This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8949

for the current year.

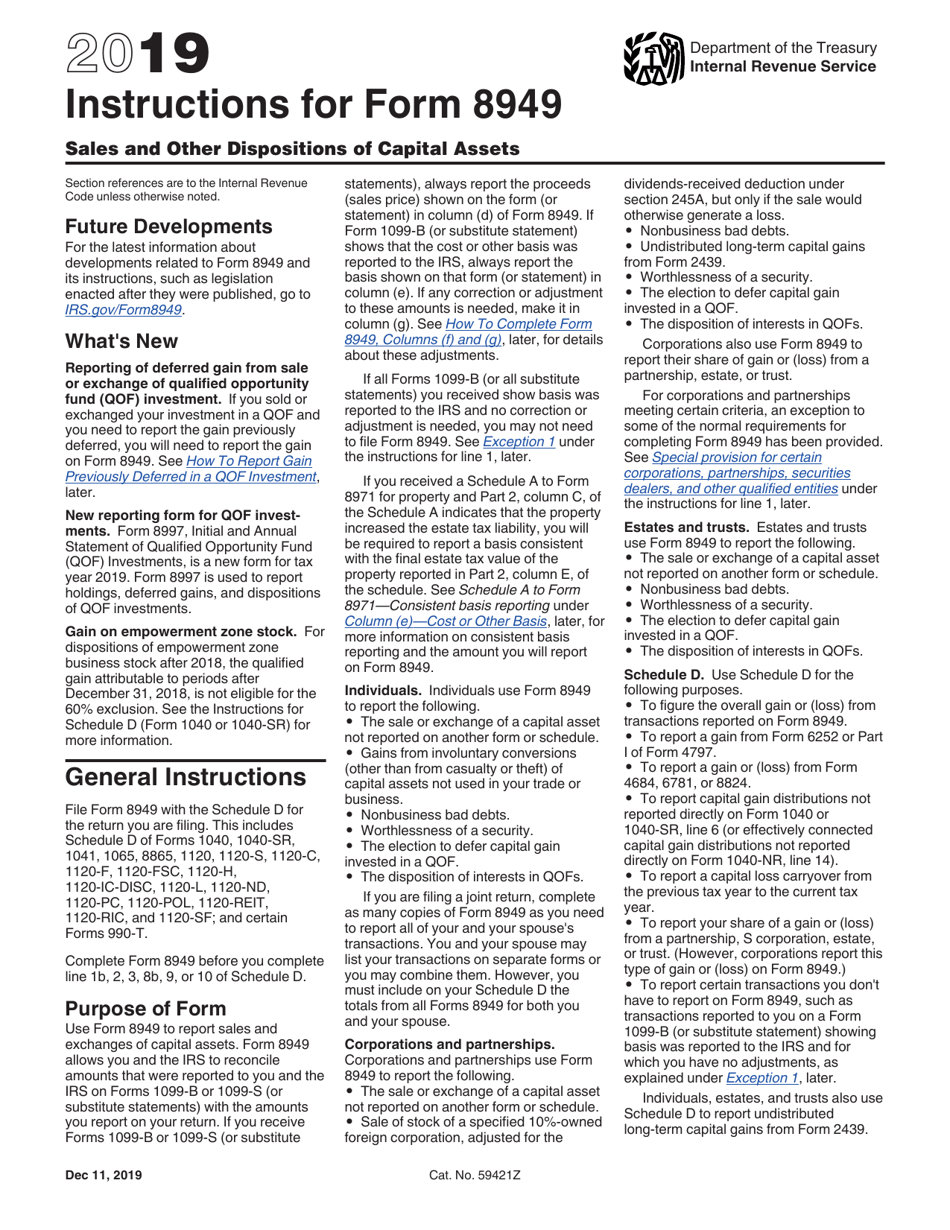

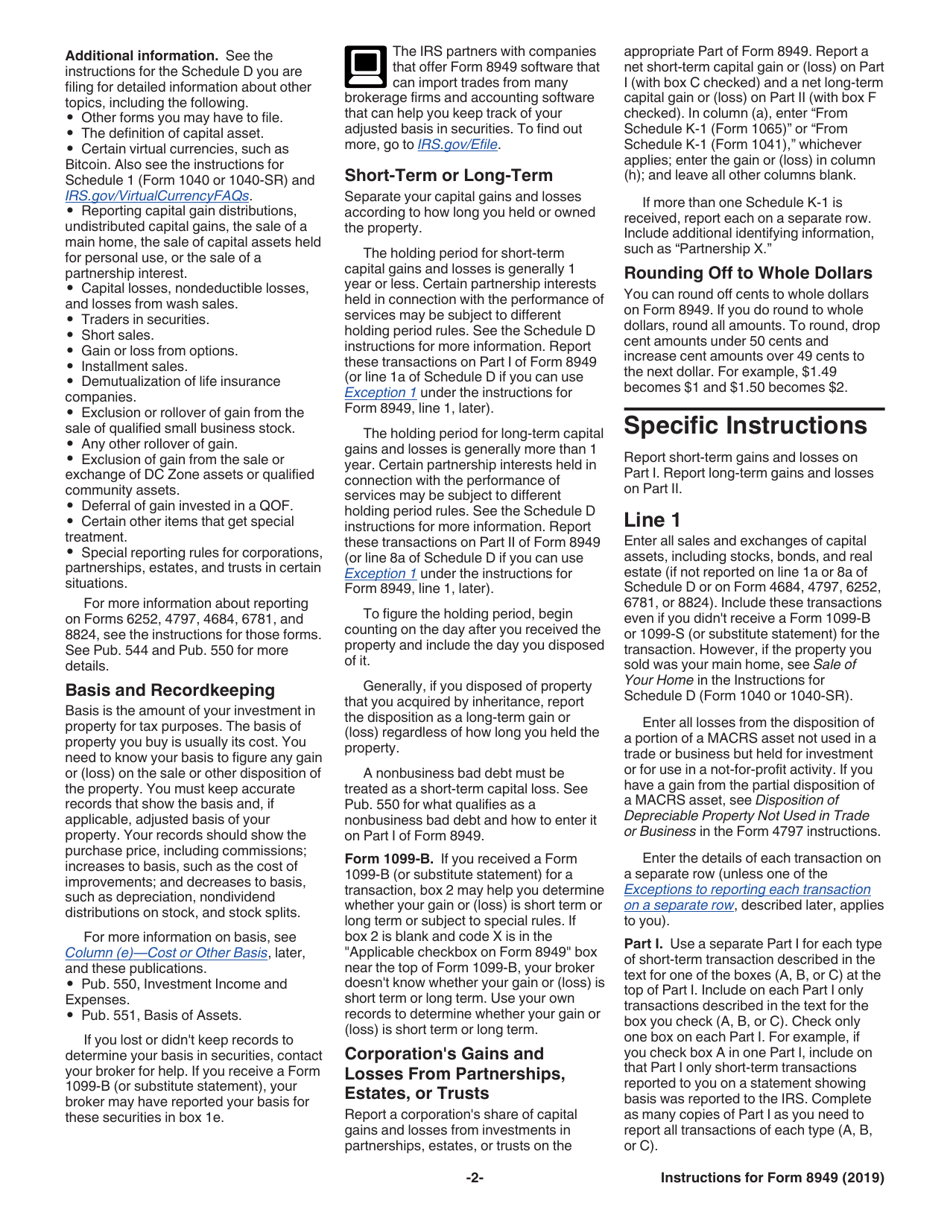

Instructions for IRS Form 8949 Sales and Other Dispositions of Capital Assets

This document contains official instructions for IRS Form 8949 , Sales and Other Dispositions of Capital Assets - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8949 is available for download through this link.

FAQ

Q: What is Form 8949?

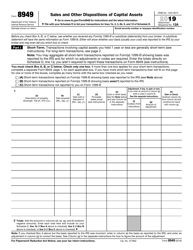

A: Form 8949 is a tax form used to report sales and other dispositions of capital assets.

Q: When is Form 8949 required?

A: Form 8949 is required if you have sold or disposed of capital assets during the tax year.

Q: What types of transactions are reported on Form 8949?

A: Form 8949 is used to report transactions such as stock sales, real estate sales, and sales of other investment assets.

Q: Do I need to attach Form 8949 to my tax return?

A: Yes, you need to attach Form 8949 to your tax return if you have any reportable transactions.

Q: What information is required on Form 8949?

A: Form 8949 requires you to provide details of each transaction, including the date of sale, description of the asset, and the cost basis and proceeds from the sale.

Q: Are there any special rules for reporting cryptocurrency transactions on Form 8949?

A: Yes, there are specific instructions for reporting cryptocurrency transactions on Form 8949. Make sure to follow the IRS guidelines for reporting these transactions.

Q: Can I e-file Form 8949?

A: Yes, you can e-file Form 8949 along with your tax return.

Q: What happens if I make a mistake on Form 8949?

A: If you make a mistake on Form 8949, you may need to file an amended tax return to correct the error.

Q: Do I need to keep copies of Form 8949 and supporting documents?

A: Yes, it is important to keep copies of Form 8949 and any supporting documents for your records in case of an audit.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.