This version of the form is not currently in use and is provided for reference only. Download this version of

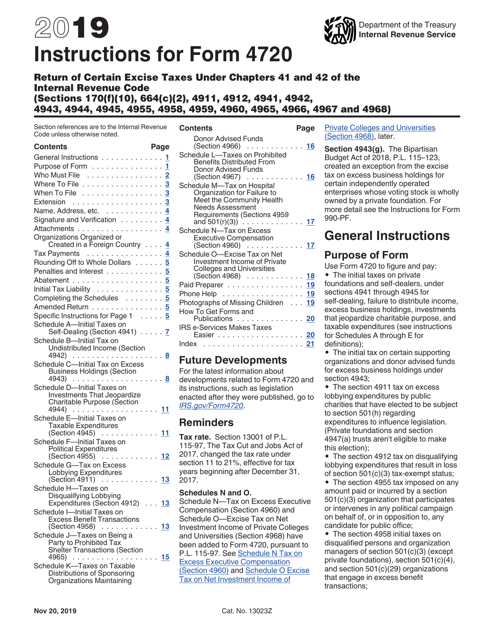

Instructions for IRS Form 4720

for the current year.

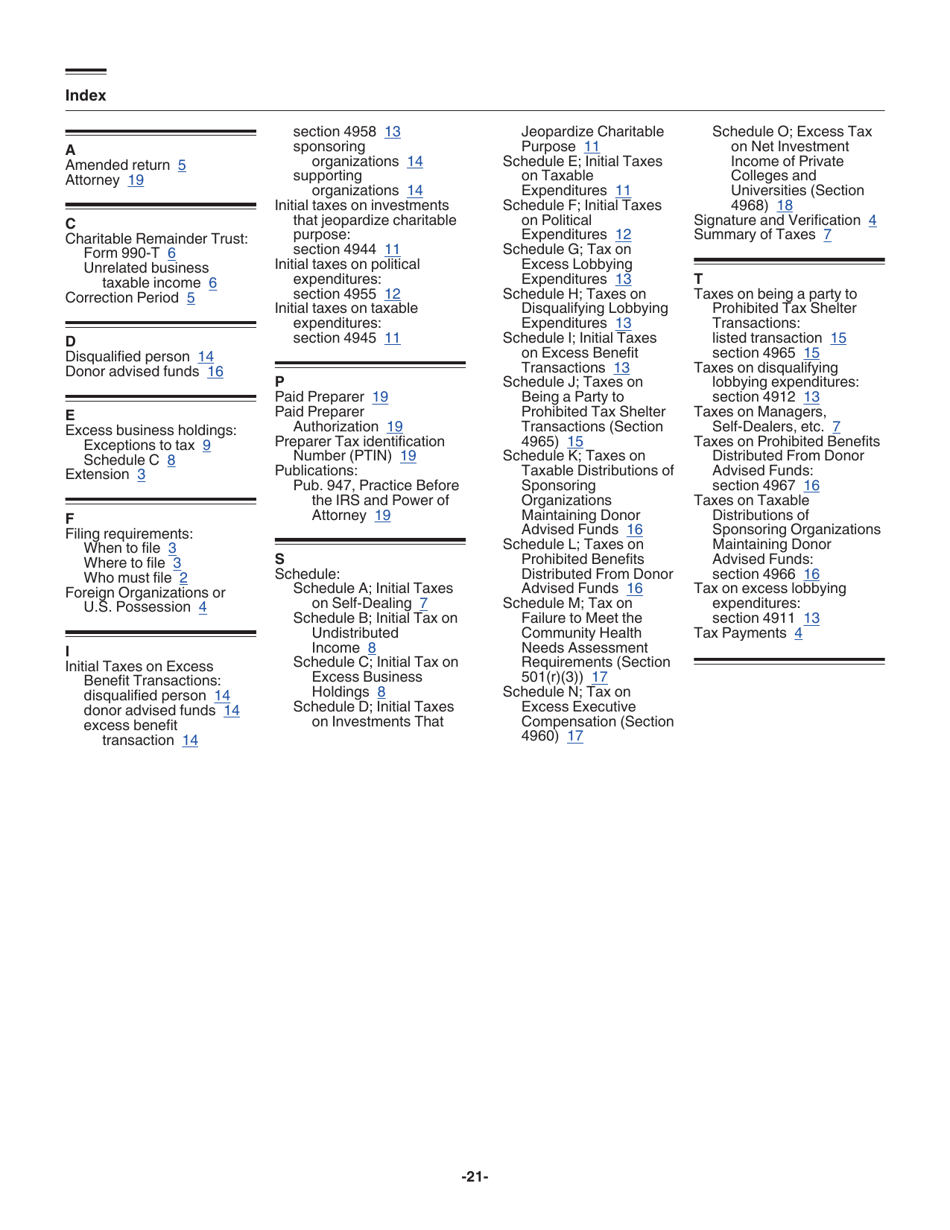

Instructions for IRS Form 4720 Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code

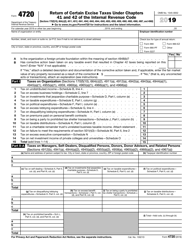

This document contains official instructions for IRS Form 4720 , Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4720 is available for download through this link.

FAQ

Q: What is IRS Form 4720?

A: IRS Form 4720 is used to file a return for certain excise taxes under chapters 41 and 42 of the Internal Revenue Code.

Q: Who needs to file IRS Form 4720?

A: Individuals or organizations that are liable for certain excise taxes under chapters 41 and 42 of the Internal Revenue Code.

Q: What are chapters 41 and 42 of the Internal Revenue Code?

A: Chapters 41 and 42 of the Internal Revenue Code pertain to excise taxes on two different types of trusts or entities - private foundations and certain tax-exempt organizations.

Q: What types of excise taxes are reported on IRS Form 4720?

A: Excise taxes on private foundations and certain tax-exempt organizations are reported on IRS Form 4720.

Q: When is the deadline for filing IRS Form 4720?

A: The deadline for filing IRS Form 4720 is generally the 15th day of the 5th month after the end of the organization's taxable year.

Q: Do I need to attach supporting documents with IRS Form 4720?

A: Yes, you may need to attach certain supporting documents depending on the specific details of your excise tax liability. The instructions for IRS Form 4720 provide guidance on the required documentation.

Q: What should I do if I make an error on IRS Form 4720?

A: If you make an error on IRS Form 4720, you should file an amended return using IRS Form 4720X.

Q: Are there any penalties for late filing of IRS Form 4720?

A: Yes, there are penalties for late filing of IRS Form 4720. The specific penalties depend on the circumstances, and it is important to consult the instructions for IRS Form 4720 or seek professional tax advice.

Q: Can I e-file IRS Form 4720?

A: As of now, e-filing is not available for IRS Form 4720. It must be filed by mail or delivered in person.

Instruction Details:

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.