This version of the form is not currently in use and is provided for reference only. Download this version of

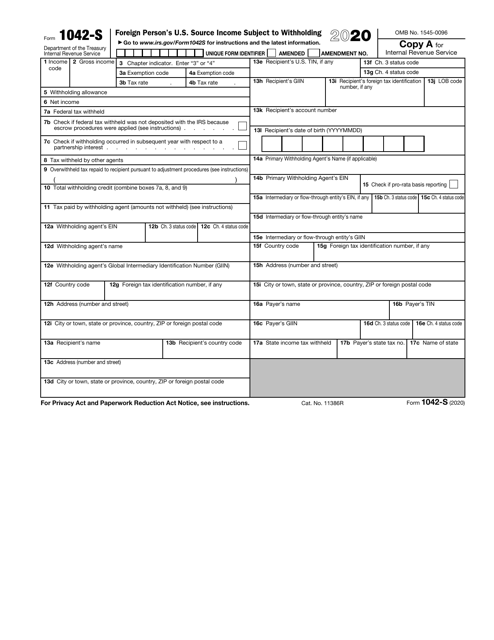

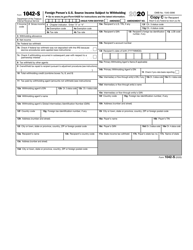

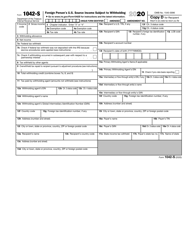

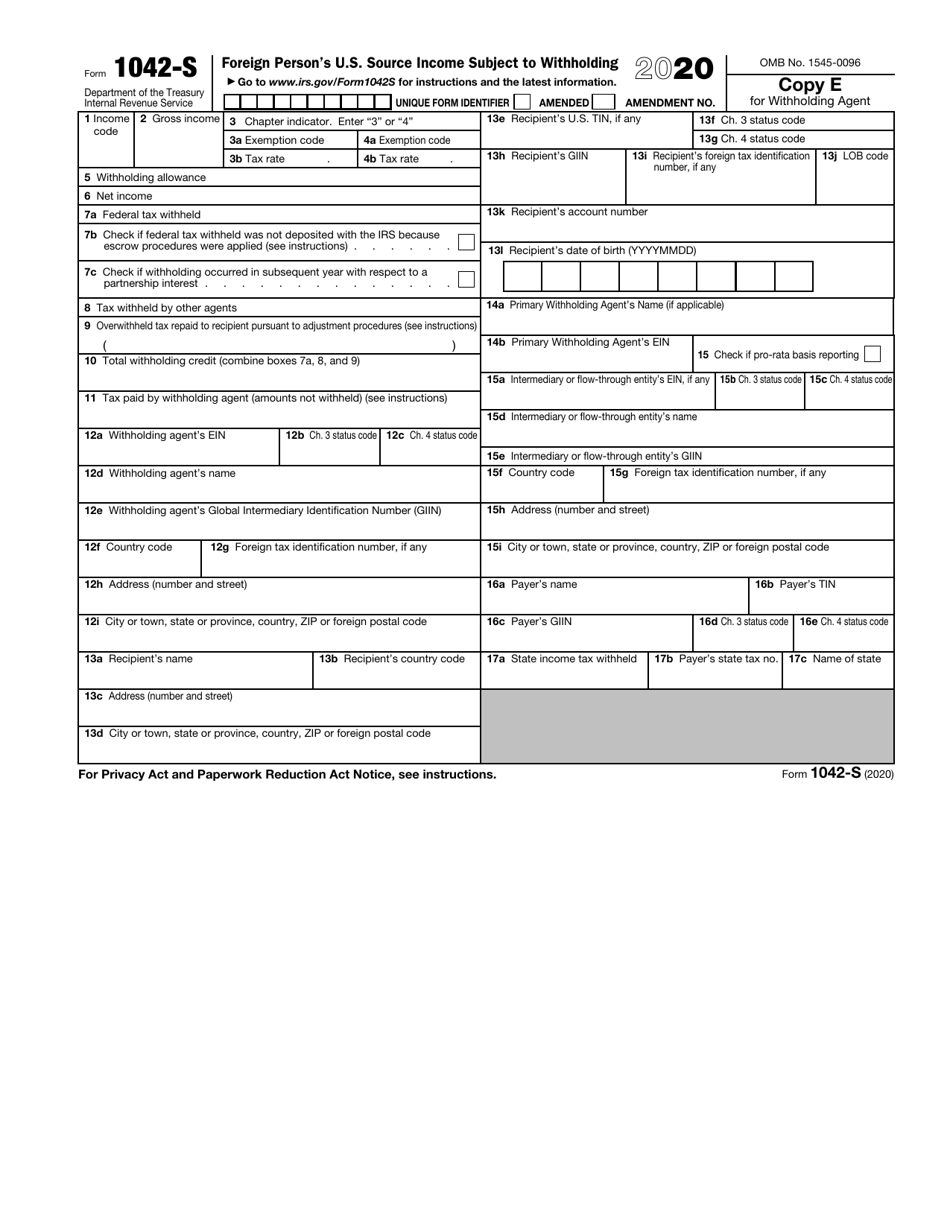

IRS Form 1042-S

for the current year.

