This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1065

for the current year.

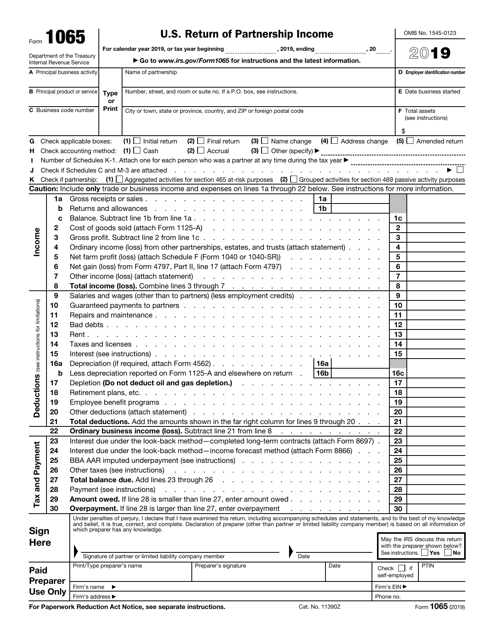

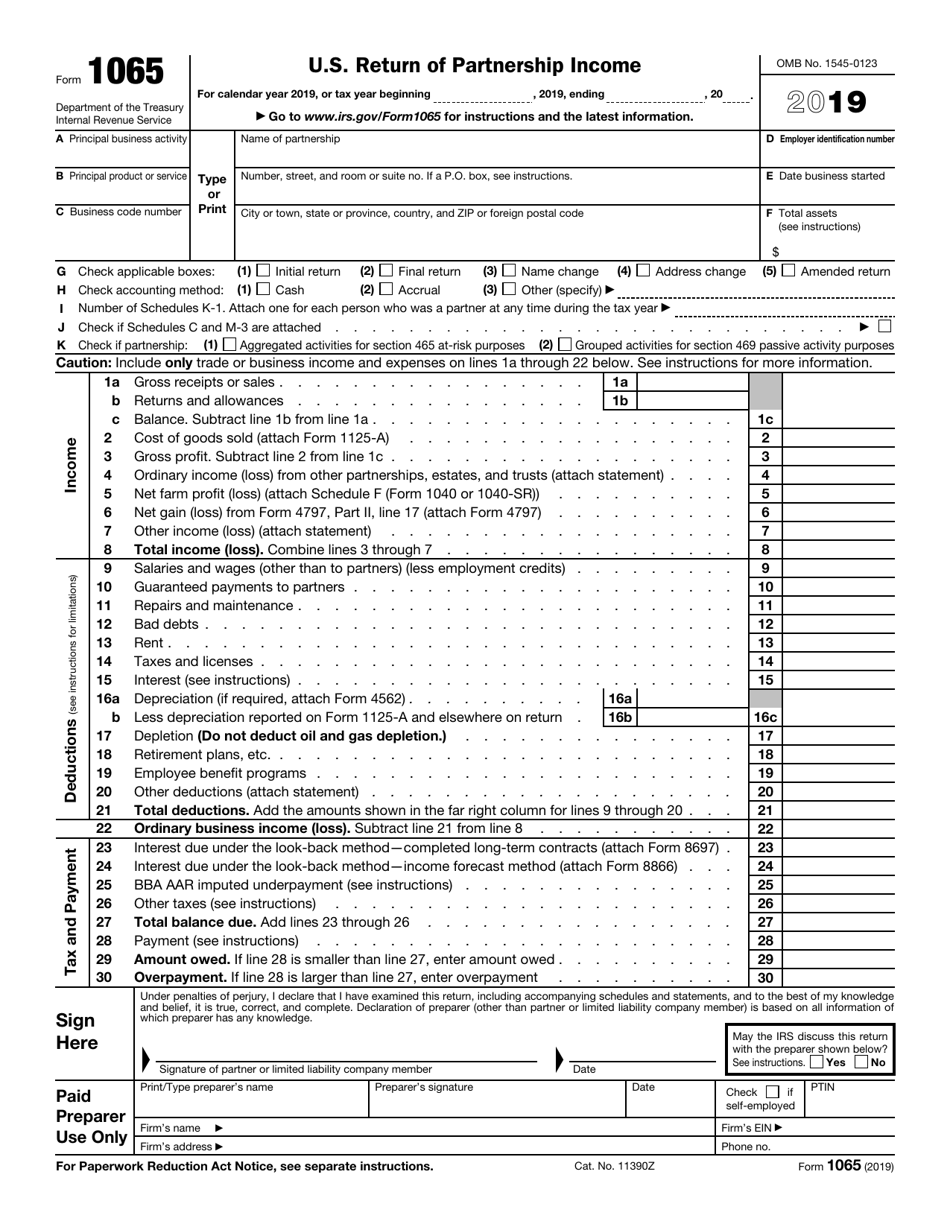

IRS Form 1065 U.S. Return of Partnership Income

What Is Form 1065?

