This version of the form is not currently in use and is provided for reference only. Download this version of

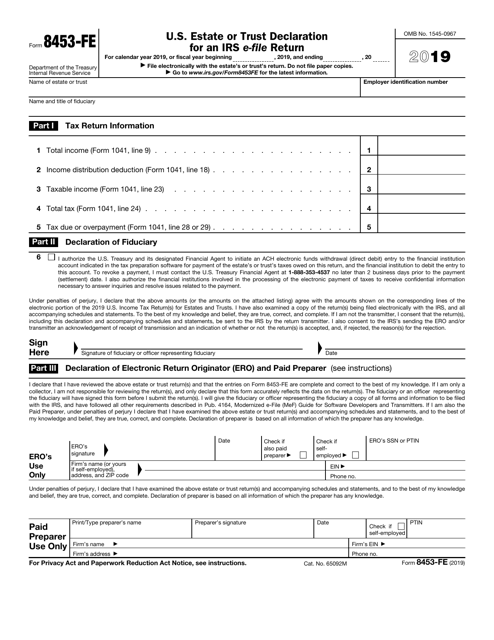

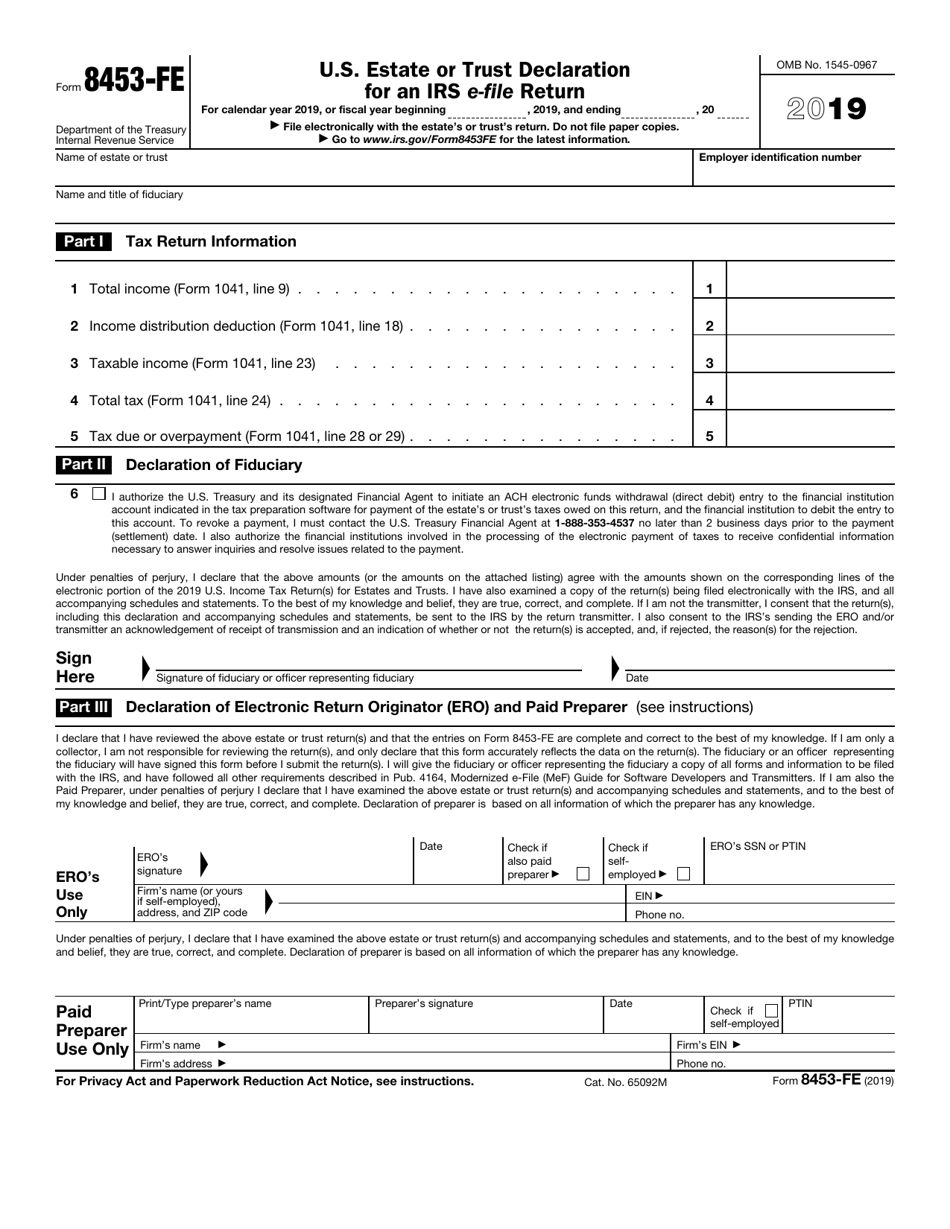

IRS Form 8453-FE

for the current year.

IRS Form 8453-FE U.S. Estate or Trust Declaration for an IRS E-File Return

What Is IRS Form 8453-FE?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8453-FE?

A: IRS Form 8453-FE is the U.S. Estate or Trust Declaration for an IRS E-File Return.

Q: Who needs to fill out IRS Form 8453-FE?

A: U.S. estates or trusts that are filing their tax returns electronically need to fill out IRS Form 8453-FE.

Q: What is the purpose of IRS Form 8453-FE?

A: The purpose of IRS Form 8453-FE is to declare and authorize the e-filed return on behalf of the estate or trust.

Q: Is IRS Form 8453-FE mandatory?

A: Yes, if you are filing the tax return for a U.S. estate or trust electronically, filling out and submitting IRS Form 8453-FE is mandatory.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8453-FE through the link below or browse more documents in our library of IRS Forms.