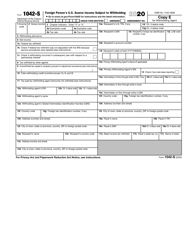

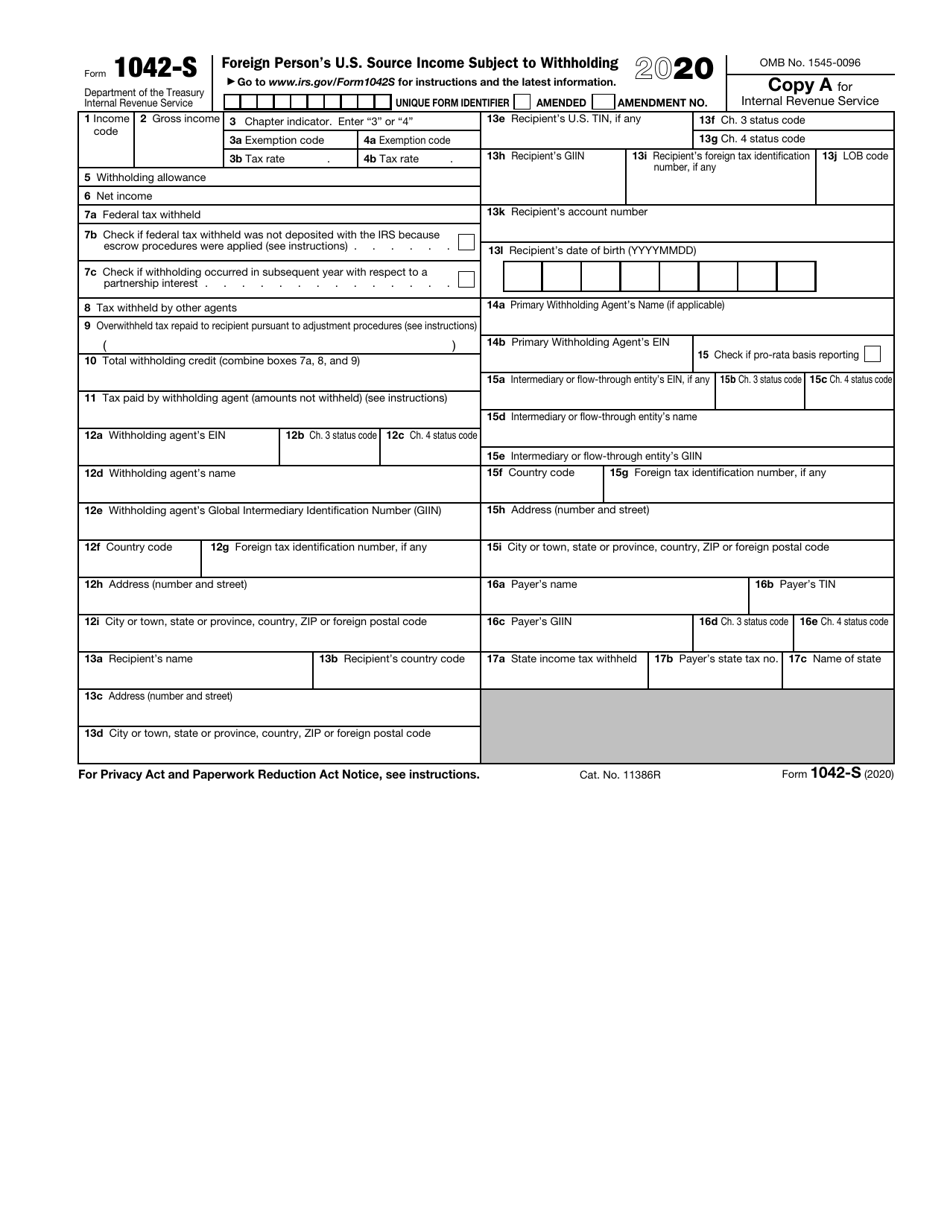

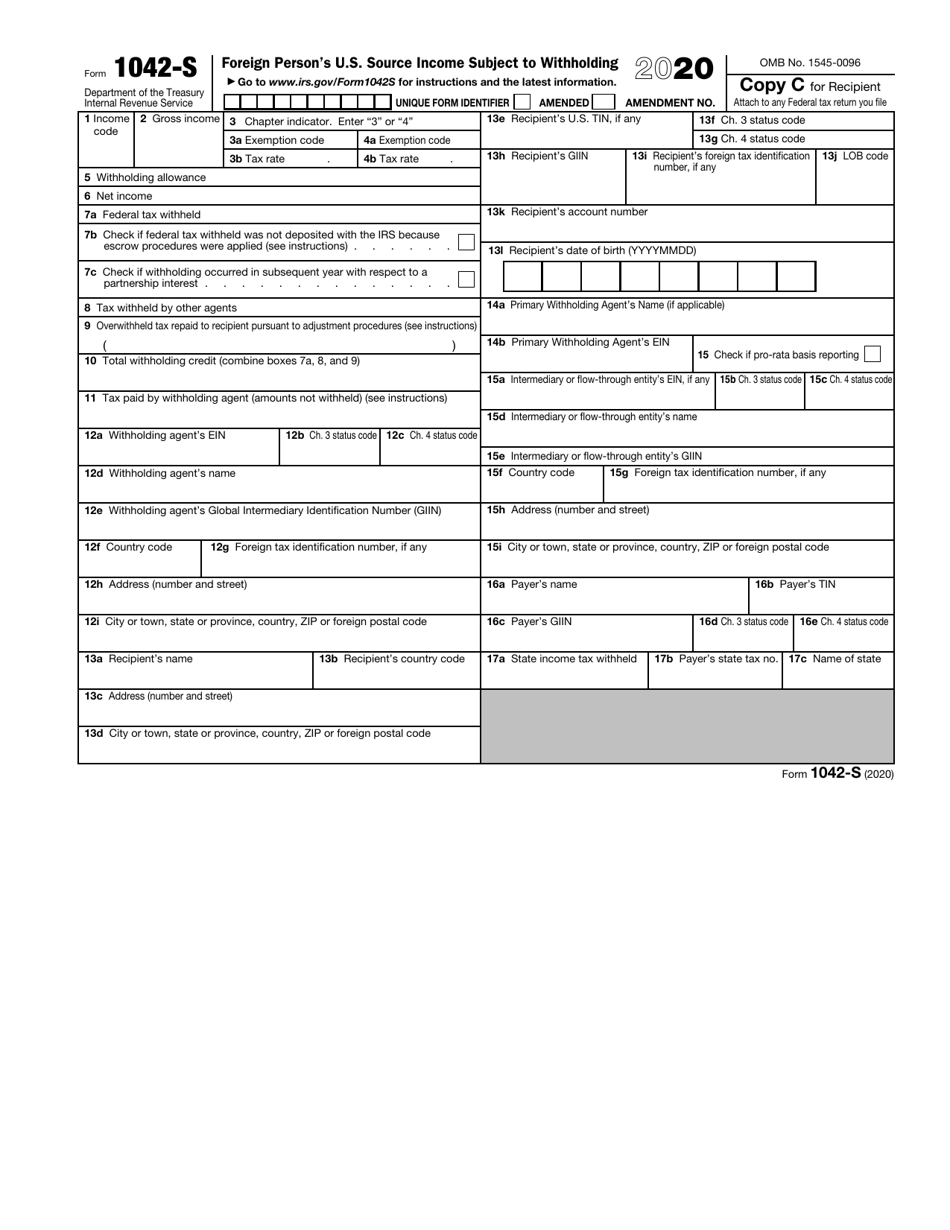

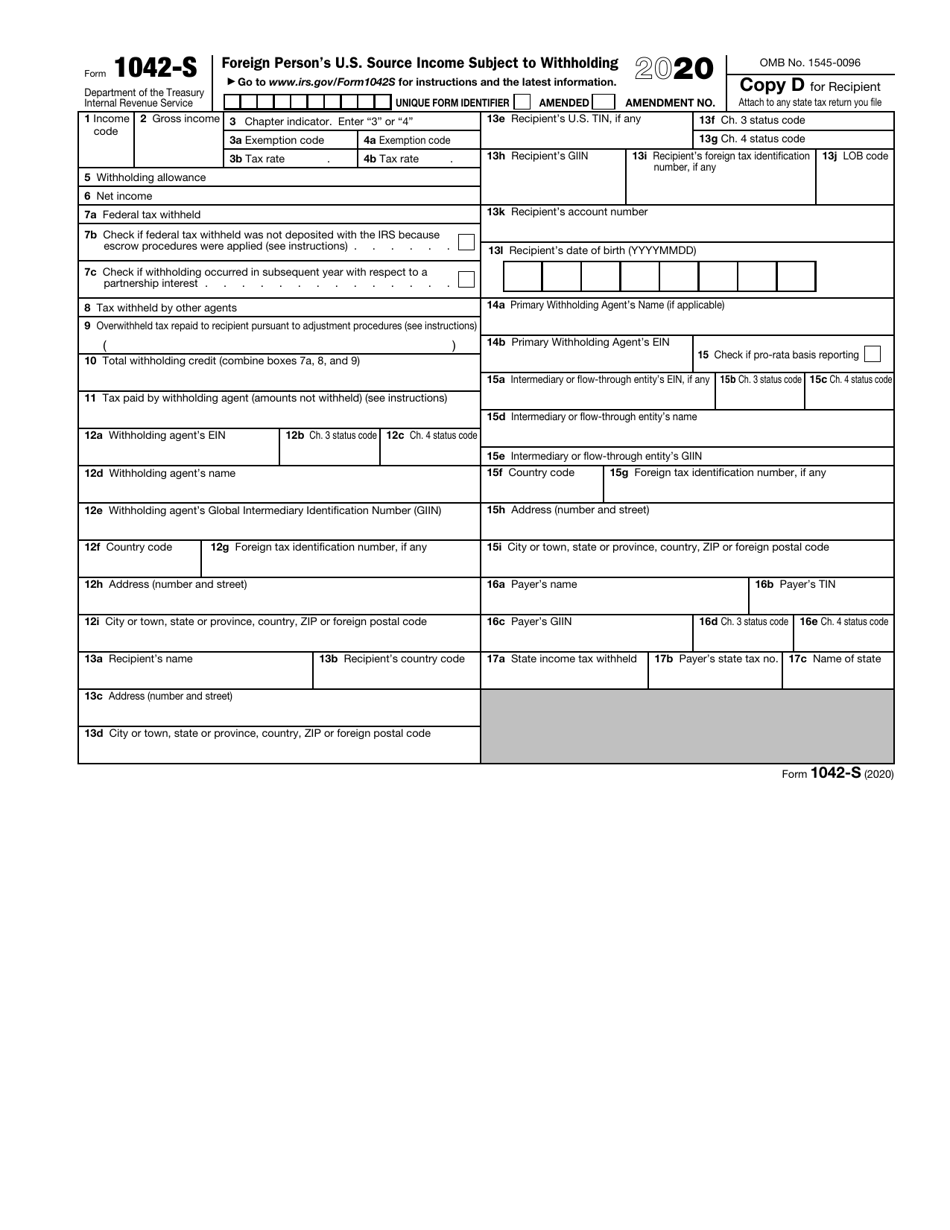

IRS Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

What Is IRS Form 1042-S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1042-S?

A: IRS Form 1042-S is a tax form used to report income paid to foreign individuals or entities subject to withholding in the United States.

