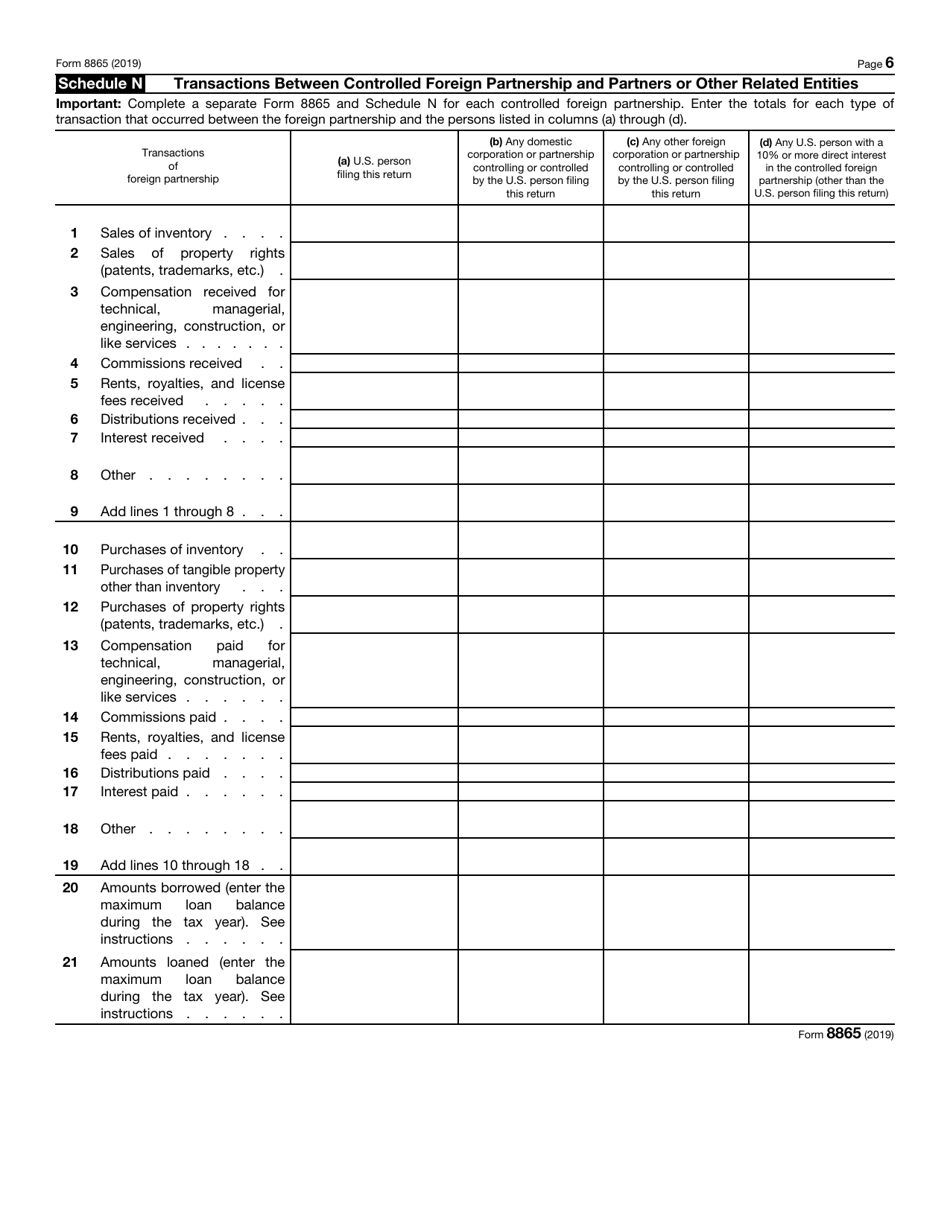

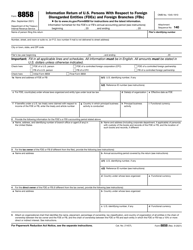

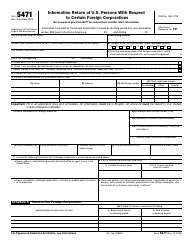

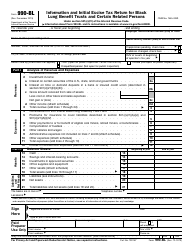

IRS Form 8865

for the current year.

