This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8853

for the current year.

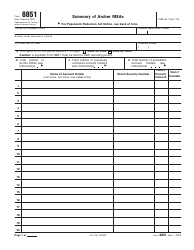

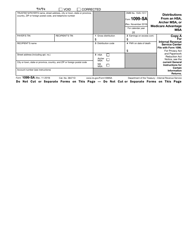

Instructions for IRS Form 8853 Archer Msas and Long-Term Care Insurance Contracts

This document contains official instructions for IRS Form 8853 , Archer Msas and Long-Term Care Insurance Contracts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8853 is available for download through this link.

FAQ

Q: What is IRS Form 8853?

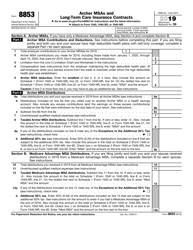

A: IRS Form 8853 is a tax form used for reporting Archer MSAs (Medical Savings Accounts) and long-term care insurance contracts.

Q: What are Archer MSAs?

A: Archer MSAs are special medical savings accounts that can be used to pay for qualified medical expenses.

Q: What is a long-term care insurance contract?

A: A long-term care insurance contract is an insurance policy that covers the costs of long-term care services, such as nursing home care or in-home care.

Q: Who needs to file IRS Form 8853?

A: You need to file IRS Form 8853 if you had any activity in an Archer MSA or received any distributions from a long-term care insurance contract during the tax year.

Q: What information do I need to complete IRS Form 8853?

A: You will need the account information for your Archer MSA, including any contributions and distributions, as well as information about your long-term care insurance contract payments.

Q: When is the deadline for filing IRS Form 8853?

A: The deadline for filing IRS Form 8853 is typically April 15th, unless that falls on a weekend or holiday, in which case it is extended to the next business day.

Q: What happens if I don't file IRS Form 8853?

A: If you are required to file IRS Form 8853 and fail to do so, you may face penalties or be subject to an audit by the IRS.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.