Q: Who needs to file IRS Form 1042-S?

A: Generally, any person or organization that makes payments subject to withholding to foreign persons must file IRS Form 1042-S.

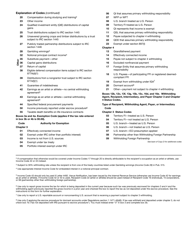

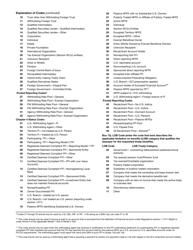

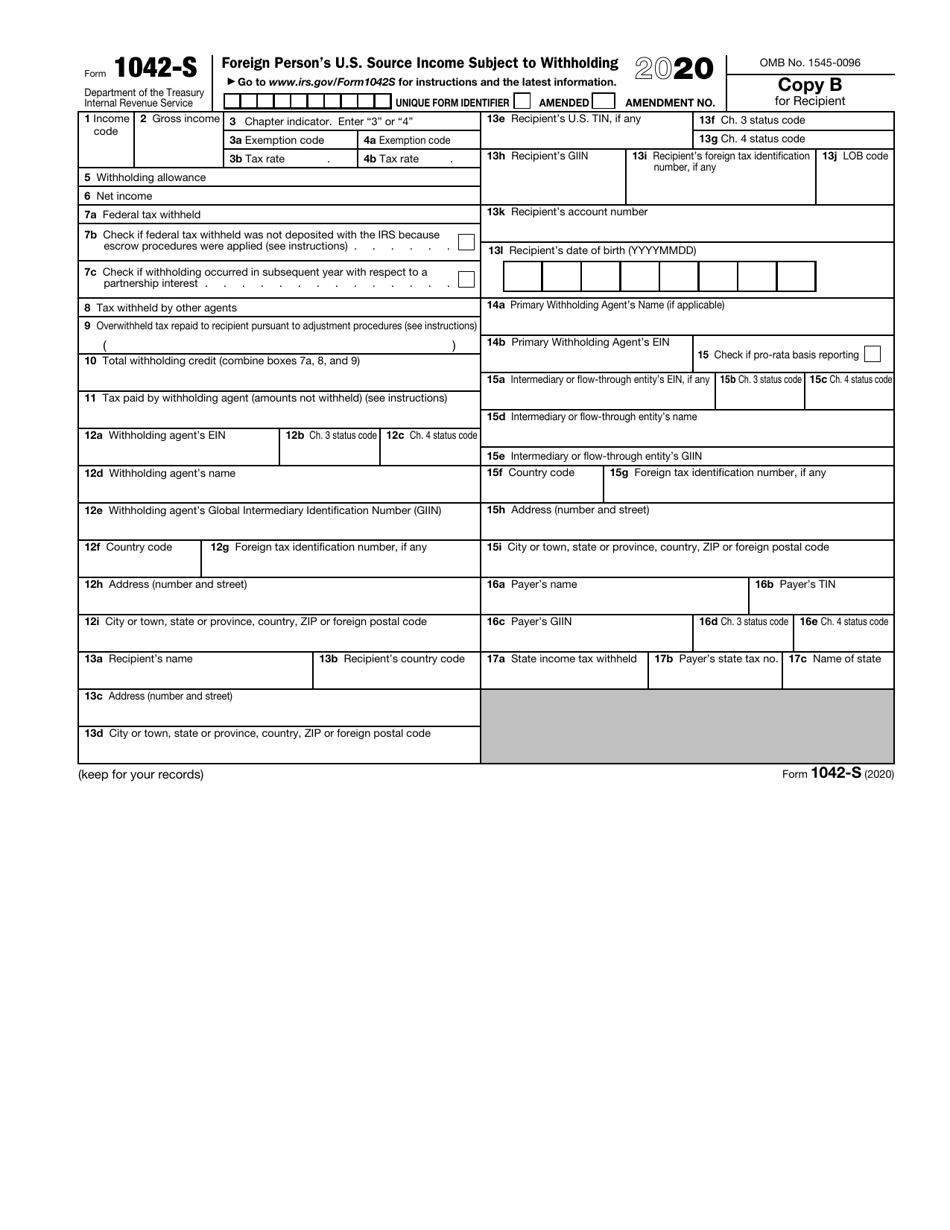

