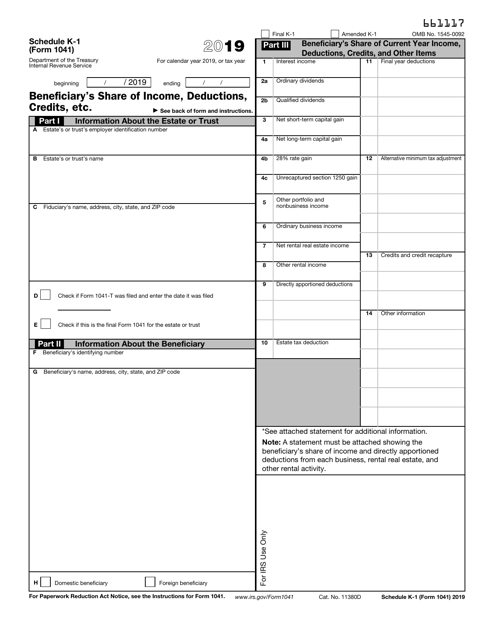

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1041 Schedule K-1

for the current year.

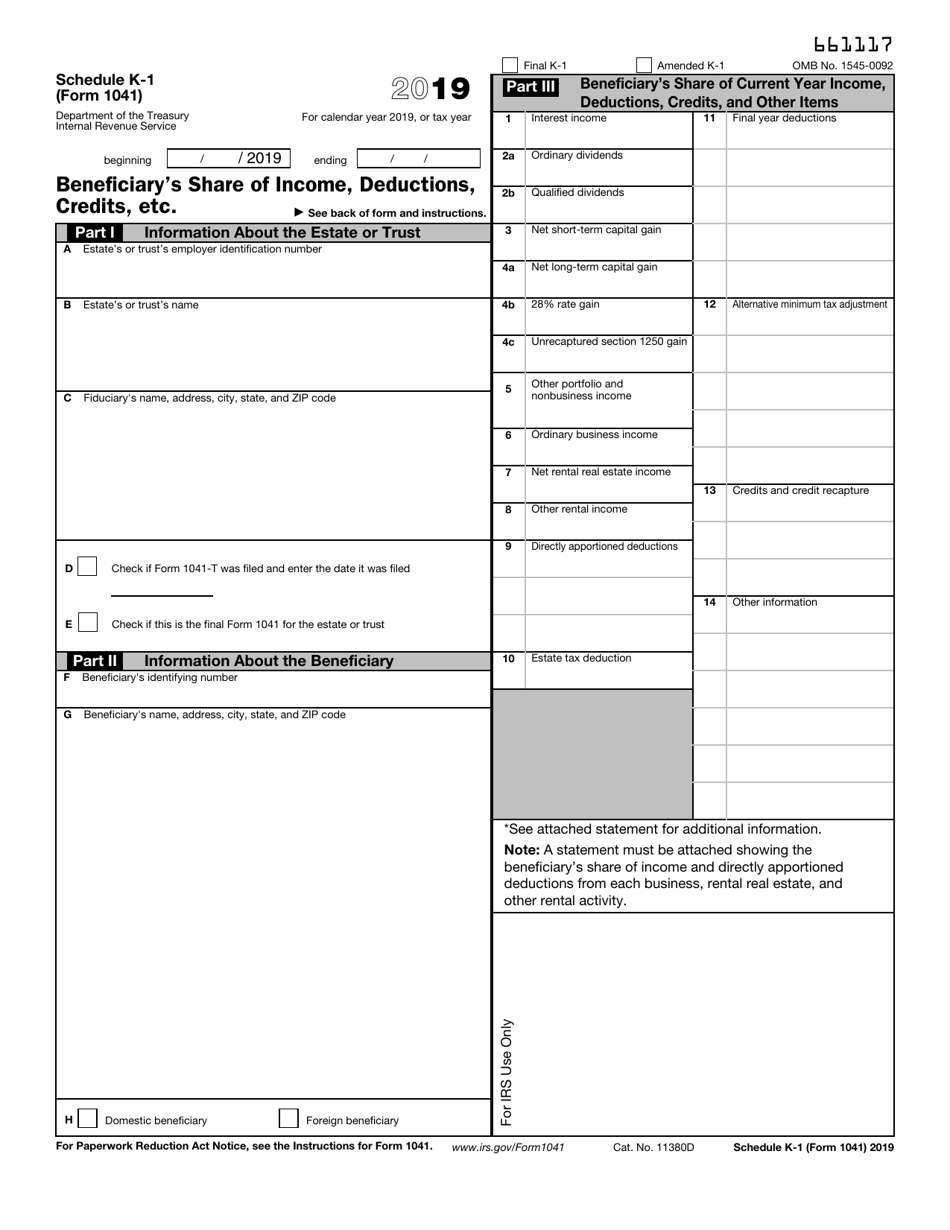

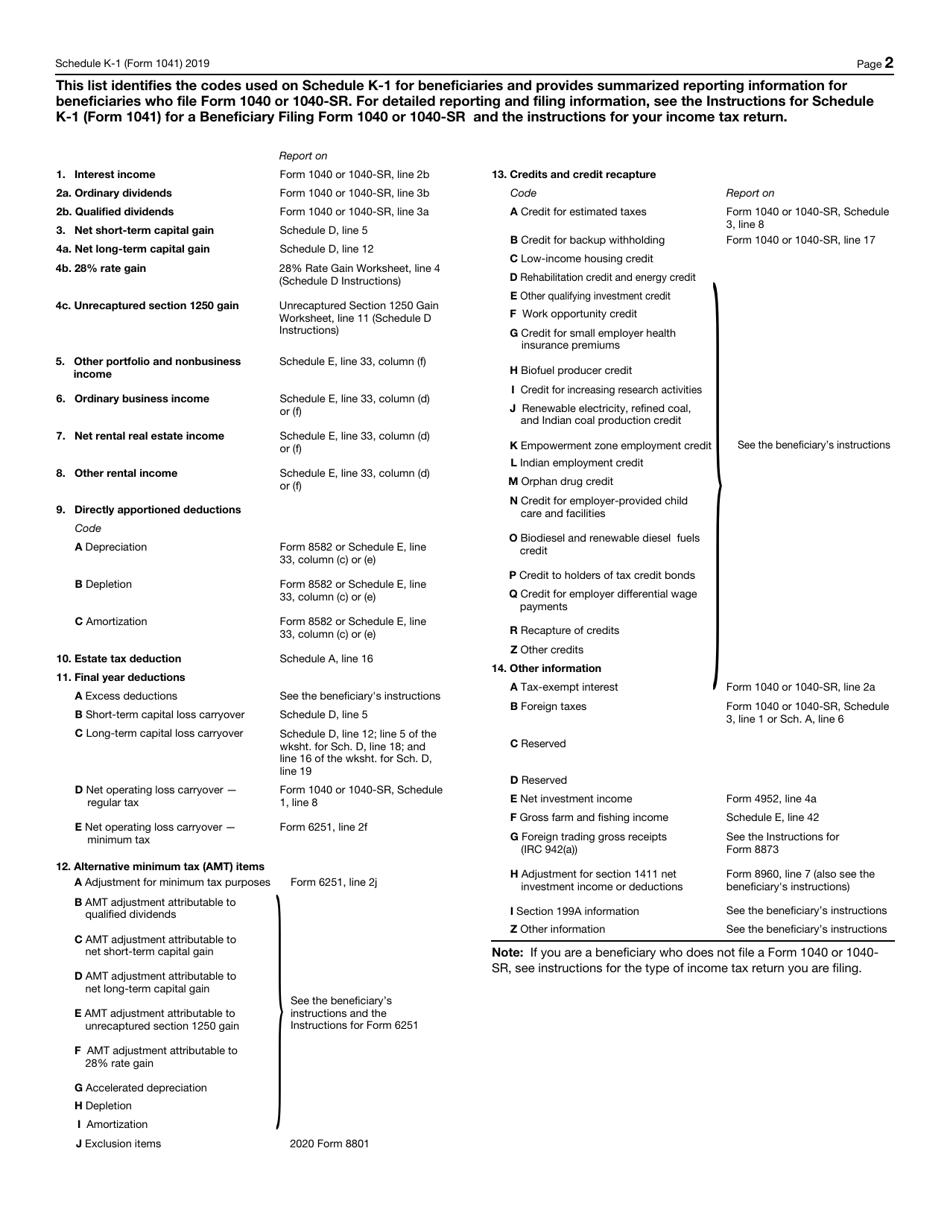

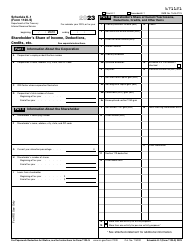

IRS Form 1041 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc.

What Is IRS Form 1041 Schedule K-1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041 Schedule K-1?

A: IRS Form 1041 Schedule K-1 is a form that reports a beneficiary's share of income, deductions, credits, and other items from an estate or trust.

Q: Who receives IRS Form 1041 Schedule K-1?

A: Beneficiaries of an estate or trust receive IRS Form 1041 Schedule K-1.

Q: What information does IRS Form 1041 Schedule K-1 provide?

A: IRS Form 1041 Schedule K-1 provides information about a beneficiary's share of income, deductions, credits, and other items from an estate or trust.

Q: How is IRS Form 1041 Schedule K-1 used?

A: Beneficiaries use IRS Form 1041 Schedule K-1 to report their share of income, deductions, credits, and other items on their individual tax returns.

Q: When is IRS Form 1041 Schedule K-1 due?

A: IRS Form 1041 Schedule K-1 is typically due on April 15th, or the next business day if it falls on a weekend or holiday.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule K-1 through the link below or browse more documents in our library of IRS Forms.