This version of the form is not currently in use and is provided for reference only. Download this version of

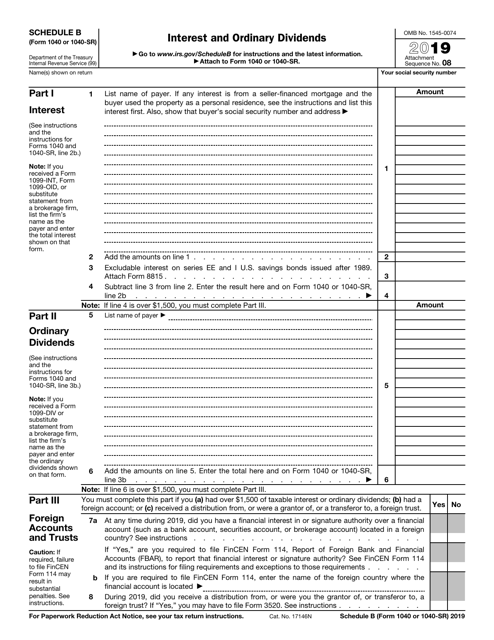

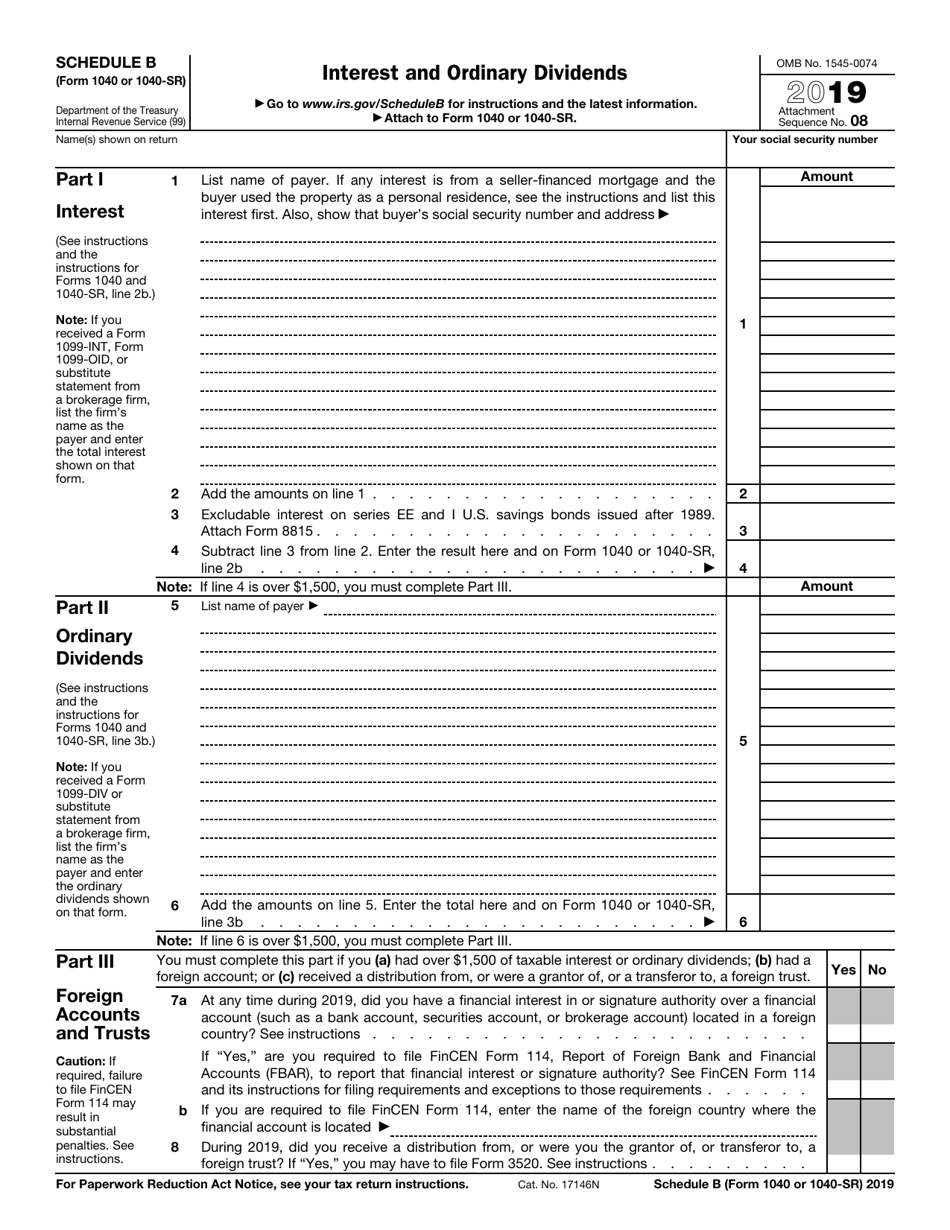

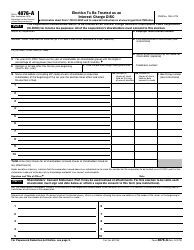

IRS Form 1040 (1040-SR) Schedule B

for the current year.

IRS Form 1040 (1040-SR) Schedule B Interest and Ordinary Dividends

What Is IRS Form 1040 (1040-SR) Schedule B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, and IRS Form 1040-SR. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the standard individual income tax return form for US residents.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 for taxpayers who are 65 or older.

Q: What is Schedule B?

A: Schedule B is a form attached to Form 1040 (or 1040-SR) used to report interest and ordinary dividends.

Q: What types of income are reported on Schedule B?

A: Schedule B is used to report income from interest on savings accounts, bonds, and other investments, as well as ordinary dividends.

Q: Do I have to file Schedule B?

A: You need to file Schedule B if you meet certain criteria, such as having more than $1,500 of taxable interest or ordinary dividends.

Q: Can Schedule B be electronically filed?

A: Yes, you can electronically file Schedule B along with your Form 1040 or 1040-SR.

Q: When is the deadline for filing Form 1040 (or 1040-SR) with Schedule B?

A: The deadline for filing Form 1040 (or 1040-SR) with Schedule B is usually April 15th, but it can vary depending on the year and any extensions.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 (1040-SR) Schedule B through the link below or browse more documents in our library of IRS Forms.