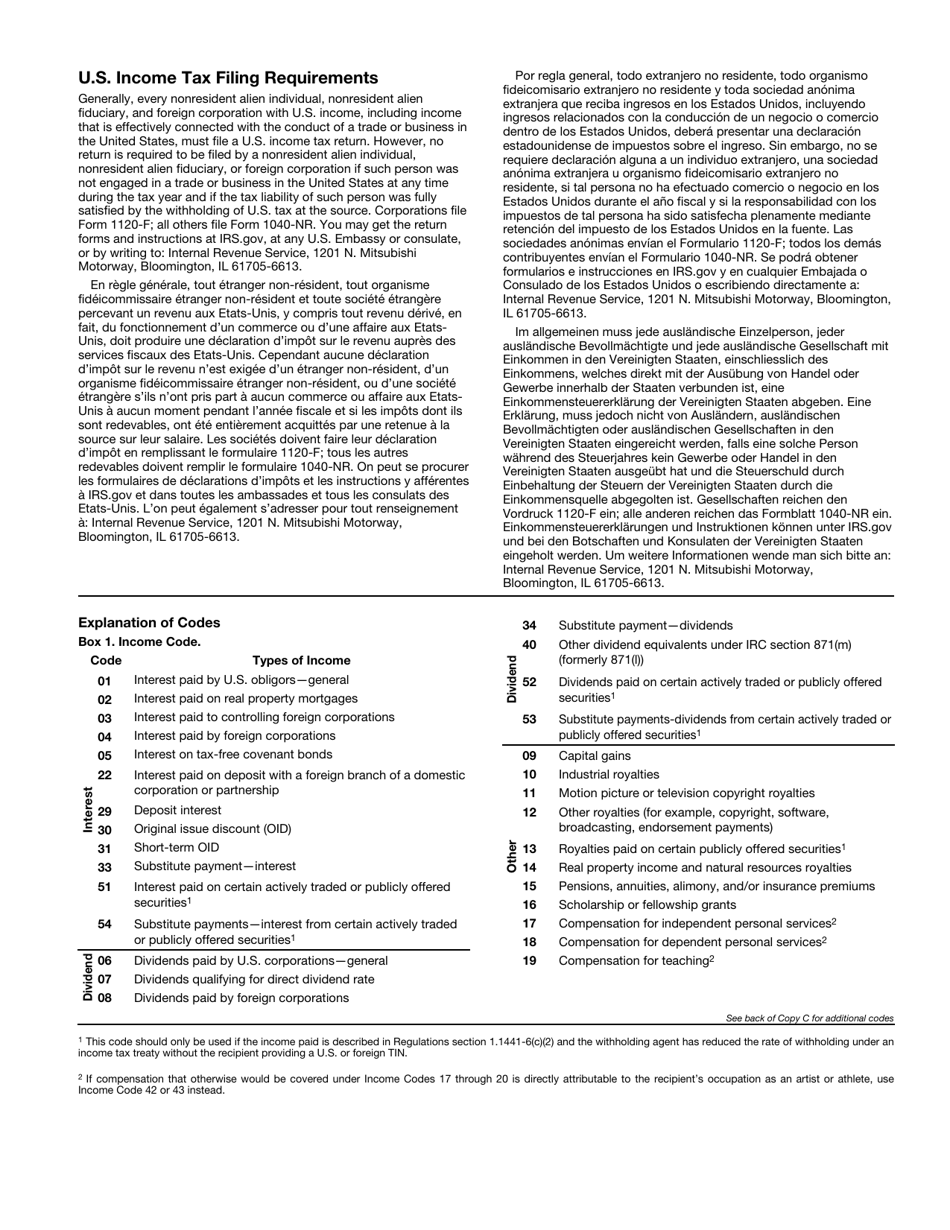

Q: What income is reported on IRS Form 1042-S?

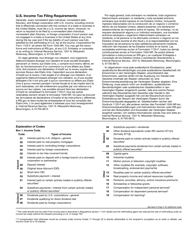

A: IRS Form 1042-S is used to report various types of U.S. source income, such as wages, scholarships, dividends, and royalties, paid to foreign persons.

Q: What is withholding?

