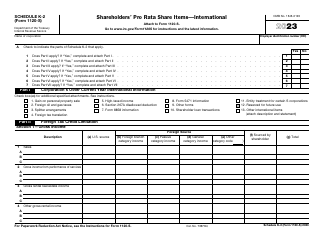

This version of the form is not currently in use and is provided for reference only. Download this version of

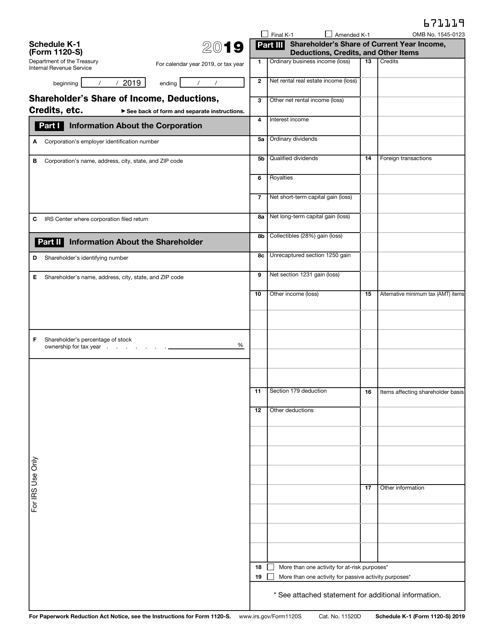

IRS Form 1120-S Schedule K-1

for the current year.

IRS Form 1120-S Schedule K-1 Shareholder's Share of Income, Deductions, Credits, Etc.

What Is IRS Form 1120-S Schedule K-1?

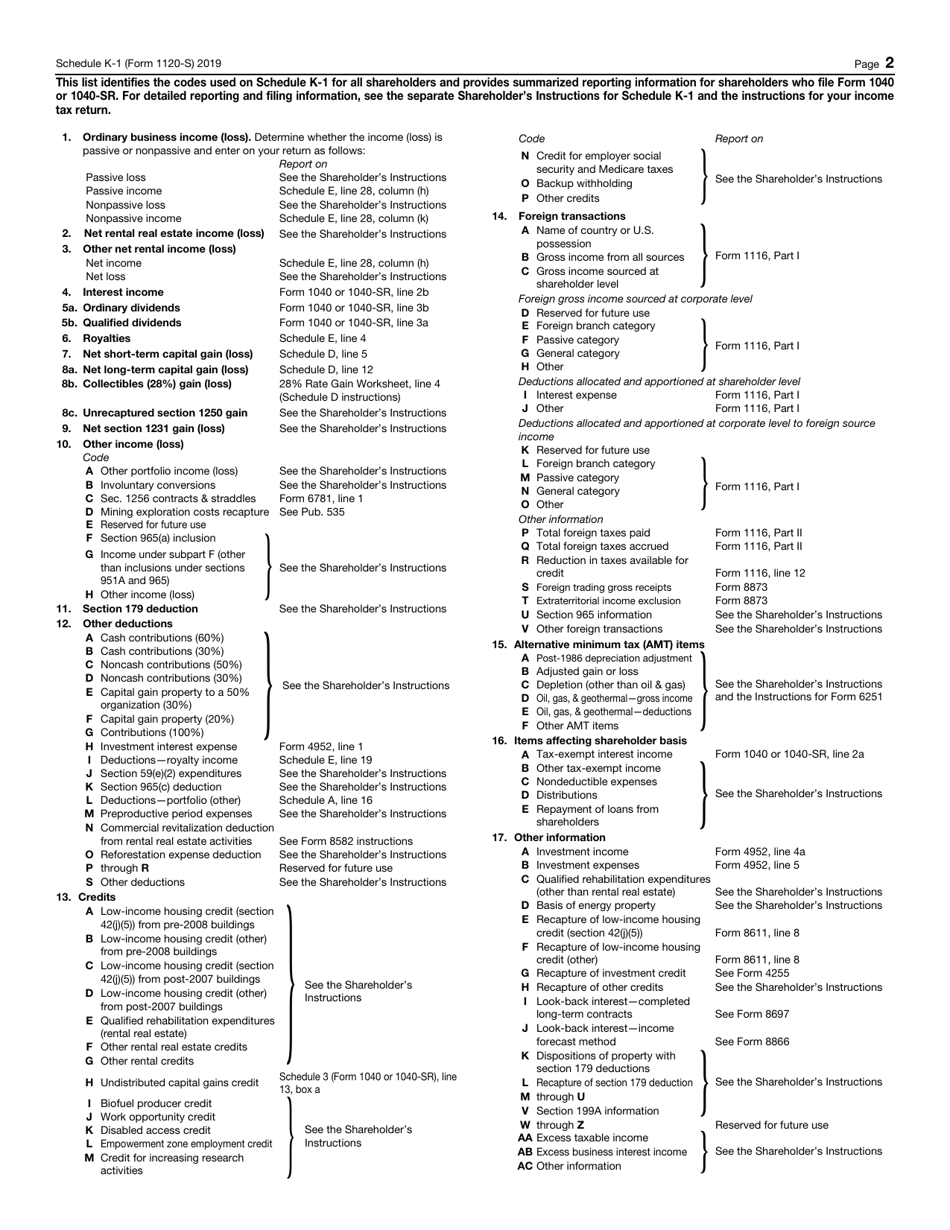

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-S, U.S. Income Tax Return for an S Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-S Schedule K-1?

