This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8994

for the current year.

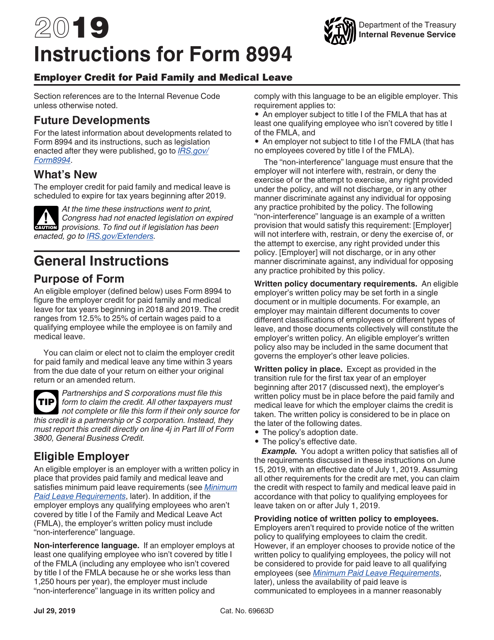

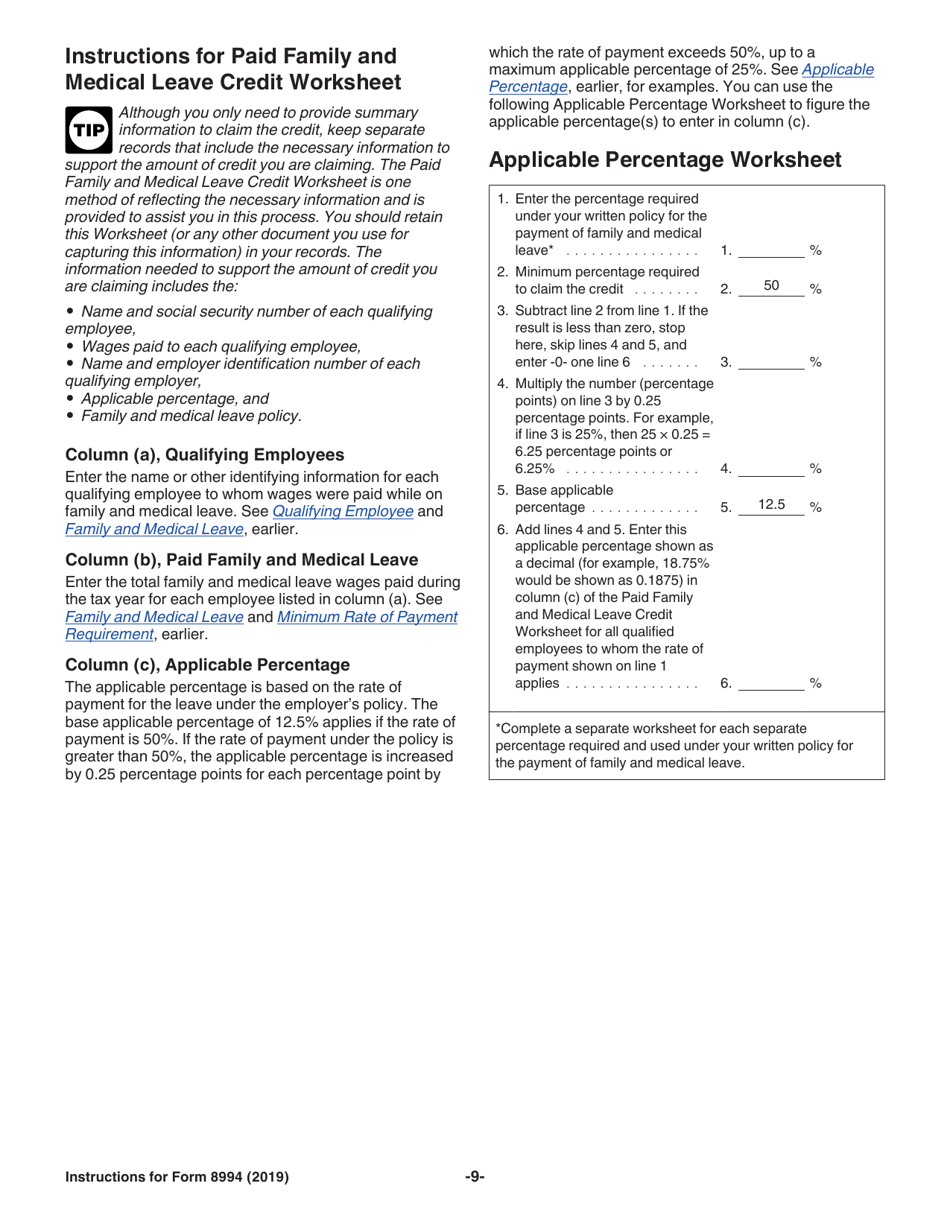

Instructions for IRS Form 8994 Employer Credit for Paid Family and Medical Leave

This document contains official instructions for IRS Form 8994 , Employer Credit for Paid Family and Medical Leave - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8994 is available for download through this link.

