This version of the form is not currently in use and is provided for reference only. Download this version of

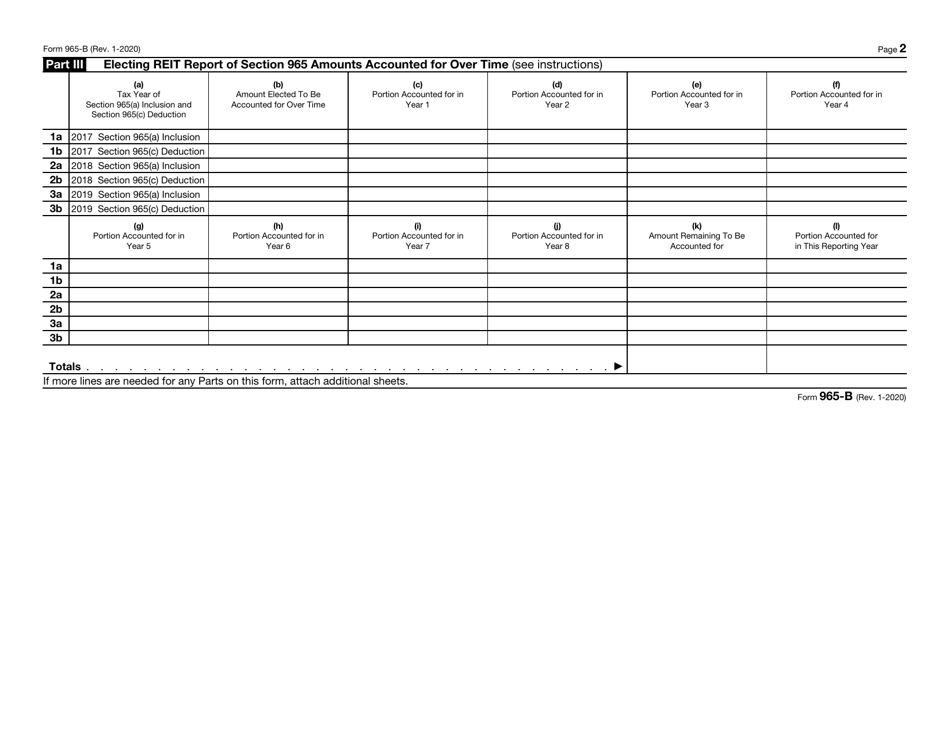

IRS Form 965-B

for the current year.