IRS Form 1065, U.S. Return of Partnership Income , also known as the partnership tax return form, is a document used by the Internal Revenue Service (IRS) to obtain information on income, credits, deductions, gains, losses, and other data related to the operation of the partnership.

The latest version of the form was released by the IRS in 2019 with all previous editions obsolete. A fillable partnership return form is available for download below.

What Is Form 1065 Used For?

IRS Form 1065 is used by partnerships to report their financial information to the IRS. A partnership can be defined as the business or trade relationship between two or more people who want to work together, invest and contribute skills, money, labor, and property and aim to share in the gains and losses of the business. The process of reporting includes two steps. First, with Tax Form 1065, the partnership reports financial information relating to the operation of the partnership. Second, every partner must prepare a Schedule K-1 to identify personal profits and losses over the course of the partnership's operation.

What Is the Difference Between Form 1065 and 1120?

IRS Form 1120, U.S. Corporation Income Tax Return is used to report gains, losses, income, credits, deductions and to show the income tax liability of the corporation. The limited liability company must file this form if it is a corporation. You can use Form 8832, Entity Classification Election to elect how your entity will be classified for federal tax purposes - as a corporation, a partnership, or an entity disregarded as separate from its owner.

IRS Form 1065 Schedules

To comply with the IRS 1065 Form filing requirements, you must file it with certain schedules:

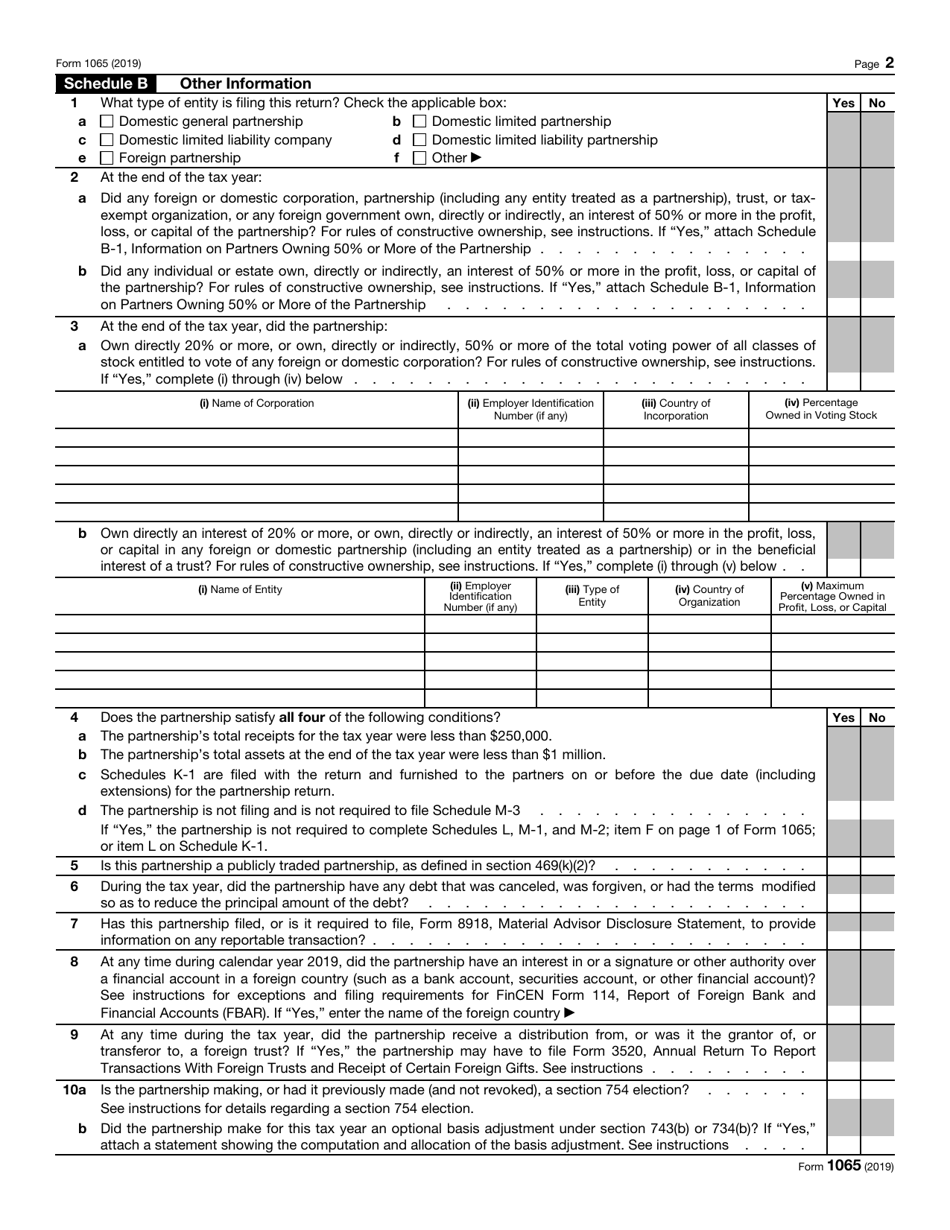

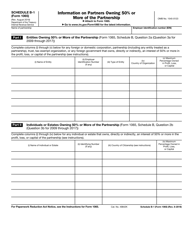

- Schedule B-1, Information on Partners Owning 50% or More of the Partnership, is used to submit information on individuals, entities, and estates that own interest of 50% or more in the capital, profit, or loss of the partnership;

- Schedule C, Additional Information for Schedule M-3 Filers provides answers to questions for filers of the Schedule M-3;

- Schedule D, Capital Gains and Losses is required to report capital gain distributions, sales or exchanges of capital assets, and nonbusiness bad debts;

- Schedule K-1, Partner's Share of Income, Deductions, Credits, etc. is used to report the distributive share of the partnership's income, deductions, credits, etc.;

- Schedule M-3, Net Income (Loss) Reconciliation for Certain Partnerships is required for all partnerships with total assets of $10 million or more to answer questions about their financial statements and reconcile financial statements, net income and return.

IRS Form 1065 Instructions

- Identify the principal business activity, the principal product or service, and the business code number. State the name of the partnership and its address. Write down the employer identification number, the date the business started, and the total assets. Choose the type of return and the accounting method. Attach appropriate schedules.

- State the income, deductions, tax, and payment.

- Sign and date the form.

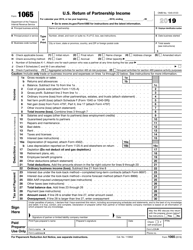

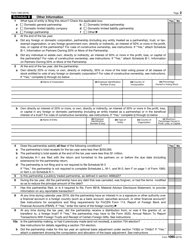

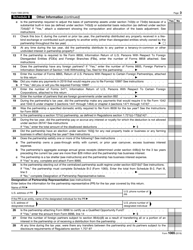

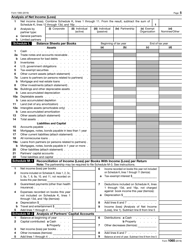

- Schedule B (Other Information). Answer questions with either «yes» or «no», and describe the type of entity.