A: It is a form that reports a shareholder's share of income, deductions, credits, etc. from an S corporation.

Q: Who needs to file IRS Form 1120-S Schedule K-1?

A: Shareholders of an S corporation need to file this form.

Q: What information does IRS Form 1120-S Schedule K-1 report?

A: It reports a shareholder's share of the S corporation's income, deductions, credits, etc.

Q: When is IRS Form 1120-S Schedule K-1 due?

A: It is generally due by the 15th day of the third month after the end of the corporation's tax year.

Form Details:

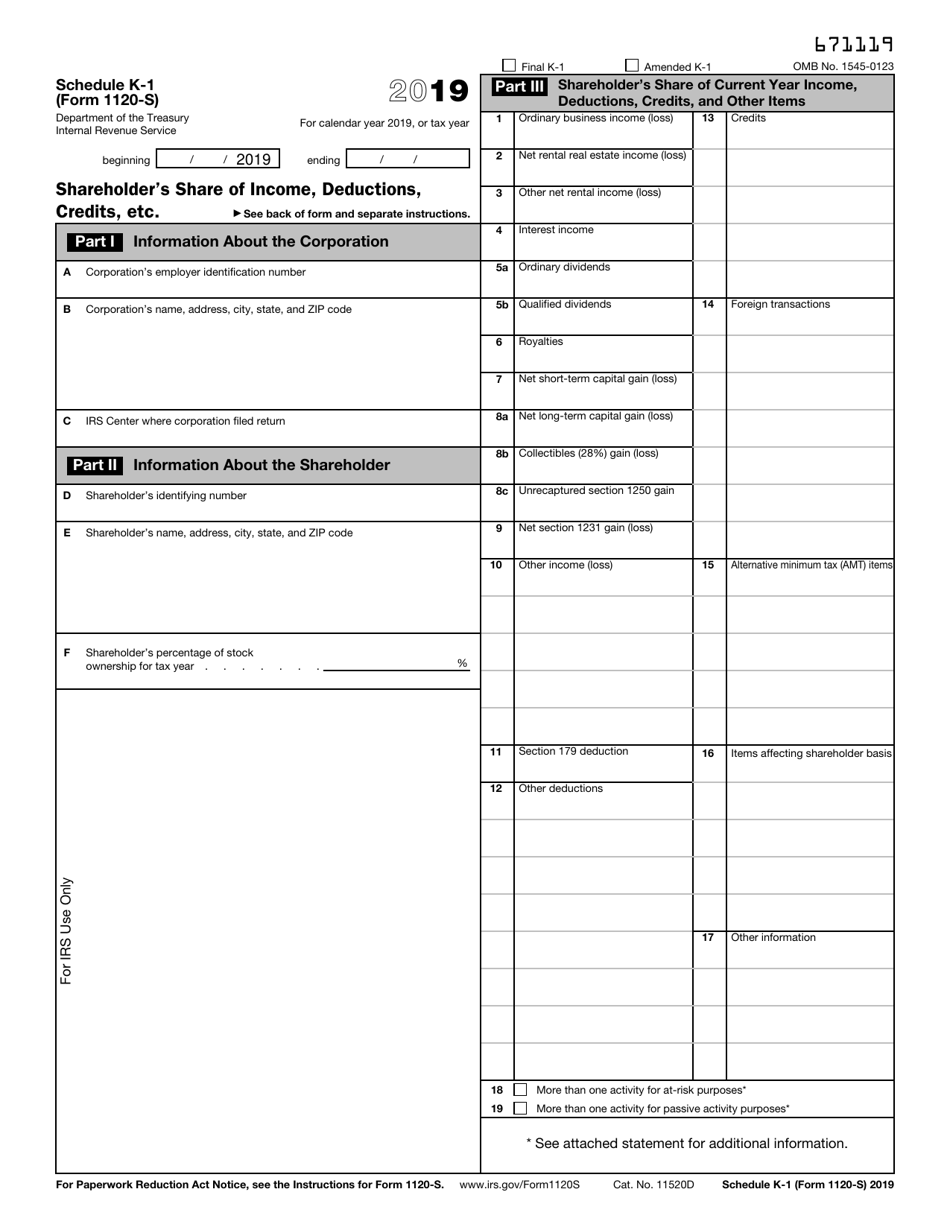

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S Schedule K-1 through the link below or browse more documents in our library of IRS Forms.