This version of the form is not currently in use and is provided for reference only. Download this version of

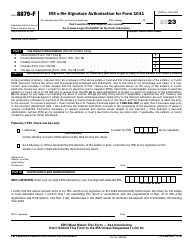

IRS Form 8879-PE

for the current year.

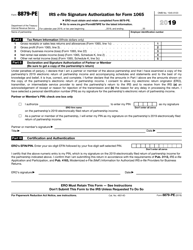

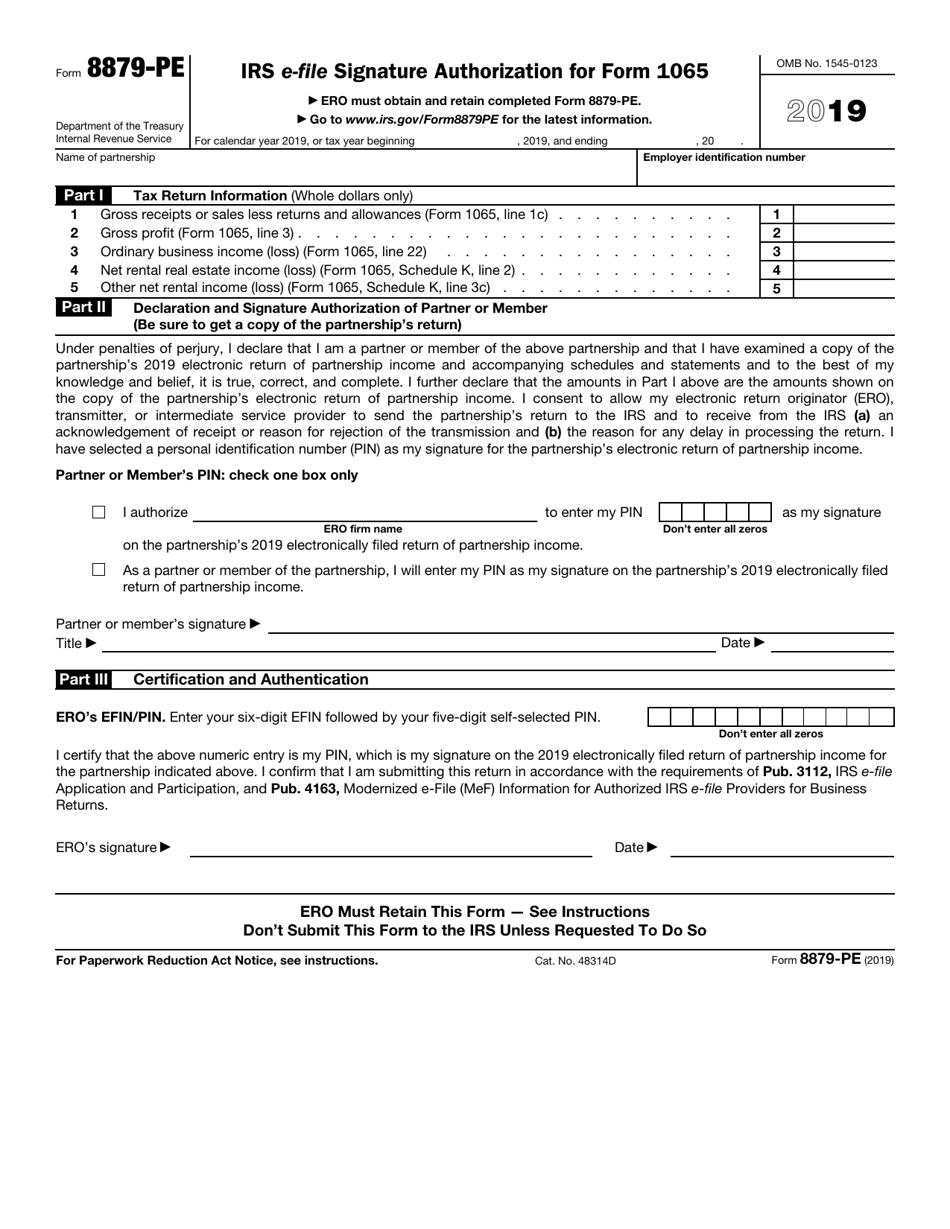

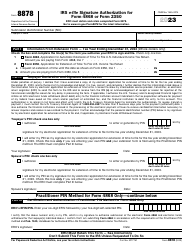

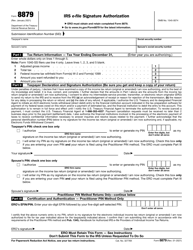

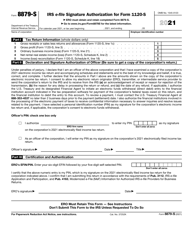

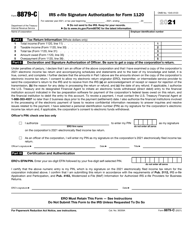

IRS Form 8879-PE IRS E-File Signature Authorization for Form 1065

What Is IRS Form 8879-PE?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8879-PE?

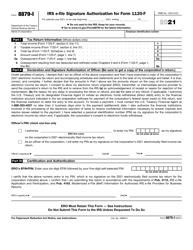

A: IRS Form 8879-PE is the E-File Signature Authorization for Form 1065.

Q: What is the purpose of IRS Form 8879-PE?

A: The purpose of IRS Form 8879-PE is to authorize the electronic filing of Form 1065.

Q: Who needs to file IRS Form 8879-PE?

A: Partnerships or limited liability companies filing Form 1065 electronically need to file IRS Form 8879-PE.

Q: Can IRS Form 8879-PE be filed electronically?

A: Yes, IRS Form 8879-PE can be filed electronically.

Q: What information is required on IRS Form 8879-PE?

A: IRS Form 8879-PE requires the taxpayer's name, address, electronic filing identification number, and signature.

Q: What is the deadline for filing IRS Form 8879-PE?

A: The deadline for filing IRS Form 8879-PE is the same as the deadline for filing Form 1065.

Q: Can I submit IRS Form 8879-PE separately from Form 1065?

A: No, IRS Form 8879-PE must be filed together with Form 1065.

Q: What should I do after filing IRS Form 8879-PE?

A: After filing IRS Form 8879-PE, you should retain a copy for your records and keep it for at least three years.

Q: What if I need to make corrections to IRS Form 8879-PE?

A: If you need to make corrections to IRS Form 8879-PE, you should file an amended IRS Form 8879 with the corrected information.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8879-PE through the link below or browse more documents in our library of IRS Forms.