FAQ

Q: What is IRS Form 8994?

A: IRS Form 8994 is a form used to claim the Employer Credit for Paid Family and Medical Leave.

Q: What is the Employer Credit for Paid Family and Medical Leave?

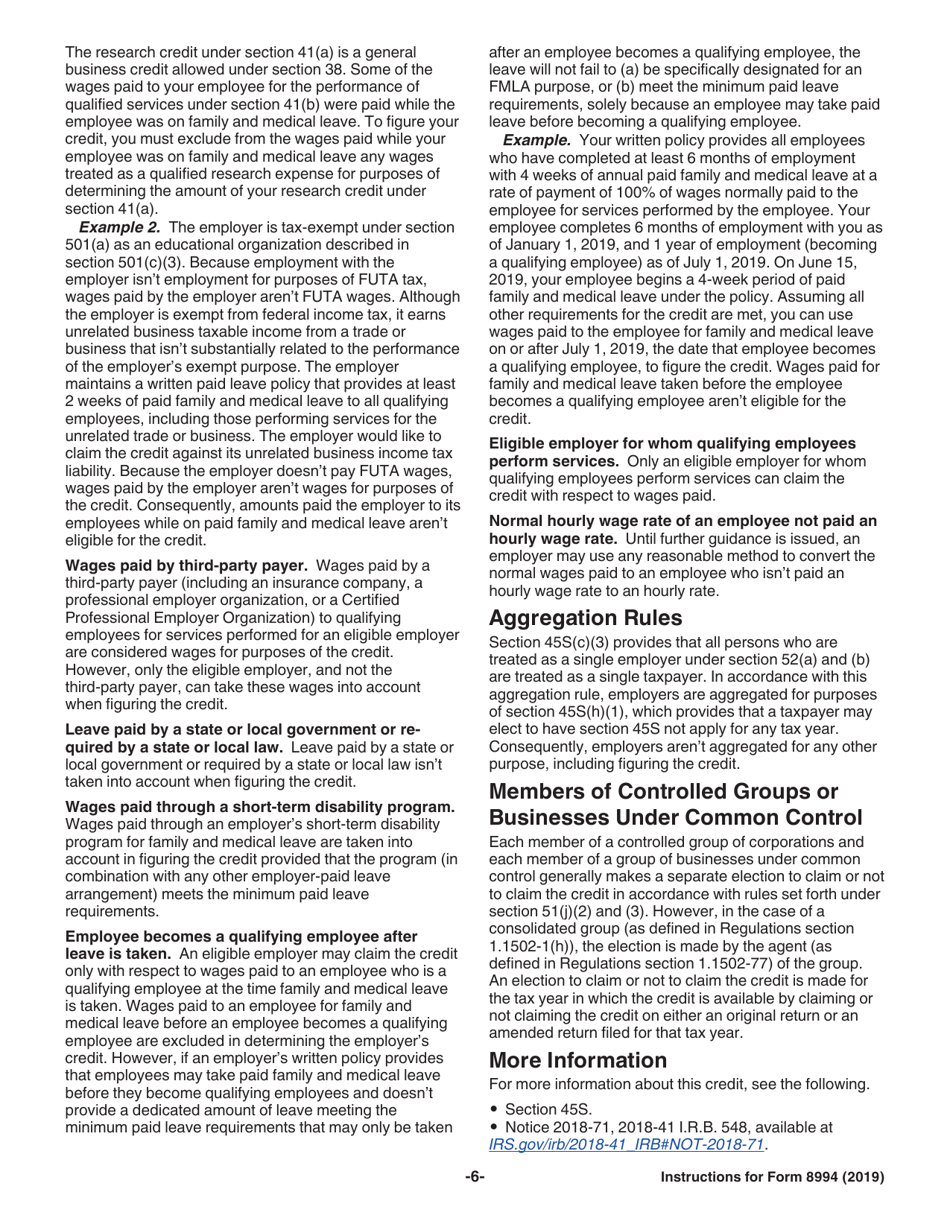

A: The Employer Credit for Paid Family and Medical Leave is a tax credit available to employers who provide paid leave to their employees for family and medical reasons.

Q: Who is eligible to claim the credit?

A: Employers who have a written policy that provides at least two weeks of paid leave to their employees for family and medical reasons are eligible to claim the credit.

Q: What is the purpose of Form 8994?

