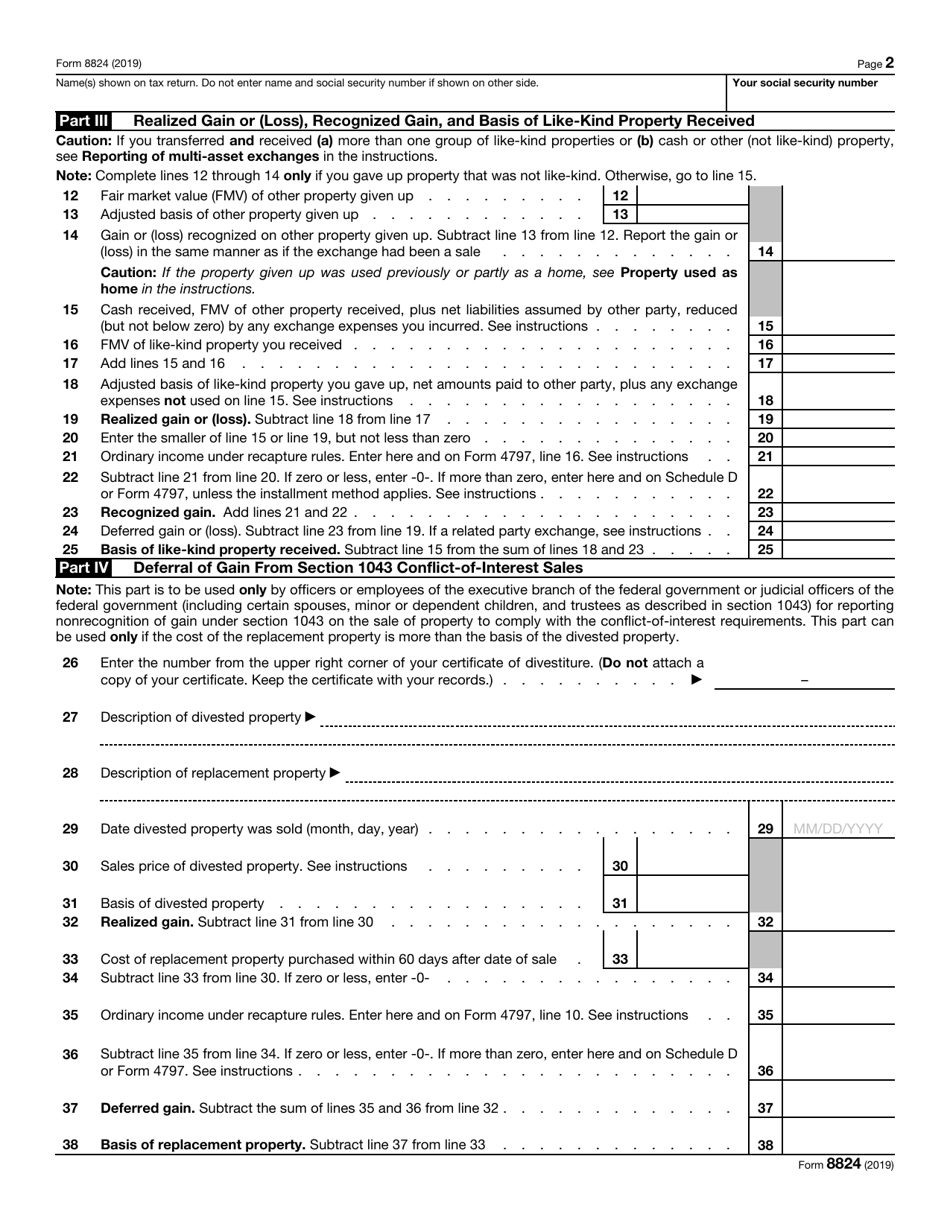

This version of the form is not currently in use and is provided for reference only. Download this version of

