This version of the form is not currently in use and is provided for reference only. Download this version of

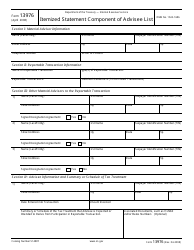

IRS Form 1120-F Schedule V

for the current year.

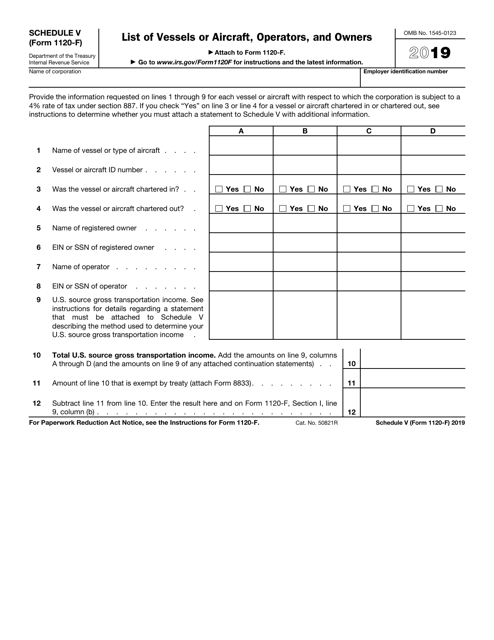

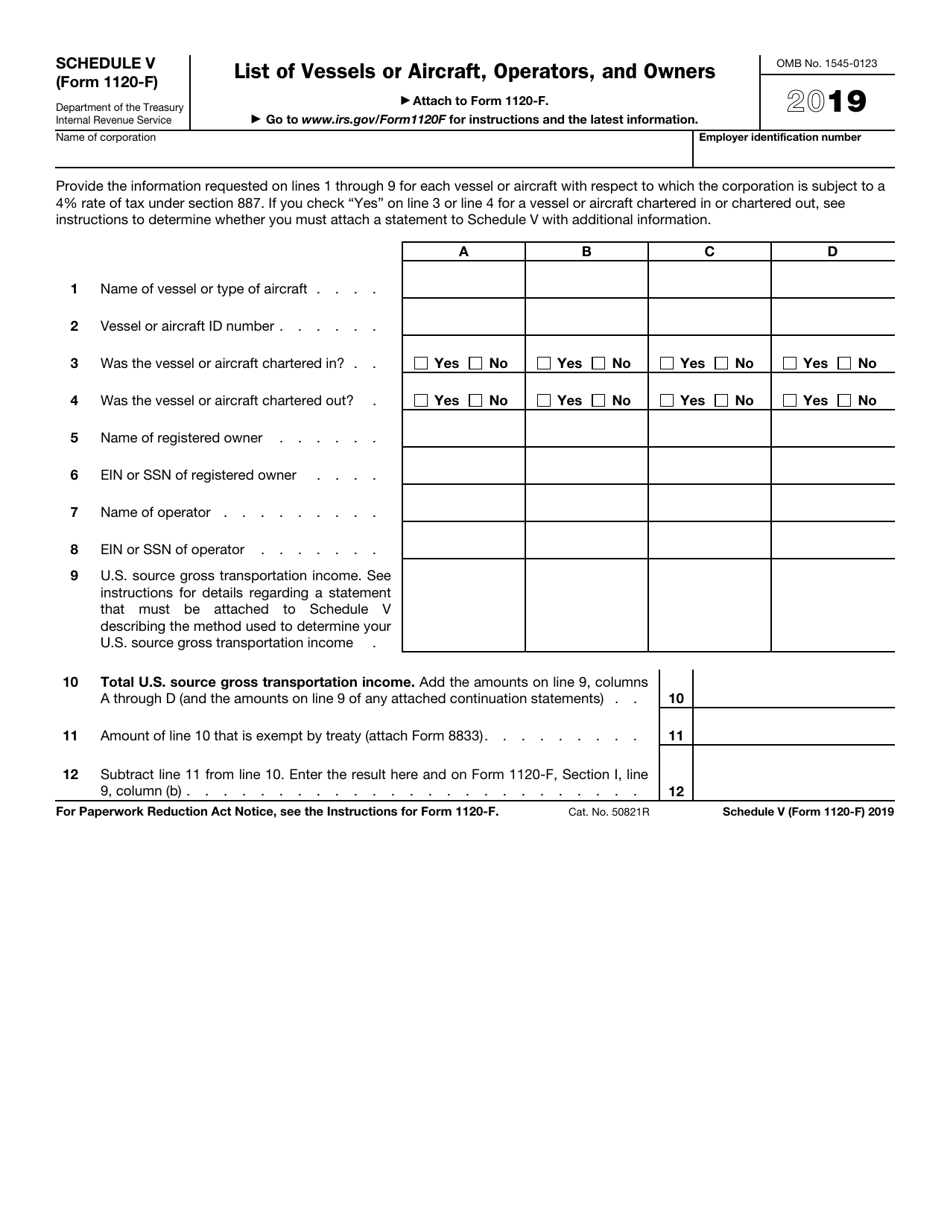

IRS Form 1120-F Schedule V List of Vessels or Aircraft, Operators, and Owners

What Is IRS Form 1120-F Schedule V?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F Schedule V?

A: IRS Form 1120-F Schedule V is a form used by certain foreign corporations to report a list of vessels or aircraft, operators, and owners.

Q: Who is required to file IRS Form 1120-F Schedule V?

A: Foreign corporations that meet certain criteria and have vessels or aircrafts, operators, and owners need to file IRS Form 1120-F Schedule V.

Q: What information is reported on IRS Form 1120-F Schedule V?

A: IRS Form 1120-F Schedule V requires reporting of the list of vessels or aircraft, operators, and owners, along with their relevant details.

Q: When is IRS Form 1120-F Schedule V due?

A: IRS Form 1120-F Schedule V is generally due on the same date as the annual tax return for the foreign corporation.

Q: Are there any penalties for not filing IRS Form 1120-F Schedule V?

A: Yes, failure to file IRS Form 1120-F Schedule V or filing it with incomplete or inaccurate information may result in penalties imposed by the IRS.

Q: Can I e-file IRS Form 1120-F Schedule V?

A: No, as of now, IRS Form 1120-F Schedule V cannot be e-filed. It must be filed by mail.

Q: Do I need to file IRS Form 1120-F Schedule V if I don't have any vessels or aircrafts?

A: No, if you don't have any vessels or aircrafts, you don't need to file IRS Form 1120-F Schedule V.

Q: Is IRS Form 1120-F Schedule V the same as Form 1120-F?

A: No, IRS Form 1120-F Schedule V is a separate form that is filed along with Form 1120-F.

Q: Can I seek professional help to complete IRS Form 1120-F Schedule V?

A: Yes, if you are unsure about how to complete IRS Form 1120-F Schedule V, it is recommended to seek assistance from a tax professional or an accountant.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule V through the link below or browse more documents in our library of IRS Forms.