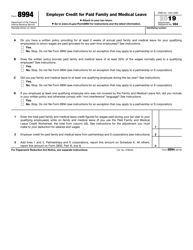

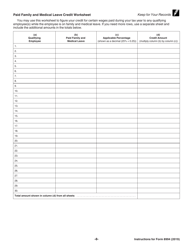

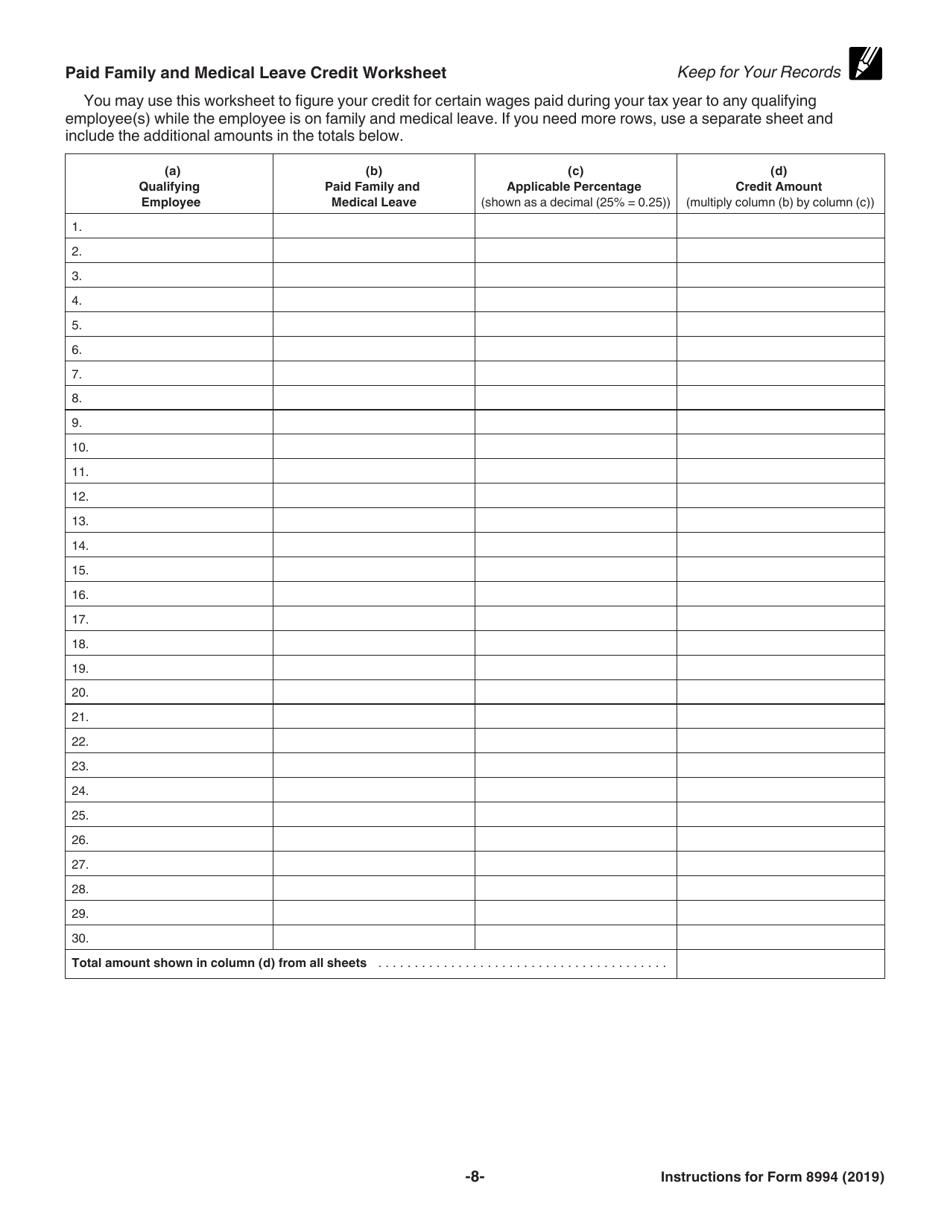

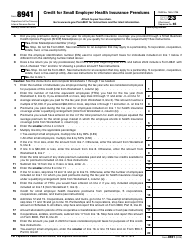

A: Form 8994 is used to calculate and claim the amount of the Employer Credit for Paid Family and Medical Leave.

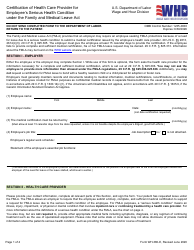

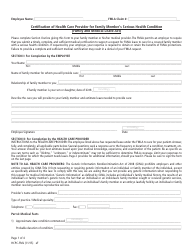

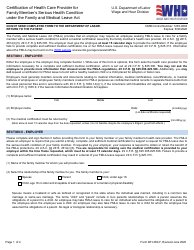

Q: What information is required on Form 8994?