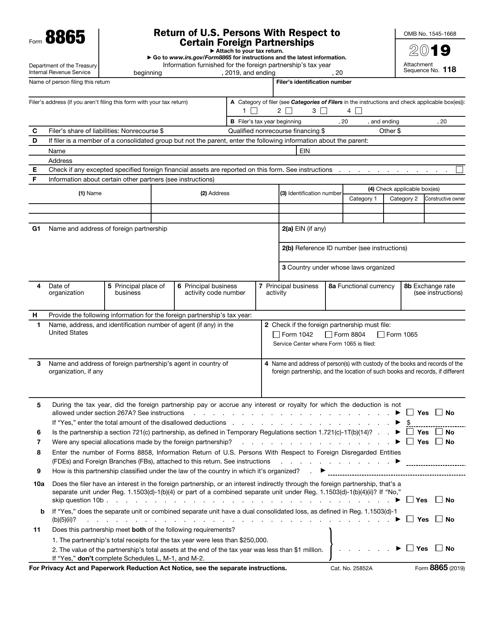

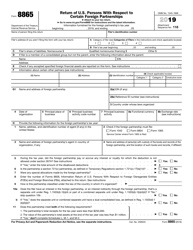

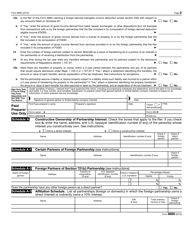

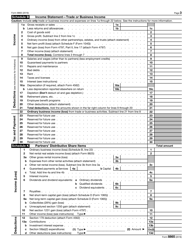

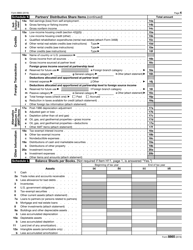

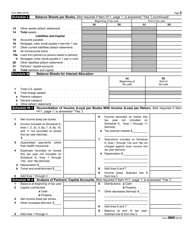

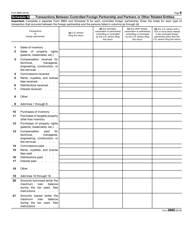

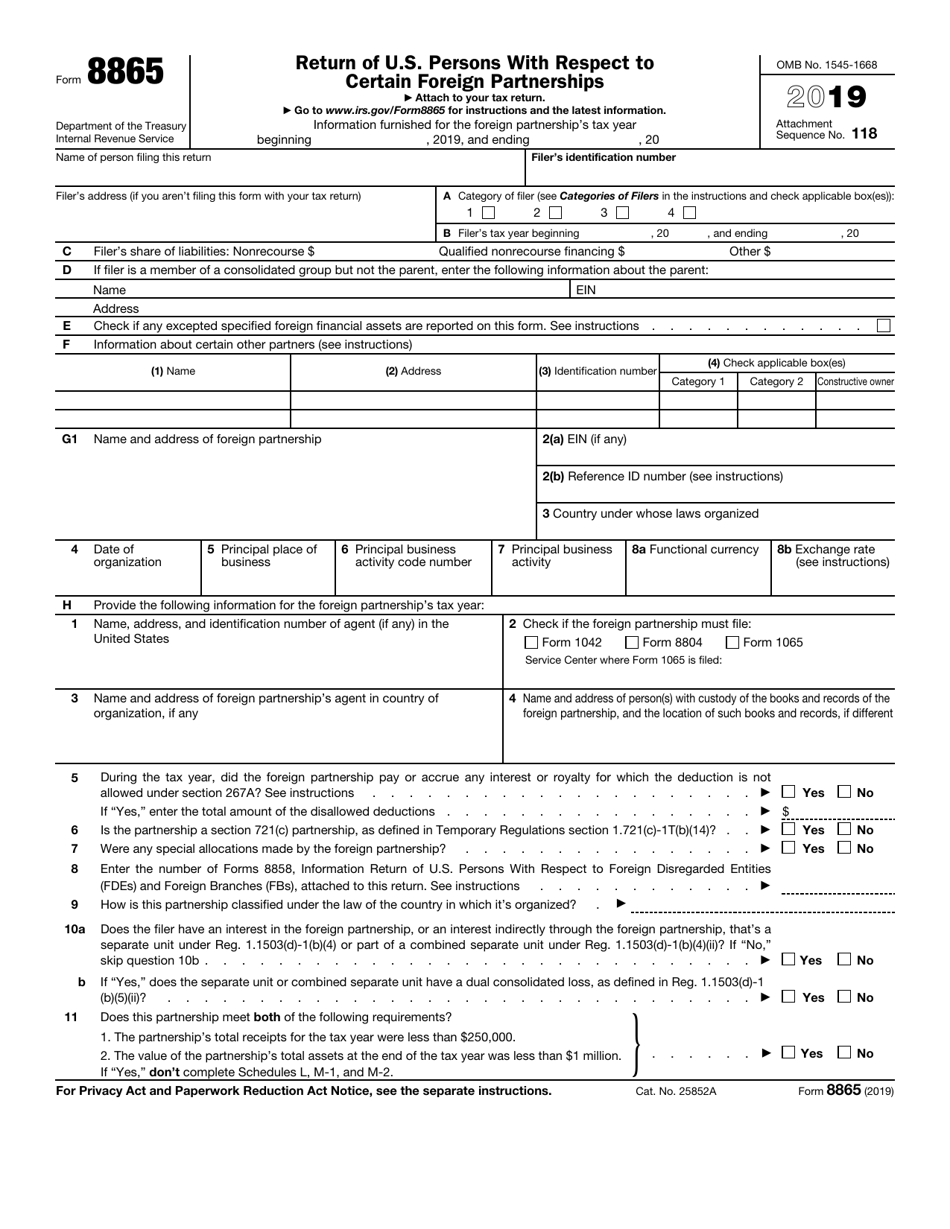

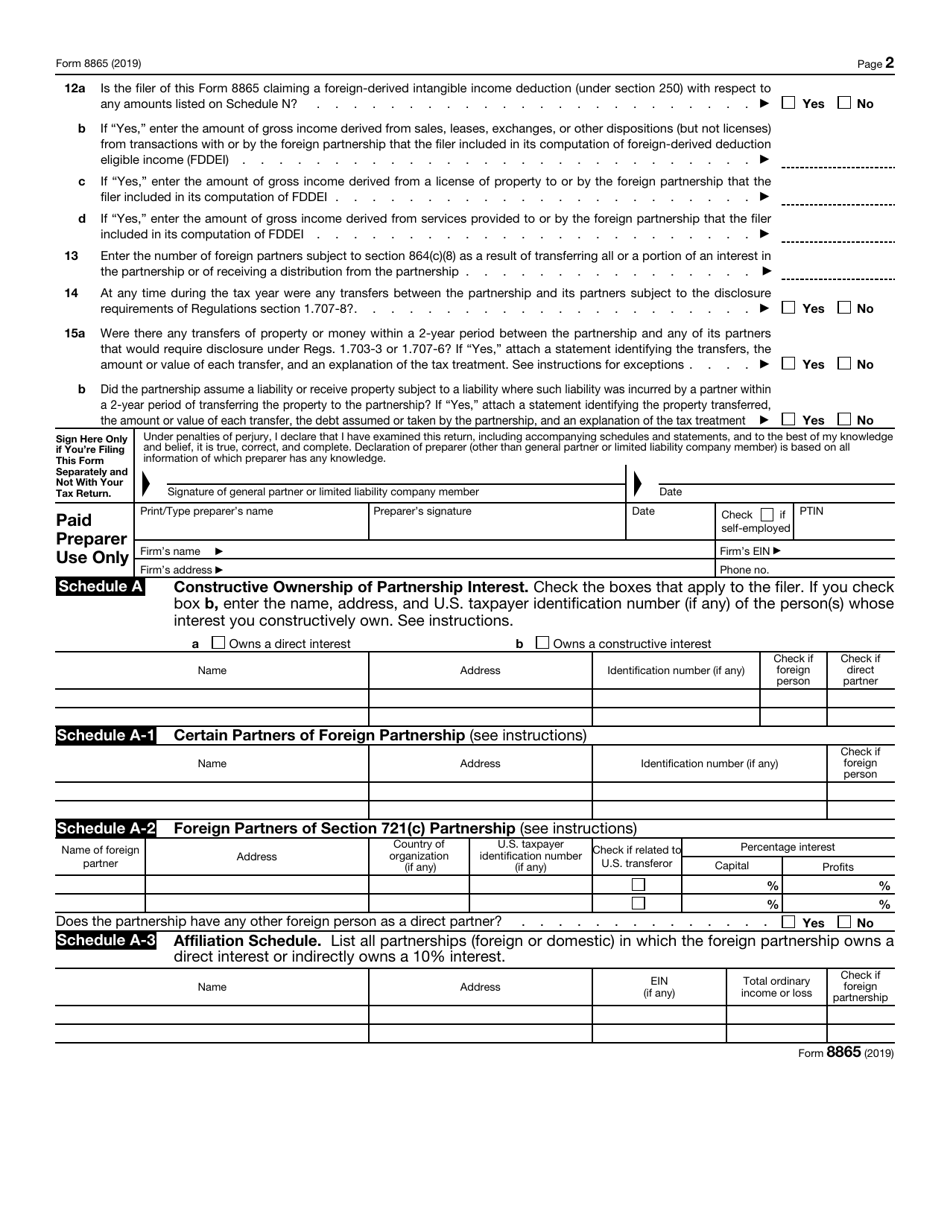

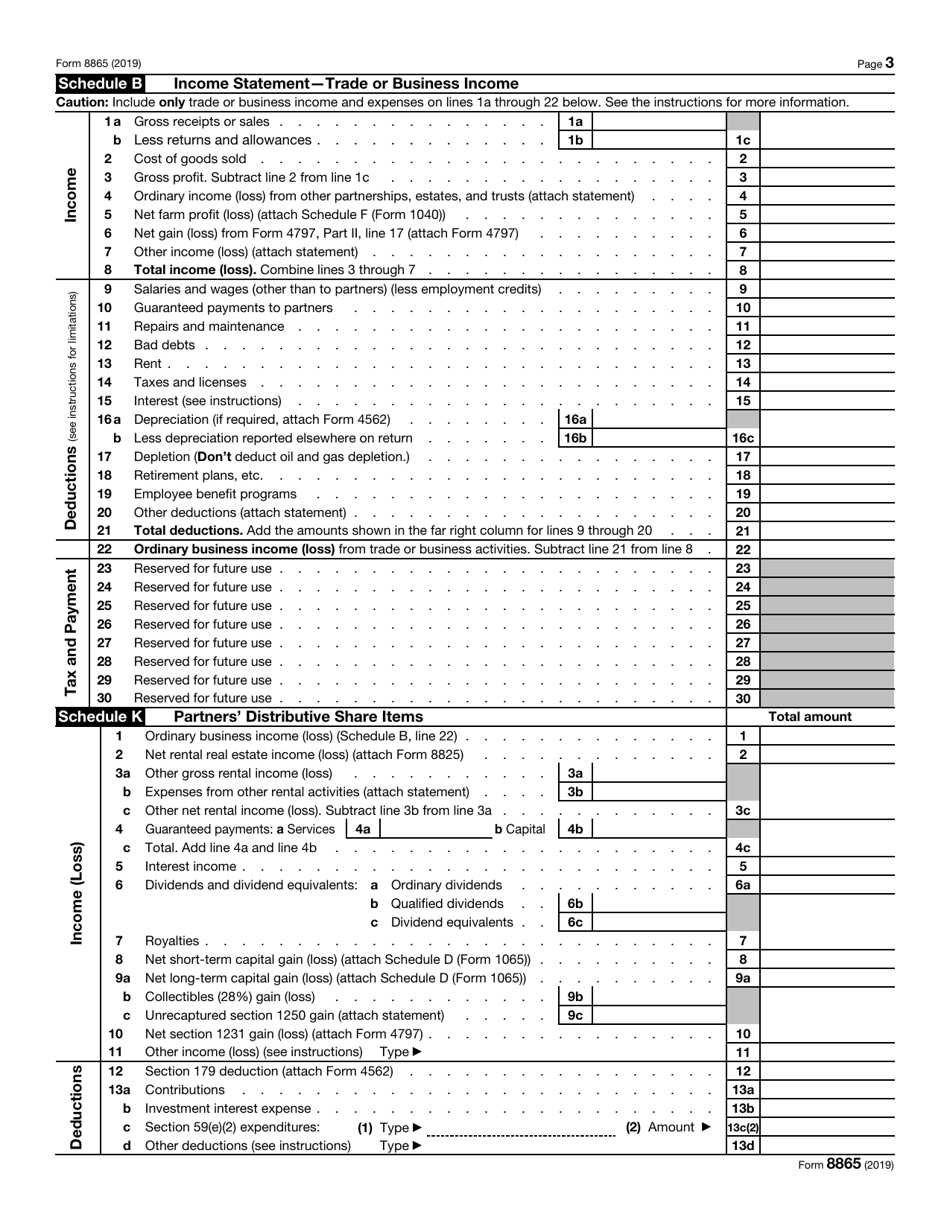

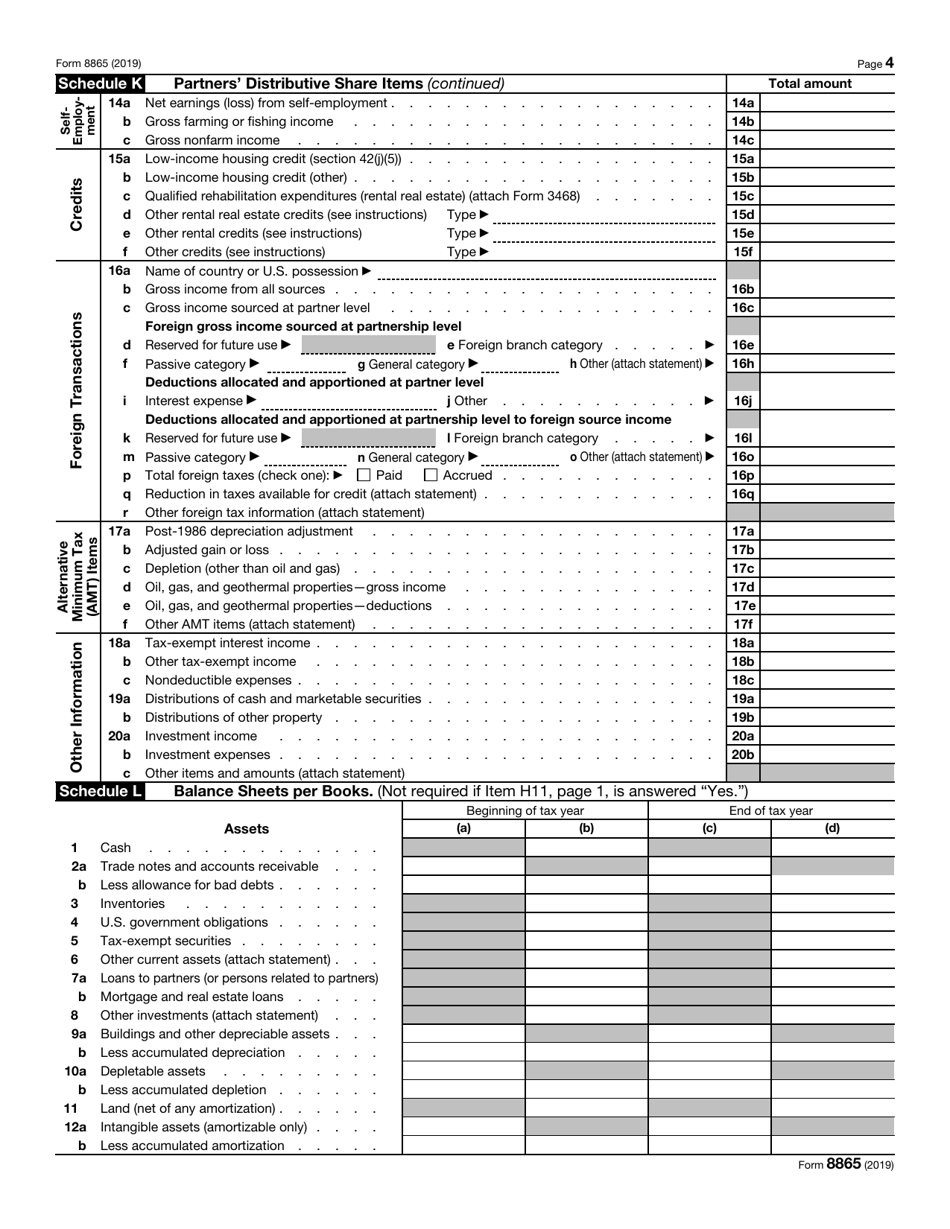

