This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8867

for the current year.

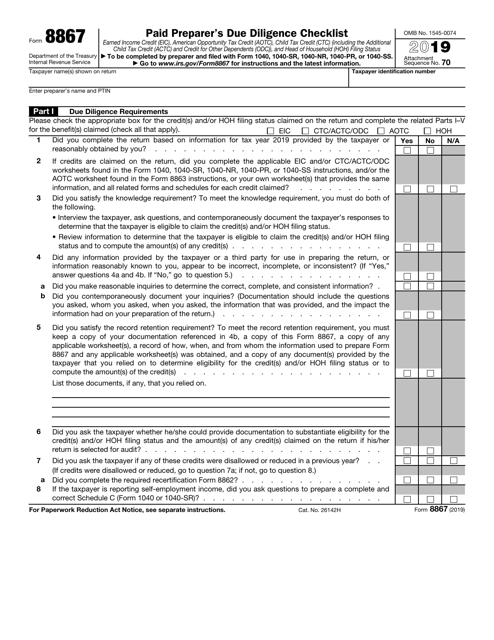

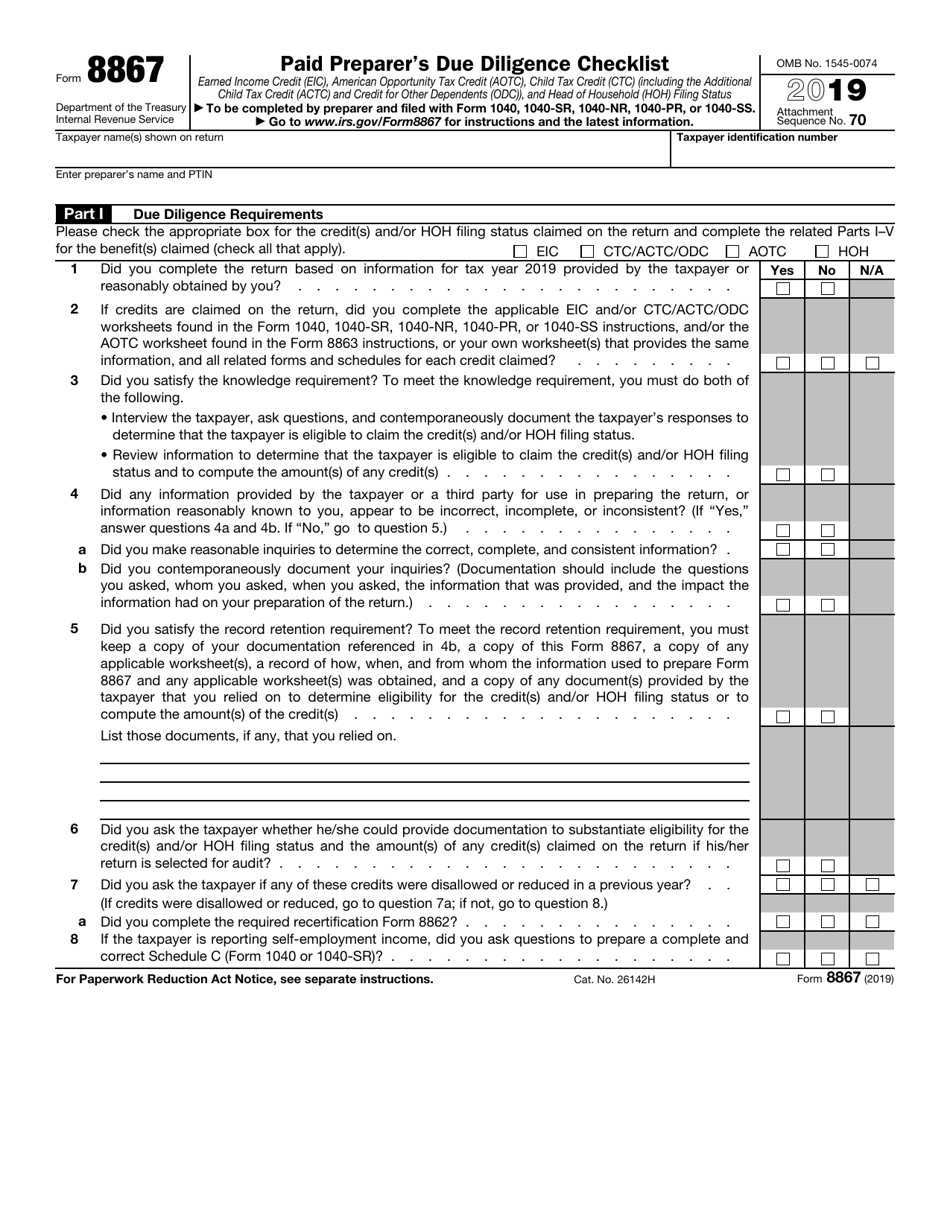

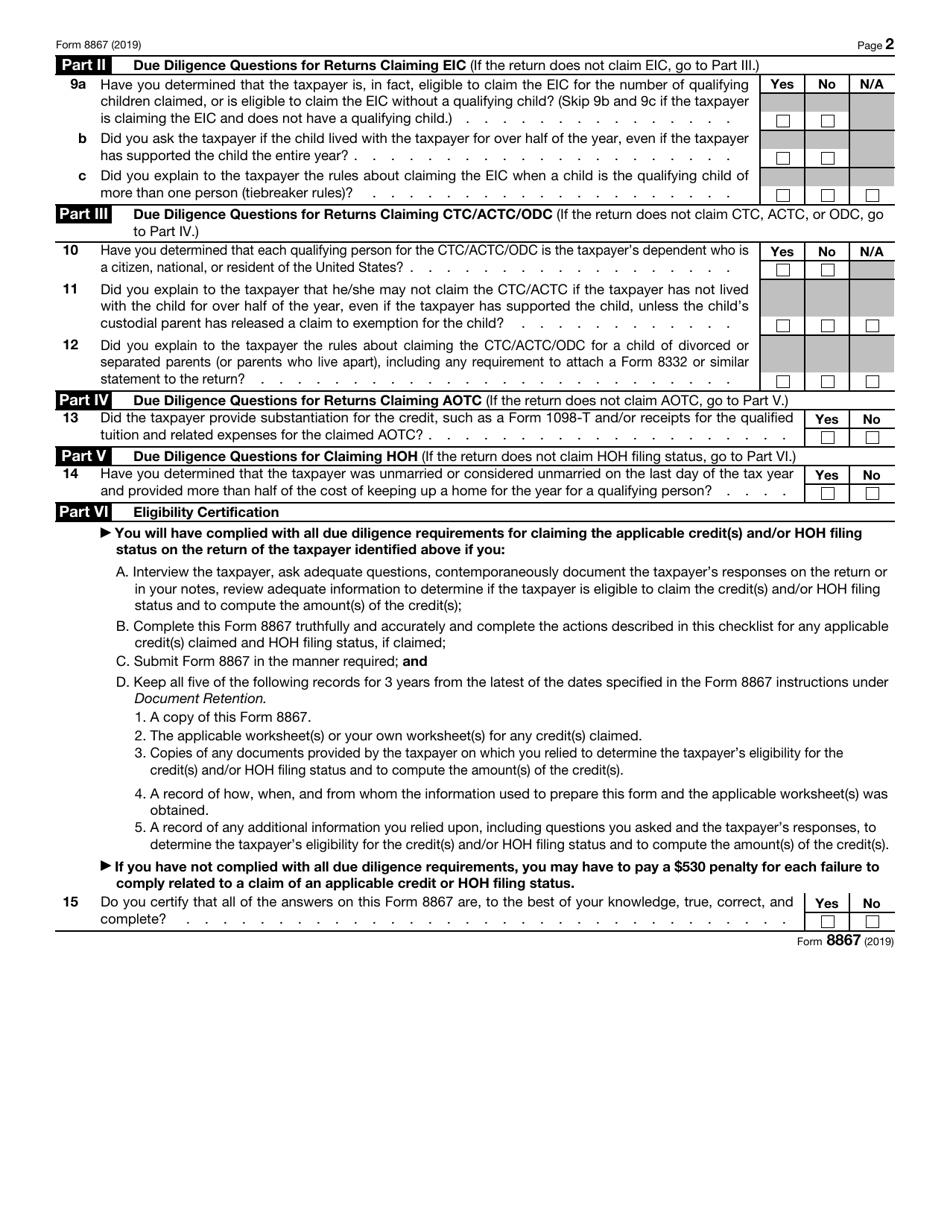

IRS Form 8867 Paid Preparer's Due Diligence Checklist

What Is IRS Form 8867?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8867?

A: IRS Form 8867 is a Paid Preparer's Due Diligence Checklist.

Q: Who needs to fill out IRS Form 8867?

A: Paid tax preparers who are responsible for preparing a client's tax return need to fill out IRS Form 8867.

Q: What is the purpose of IRS Form 8867?

A: The purpose of IRS Form 8867 is to ensure that paid tax preparers have exercised due diligence in determining a client's eligibility for certain tax benefits.

Q: What are some examples of tax benefits covered in IRS Form 8867?

A: Some examples of tax benefits covered in IRS Form 8867 include the Earned Income Credit (EIC) and the Child Tax Credit (CTC).

Q: What information does IRS Form 8867 require?

A: IRS Form 8867 requires the tax preparer to provide information about the client's income, expenses, and any potential eligibility for tax benefits.

Q: What are the consequences of not filing IRS Form 8867?

A: Failing to file IRS Form 8867 when required may result in penalties and financial liability for the tax preparer.

Q: Can I fill out IRS Form 8867 if I am not a paid tax preparer?

A: No, IRS Form 8867 is specifically designed for paid tax preparers and cannot be filled out by individuals who are not tax professionals.

Q: Are there any exceptions to filing IRS Form 8867?

A: Yes, there are certain exceptions to filing IRS Form 8867, such as when the tax return is not claiming any of the tax benefits covered by the form.

Q: Is it necessary to retain a copy of IRS Form 8867?

A: Yes, tax preparers should retain a copy of IRS Form 8867 and any supporting documentation for their records.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8867 through the link below or browse more documents in our library of IRS Forms.