A: Form 8994 requires information about the employer, the amount of paid leave provided, and the number of employees who took the leave.

Q: When is Form 8994 due?

A: Form 8994 is generally due on the employer's tax return for the year in which the paid leave was provided.

Q: Are there any limitations or conditions for claiming the credit?

A: Yes, there are limitations and conditions for claiming the Employer Credit for Paid Family and Medical Leave. Employers must meet certain requirements, such as providing leave to all qualifying employees and meeting minimum wage requirements.

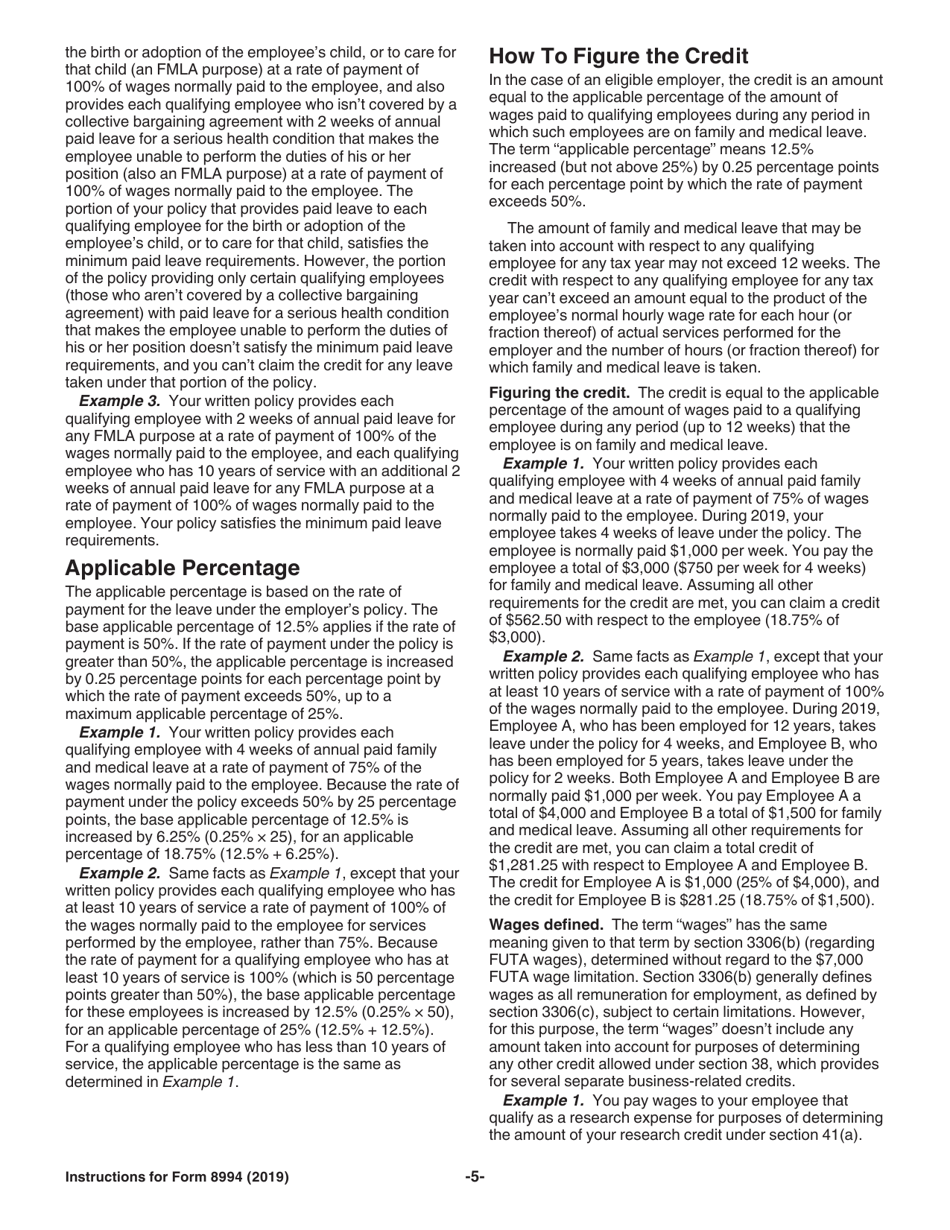

Q: How much is the credit?

A: The amount of the credit is a percentage of the wages paid to employees during the leave period, ranging from 12.5% to 25%, depending on the amount of wages paid.

Q: Can the credit be carried forward or back?

A: Yes, the credit can be carried forward to future tax years if it exceeds the employer's tax liability. However, it cannot be carried back to previous tax years.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.