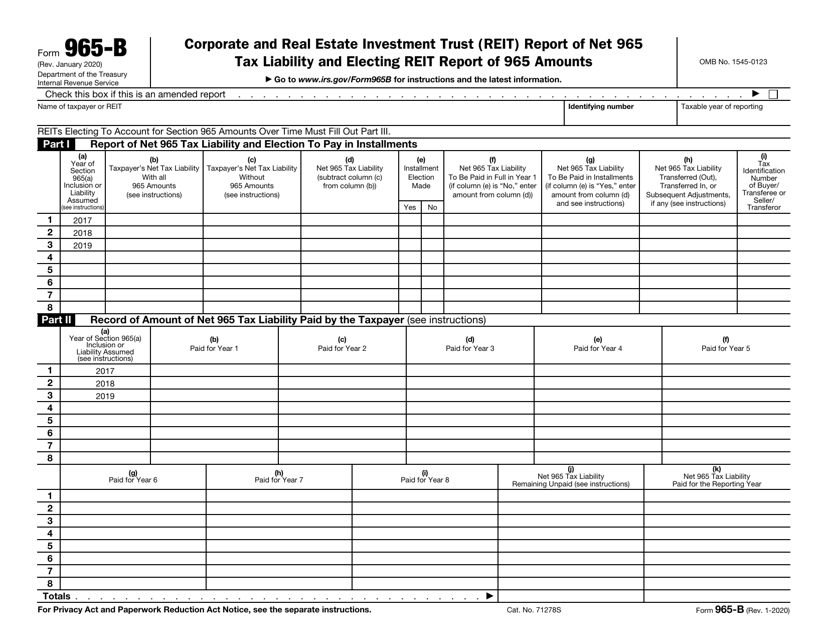

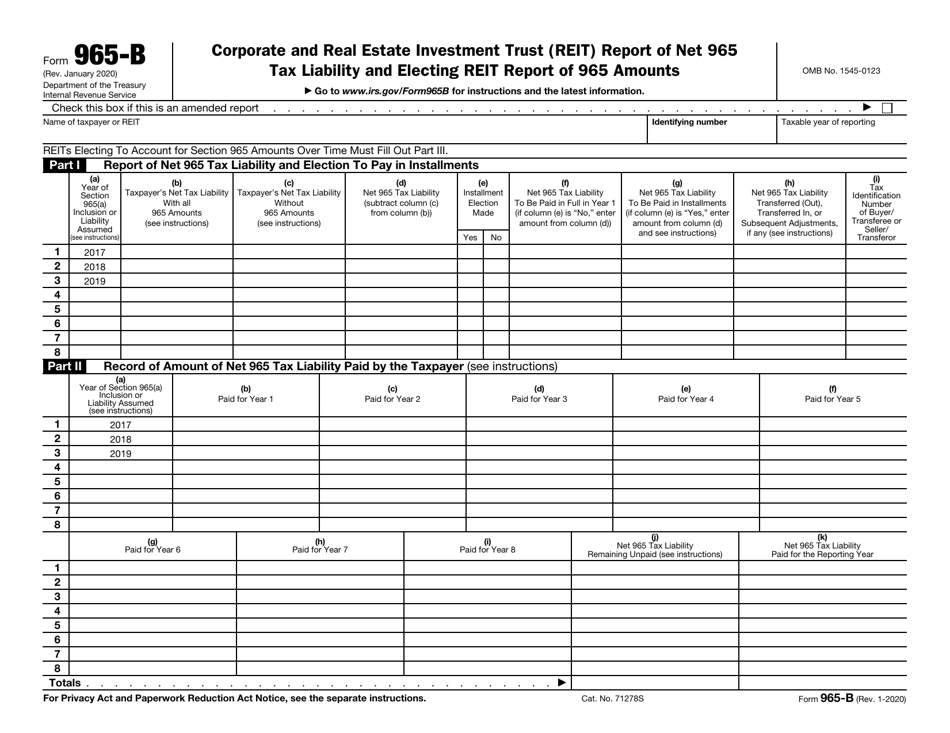

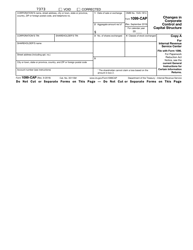

IRS Form 965-B Corporate and Real Estate Investment Trust (Reit) Report of Net 965 Tax Liability and Electing Reit Report of 965 Amounts

What Is IRS Form 965-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 965-B?

A: IRS Form 965-B is a form used to report the net 965 tax liability and electing REIT report of 965 amounts.

Q: Who needs to file IRS Form 965-B?

A: Taxpayers who have net 965 tax liability and electing REIT report of 965 amounts need to file IRS Form 965-B.

Q: What is the purpose of IRS Form 965-B?

A: The purpose of IRS Form 965-B is to report the net 965 tax liability and electing REIT report of 965 amounts.

Q: What is net 965 tax liability?

A: Net 965 tax liability is the amount of tax owed under section 965 of the Internal Revenue Code.

Q: What is electing REIT report of 965 amounts?

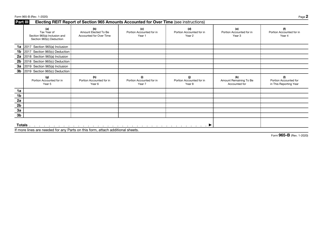

A: Electing REIT report of 965 amounts refers to the reporting of amounts related to electing real estate investment trusts under section 965 of the Internal Revenue Code.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 965-B through the link below or browse more documents in our library of IRS Forms.