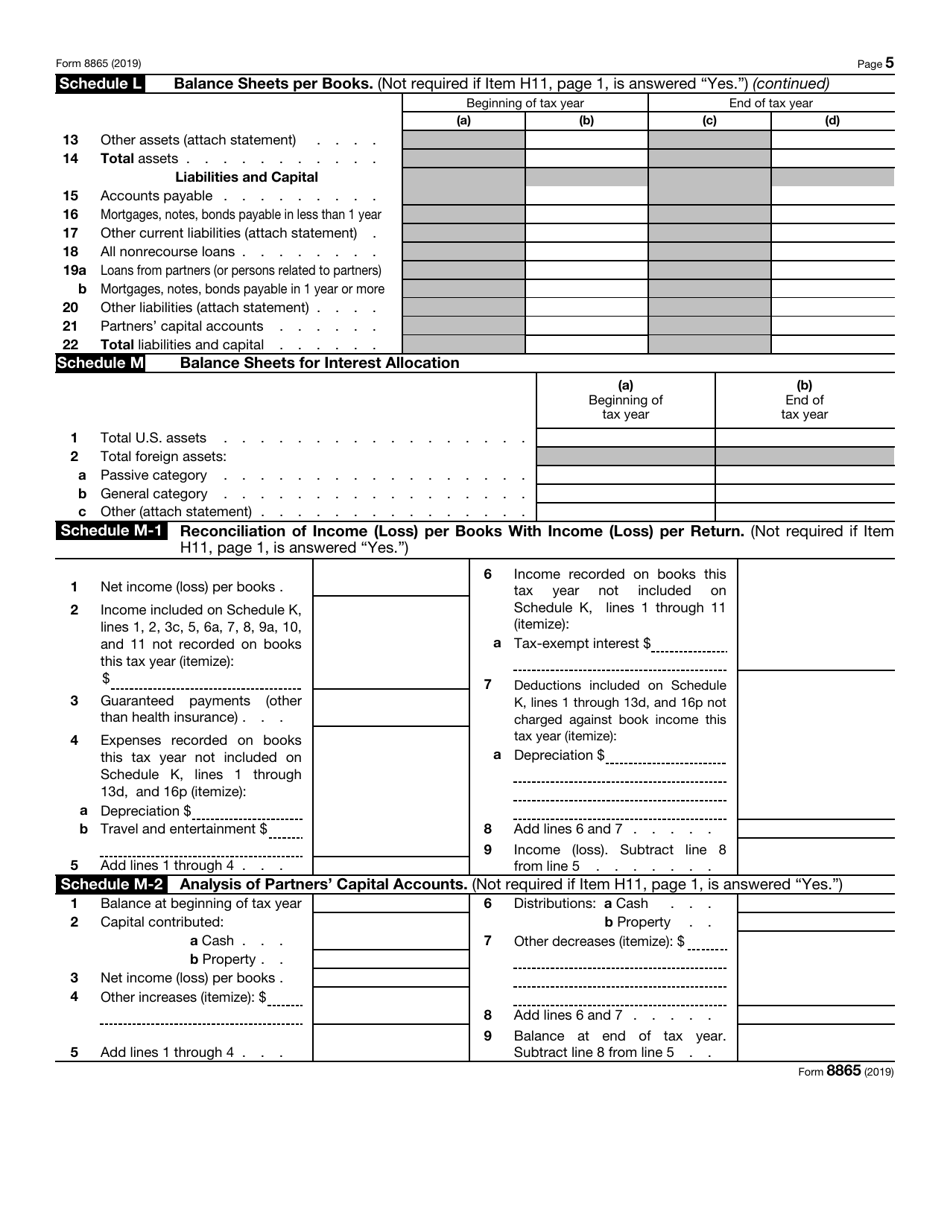

IRS Form 8865 Return of U.S. Persons With Respect to Certain Foreign Partnerships

What Is IRS Form 8865?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8865?

A: IRS Form 8865 is a tax form used by U.S. persons who are partners in certain foreign partnerships to report their income, deductions, and credits.

Q: Who needs to file IRS Form 8865?

A: U.S. persons who are partners in certain foreign partnerships need to file IRS Form 8865.

Q: What information is required to complete IRS Form 8865?

A: To complete IRS Form 8865, you will need information related to the foreign partnership, including its name, address, and tax year.

Q: When is the deadline to file IRS Form 8865?

A: The deadline to file IRS Form 8865 is typically the same as the individual income tax return deadline, which is April 15th.

Q: Are there any penalties for not filing IRS Form 8865?

A: Yes, there are penalties for not filing IRS Form 8865, including monetary penalties and potential criminal charges.

Q: Can I file IRS Form 8865 electronically?

A: Yes, you can file IRS Form 8865 electronically using the IRS's e-file system.

Q: Do I need to attach any additional documents with IRS Form 8865?

A: Yes, you may need to attach additional documents with IRS Form 8865 to provide supporting information for the partnership.

Q: What should I do if I have more than one foreign partnership to report?

A: If you have more than one foreign partnership to report, you will need to file a separate IRS Form 8865 for each partnership.

Q: Is there a fee for filing IRS Form 8865?

A: No, there is no fee for filing IRS Form 8865.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8865 through the link below or browse more documents in our library of IRS Forms.