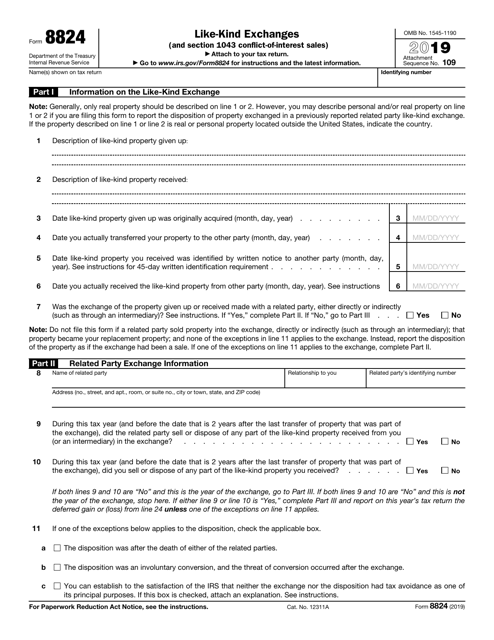

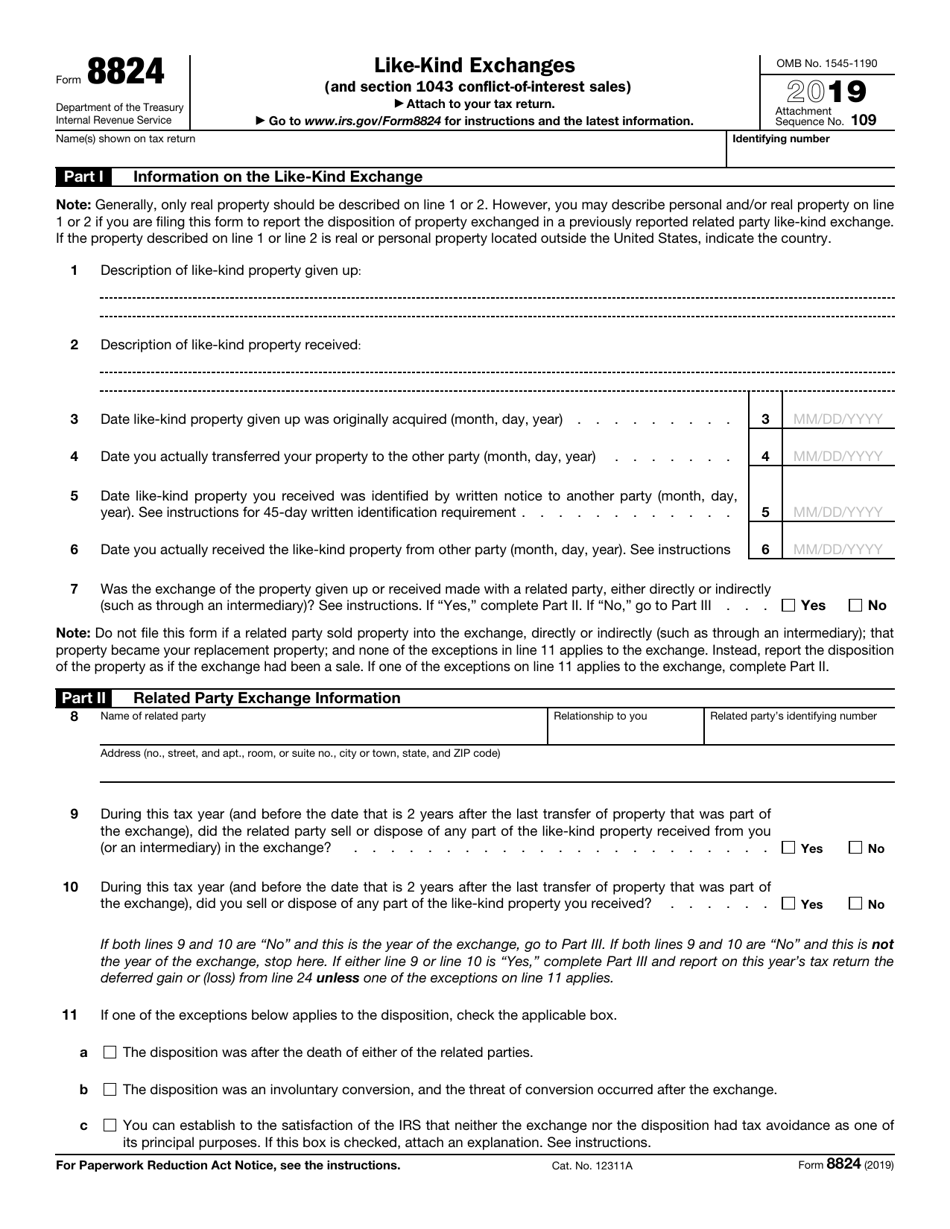

IRS Form 8824

for the current year.

IRS Form 8824 Like-Kind Exchanges

What Is IRS Form 8824?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8824?

A: IRS Form 8824 is used for reporting like-kind exchanges, also known as 1031 exchanges, to the Internal Revenue Service.

Q: What is a like-kind exchange?

A: A like-kind exchange is the exchange of property held for productive use in a trade or business or for investment, for another property of like kind.

Q: What are the benefits of a like-kind exchange?

A: Like-kind exchanges allow taxpayers to defer the recognition of any gain on the exchange and potentially reduce their overall tax liability.

Q: What is the time frame for a like-kind exchange?

A: To qualify as a like-kind exchange, the taxpayer must identify the replacement property within 45 days of transferring their relinquished property, and complete the exchange within 180 days.

Q: What types of property qualify for a like-kind exchange?

A: Real estate used for business or investment purposes, such as rental properties, and certain personal property, such as equipment or vehicles used in a trade or business, can qualify for a like-kind exchange.

Q: Are there any restrictions or limitations on like-kind exchanges?

A: While like-kind exchanges offer tax benefits, there are rules and limitations that must be followed, such as the requirement that the properties involved must be of like kind and held for productive use in a trade or business or for investment.

Q: Do I need to report a like-kind exchange on my tax return?

A: Yes, you must report the details of the like-kind exchange on IRS Form 8824 and include it with your tax return for the year in which the exchange took place.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8824 through the link below or browse more documents in our library of IRS Forms.