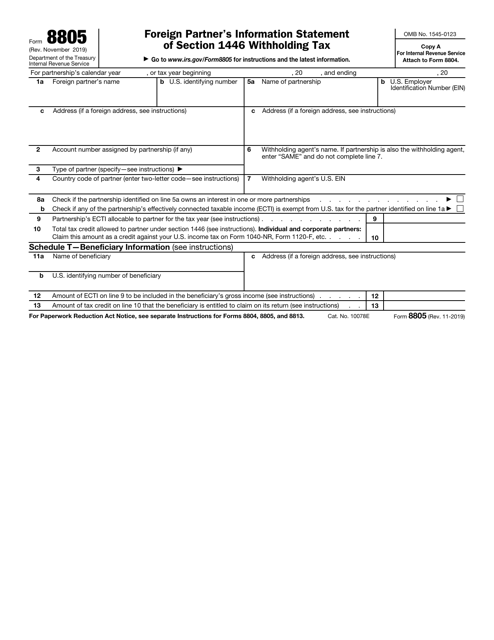

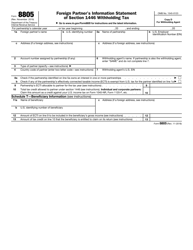

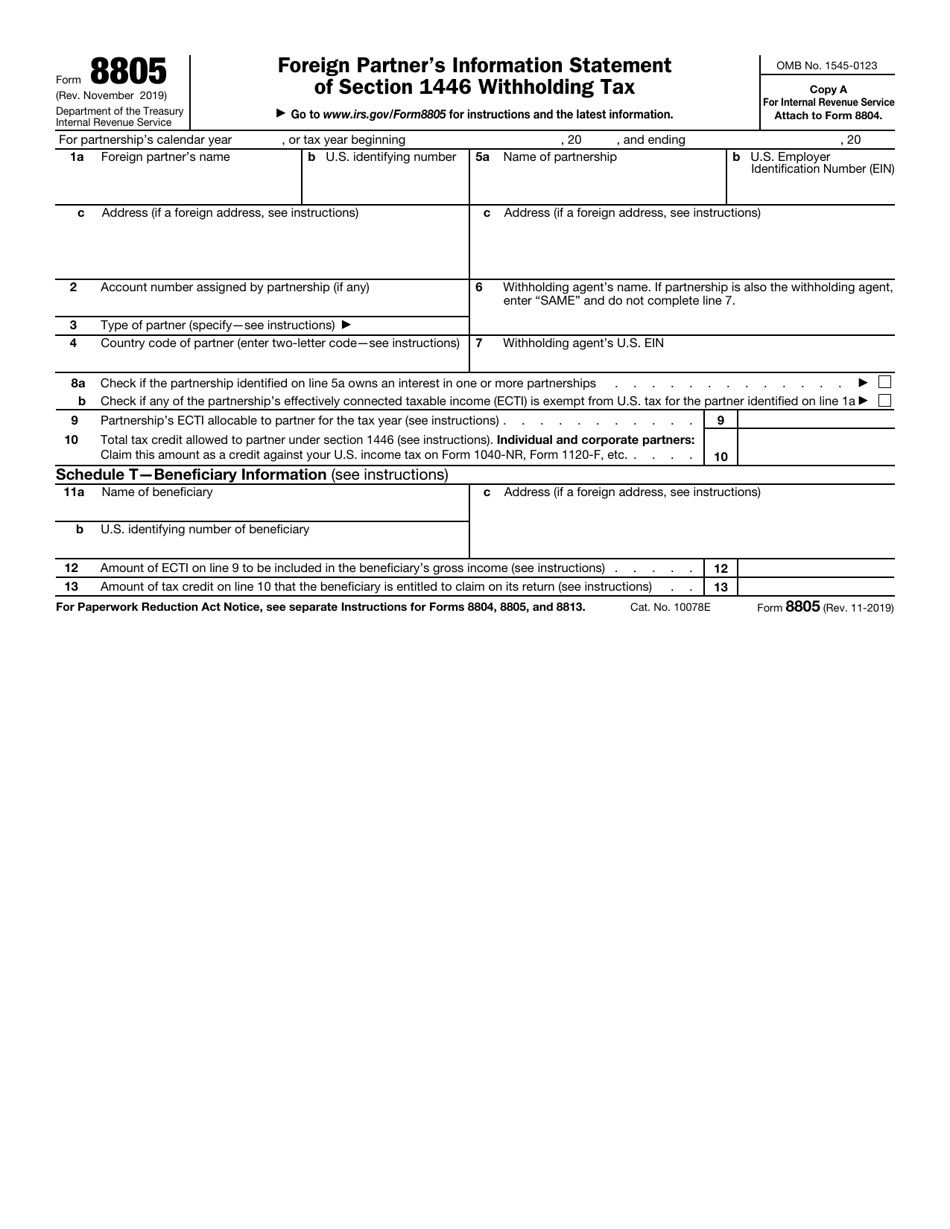

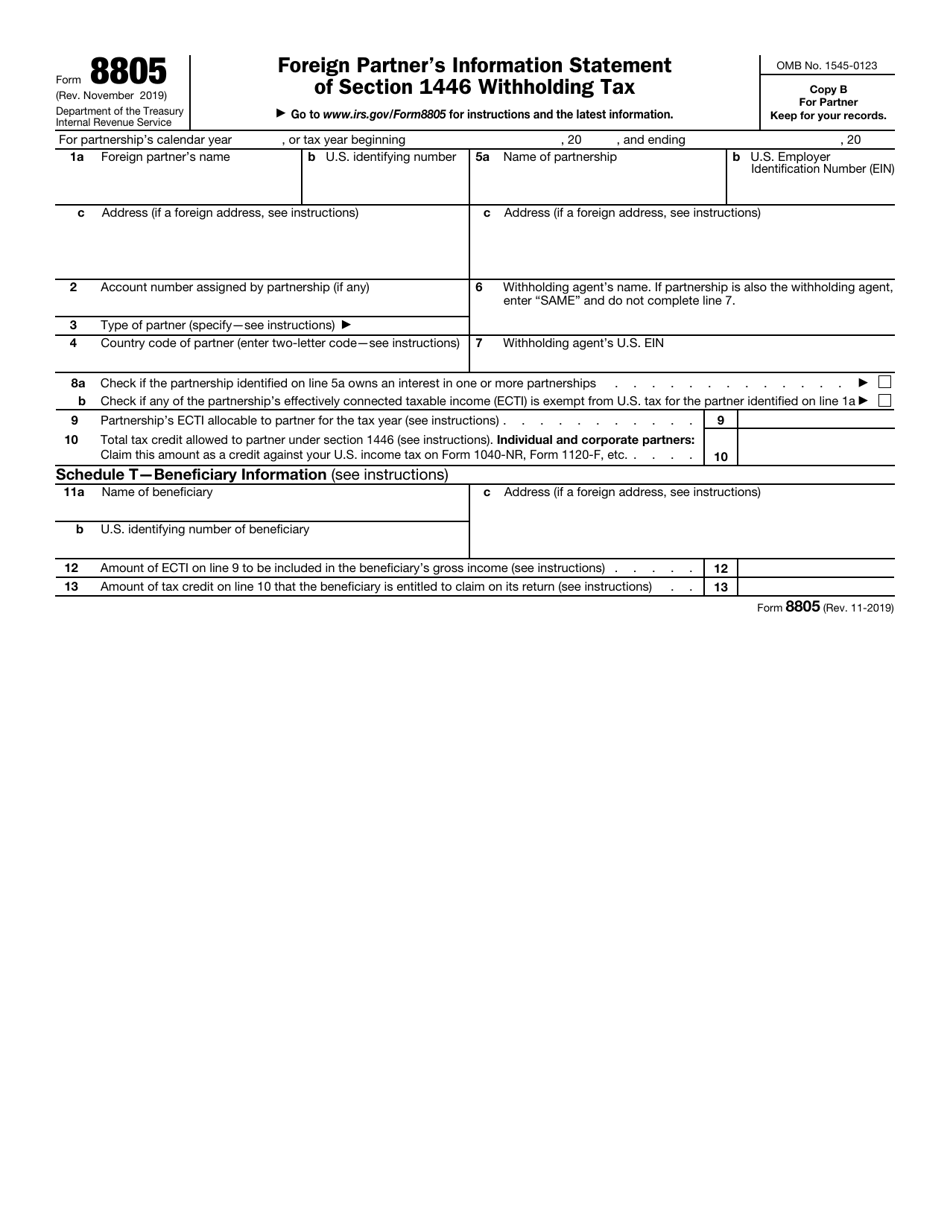

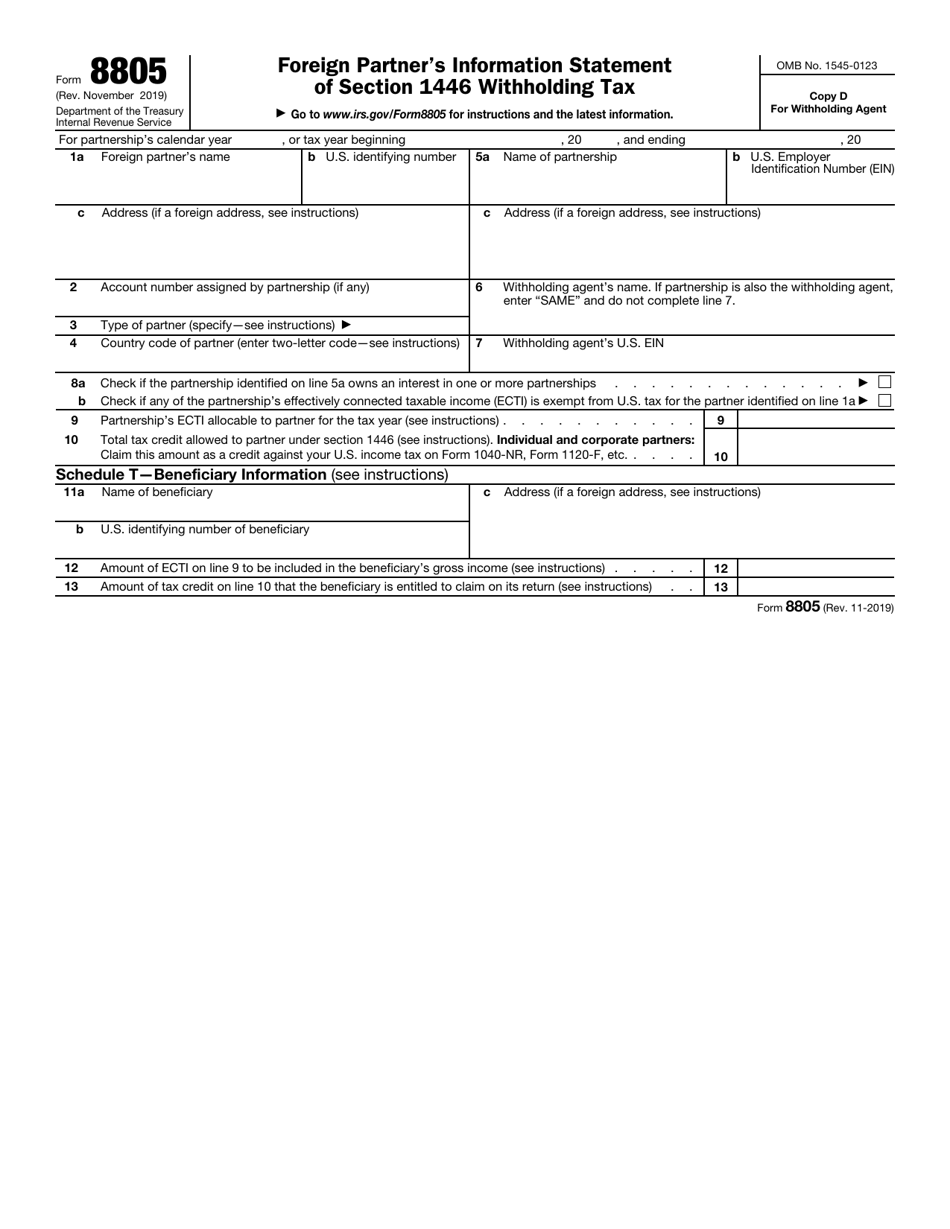

IRS Form 8805 Foreign Partner's Information Statement of Section 1446 Withholding Tax

What Is IRS Form 8805?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8805?

A: IRS Form 8805 is the Foreign Partner's Information Statement of Section 1446 Withholding Tax.

Q: Who needs to file IRS Form 8805?

A: Foreign partners who are subject to Section 1446 withholding tax.

Q: What is Section 1446 withholding tax?

A: Section 1446 withholding tax is the tax withheld on a foreign partner's share of partnership incomeeffectively connected with a U.S. trade or business.

Q: When is IRS Form 8805 due?

A: IRS Form 8805 is generally due on the 15th day of the 4th month following the close of the partnership's tax year.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8805 through the link below or browse more documents in our library of IRS Forms.