This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8554-EP

for the current year.

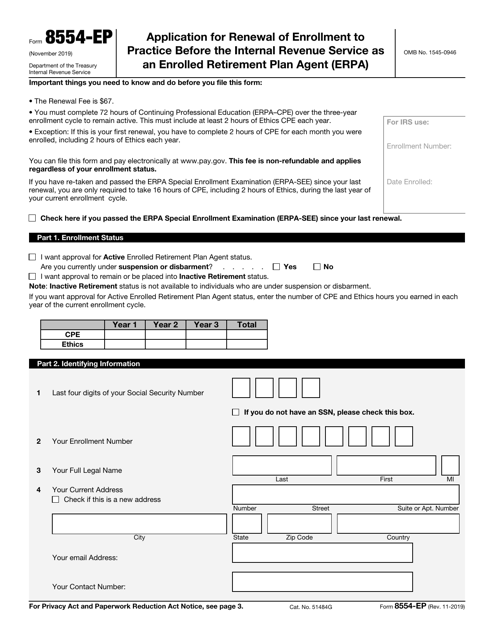

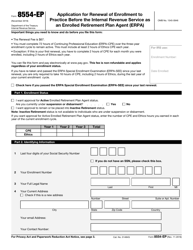

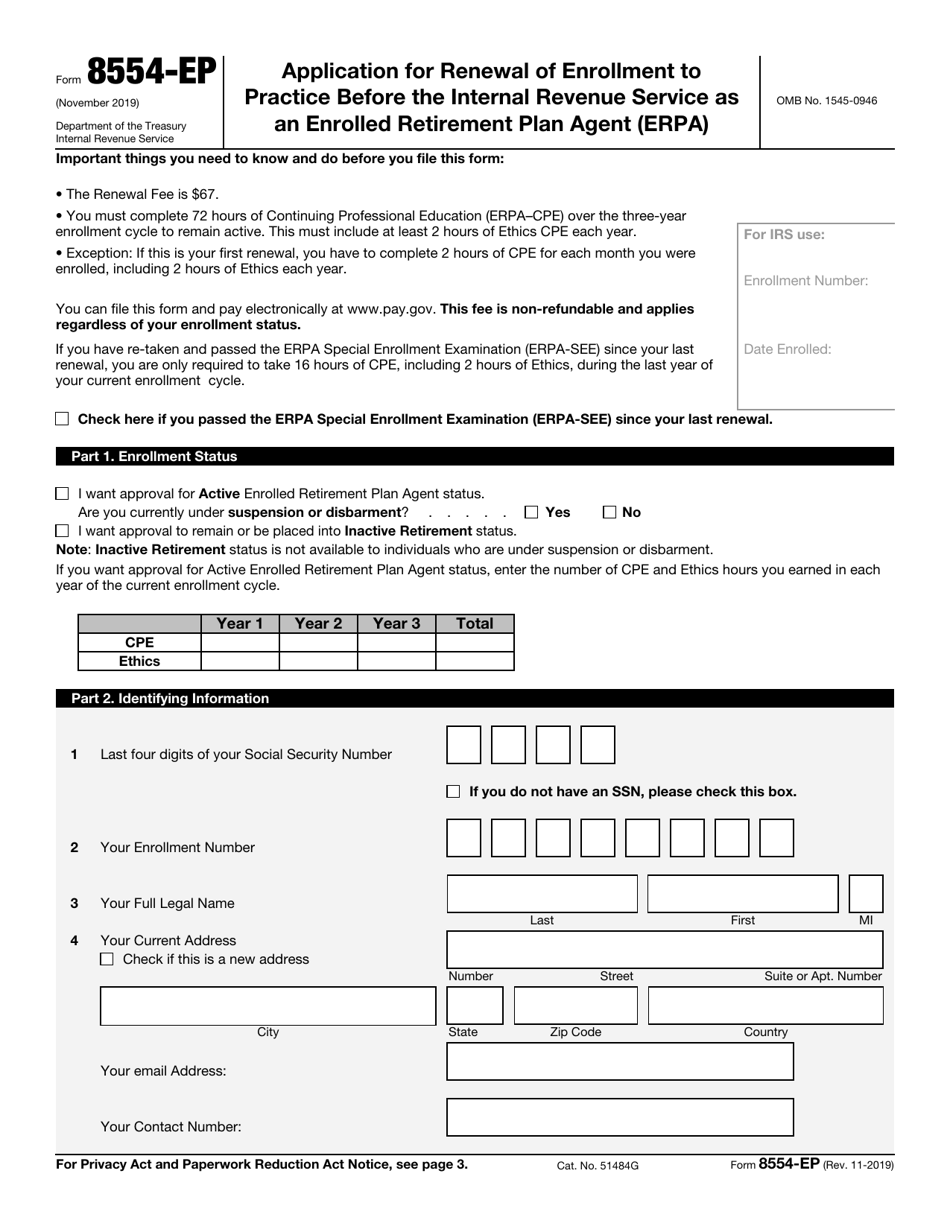

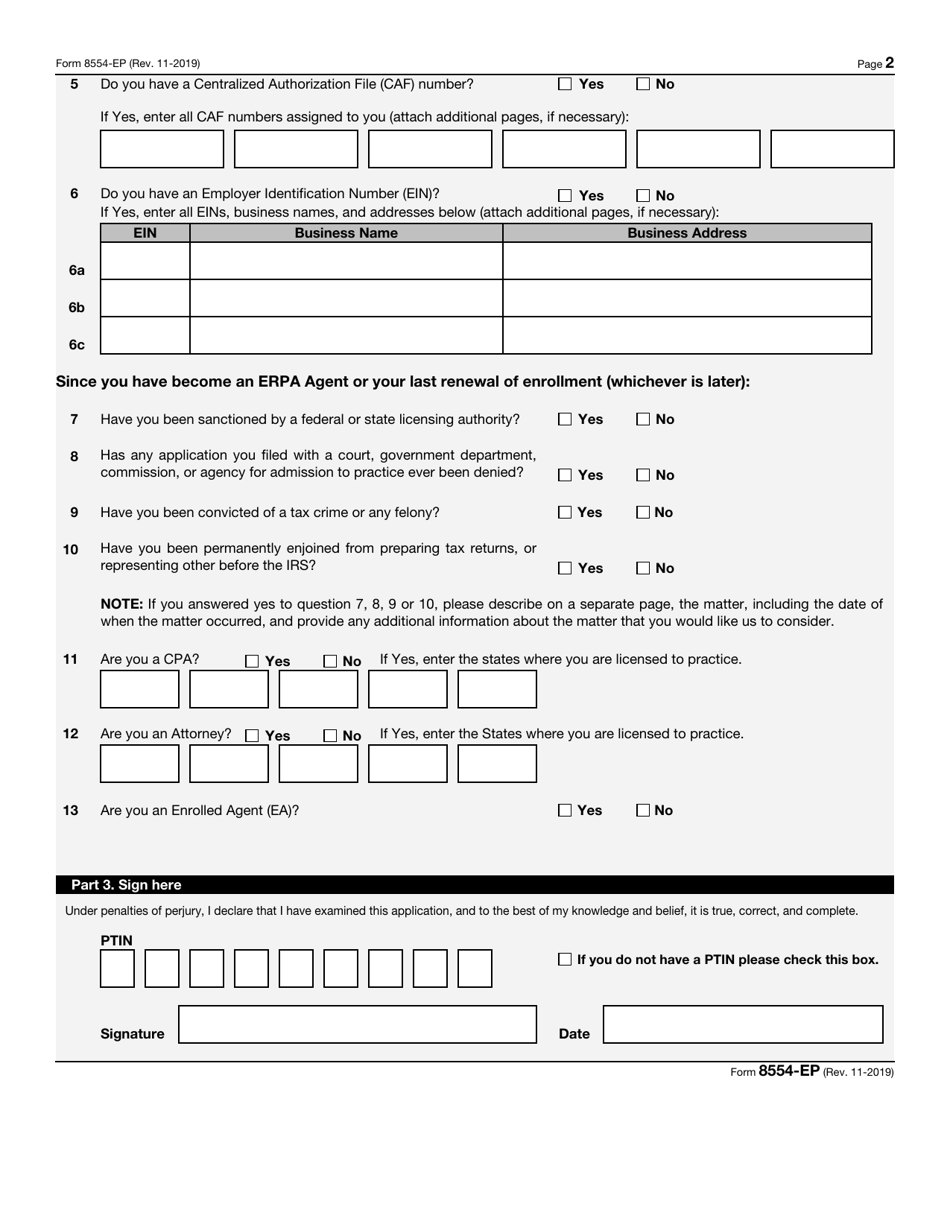

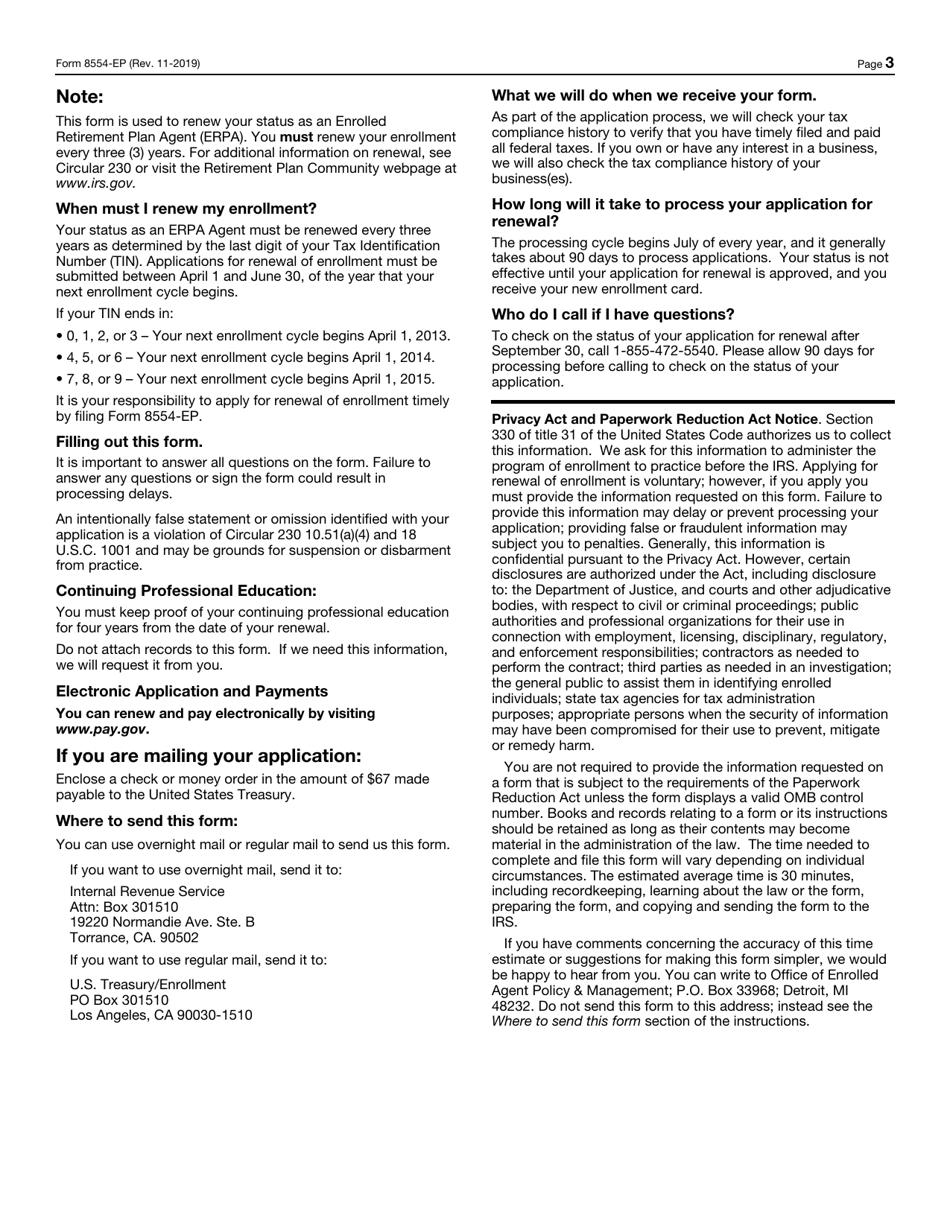

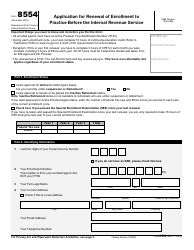

IRS Form 8554-EP Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent (Erpa)

What Is IRS Form 8554-EP?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 8554-EP?

A: Form 8554-EP is the application for renewal of enrollment to practice before the Internal Revenue Service as an Enrolled Retirement Plan Agent (ERPA).

Q: Who needs to file Form 8554-EP?