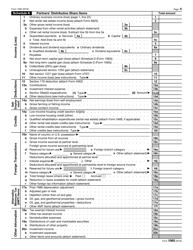

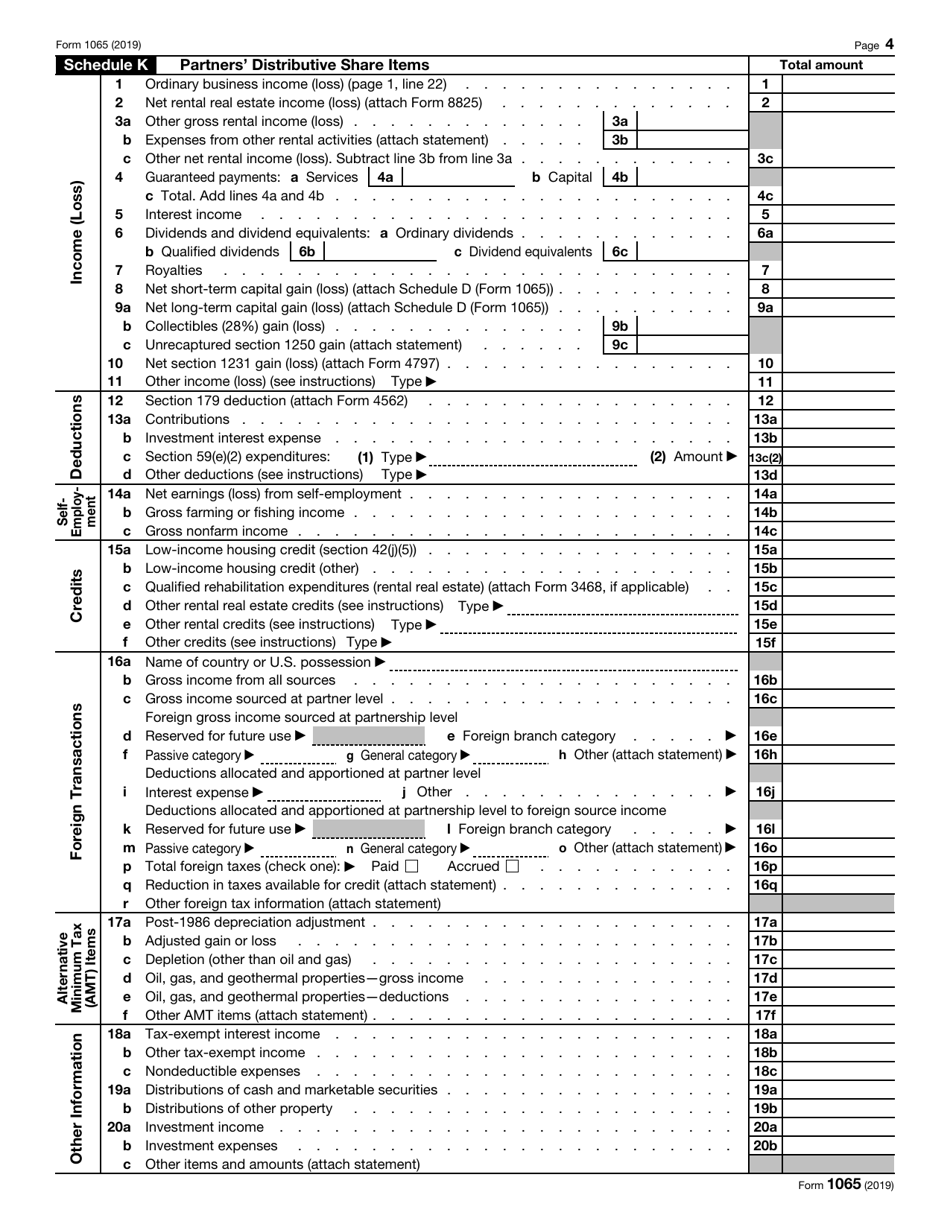

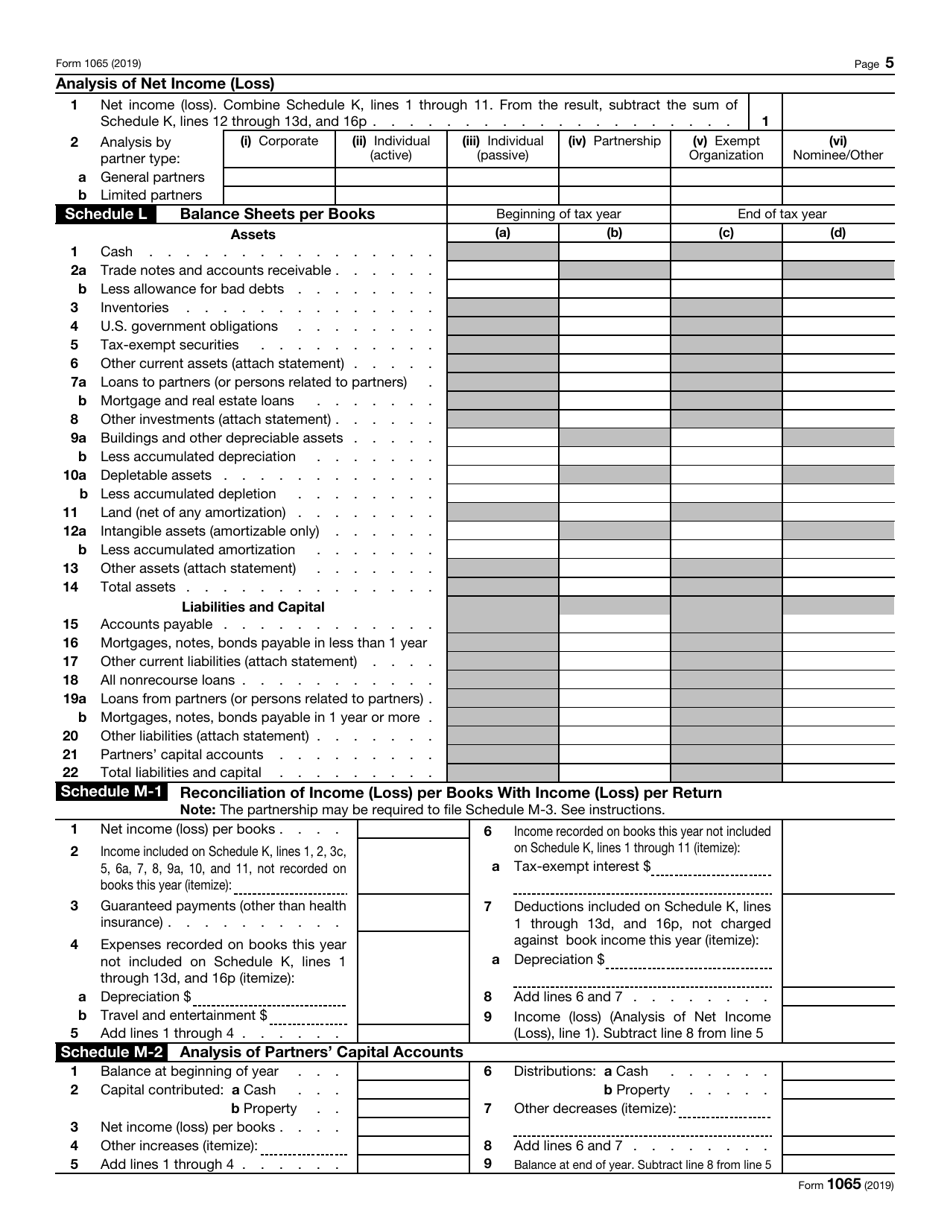

- Schedule K (Partners' Distributive Share Items). State the total amount of income (loss), deductions, self-employment, credits, foreign transactions, alternative minimum tax items, etc., and provide the analysis of the net income (loss).

- Schedule L (Balance Sheets per Books). Indicate the assets, liabilities, and capital.

- Schedule M-1 (Reconciliation of Income (Loss) per Books with Income (Loss) per Return. State the net income, guaranteed payments, tax-exempt interest, etc..

- Schedule M-2 (Analysis of Partners' Capital Accounts). Provide information about the balance and capital of the partnership.

How to File Form 1065?

IRS tax form 1065 is filed by the fifteenth day of the third month following the date its tax year ended. However, IRS form 1065 due dates can be extended if you file Form 7004. The late filing penalty is $210 for each month or part of the month the failure continues multiplied by the number of partners.

The 1065 return mailing addresses are the following:

-

If the partnership is located in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin and:

- Total assets are less than $10 million and you did not file Schedule M-3, send the form to the IRS Center Kansas City, MO 64999-0011;

- Total assets are $10 million or more or you filed Schedule M-3 - IRS Center Ogden, UT 84201-0011;

-

If the partnership is located in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming IRS Center Ogden, UT 84201-0011;

-

If the partnership is located in a foreign country or U.S. possession - IRS PO Box 409101 Ogden, UT 84409.

-

Partnerships with more than 100 partners must file the form and related schedules electronically unless they submit bankruptcy returns or returns with pre-computed interest and penalty.

IRS 1065 Related Forms:

- IRS Form 1065-B, U.S. Return of Income for Electing Large Partnerships is a related document used to report to the IRS the gains, losses, deductions, income, and other details on the electing large partnership's operation. An electing large partnership can be defined as any partnership that had 100 or more partners in the preceding year and chose the application of this status, and as a result, an ELP chooses to file this form instead of IRS Form 1065;

- IRS Form 1065-X, Amended Return or Administrative Adjustment Request (AAR) is a related form needed to amend items on the previously filed Form 1065, Form 1065-B, or Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return. You can also make an AAR change the disclosure of the items relating to the partnership.