A: Withholding is the process of deducting taxes from income at the time it is paid and remitting those taxes to the IRS.

Q: Are there any exceptions to withholding?

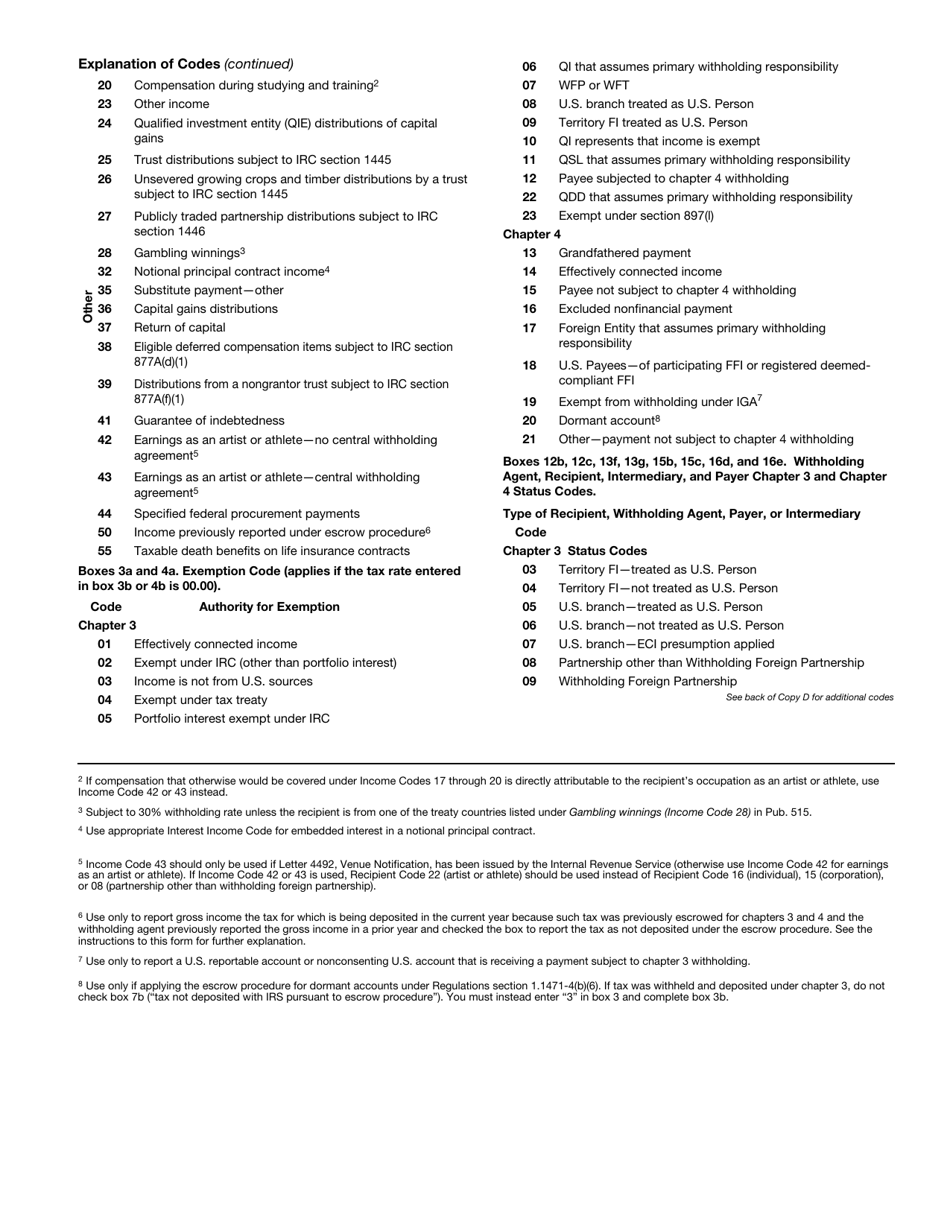

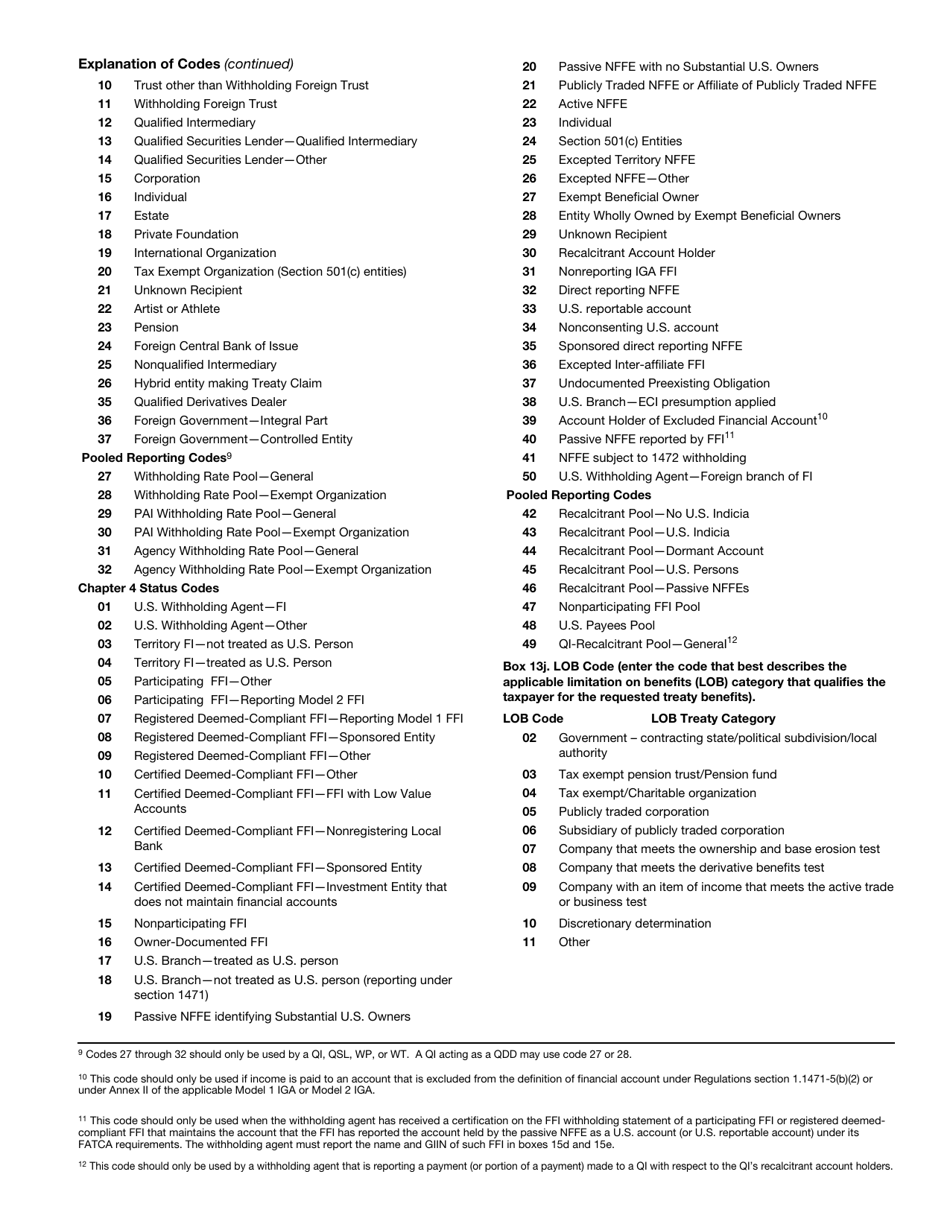

A: Yes, there are various exemptions and reduced withholding rates available based on tax treaties or other provisions.

Q: When is the deadline to file IRS Form 1042-S?

A: The deadline to file IRS Form 1042-S is generally March 15th of the year following the calendar year in which the income was paid.

Q: What happens if I don't file IRS Form 1042-S?

A: Failure to file IRS Form 1042-S or to report accurate information may result in penalties and interest.

Q: Can I e-file IRS Form 1042-S?

A: Yes, e-filing is available for IRS Form 1042-S, but certain requirements must be met.

Q: Do I need to send a copy of IRS Form 1042-S to the recipient?

A: Yes, a copy of IRS Form 1042-S must generally be provided to the recipient of the income.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1042-S through the link below or browse more documents in our library of IRS Forms.