A: Individuals who are Enrolled Retirement Plan Agents (ERPA) and want to renew their enrollment to practice before the Internal Revenue Service need to file Form 8554-EP.

Q: What is the purpose of Form 8554-EP?

A: The purpose of Form 8554-EP is to renew the enrollment of Enrolled Retirement Plan Agents (ERPA) for them to continue practicing before the Internal Revenue Service.

Q: What supporting documents are required to be submitted with Form 8554-EP?

A: The specific supporting documents required to be submitted with Form 8554-EP are listed on the form instructions. It is important to review the instructions carefully to ensure all necessary documents are included.

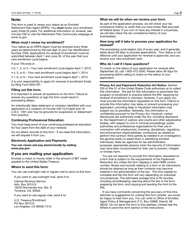

Q: When is the deadline for filing Form 8554-EP?

A: The deadline for filing Form 8554-EP varies. It is recommended to check the instructions or consult with the Internal Revenue Service (IRS) to determine the specific deadline for the current year.

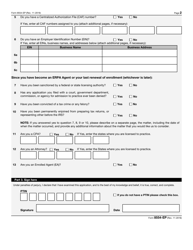

Q: Can Form 8554-EP be filed electronically?

A: No, currently Form 8554-EP cannot be filed electronically. It must be filed by mail.

Q: What happens after filing Form 8554-EP?

A: After filing Form 8554-EP, the Internal Revenue Service will review the application and notify the individual of the renewal status of their enrollment to practice as an Enrolled Retirement Plan Agent (ERPA).

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8554-EP through the link below or browse more documents in our library of IRS Forms.